By Thomas Cooley, Ben Griffy and Peter Rupert

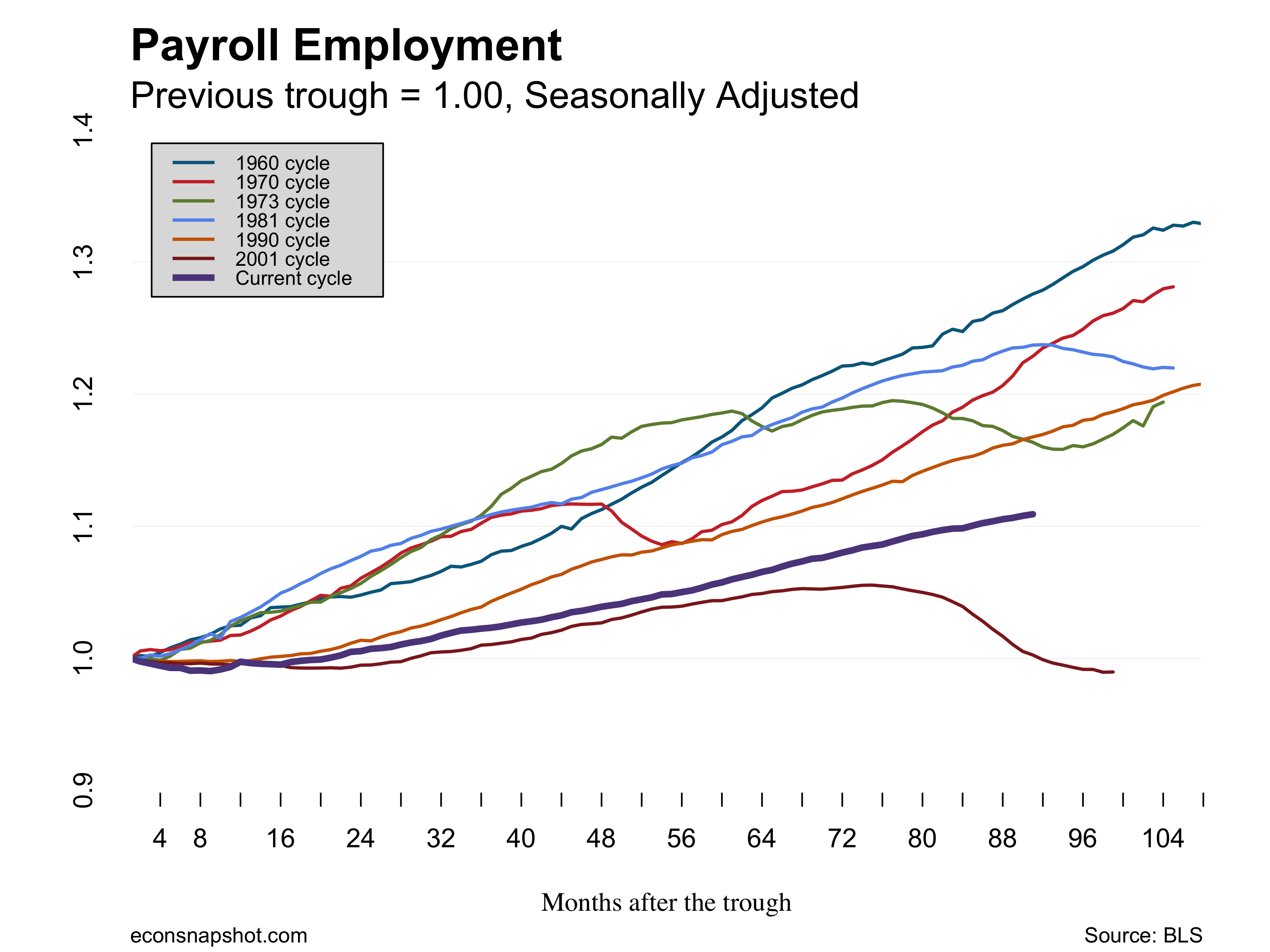

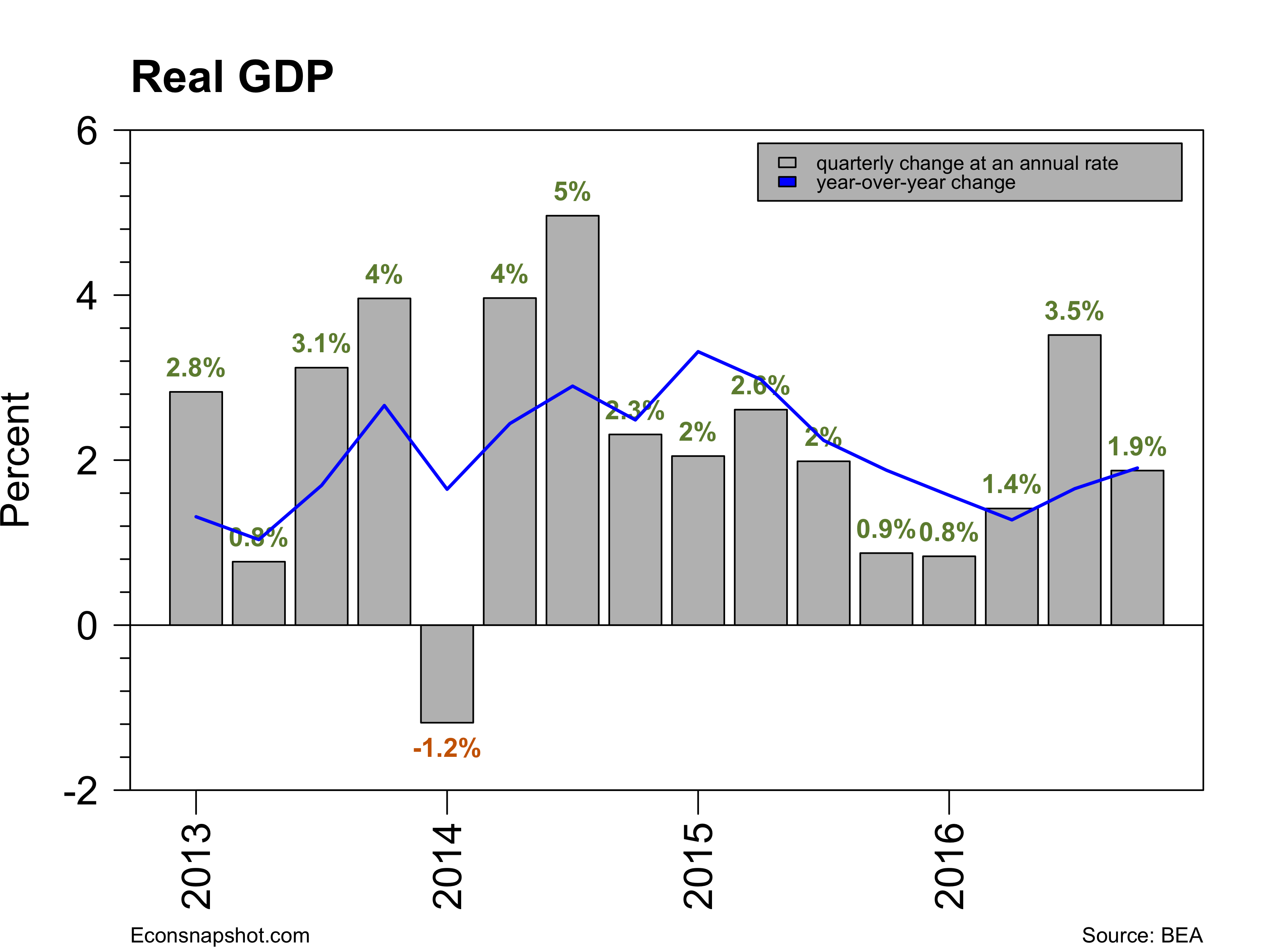

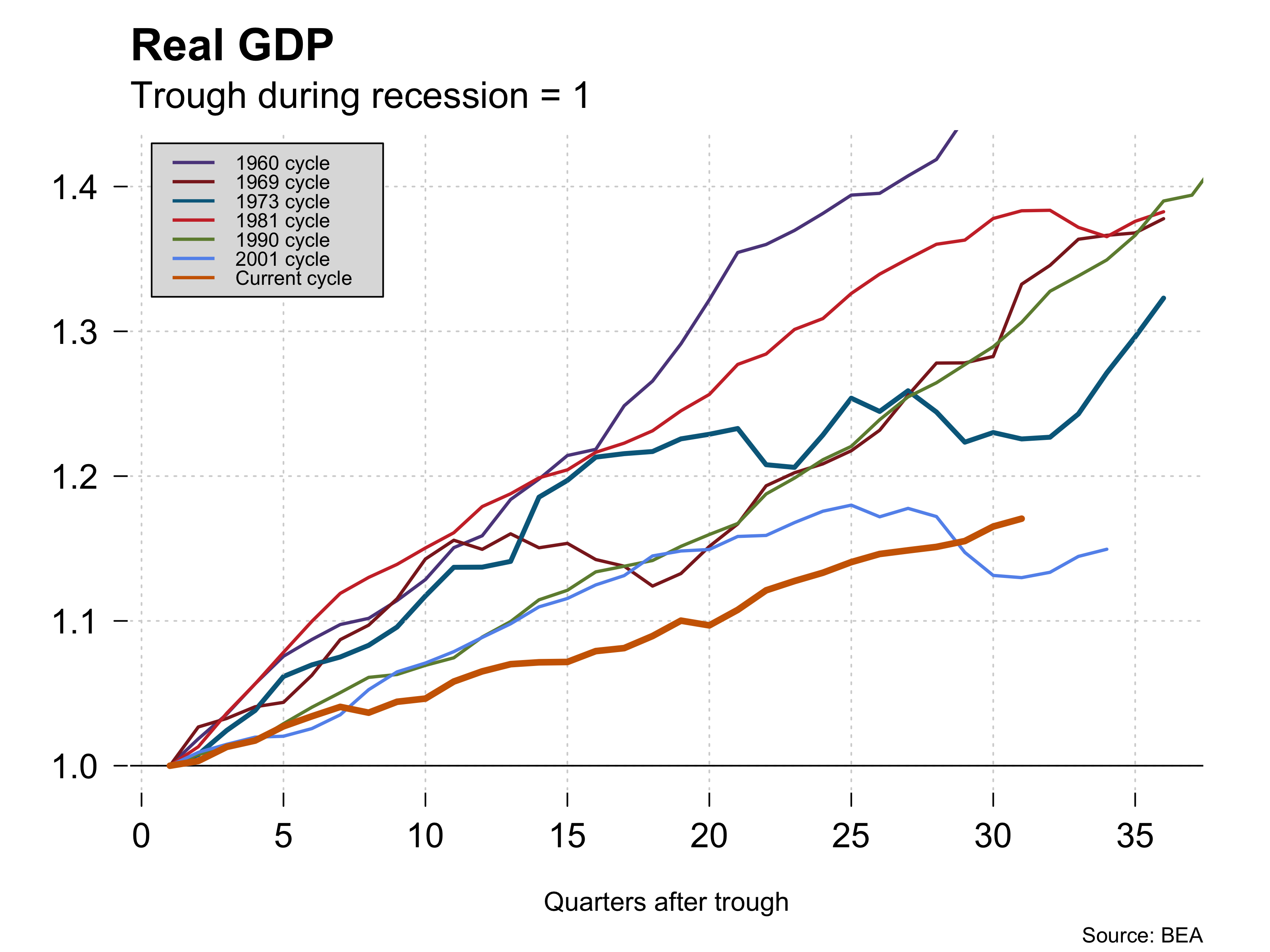

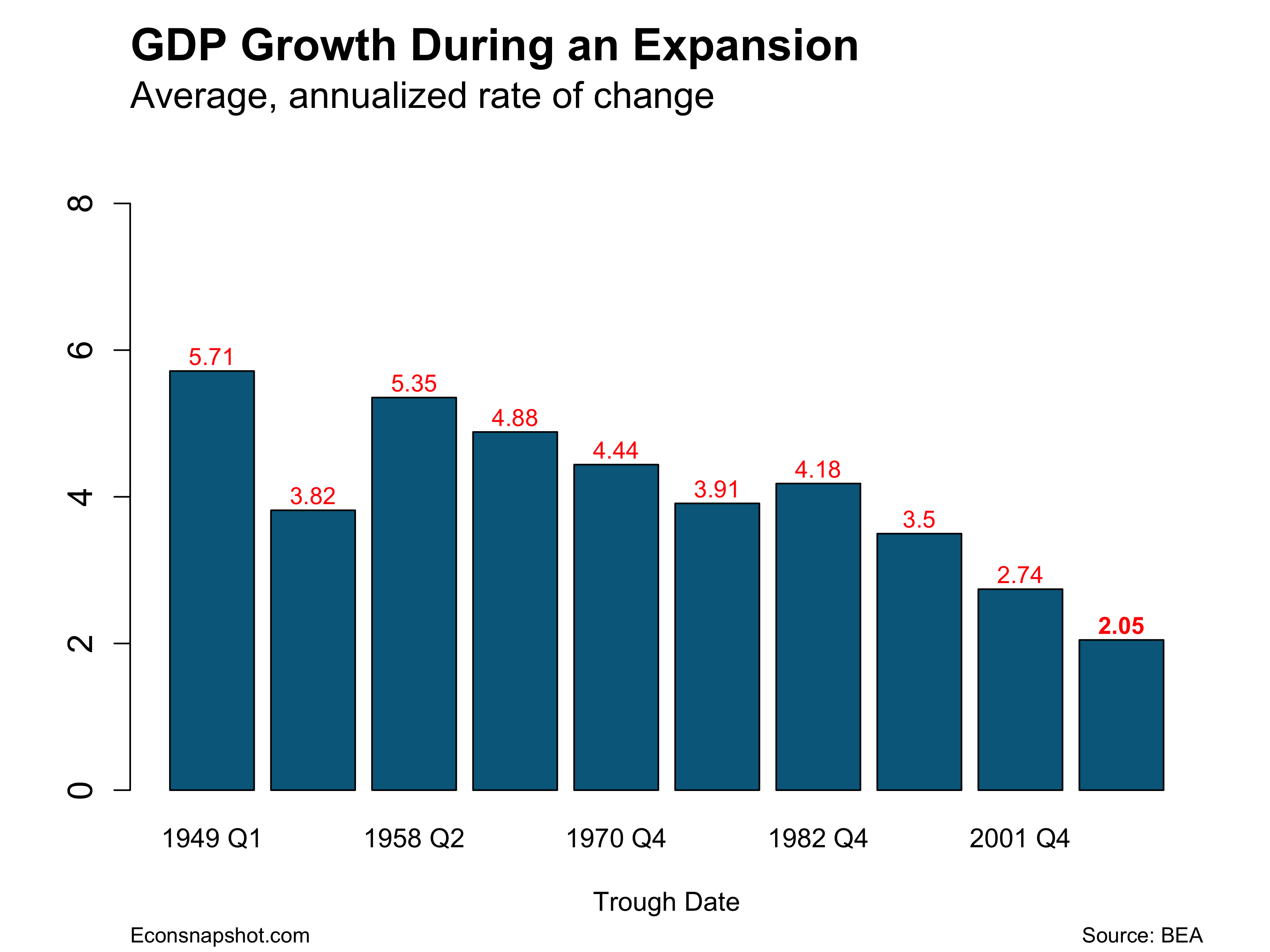

Fourth quarter real GDP grew at a 1.9% seasonally adjusted annual rate, according to the advance estimate, as announced by the Bureau of Economic Analysis. Overall, for 2016 GDP increased at a 1.6% clip, one full percentage point lower than the 2.6% increase in 2015 and also lower than the 2.4% growth rate posted in 2014. Although, the year-over-year change has somewhat reversed its downward trend that began in 2015. Compared to other recoveries, our current one depicts slower growth coming out of the trough than previous recoveries going back to the 1960’s. Note, however, that several of the recoveries had slipped back into recession by this time, some eight years after the trough. According to the NBER business cycle dating committee there have been 11 cycles since 1945, the average duration during that time span from trough to peak is 58.4 months.

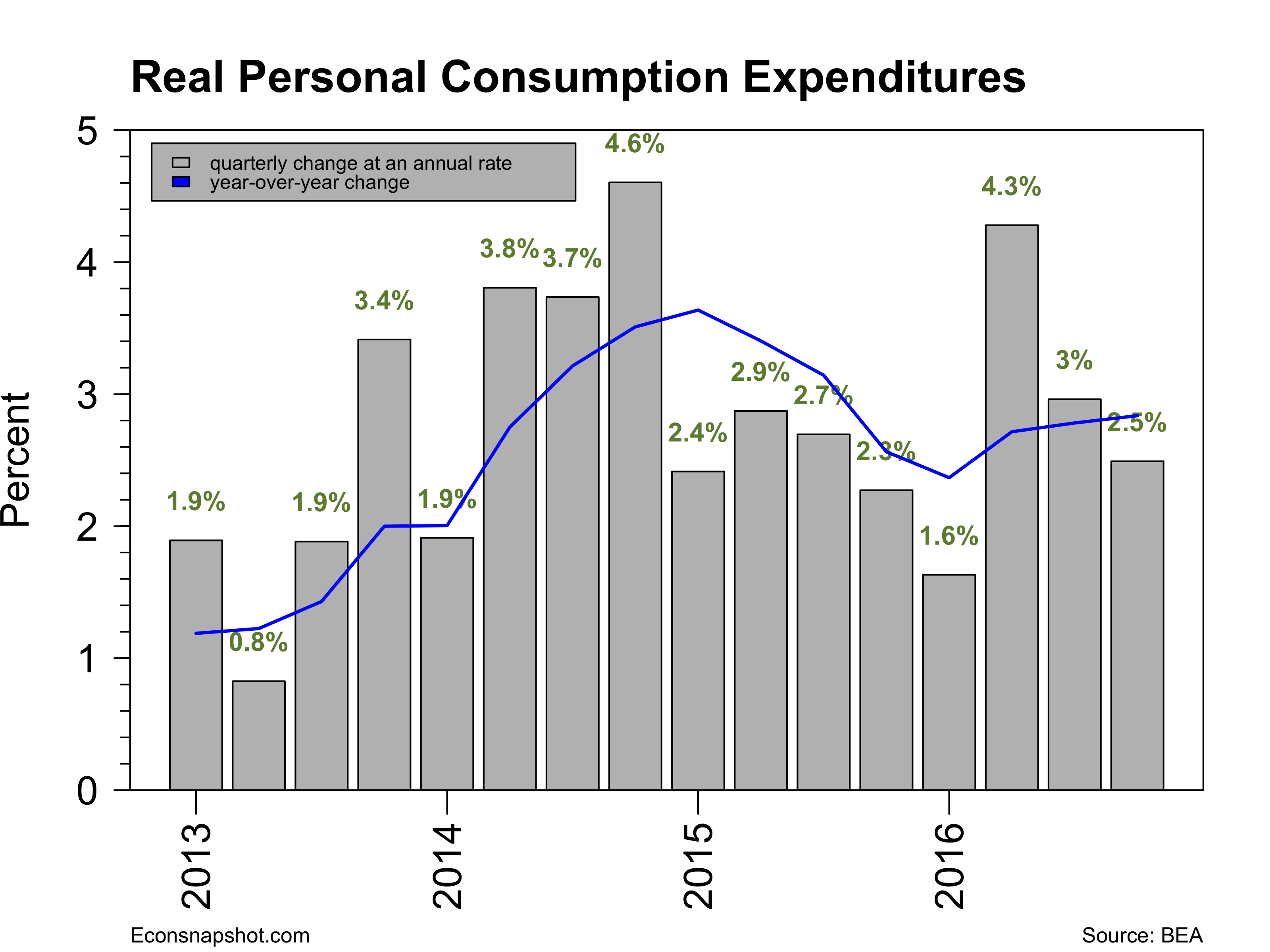

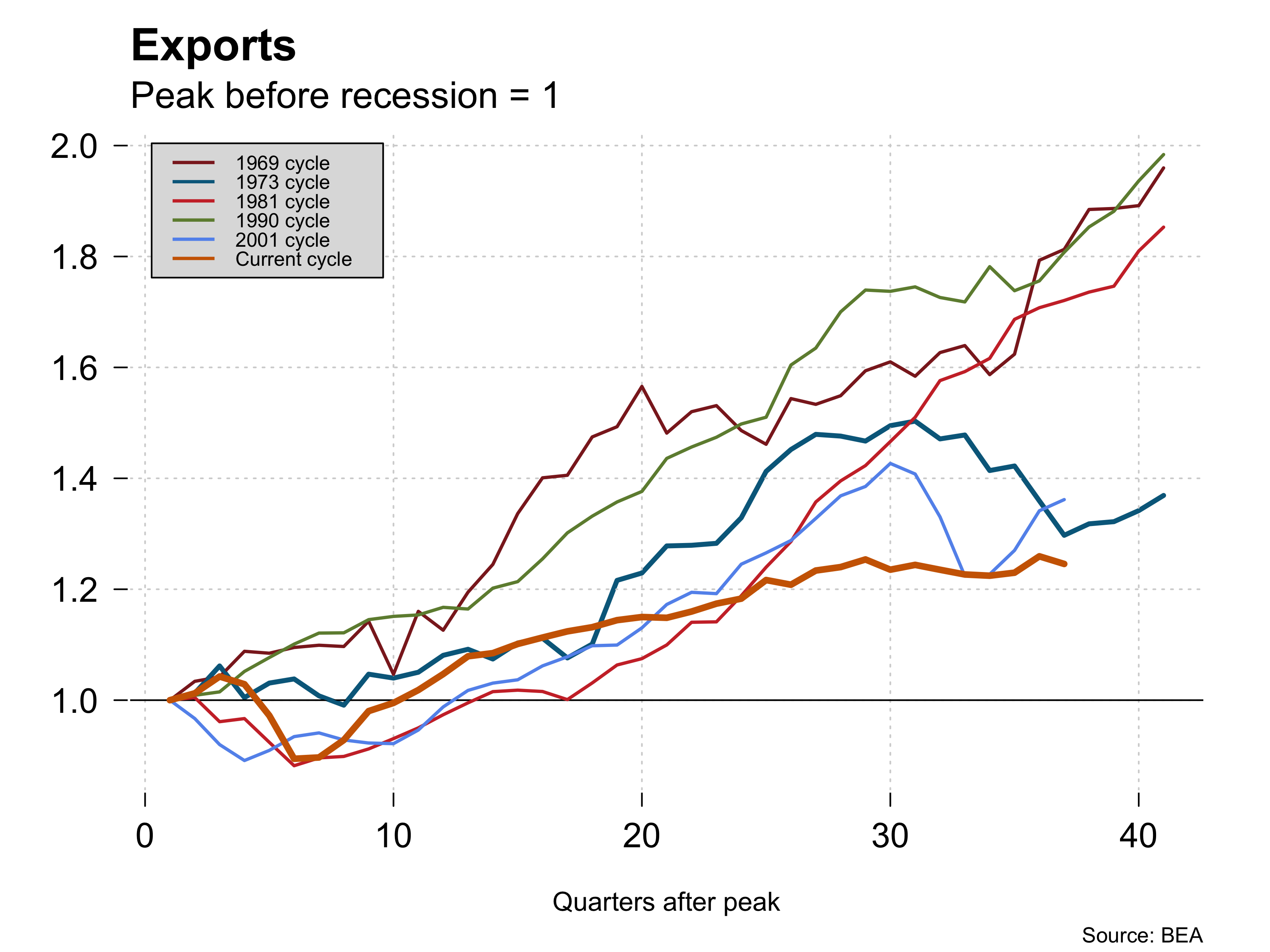

The principal contributors to the Q4 growth were personal consumption expenditures (contributing 1.70) and investment (contributing 1.67). The decline in exports and increase in imports were the largest drag on growth with net exports contributing -1.70. Over the year, real PCE grew 2.7%, only slightly lower than the 3.2% growth in 2015 and 2.9% in 2014.

Overall for 2016 investment fell 1.5%, nonresidential structures down 3.1%, equipment down 2.8 but intellectual property products up 5.0%.