By Thomas Cooley and Peter Rupert

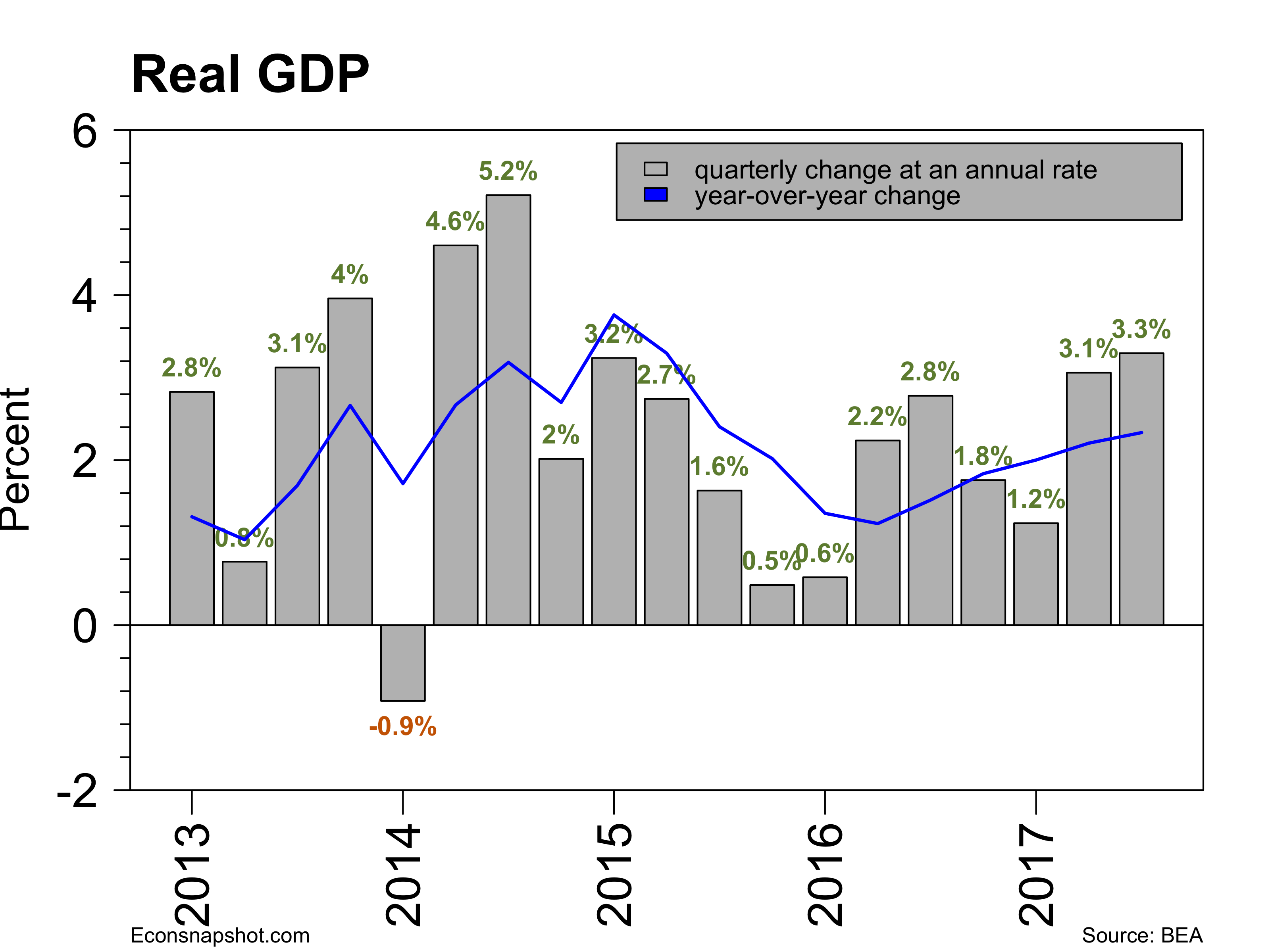

The BEA announced a small upward revision to Q3 GDP, from 3.0% in the preliminary estimate to 3.3% in the second estimate. Year-over-year growth continues its upward trajectory. Consumption growth was revised down slightly to 2.3%.

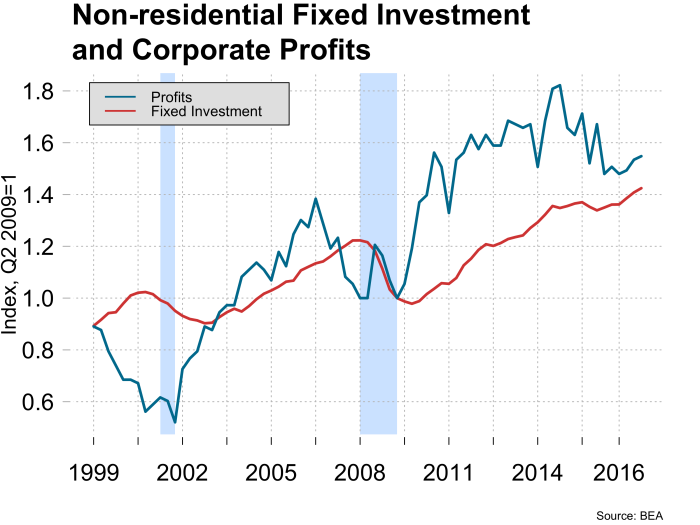

The upward revision to fixed investment was large, increasing almost a full percentage point, from 1.5% to 2.4%. The big gainers in the investment sector were equipment, from 8.6% to 10.4%, and intellectual property, from 4.3% to 5.8%. Non-residential structures were bumped down, from -5.2% to -6.8%. Residential investment, however, was revised up, from -6.0% to -5.1%, respectively.

Corporate profits increased 4.3% from Q2 to Q3 and are up 5.4% compared to Q3 2016.

This revision does little to change the overall outlook of the US economy…meaning that the Fed is likely still on for a December rate hike.