By Thomas Cooley, Ben Griffy and Peter Rupert

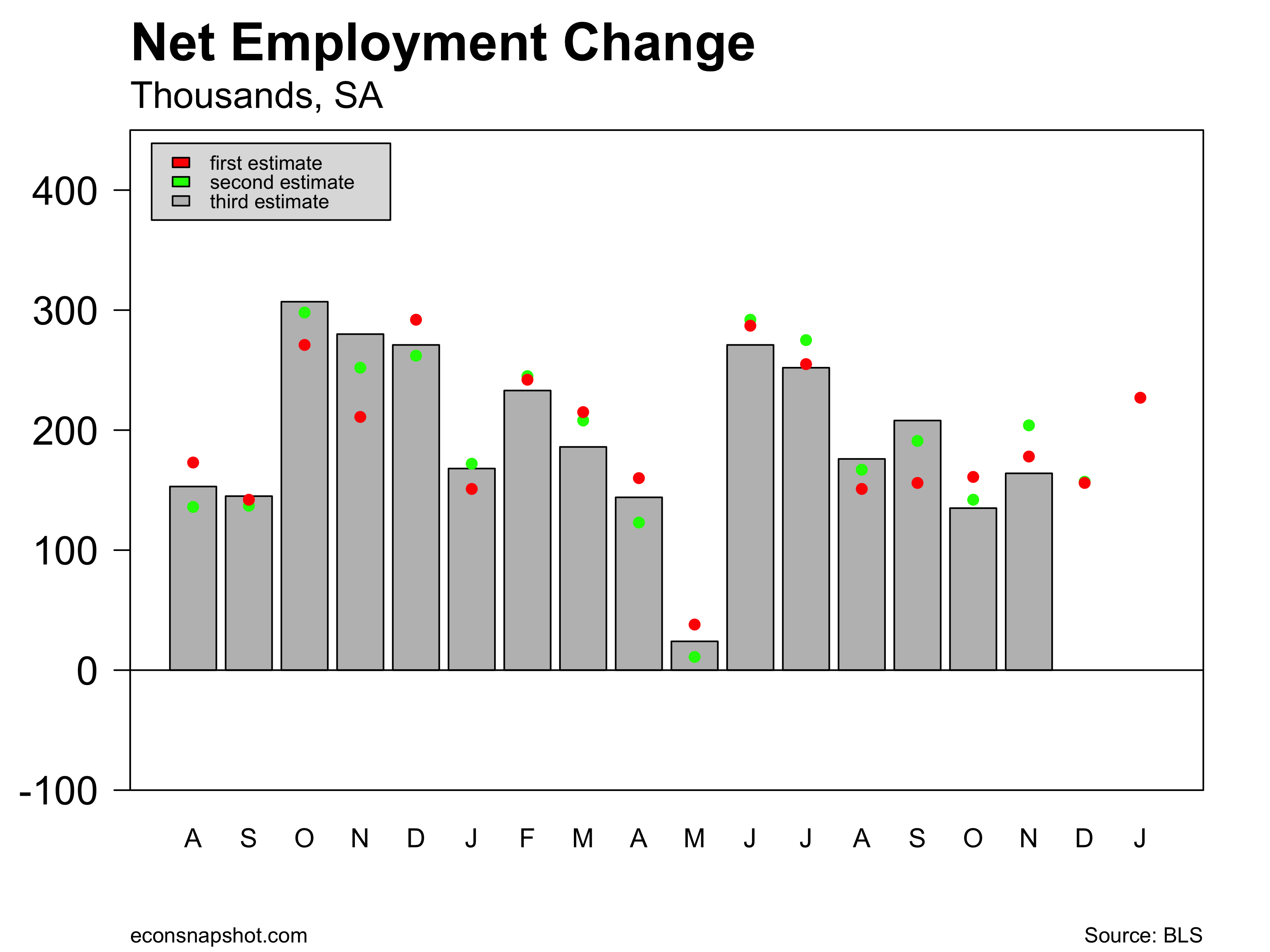

January employment numbers released by the BLS reveal a 227,000 increase in payroll employment, but a 40,000 decrease in November after the final revision and a 1,000 increase to December. Total private employment, however, was up 237,000 as the government shed 10,000 jobs. The service sector showed the largest increase with 192,000 more jobs. Mining and logging (oil largely) increased for the third consecutive month. Average job growth for the last three months is 183,000 similar to what it was in 2015. This is not spectacular, but it is steady.

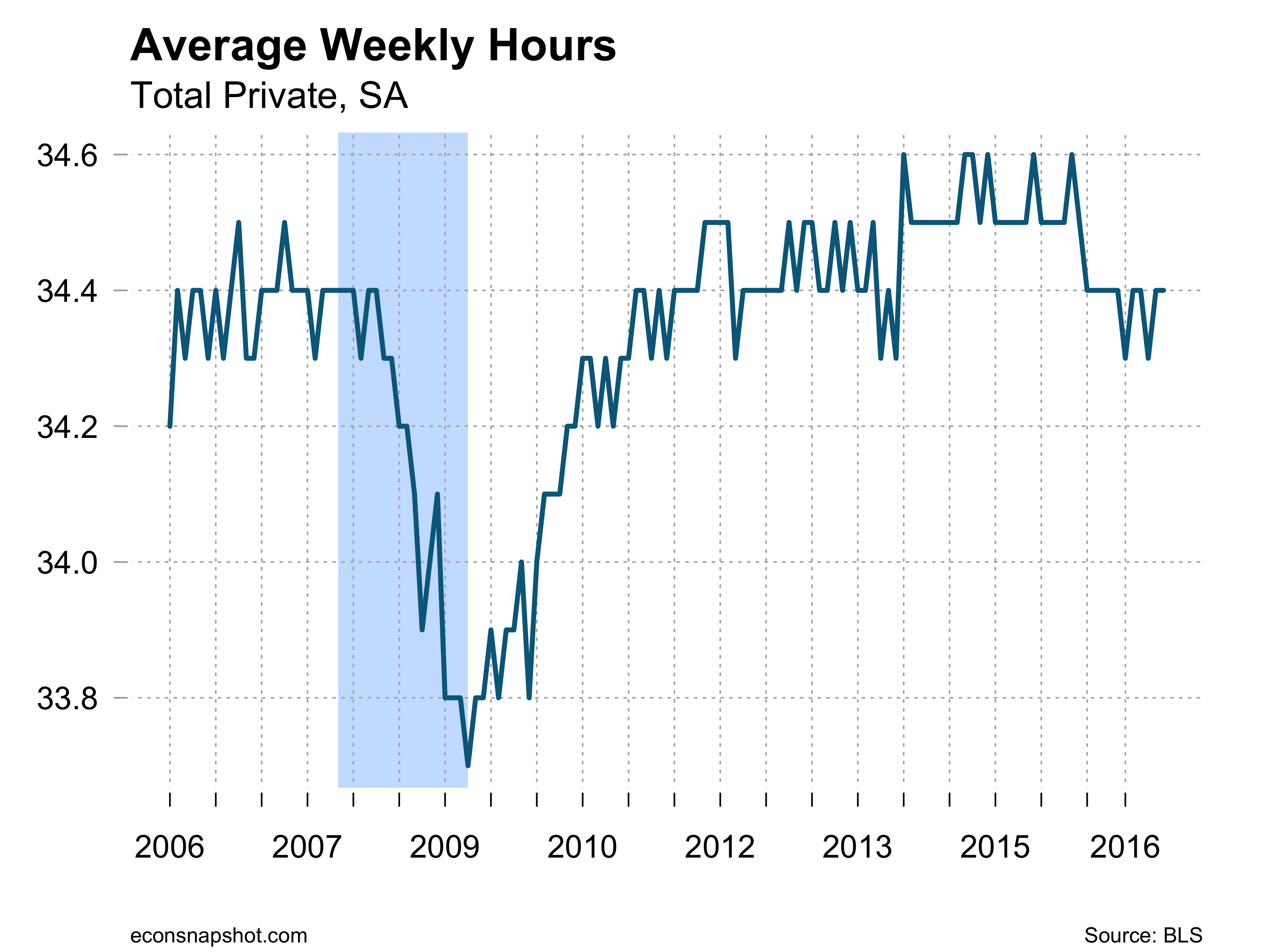

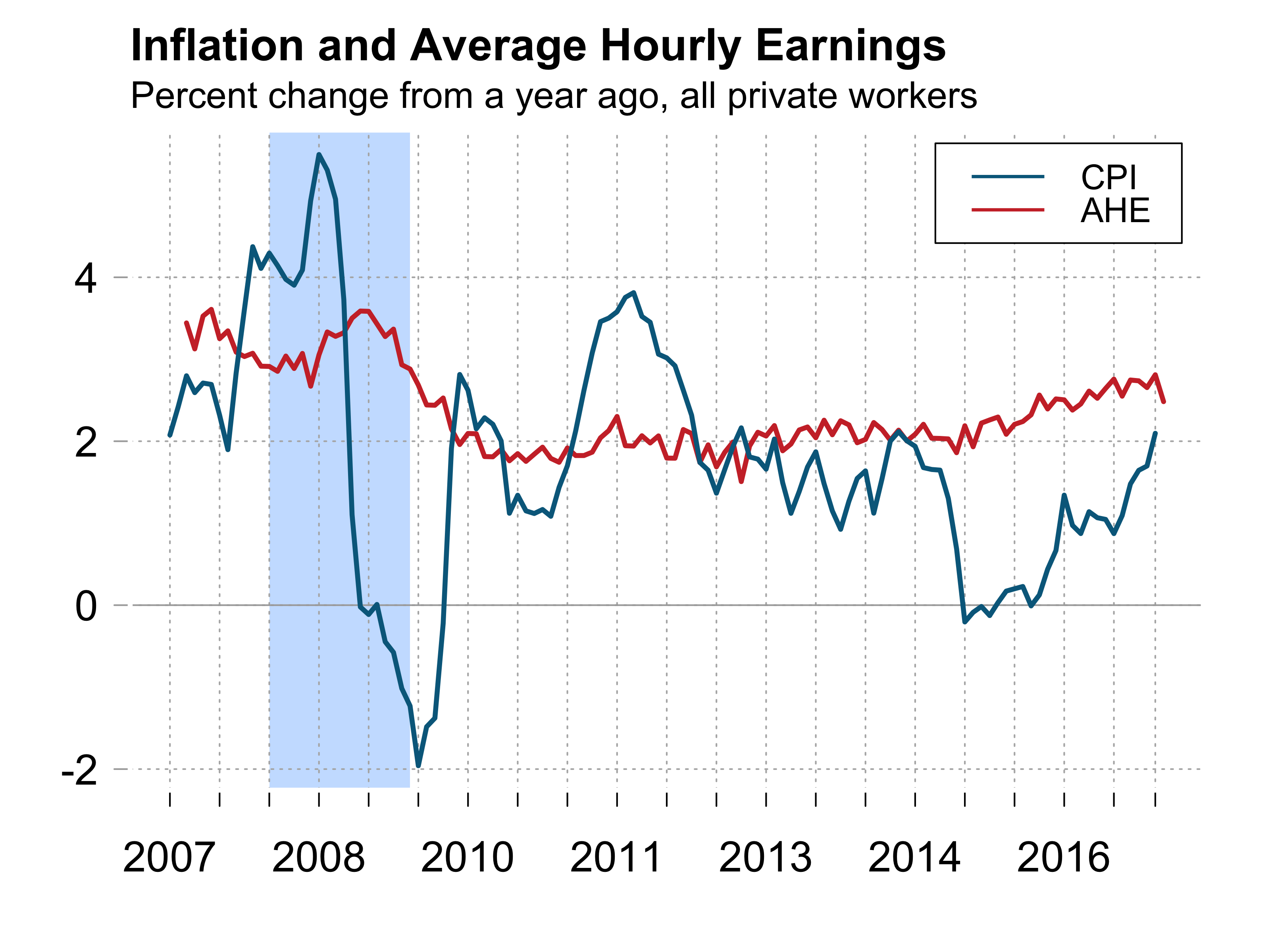

Average weekly hours remained at 34.4 and average hourly earnings increased very slightly, from $25.97 to $26.00.

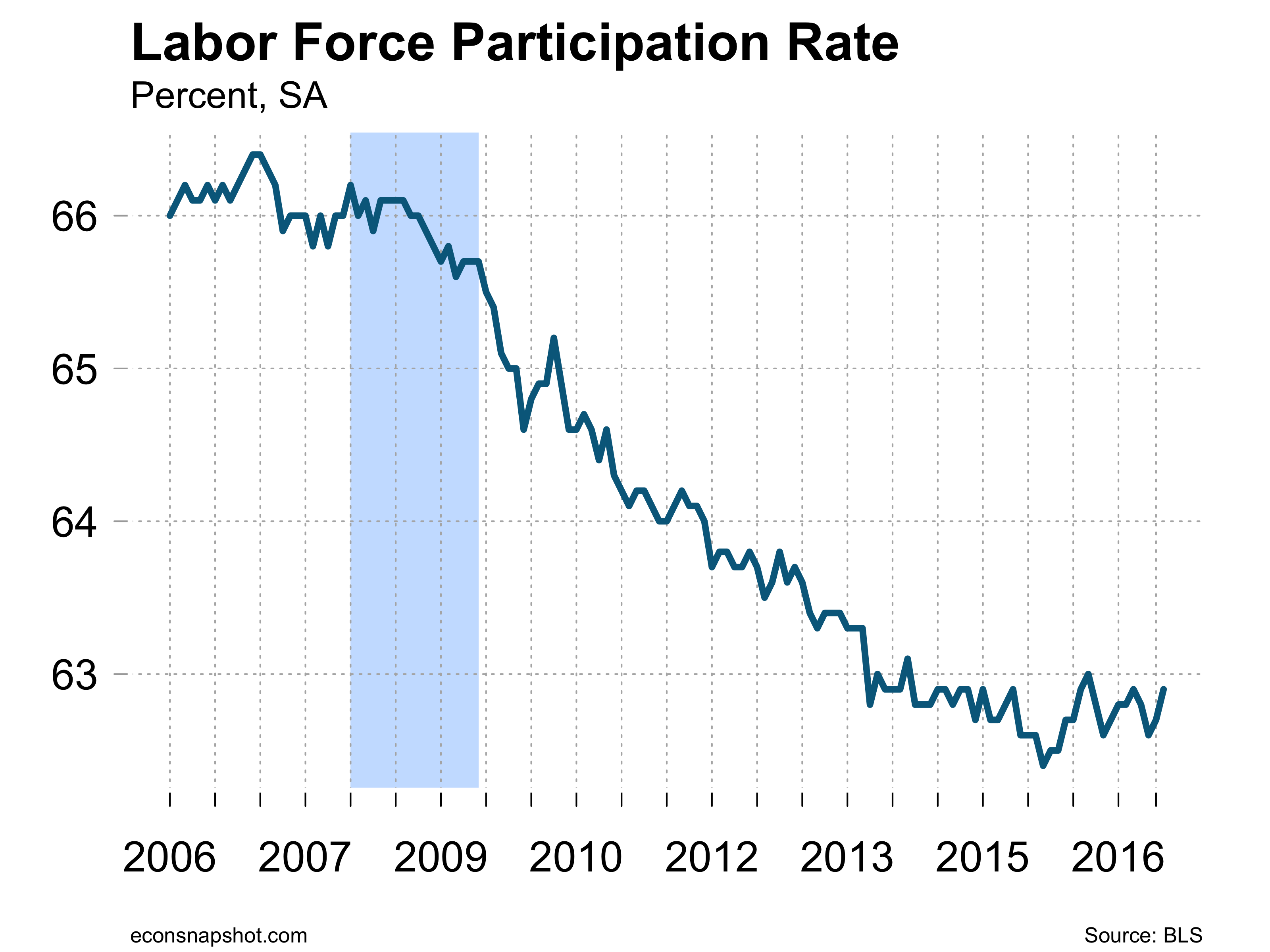

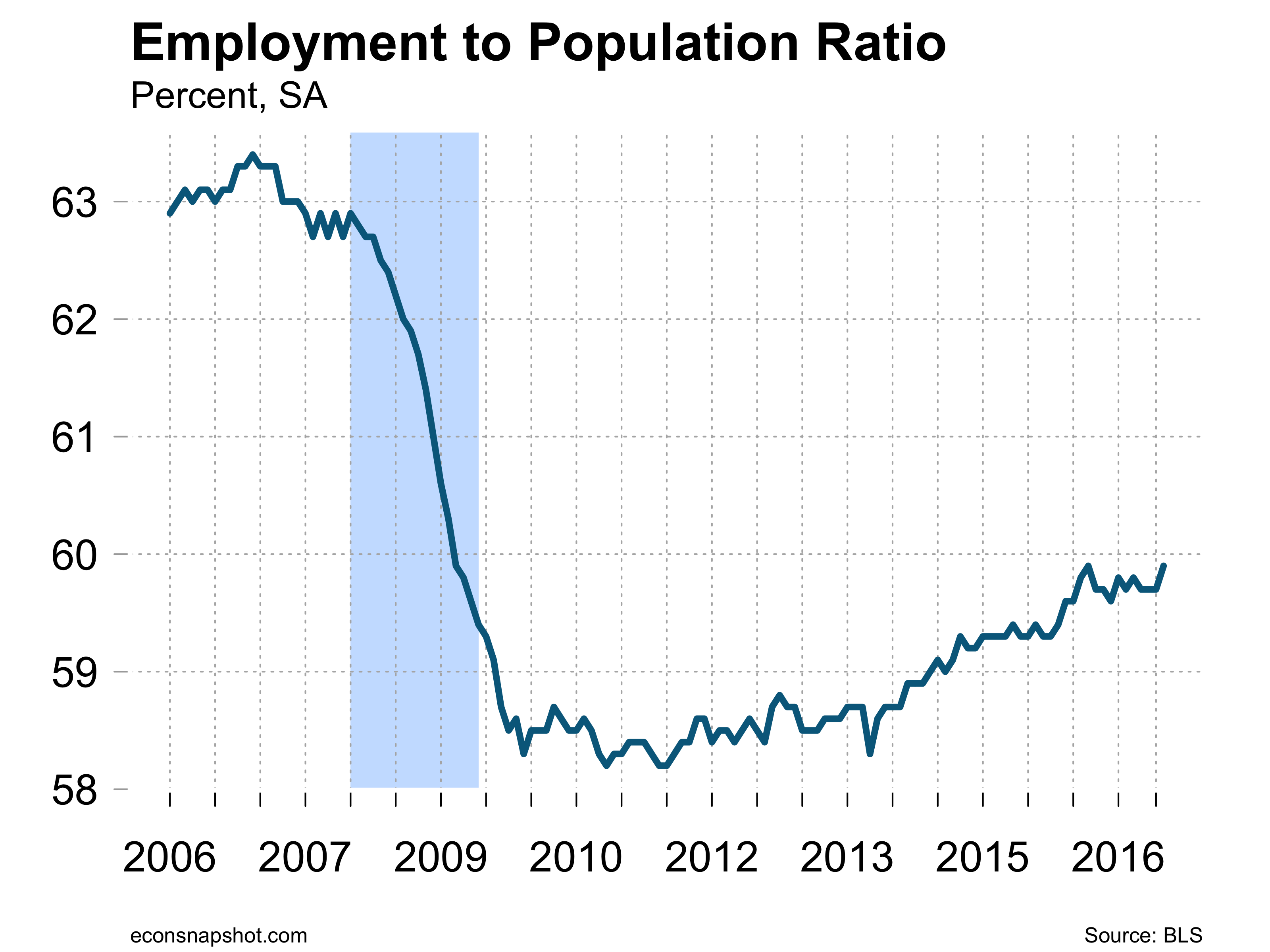

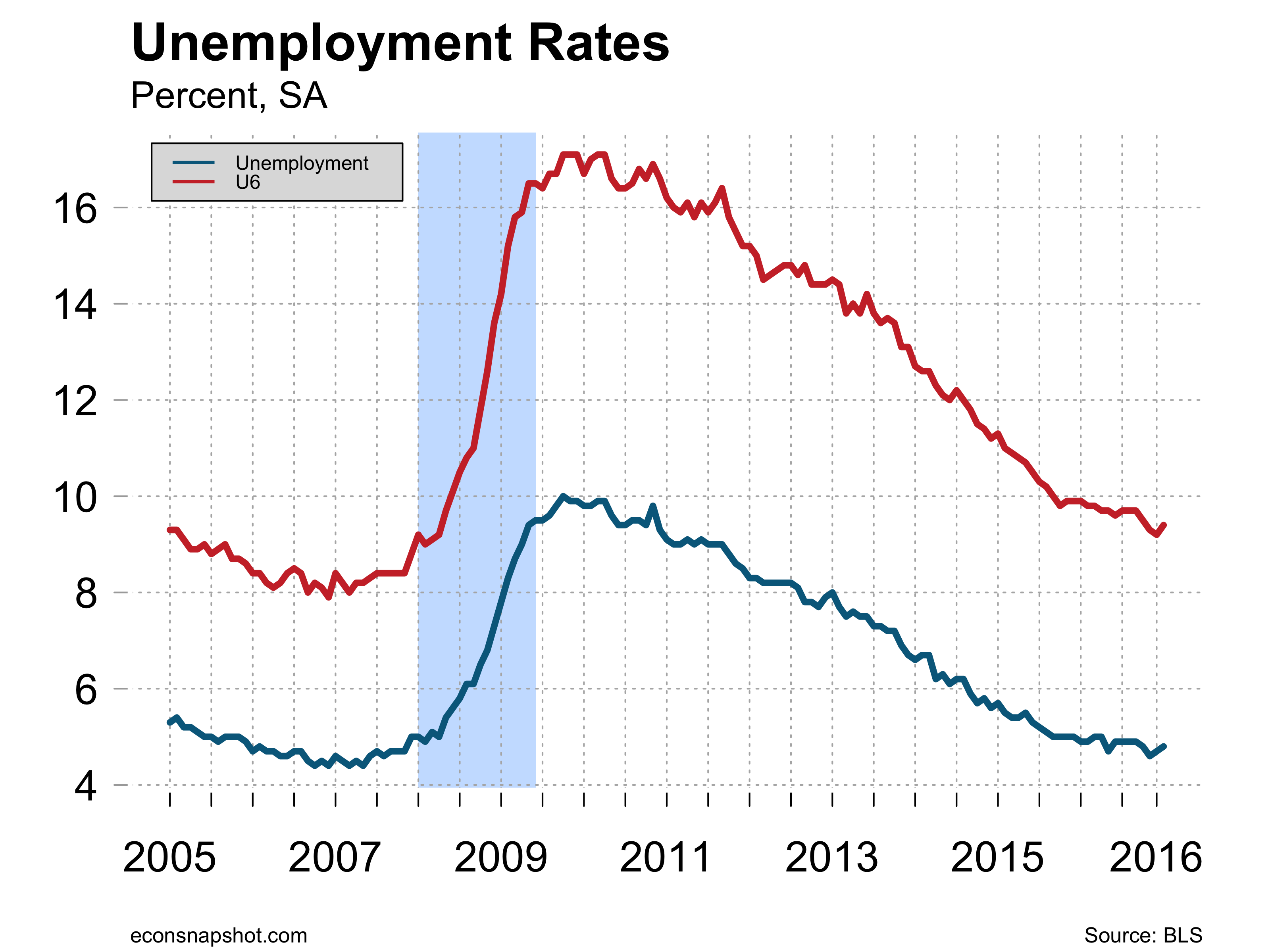

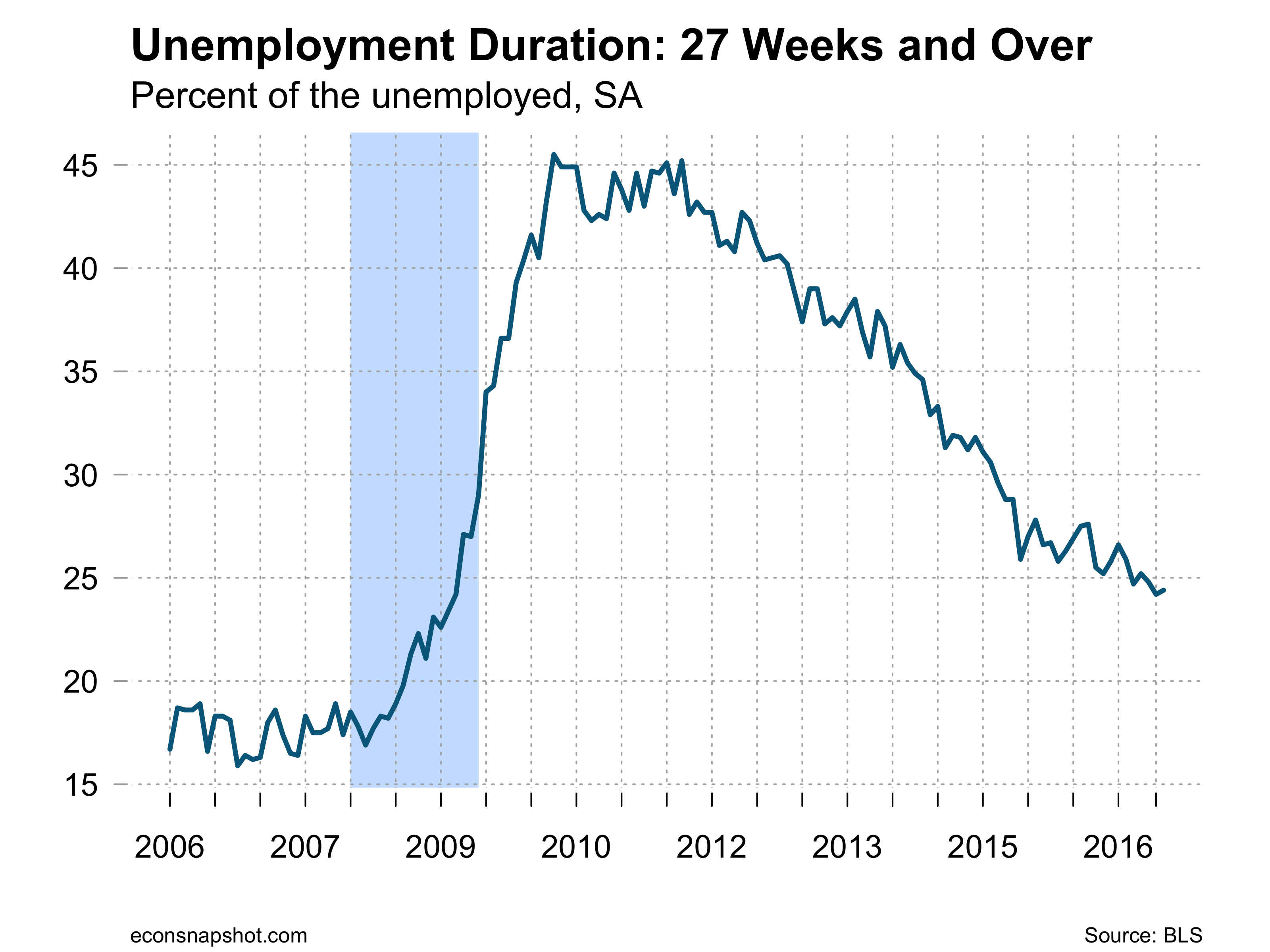

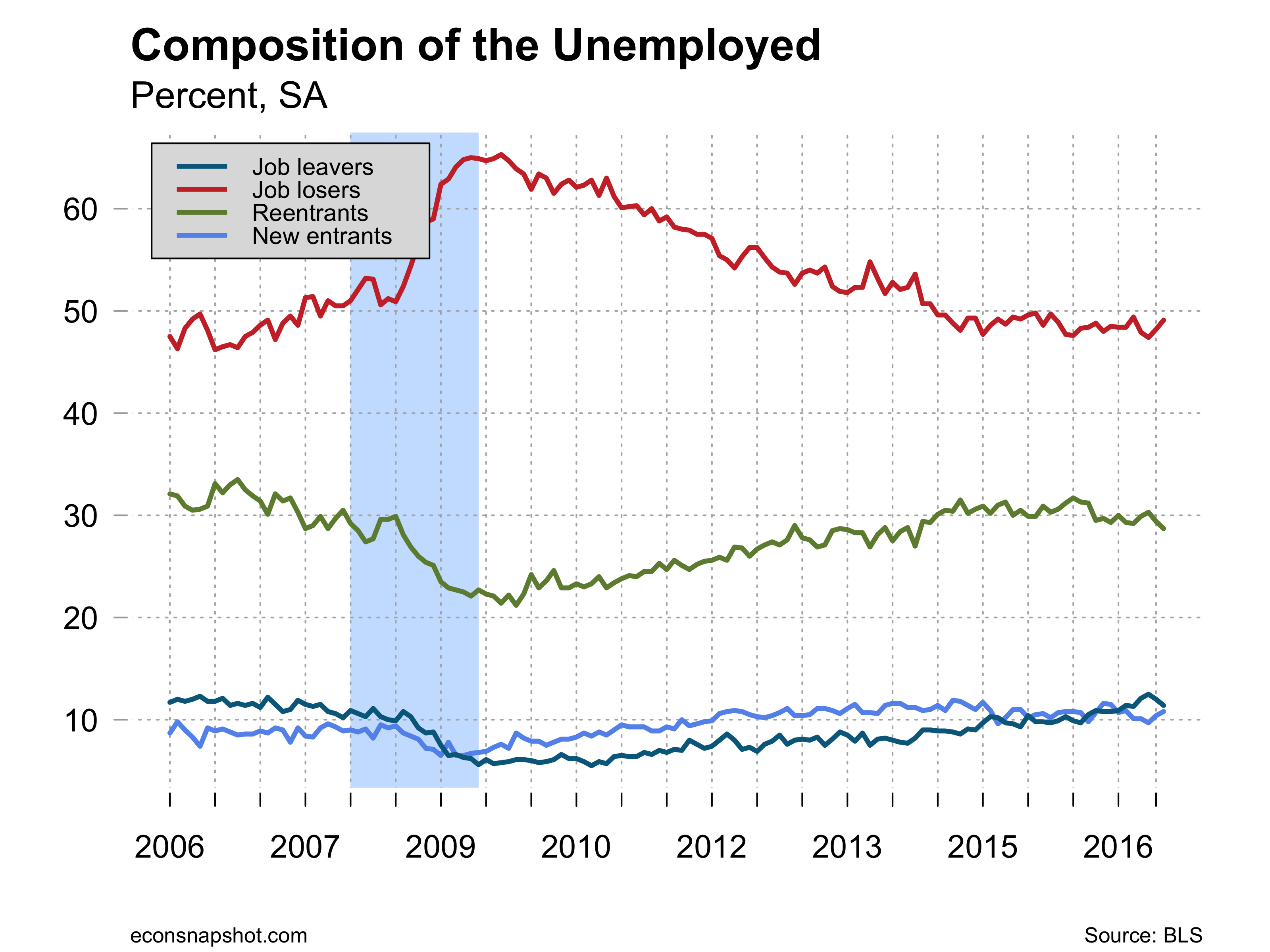

The household survey showed an increase in the labor force, the participation rate climbing to 62.9% and the employment to population ratio increased to 59.9. This is encouraging if it signals that workers who have been sitting on the sidelines are coming back into the labor force. However, the number employed fell somewhat and those unemployed rose, so that the unemployment rate increased slightly, from 4.72% to 4.78%. The number unemployed 27 weeks or longer ticked up slightly.

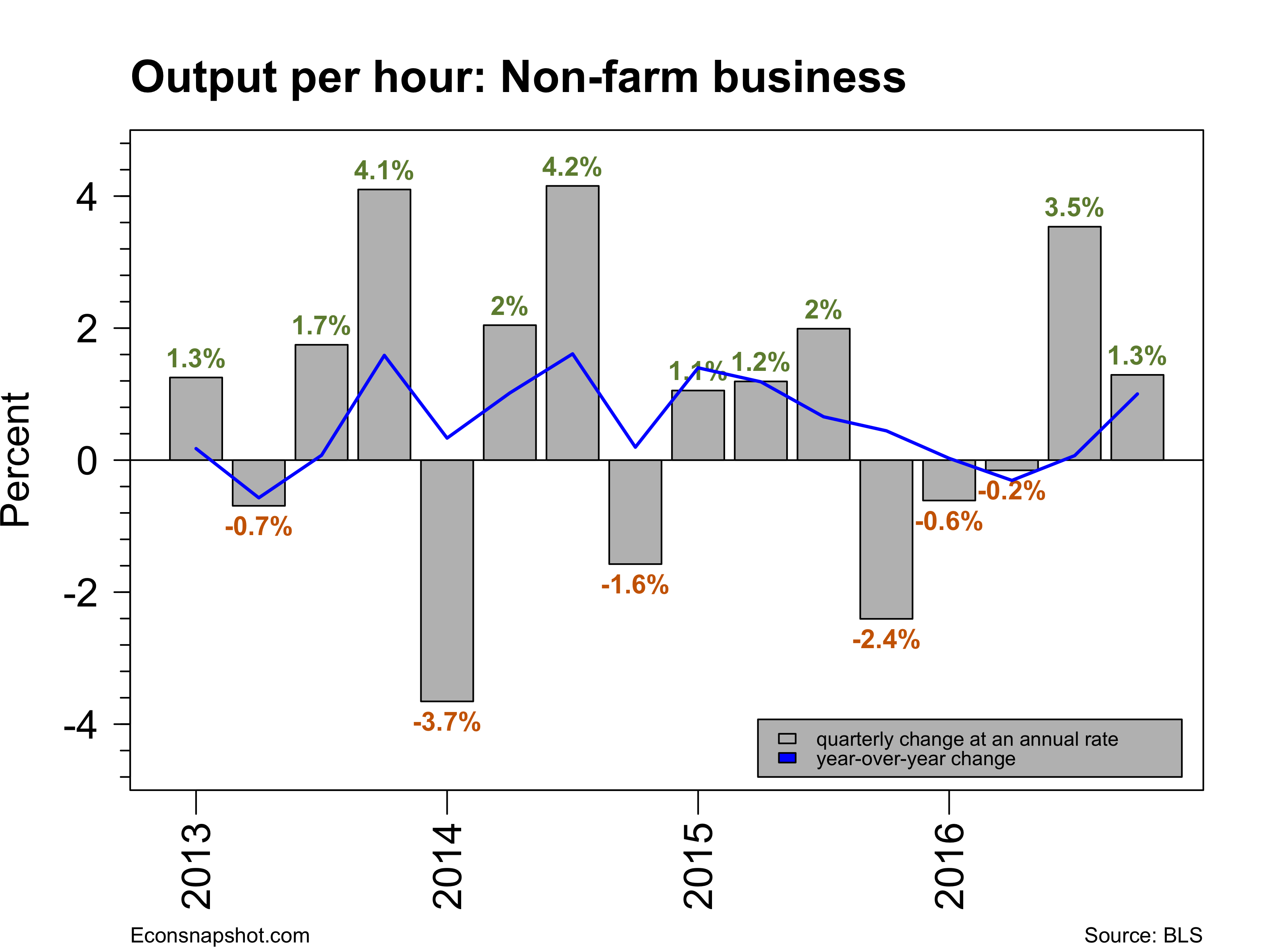

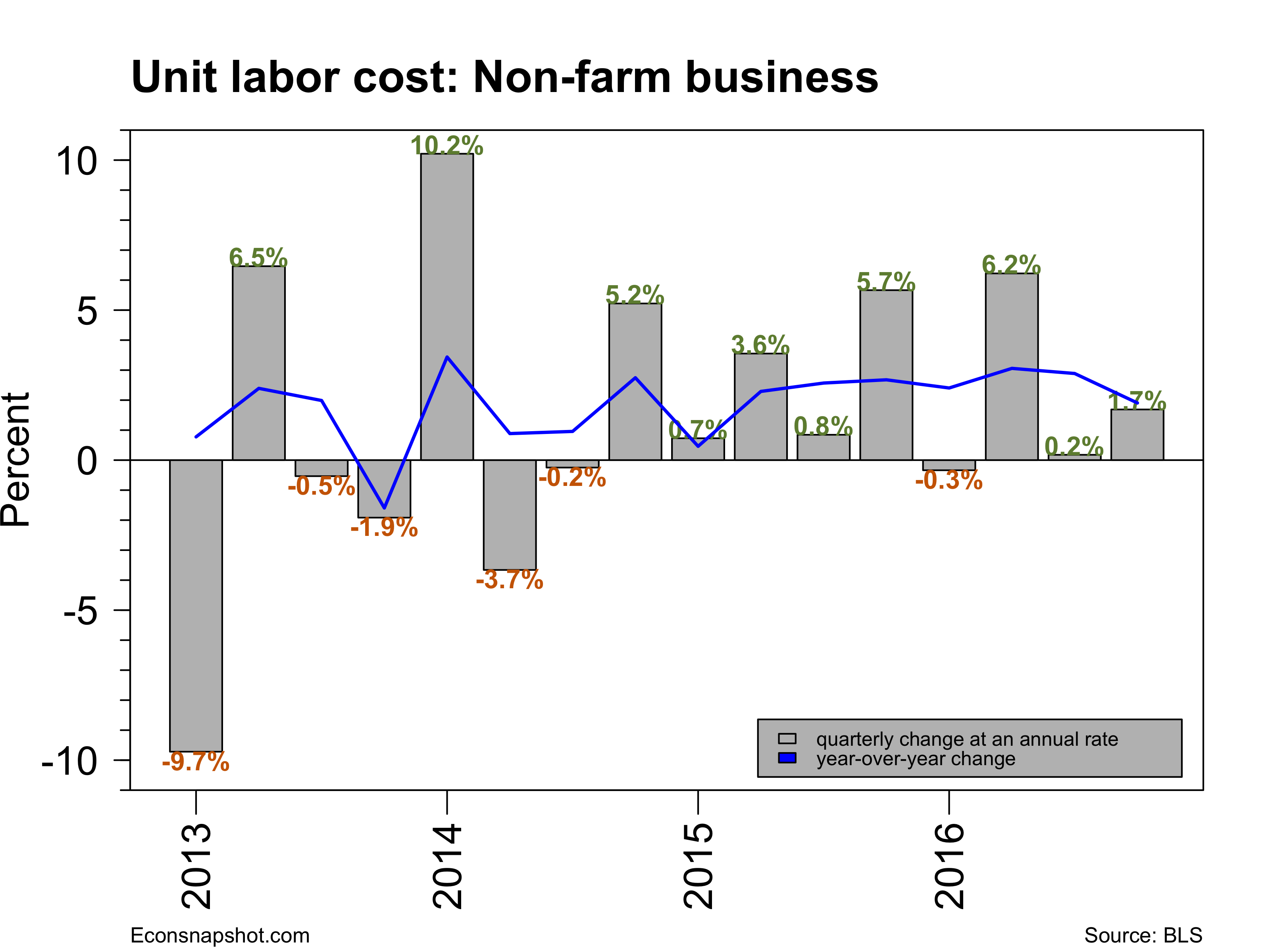

The productivity report on February 2 revealed a 1.3% increase in output per hour for the fourth quarter of 2016. Output increased 2.2% and hours increased 0.9%. Unit labor cost rose 1.7%, reflecting a 3.0% increase in hourly compensation alongside the 1.3% increase in productivity.

The overall labor market picture is one of steady progress but not much pressure on wages. This sets the table well for the Fed’s plan to gradually raise rates over the course of the year. There is no reason to hurry and no real reason to back away from their plan.