by Peter Rupert

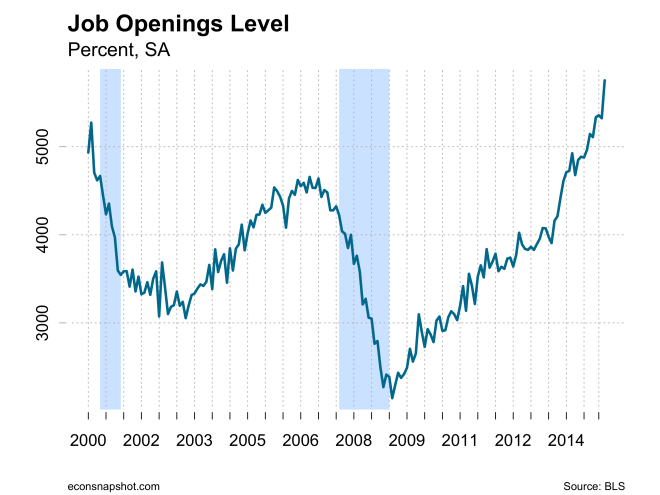

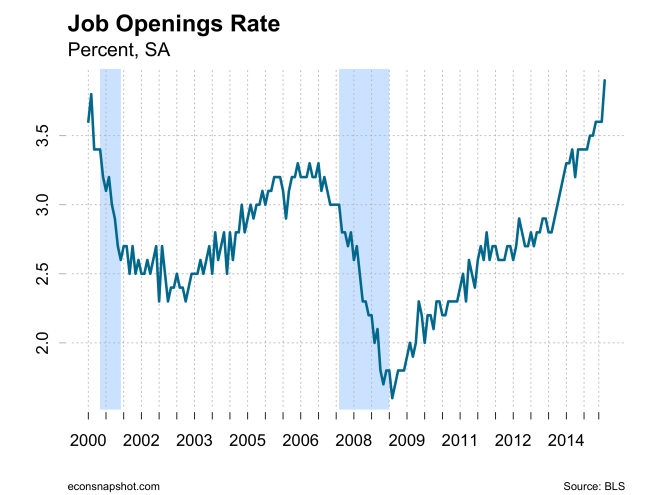

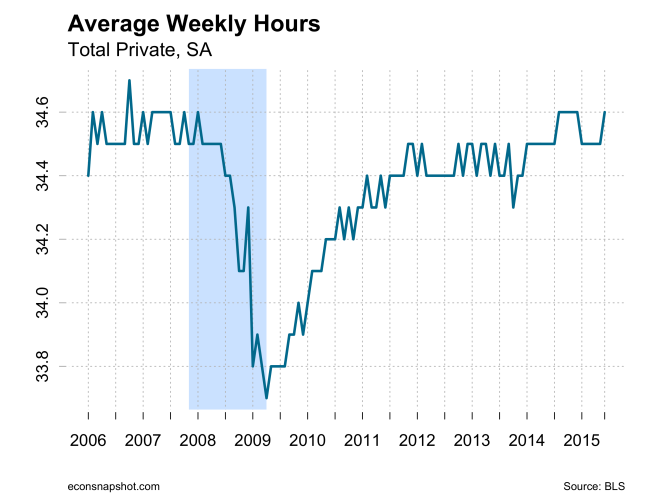

The moment of truth concerning liftoff is upon us as the FOMC makes their decision and delivers their verdict tomorrow. With the release of the latest Job Openings and Labor Turnover Survey (JOLTS) and the previous employment report, it appears the labor market is firing on many, if not all, cylinders. The JOLTS data reveal both the highest level (about 5.7 million vacancies) and rate (3.9%) of job openings since the series began in December of 2000.

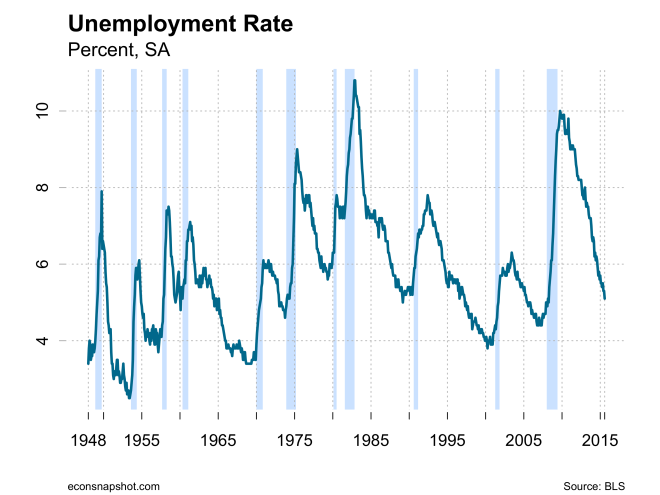

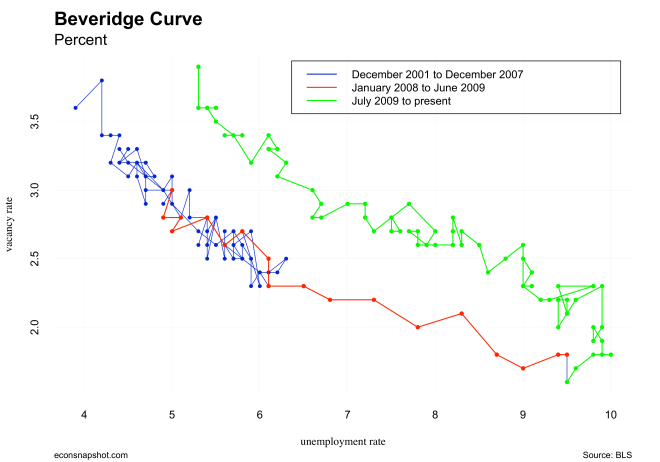

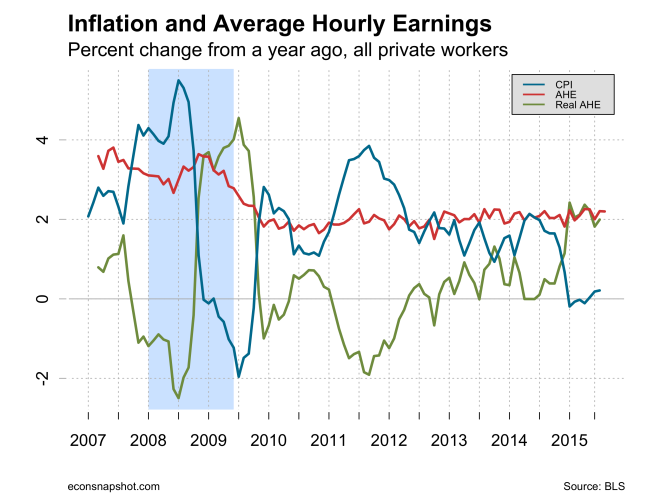

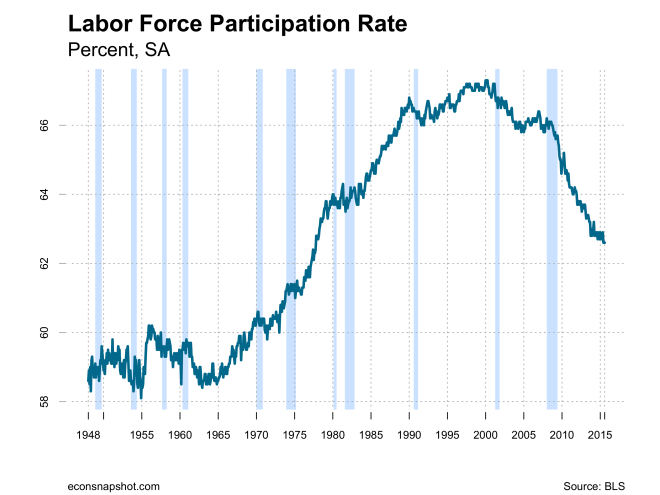

The unemployment rate is also quite low and the Beveridge Curve (a plot of vacancies vs. unemployment) is now looking much healthier after its typical counter-clockwise journey. Many of the previous statements from the meetings suggested that there was still some slack in the labor market, but it was dissipating. With vacancies as high as ever it appears that businesses are in hiring mode big time…but, inflation is not in sight.

So, the question is: When is the right time? Financial markets are volatile for sure; however, to what extent has Fed policy fed into the volatility? The rest of the world has its problems, but many areas will continue to be problematic for some time to come, see our commentary here.

If the FOMC does not raise rates today, here is what they will likely say: “While labor markets appear to have reduced slack, there is little evidence of inflation. The rest of the world is still in turmoil.” And if they do raise rates, “Labor markets have continued to recover and are now near levels thought to be in the target range. While global markets are still somewhat fragile, the evidence in the US suggests that the current stance of policy is not in line with normal policy.”