By Thomas Cooley and Peter Rupert

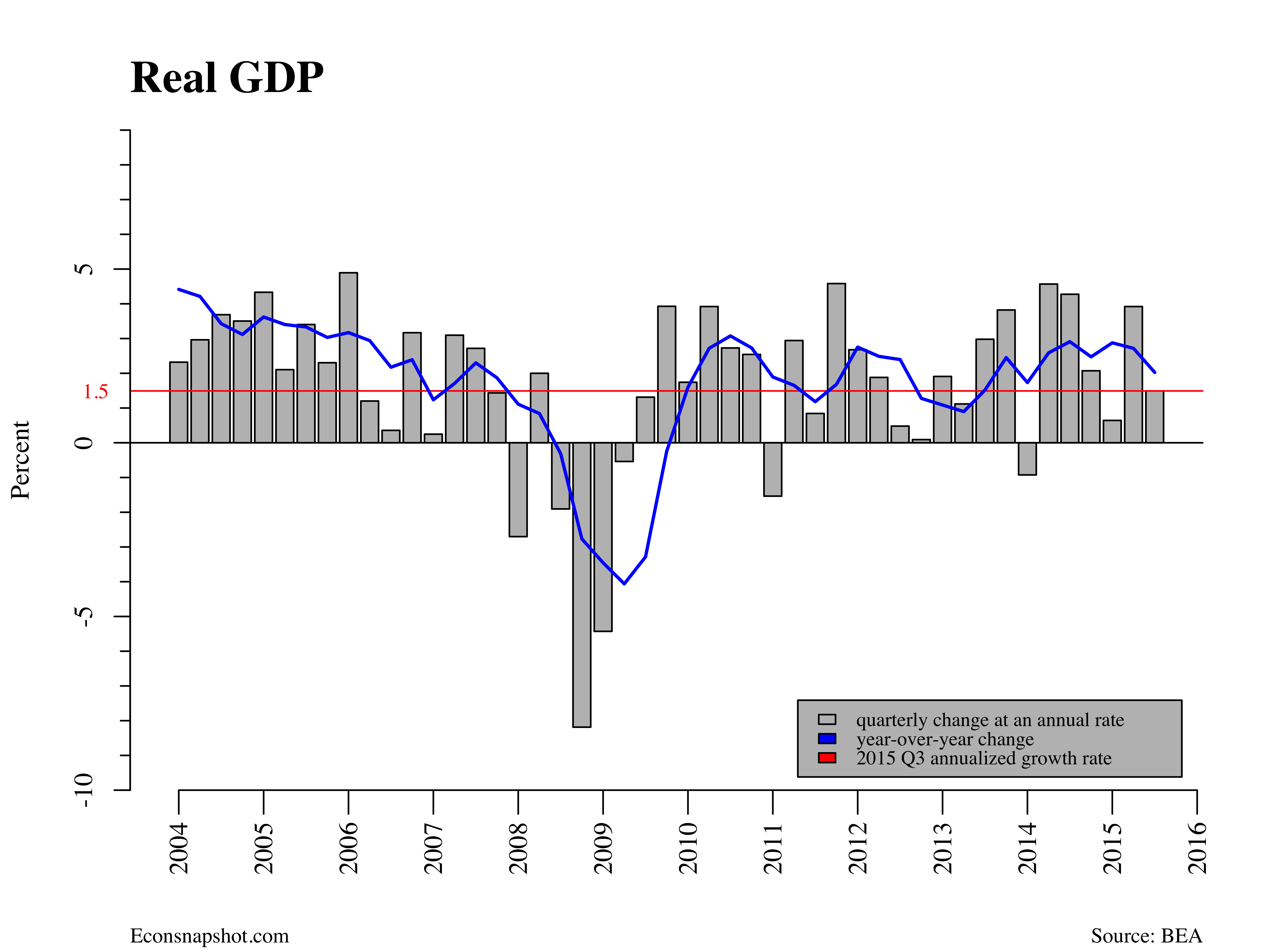

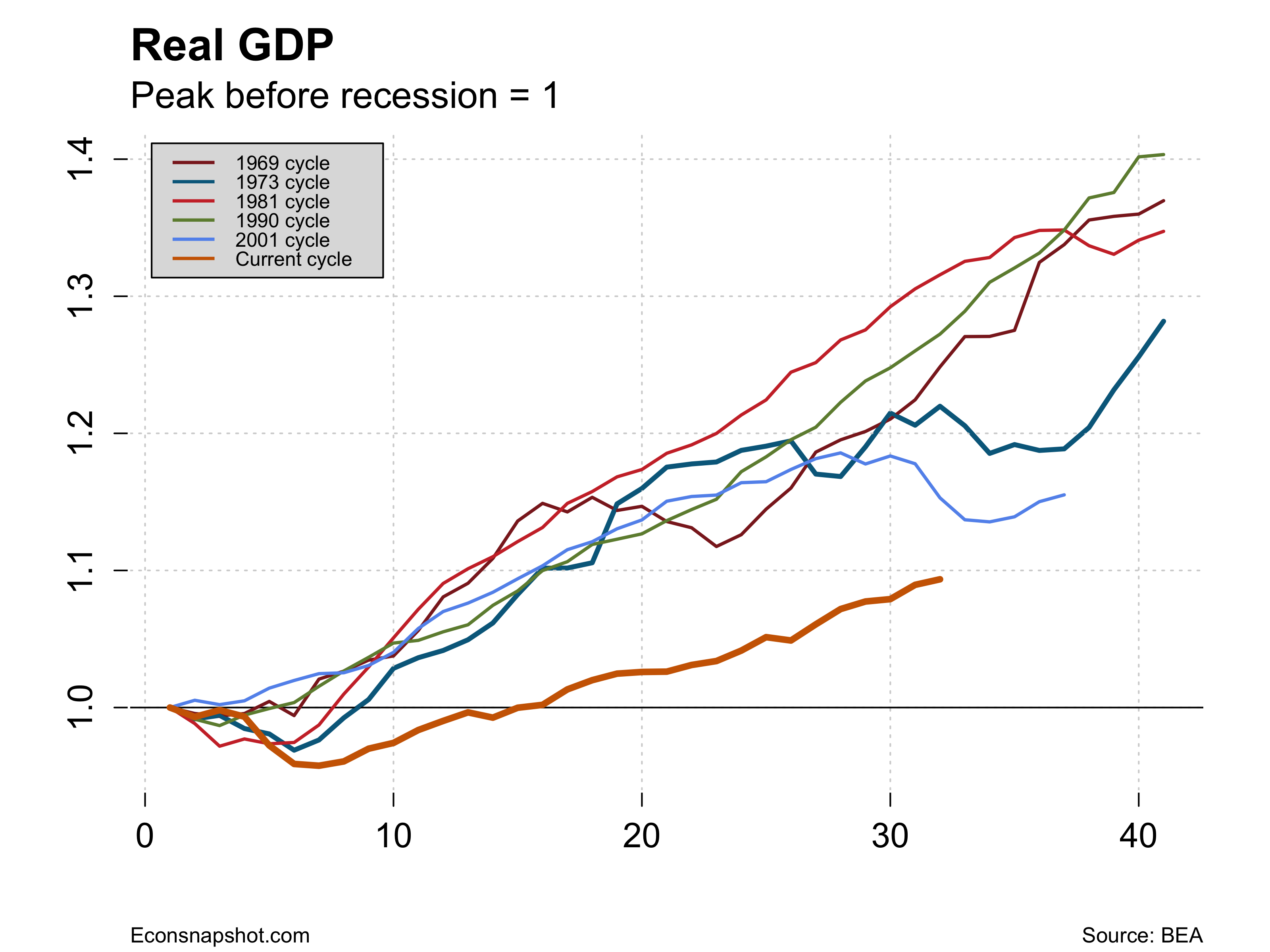

The Bureau of Economic Analysis released the advance estimate for GDP the day after the October meeting of the FOMC. Kind of bad timing…would the FOMC statement have been the same after knowing GDP in the 3rd quarter increased by just 1.5%? Most prognosticators expected a large drop in GDP growth compared to Q2, so the weakness was not entirely unexpected. In fact the fundamentals of the GDP report were not disappointing at all if you look at the composition and were not so far off Q2 results. But, markets will take some time to digest what it all means and what it means for liftoff. The way we read the numbers, there is very little reason for the “data driven” Fed to wait.

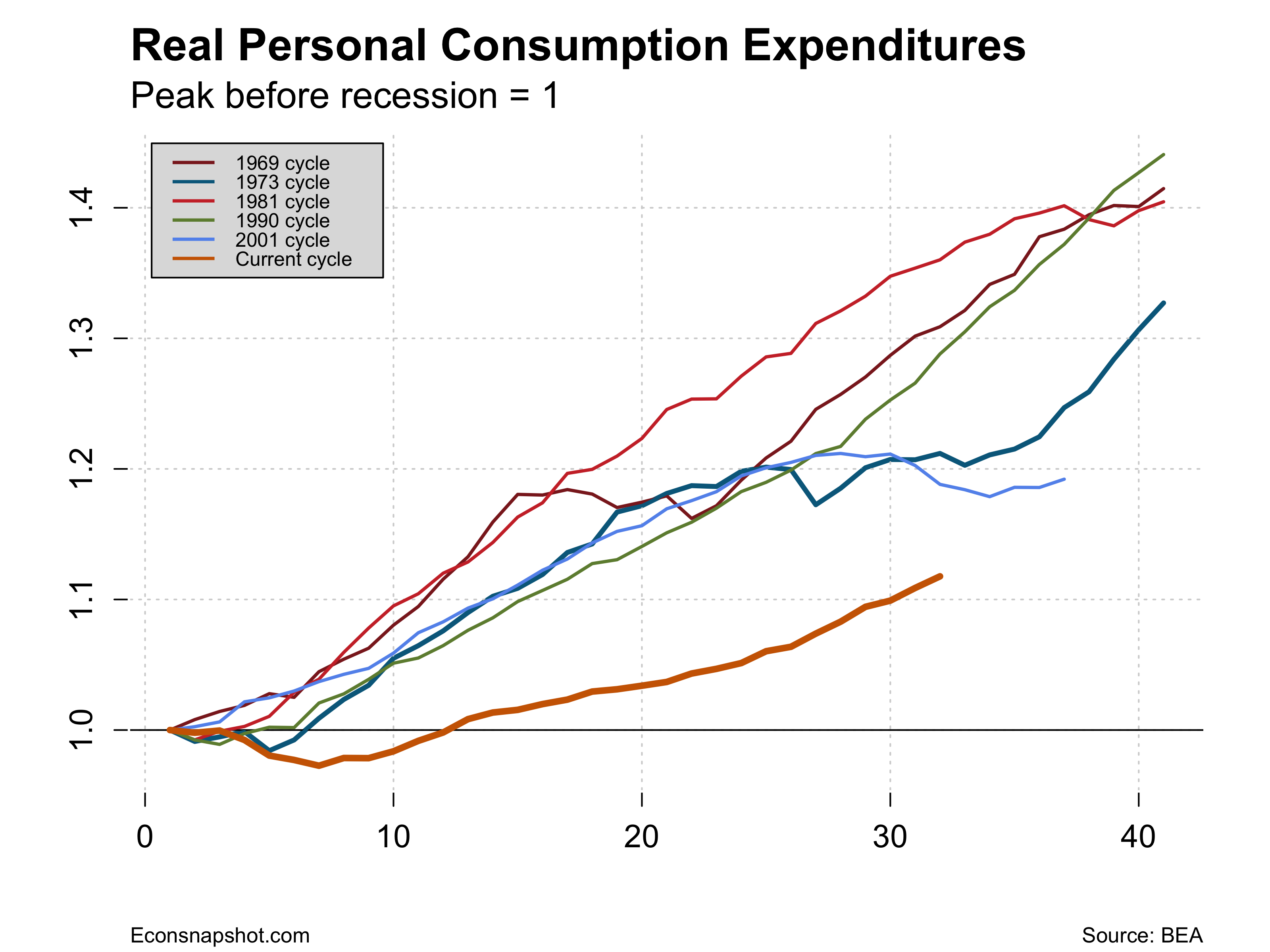

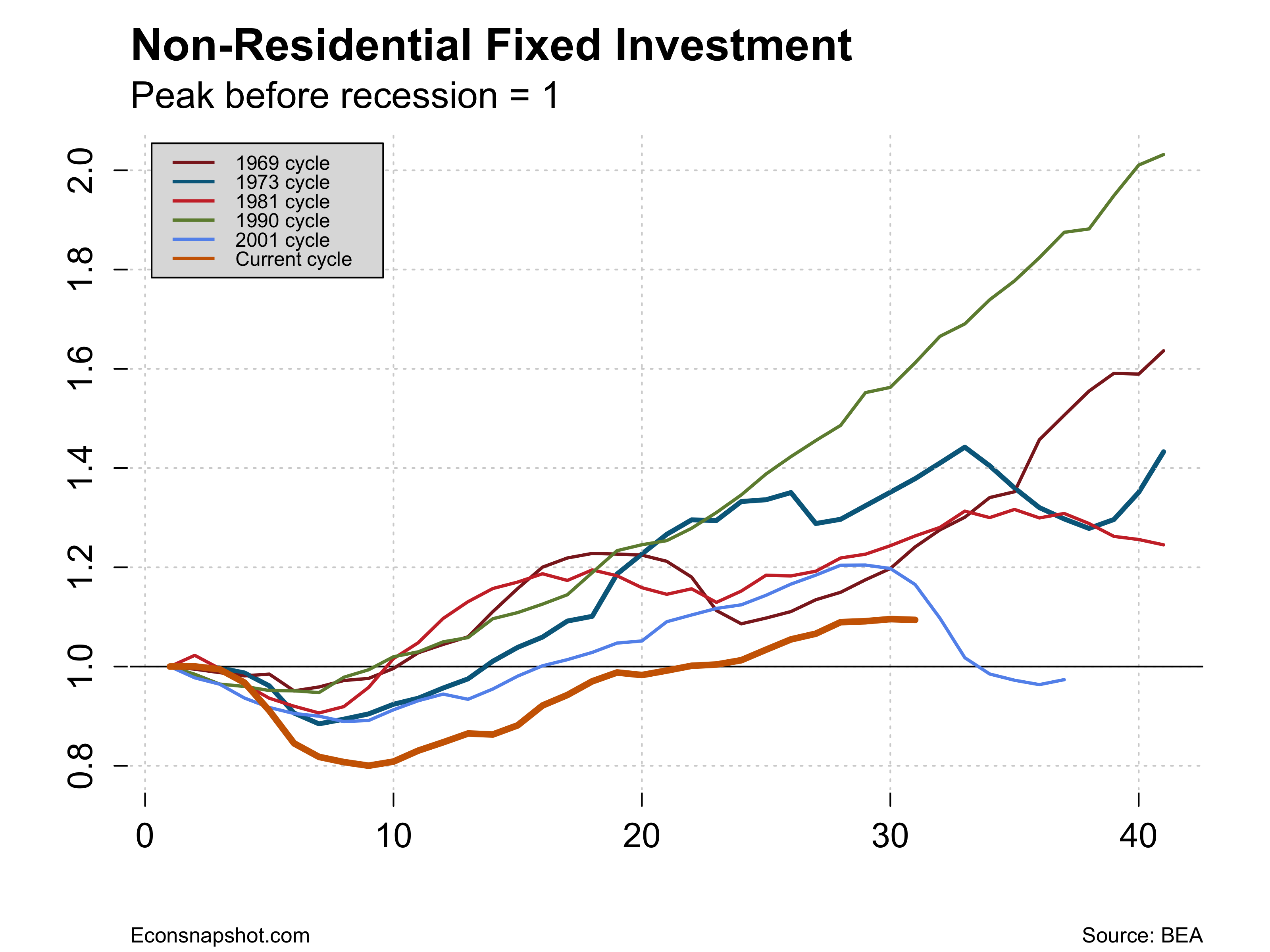

While the headline GDP growth number was lower than in Q2, the components of final demand were strong. Personal consumption expenditures grew at a 3.2% clip after climbing 3.6% in Q2. The contribution of gross private domestic investment to GDP growth fell by .9%, caused by a small decline in nonresidential structures and a big decline in inventories. Weaker exports were also a factor.

What next?

It is clear that the U.S. economy is continuing to grow. That consumption and basic investment are strong is a sign that the domestic fundamentals are pretty strong. Real disposable personal income increased by 3.5%. Declines in the energy sector have held back investment in non-residential structures and equipment and that doesn’t promise to improve in the near future. Most of the uncertainty and worry are external. The biggest worry is about the much discussed slow-down in China and the knock-on effects that has for other commodity exporting nations like Brazil and Australia, as well as continued slow growth in Europe and Japan. The world economy is not booming and that raises the legitimate question of what our expectations should be and what considerations should guide Fed policy. At the moment they seem to be operating on the basis of a “first do no harm” principle. There is a growing chorus of people who believe that they are doing unseen harm by not normalizing monetary policy. There will be a couple more employment reports and the second estimate of Q3 GDP before the next FOMC meeting in mid-December, so time and data will tell!