by Thomas Cooley and Peter Rupert

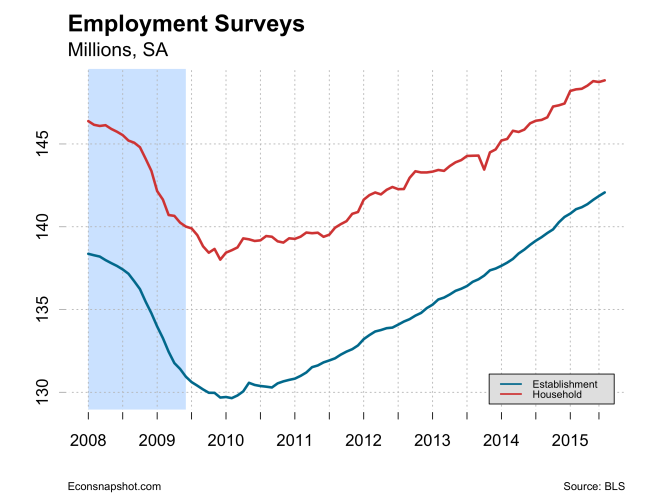

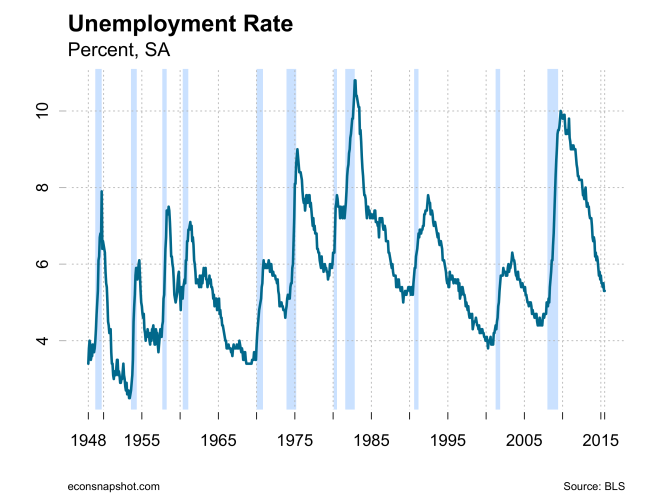

The past week has been a wild and crazy ride, capped by a strong GDP report, boosting Q2 growth from the advance estimate of 2.3% to 3.7%. This morning, the personal income release reveals personal income growth of 0.4% for July, the same growth rate as the previous three months. The week began with a Dow drop of about a 1000 points during the morning, but closed down “only” 588 points (-3.57%)…followed by -1.29% on Tuesday, +3.95% on Wednesday, +2.27% on Thursday. That turmoil was puzzling given that most observers saw the U.S. economy as fundamentally strong even before the latest update of Q2, with low unemployment and steady growth in real output.

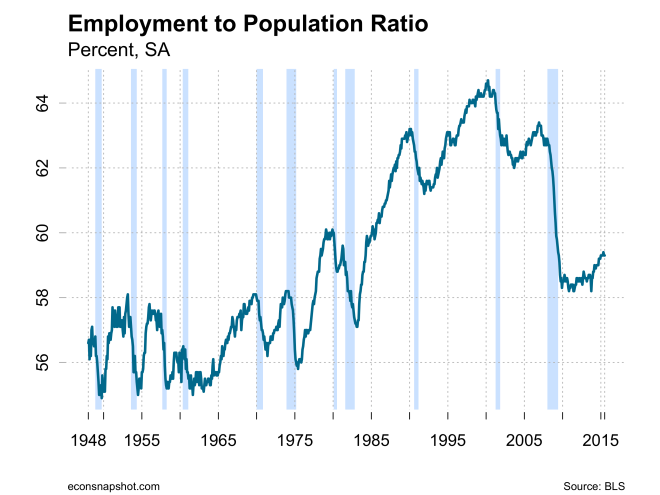

That the economy has grown steadily, albeit slower than during other recoveries, has given monetary policy makers the opportunity to begin to normalize operations. However, given the length of the recovery, are some now worried about another possible dip…as seen in the 1973 and 2001 cycles below?

The fundamentals of this recovery are strong as well. Consumer spending growth was up 3.1% and has been strong for the past year.

Investment, particularly intellectual property investment was strong.

What Next for The Fed?

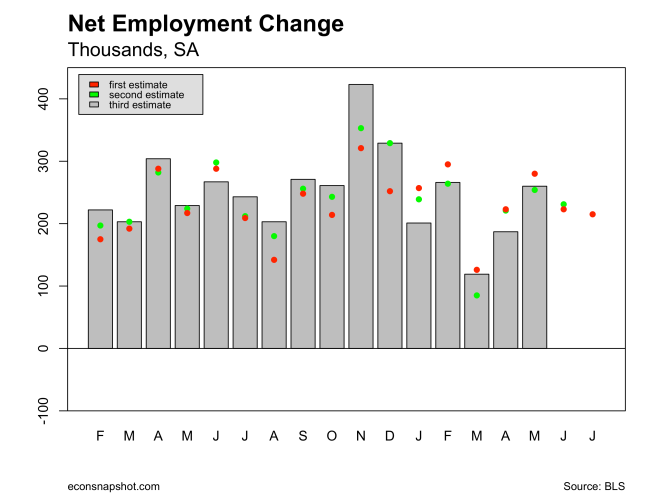

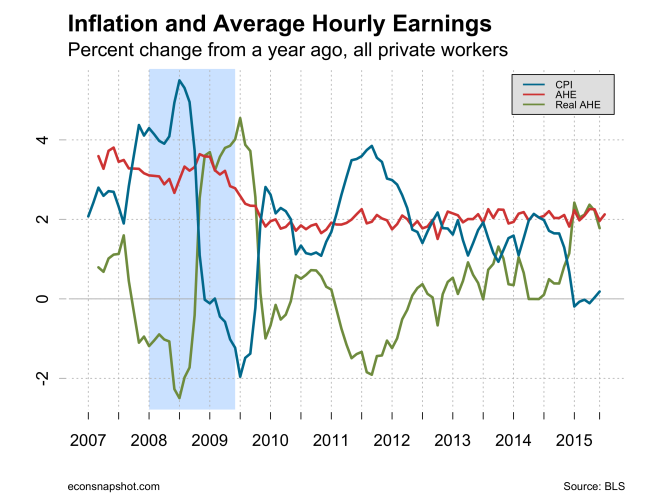

The market turmoil of last week led many, including William Dudley , President of the New York Fed, to call for caution in normalizing monetary policy and beginning “liftof”as many expected them to do at the September meeting. Why the turmoil in markets should cause them be cautious is a puzzling question because it can be argued with some credibility that the state of financial markets has been significantly distorted by the Fed’ policy of the last seven years. It is even more bizarre to see former Treasury Secretary Larry Summers calling for more asset purchases by the Fed. The fact of the matter is that the U.S. economy is looking extremely normal with low unemployment, steady job growth, and decent growth in real GDP in spite of significant headwinds from the rest of the world and a strong dollar. If now is not the time to return to normal monetary policy, when will be?