By Thomas Cooley and Peter Rupert

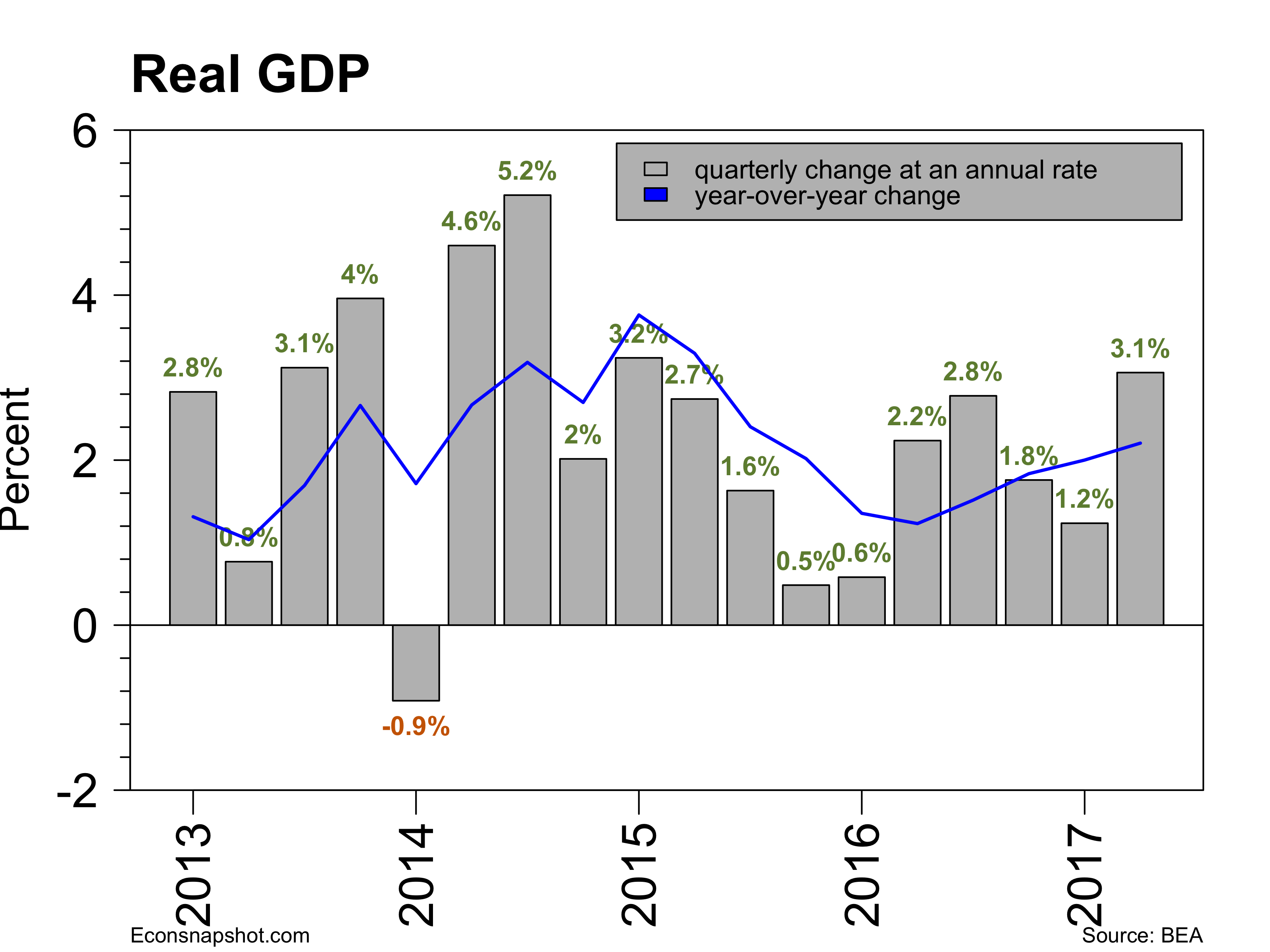

The BEA released the 3rd estimate for Q2 real GDP and hiked it from 3% in the 2nd estimate to 3.1% in the third. Real GDP increased 1.2% in Q1, unchanged from the previous estimate. The 3.1% increase is the largest since Q1 of 2015.

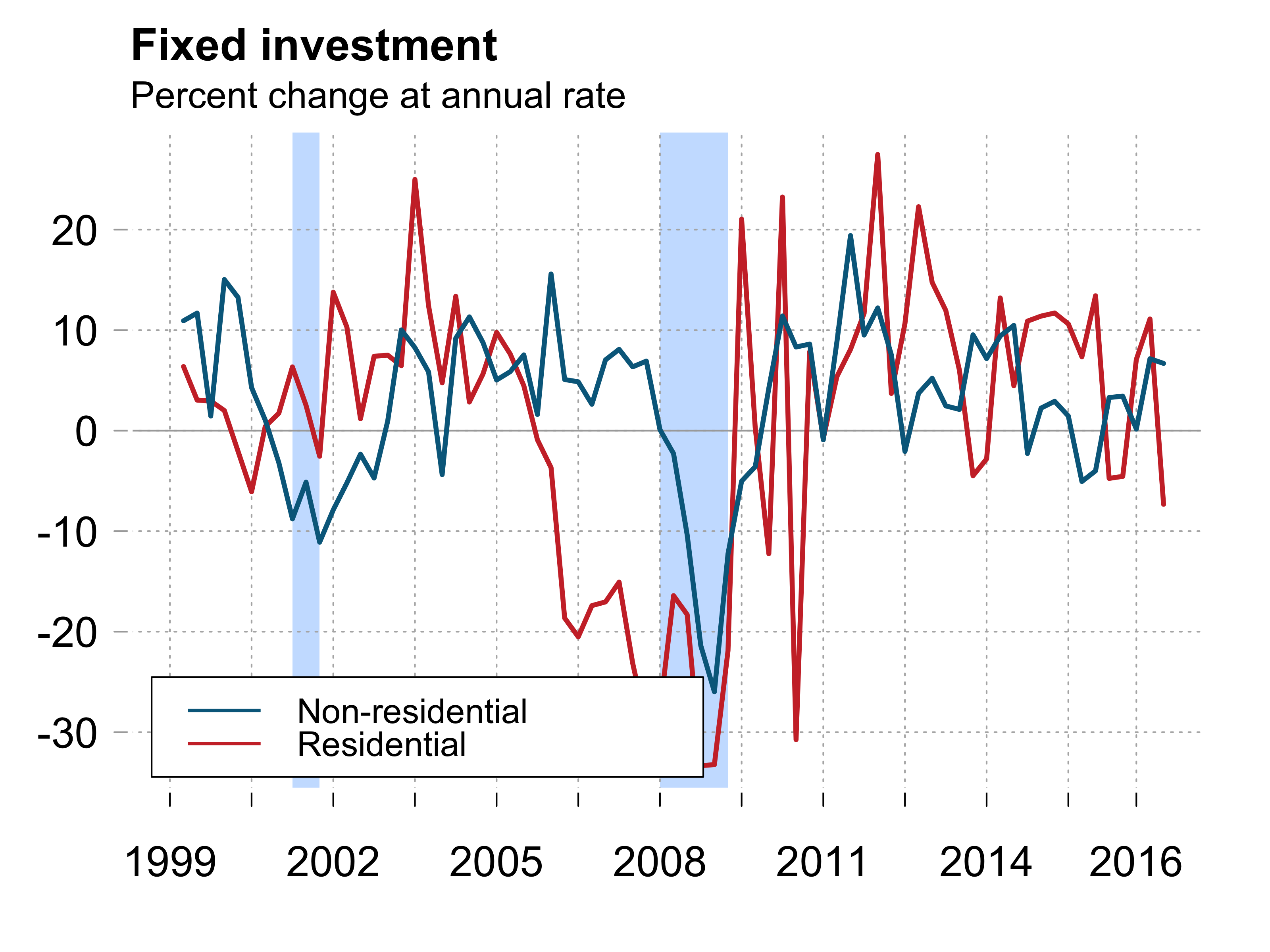

Non-residential fixed investment remained strong for the second quarter in a row, 7.2% in Q1 and 6.7% Q2. These back-to-back increases were the largest over the past three years. Residential investment, on the other hand, dropped 7.3%, the largest decline since 2011.

Hurricane Harvey created a lot of uncertainty for the future. On the one hand it foretells a big short term hit to local GDP from lost economic activity and the hit to the oil and gas sector. Hurricanes Irma and Maria will not show up strongly in GDP except insofar as they affected Florida and the U.S. mainland. This is because the GDP from Puerto Rico and the U.S. Virgin Islands does not enter into calculations of U.S. Domestic GDP. Government expenditures on relief will show up.