By Zach Bethune, Tom Cooley and Peter Rupert

Today’s GDP release from the BEA reveals a modest upward revision in GDP for the 1st quarter from -0.7% to -0.2%. Though still in negative territory the upward revision is certainly welcome. As noted by the BEA, “…primarily reflecting upward revisions to

exports, to personal consumption expenditures, to private inventory investment, to nonresidential fixed investment, and to state and local government spending that were partly offset by an upward revision to imports.” The revisions were pretty much across the board.

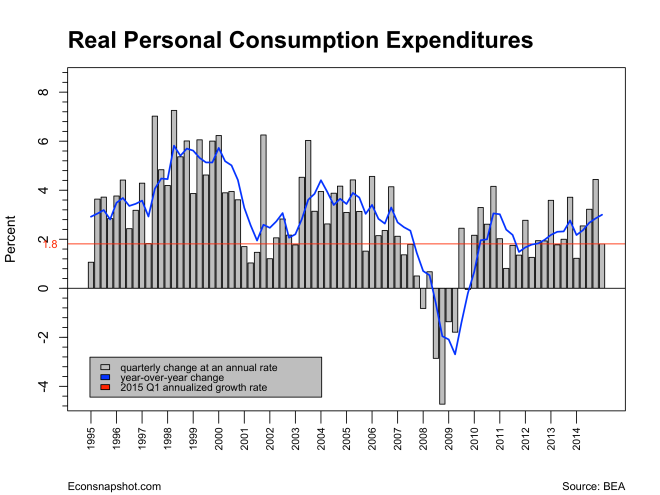

Real personal consumption expenditures increased 2.2%, the weakest recording since the first quarter of 2014. Tomorrow, the personal income report comes out that will give a little clearer picture of the path of consumption to date.

The signals coming in concerning the economy are mixed, making it extremely difficult to gauge upcoming policy moves. The latest meeting of the FOMC along with their statement seems to have left many Fed-watchers, prognosticators, and others suggesting that the Fed is on a path to raise rates in the fall or possibly winter. For example, Jon Hilsenrath of the WSJ says,

The Federal Reserve signaled Wednesday that it was moving toward interest-rate increases later this year, with the economy now firmer after a winter slump, but officials emphasized they would move even more cautiously than expected.

While many seem to suggest that the Fed is on pace to raise later this year, there is certainly nothing in the Fed statement that leads to such a conclusion. Just in case you are confused with Fed-speak, here is another statement…from 2011,

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The point is that, as the June statement emphasized, the risks are balanced. Meaning that raising rates soon is kind of 50-50. And, as the statement now always reminds us, any future moves are data dependent. So, looking forward, while the risks might be balanced, the risks are many:

- Uncertainty in Greece continues to plague policy makers and investors….but it seems now likely that many have already priced these risks in the market.

- Europe continues to have winners and losers, making it difficult to have much faith in any overall forecasts.

- How will China respond to what appears to be lower growth?

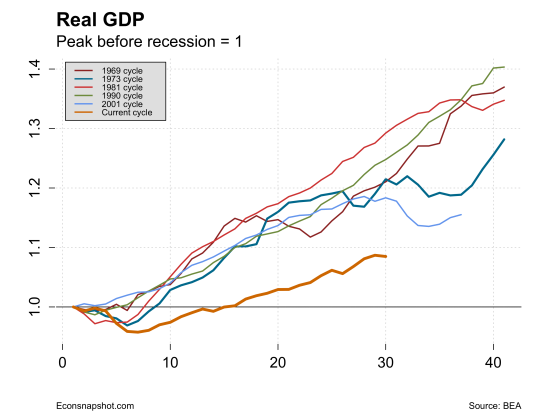

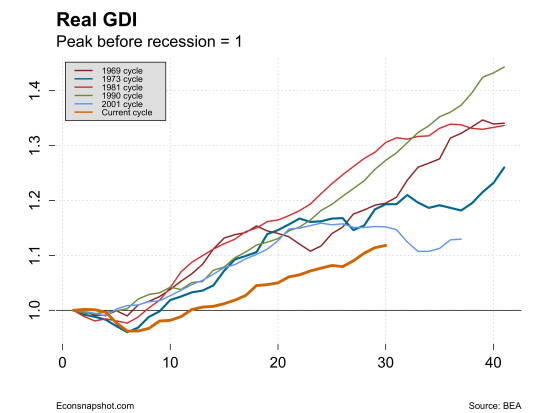

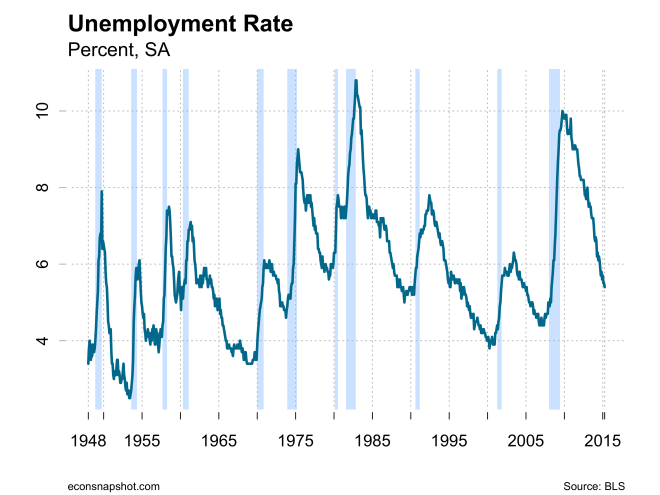

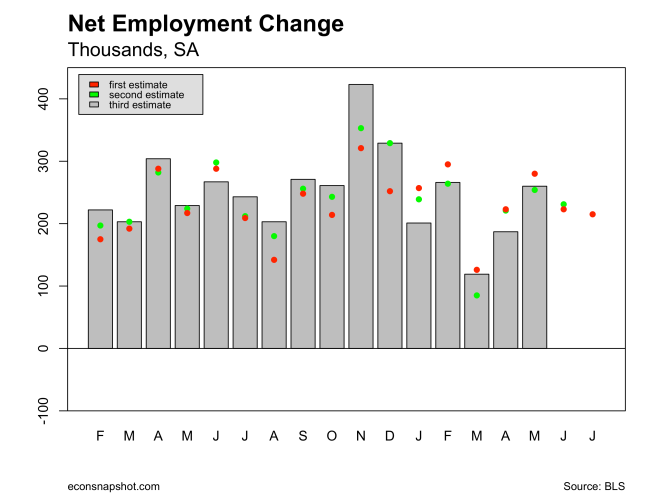

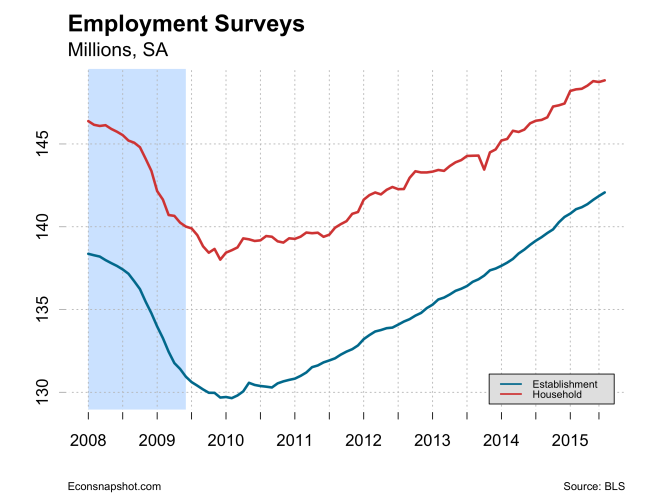

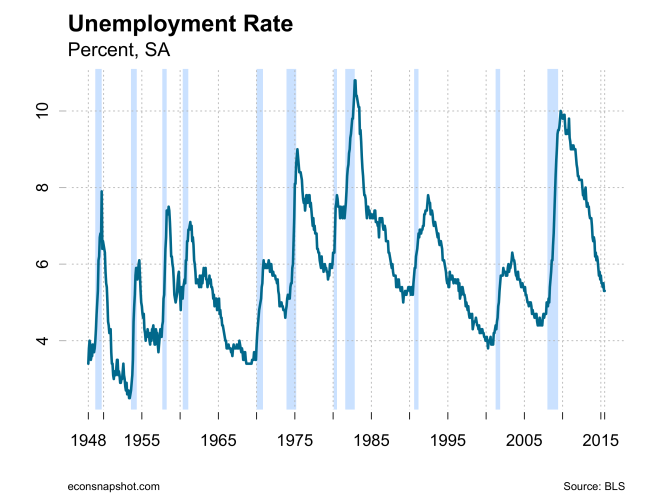

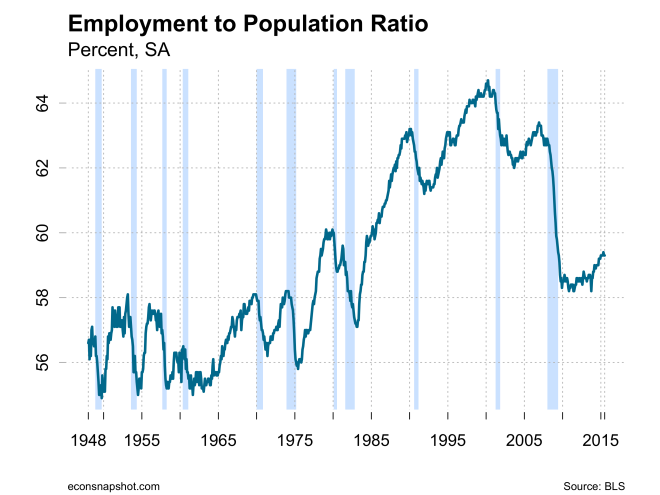

In terms of the US, nothing seems to really stand out yet that would call for the beginning of liftoff. Yes, employment has risen steadily, albeit slowly…much slower than earlier recoveries…and the unemployment rate is relatively low but labor force participation is also low.

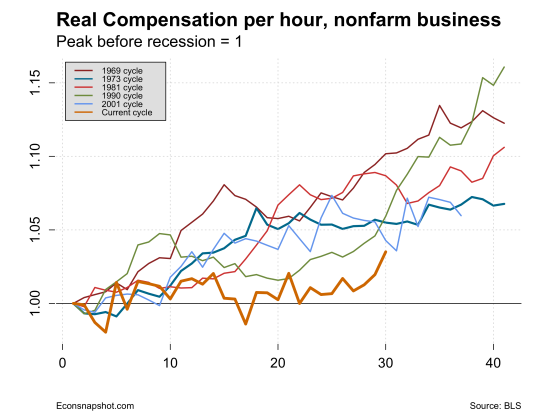

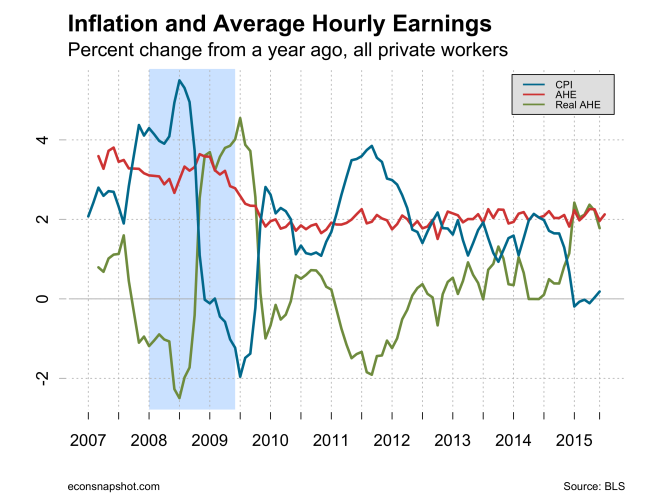

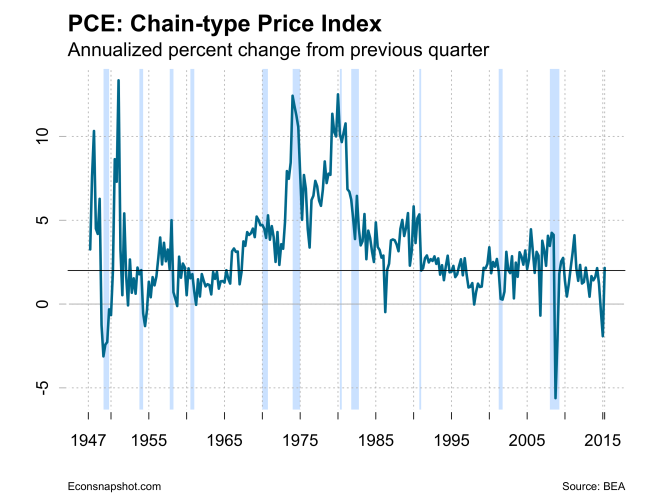

Still, there are many signs of either slow growth or real weakness to offset those indicators. There is really no sign of inflation anywhere, not recently nor in expectations. While the labor market is seeing signs of strength there does not appear to be any wage pressure, and the employment cost index has popped a little recently, but again, is still relatively subdued.

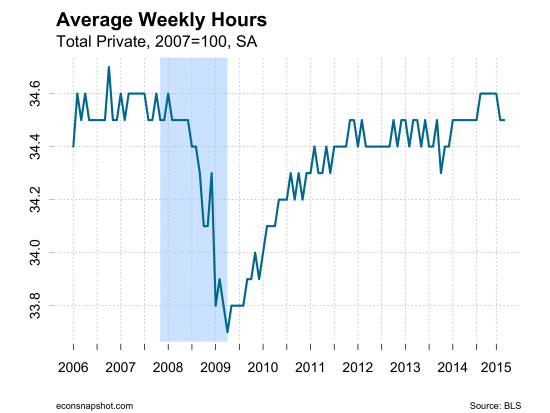

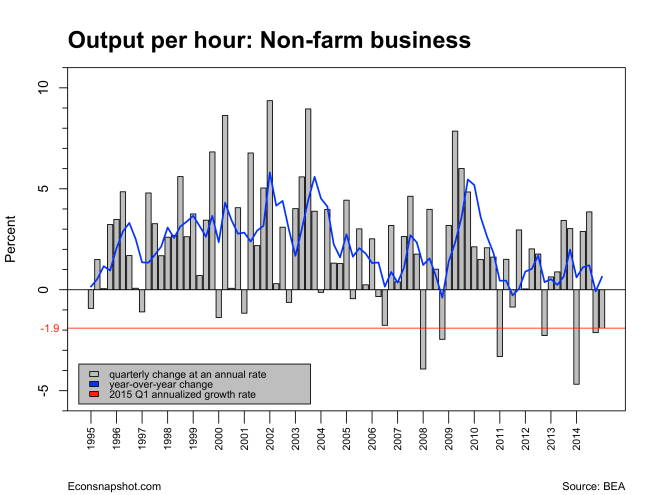

Average hours have remained pretty flat after picking up several months ago. Moreover, one indicator many use to gauge the health of the economy is output per hour of work (productivity). There also isn’t any real positive news here either as productivity has fallen for two consecutive quarters, the last time this happened was back in 2006.

While job openings are near all time highs, the hiring rate continues to climb, but quite slowly.

Some economists look at the Beveridge Curve (vacancies vs. unemployment) to see how the labor market is matching job seekers to job vacancies. While the Beveridge Curve has “looped” back, the unemployment rate is about a percentage point higher, given the vacancy level, that it was back in the early 2000’s. One interpretation is that the market is having a more difficult time matching workers to firms, for example, from skill mismatch.

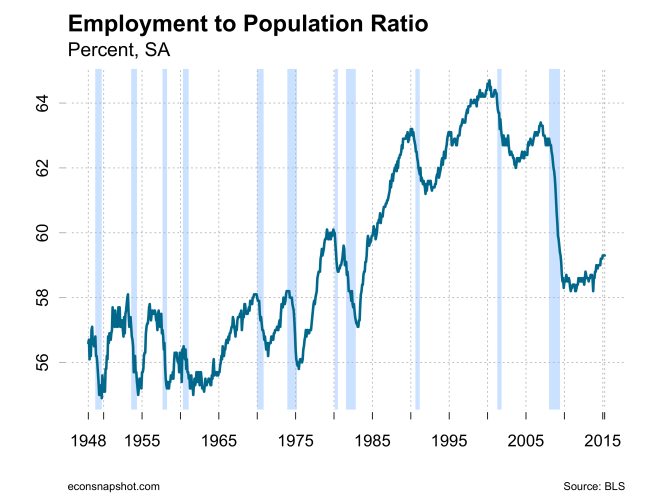

The labor market also looks quite different compared to the early 2000’s in both the employment to population ratio and labor force participation. Both are a long way from their peaks and have remained remarkably flat. Unfortunately, there is little by way of economic theory to enlighten us on what the “right” long run value should be for either statistic. Perhaps the late 1990’s and early 2000’s were unsustainable, and now we are back at more sustainable levels.

Moreover, there is still a substantial fraction of the unemployed who have been in that state for more than 27 weeks. This certainly does not bode well for such workers and it remains to be seen where and when they will eventually land.

So, in the end, what does all this mean? It simply means that the shape of the economy is in the eye of the beholder. Data can be presented to bolster either view…to raise or not raise this year. Indeed, the FOMC statement was clear about the cautious outlook:

This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The latest inflation numbers do not seem to suggest yet that one would be “reasonably confident” that inflation has moved back to its 2% objective, as the chart below shows, that inflation indicator has often been below the 2% (red line) for much of the time…and the latest reading shows a 2.0% decline. The quarter before saw a 0.4% decline.

he negative side, there were downward revisions for the past two months, April down by

he negative side, there were downward revisions for the past two months, April down by