By Thomas Cooley, Ben Griffy and Peter Rupert

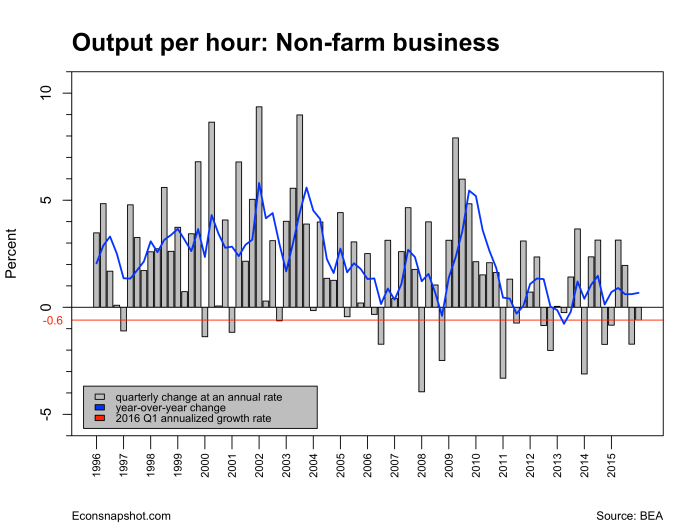

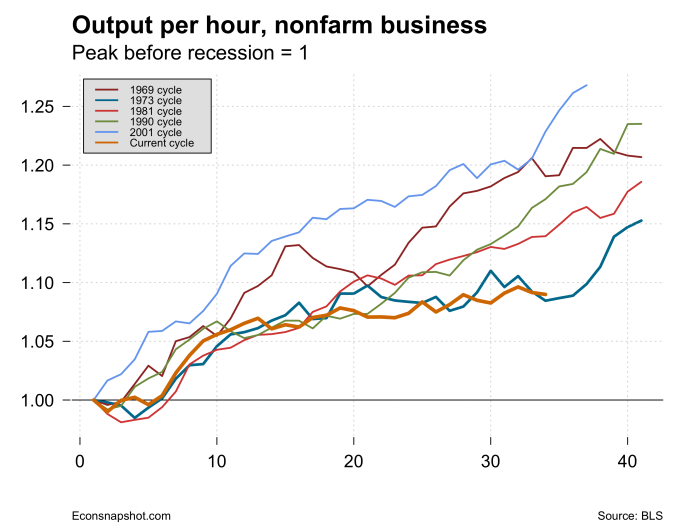

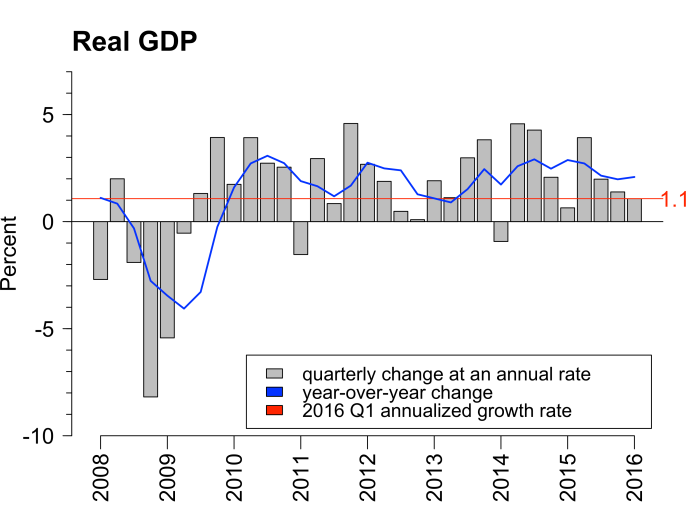

The U.S. economy grew at a paltry 1.2% rate in the second quarter continuing a pattern of anemic growth for the past three quarters. The expectations had been fairly high, somewhere around 2.6% growth. The Fed had “left the door open” for a September rate hike. The FOMC announcement on Wednesday suggested a brighter picture than the June announcement. Here the WSJ compares the two statements. Unfortunately the economy didn’t listen! Not only did the Q2 GDP report show a 1.2% growth rate for real GDP, the revision for Q1 was revised down from 1.1% to 0.8%. The annual revision to the National Income and Product Accounts (NIPA) was also announced with this release. While there were some upward and downward revisions over the last few years, the upshot was the average annual growth from 2012 through 2015 was 2.2% compared to the previous estimate of 2.1%. The past three quarters have been quite weak, 0.9%, 0.8%, and 1.2% making a September rate hike unlikely.

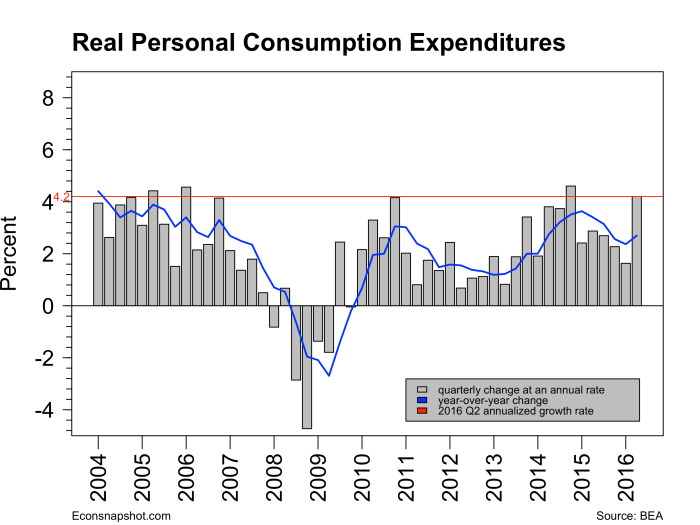

Today’s report also showed continued strength in consumer spending (PCE 4.2%),

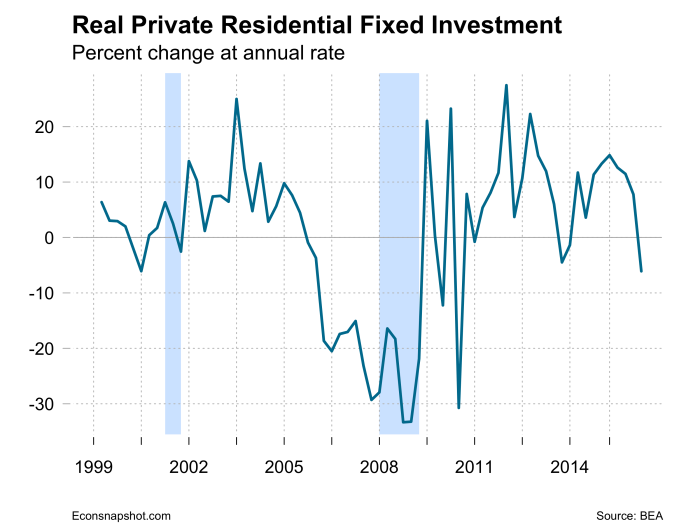

and an increase in exports (1.4%) but weakness in private inventory investment, nonresidential fixed investment (-2.2%), residential fixed investment (-6.1%), and state and local government spending (-1.3%). Imports also decreased (-0.4%).

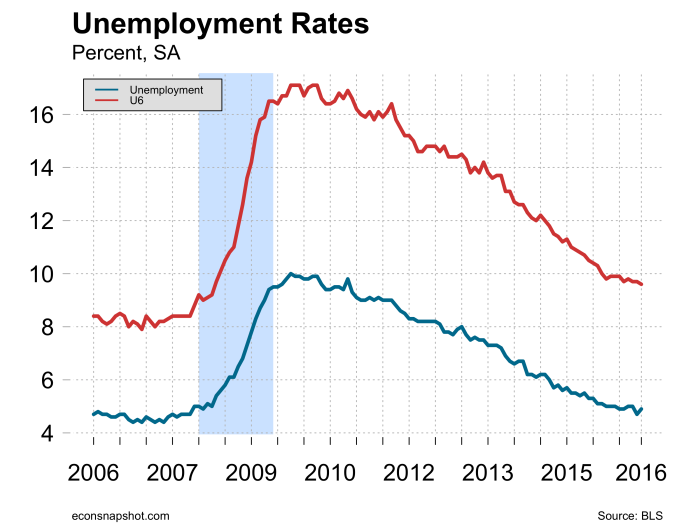

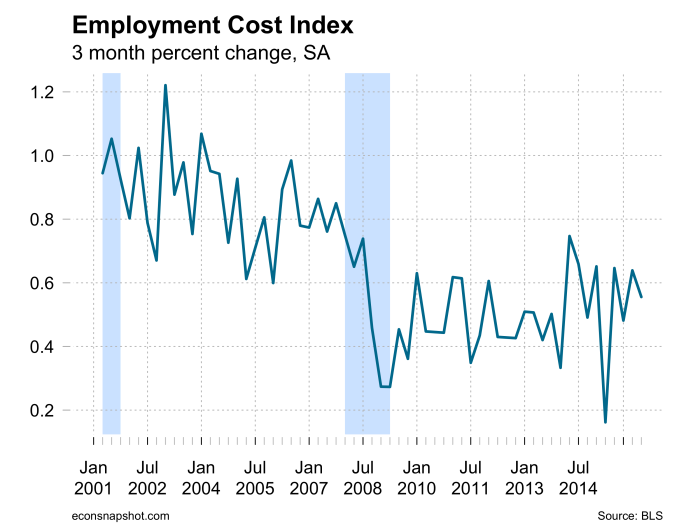

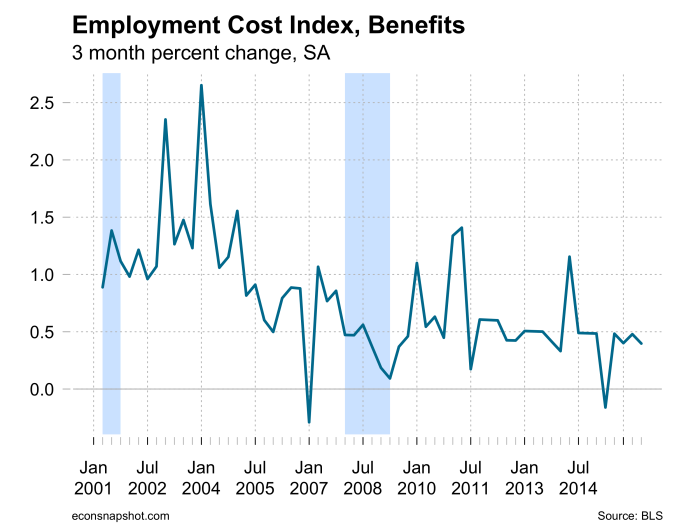

Also this morning the Bureau of Labor Statistics reported the latest Employment Cost Index. Overall, the 3-month seasonally adjusted index for total compensation for all cilvilian workers climbed 0.6% (2.3% yoy) following a 0.6% climb for the three months ending in March. The wage and salary component was up 0.6% (2.5% yoy) for the three months and the benefits component up 0.4% (2.0% yoy). Compared to the last couple of years the ECI has shown a bit of a hike, again pointing to the strengthening of the labor market.

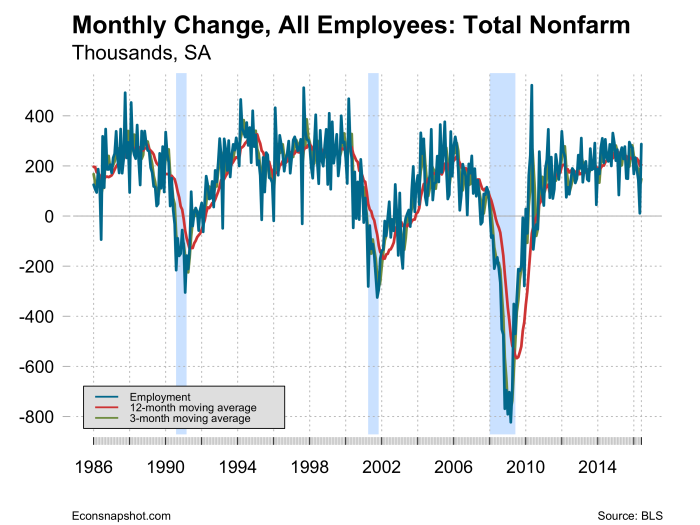

The dismal performance of GDP combined with a strongish labor market keeps one guessing as to the next move by the Fed. The most-watched signals (GDP, employment, unemployment and wages) seem not to be in sync, keeping the Fed at bay. But weakness in both Europe and Asia combined with stagnant U.S. GDP growth may be the dominant factors urging caution. Nevertheless the Taylor rule continues to call for a significant rise.