By Thomas Cooley and Peter Rupert

The advance estimate for Q2 shows a 2.6% annualized growth rate for real GDP. The largest contributor to that increase was consumption, real PCE increased 2.8% on an annualized basis.

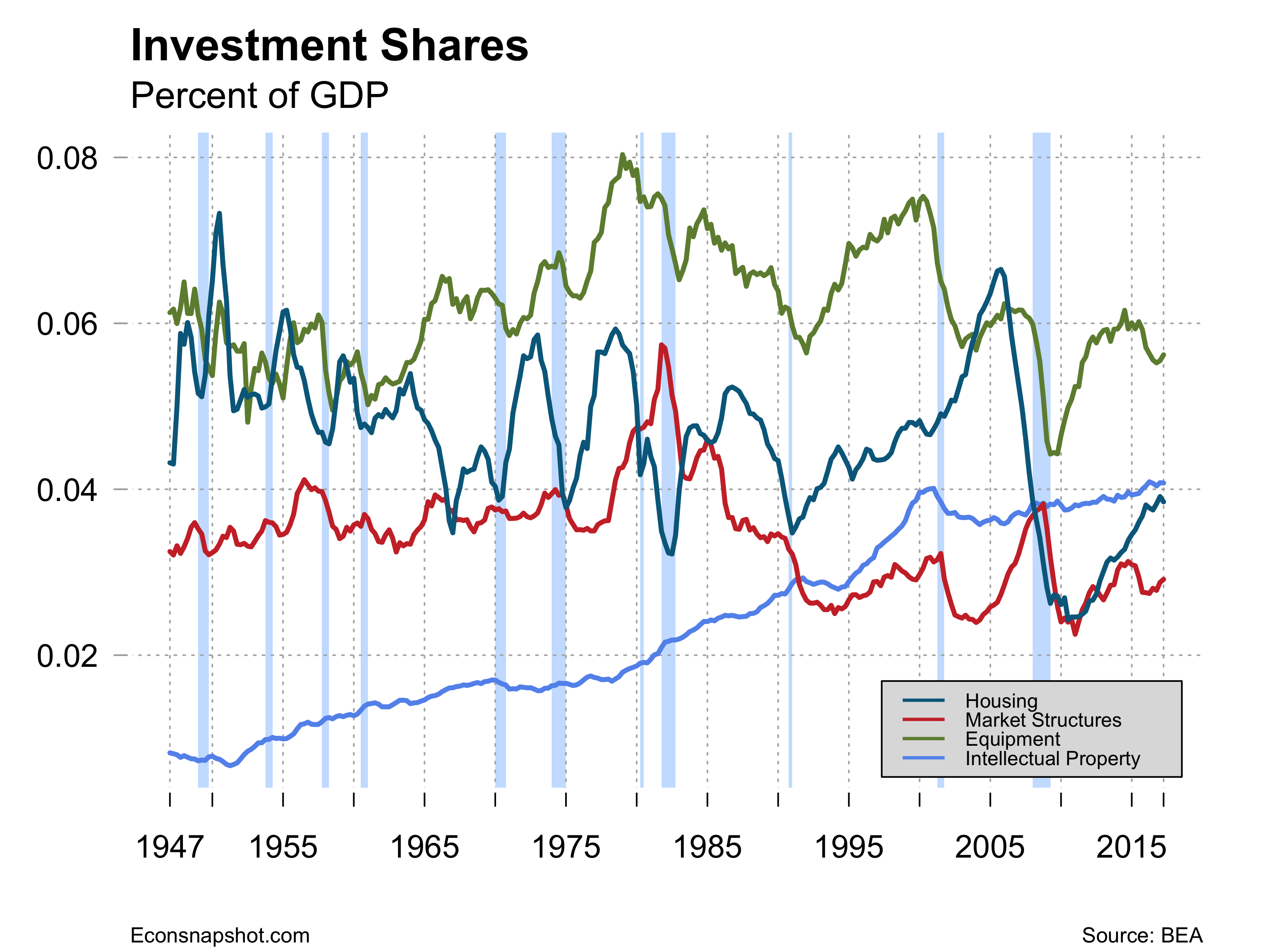

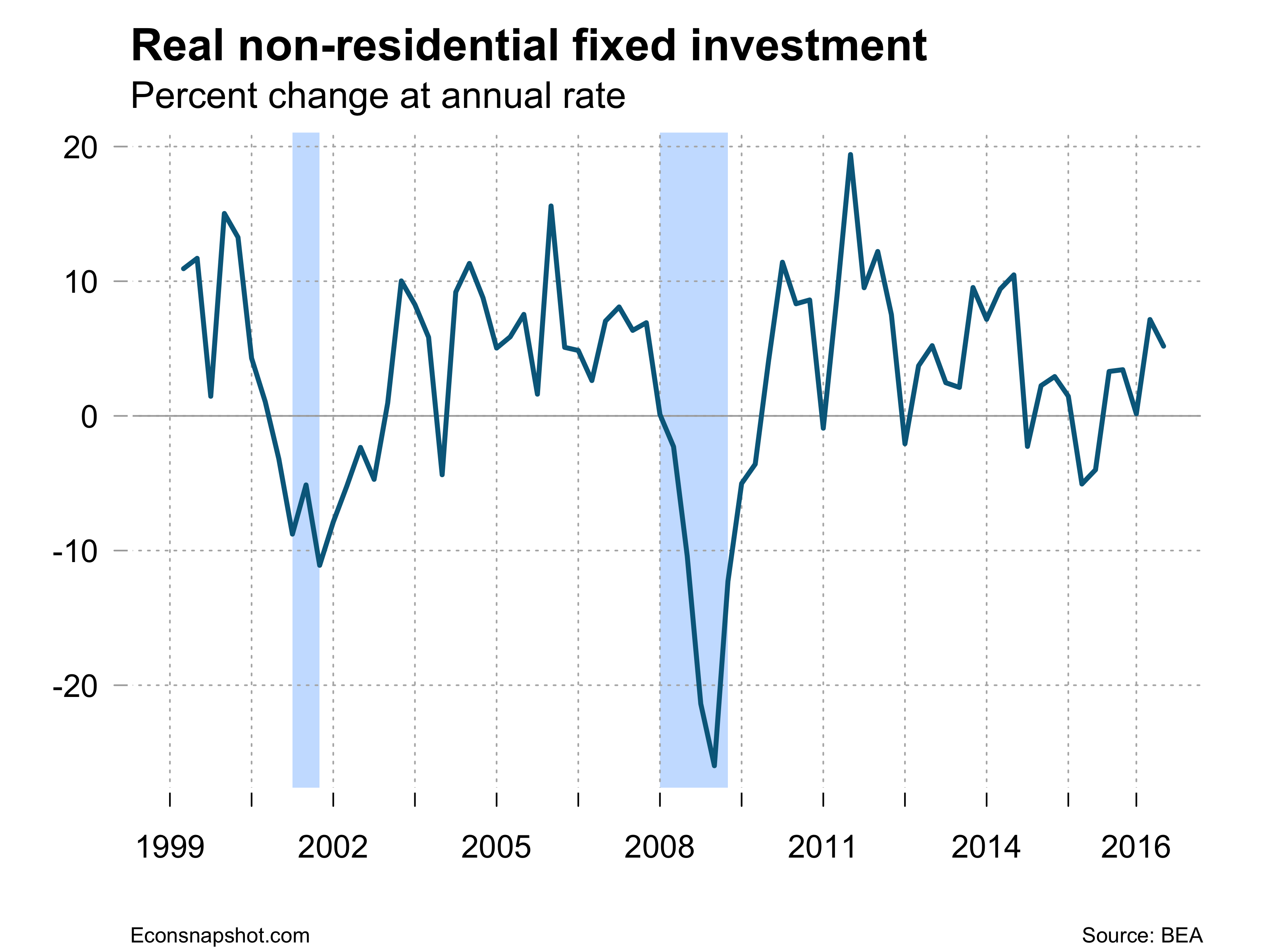

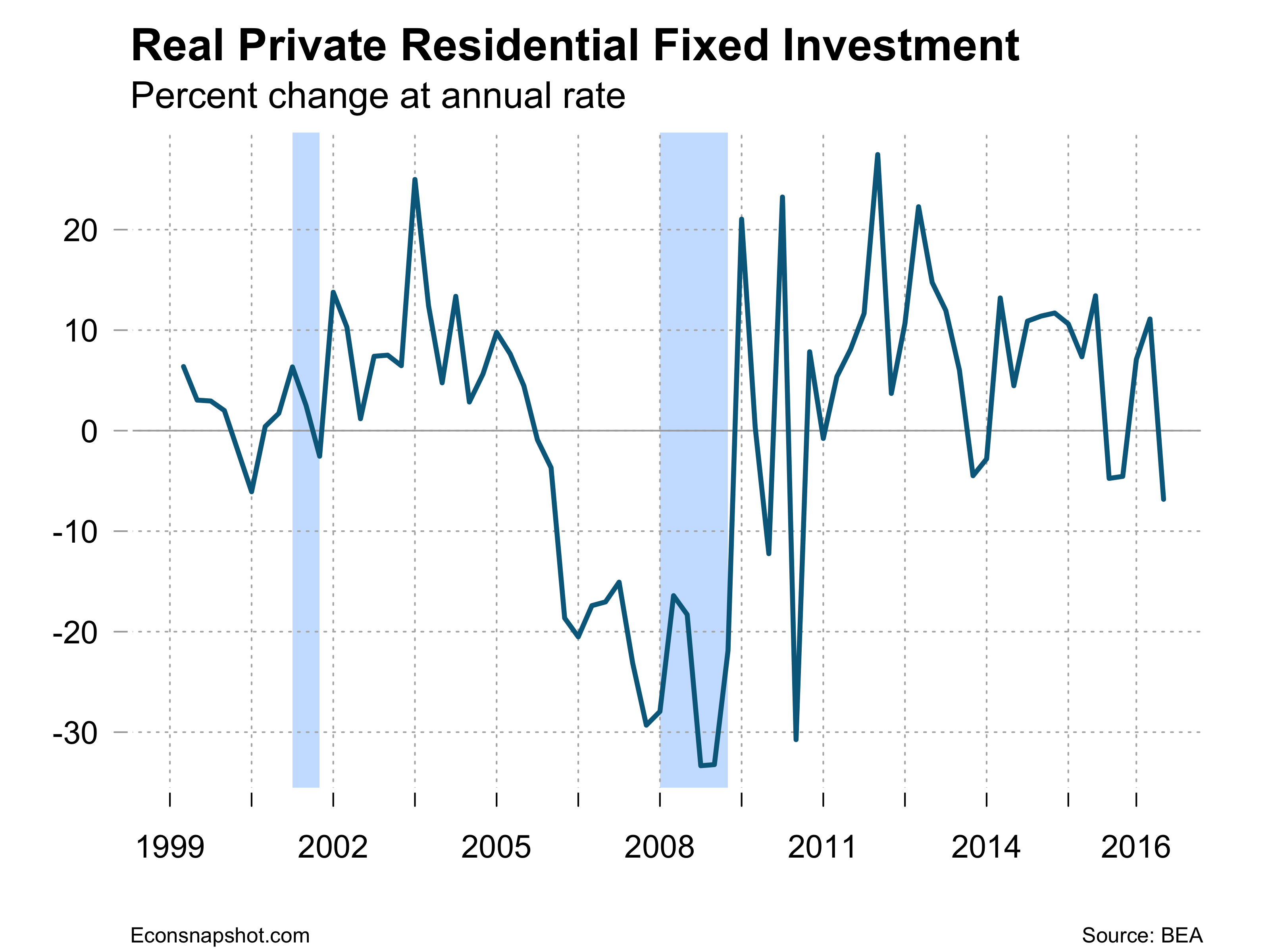

Several other sectors showed large increases, equipment up 8.2%, the largest increase since Q3 of 2015. Durable goods up 6.3%. Nonresidential fixed investment rose 5.2% following a 7.2% increase in Q1, the two highest growth rates since 2014 Q3. Residential fixed investment, however, declined 6.8%.

July is typically the month the BEA does annual updates. The timespan of the revisions is the first quarter of 2014 through the first quarter of 2017. Q1 of 2017 was revised down to 1.2% from 1.4%. The PCE price index was also revised down in Q1, from 2.4% to 2.2%. Overall, from 2013 to 2016 average annual growth was revised up slightly, to 2.3% from 2.2%.

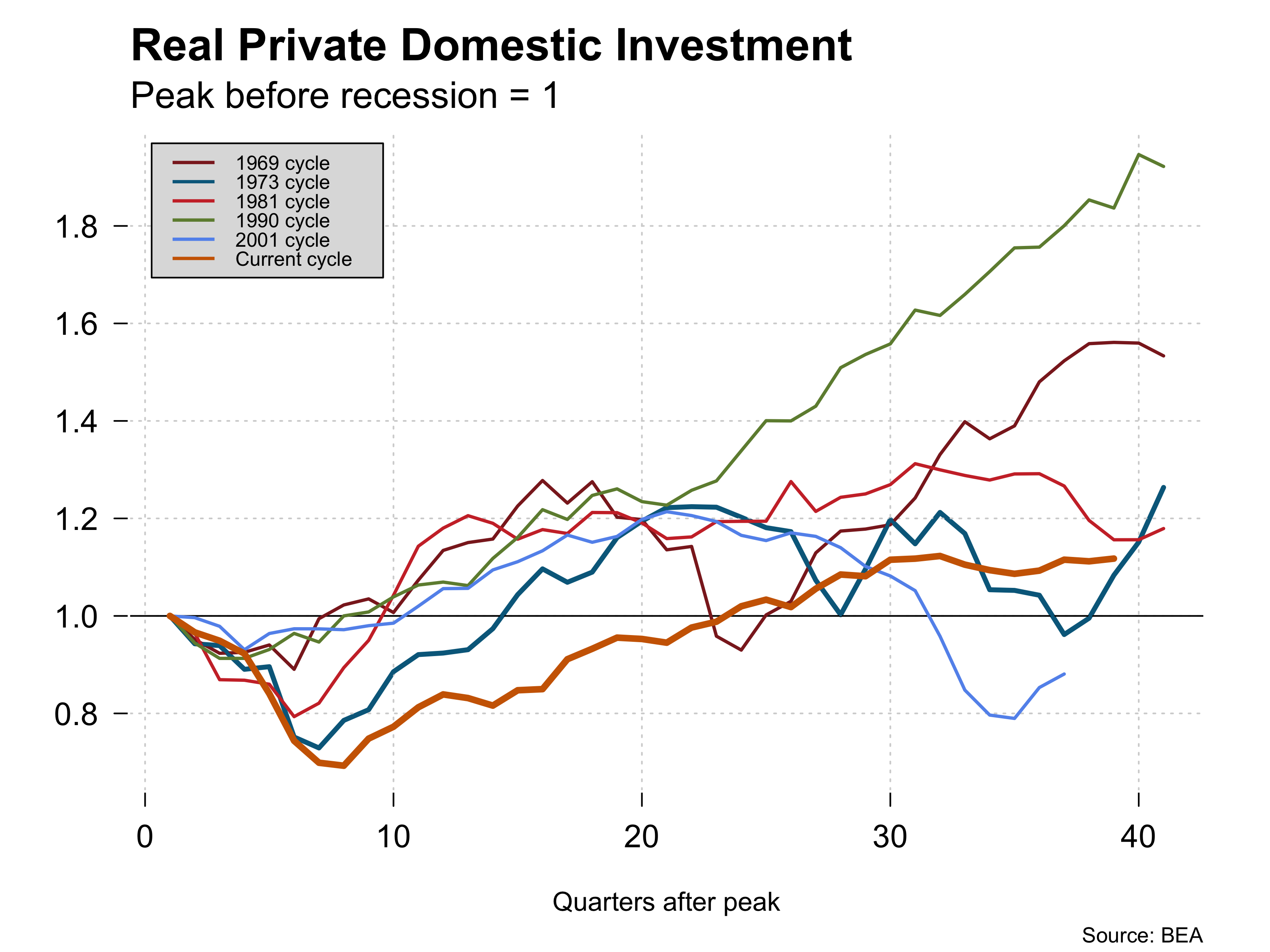

Q2 was expected to come in stronger than Q1 and it was expected that consumers would drag the numbers up. Still, the picture is of modest, unspectacular growth. This is now a very mature expansion and it could turn down at any time. What has been missing throughout is the stimulus that would come from increased investment. A big infrastructure program could turn that around but it does not seem to be likely in the near future. The current recovery, compared to earlier recoveries, has been remarkably weak for investment. It took about six years to get back to the pre-recession investment levels.