By Tom Cooley and Peter Rupert

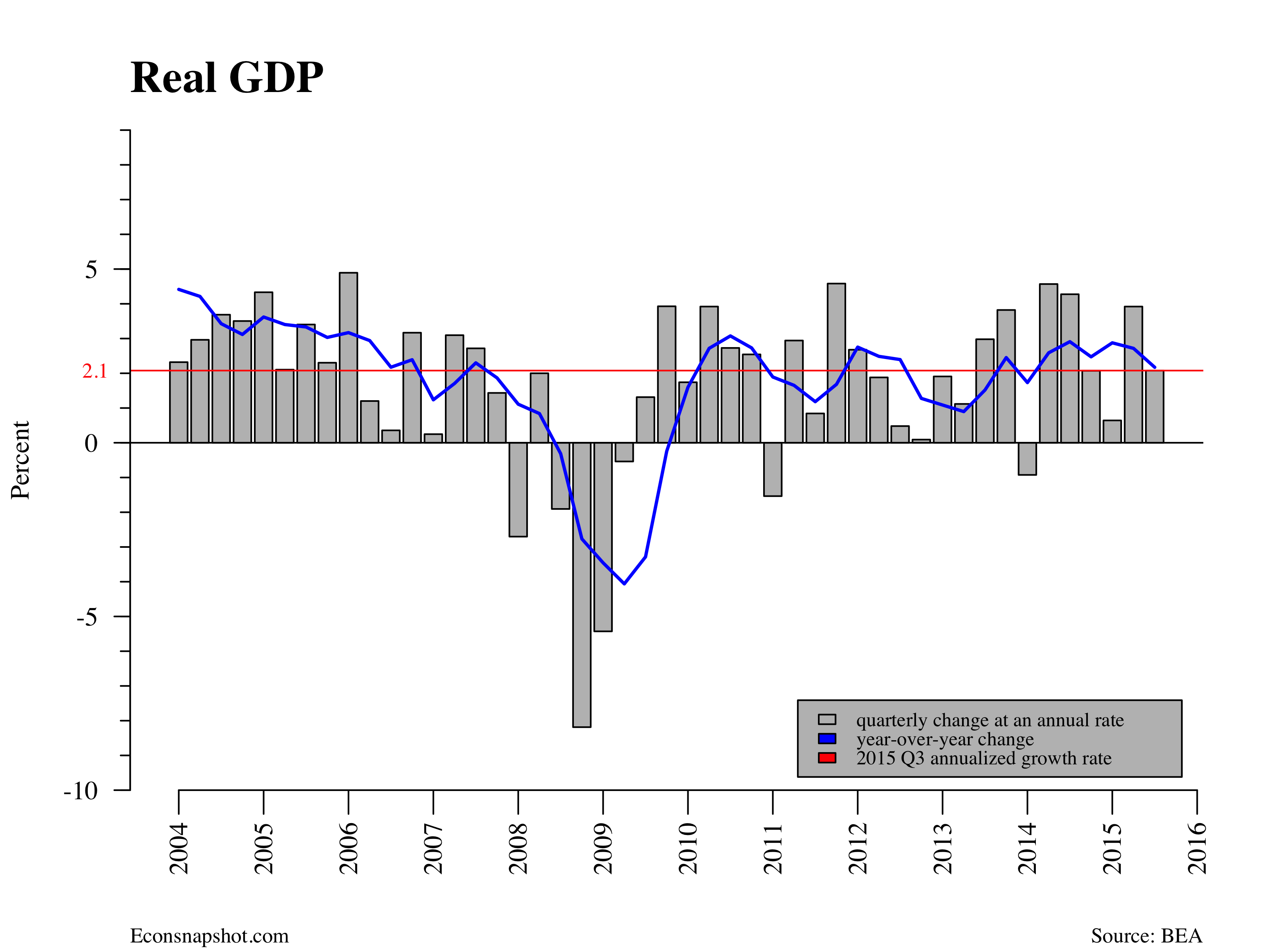

Today’s release of the second estimate for Q3 by the Bureau of Economic Analysis (BEA) reveals an upward revision from 1.5% in the advance estimate to 2.1% for real GDP.

As pointed out in the release, “The upward revision to the percent change in real GDP primarily reflected an upward revision to

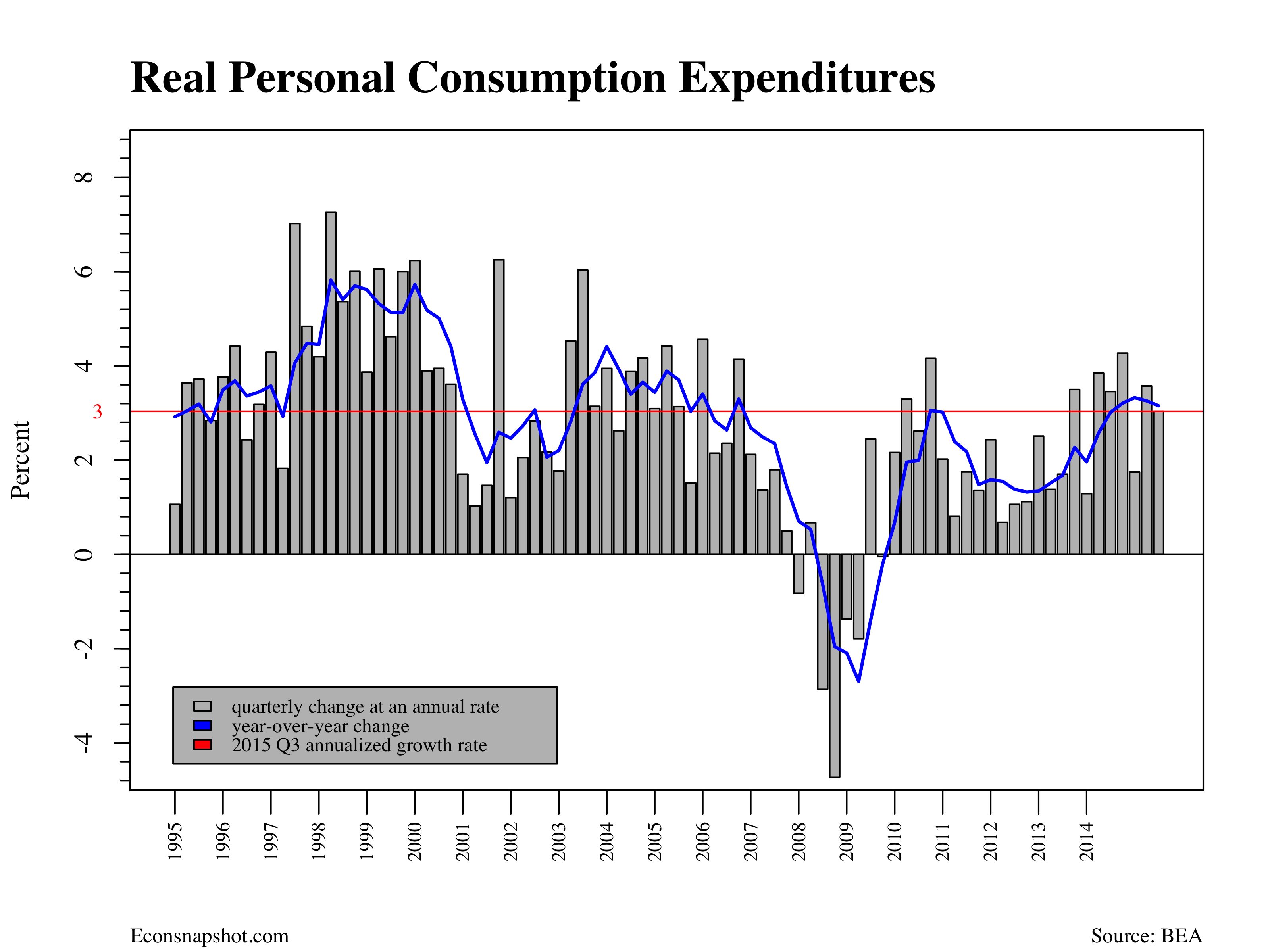

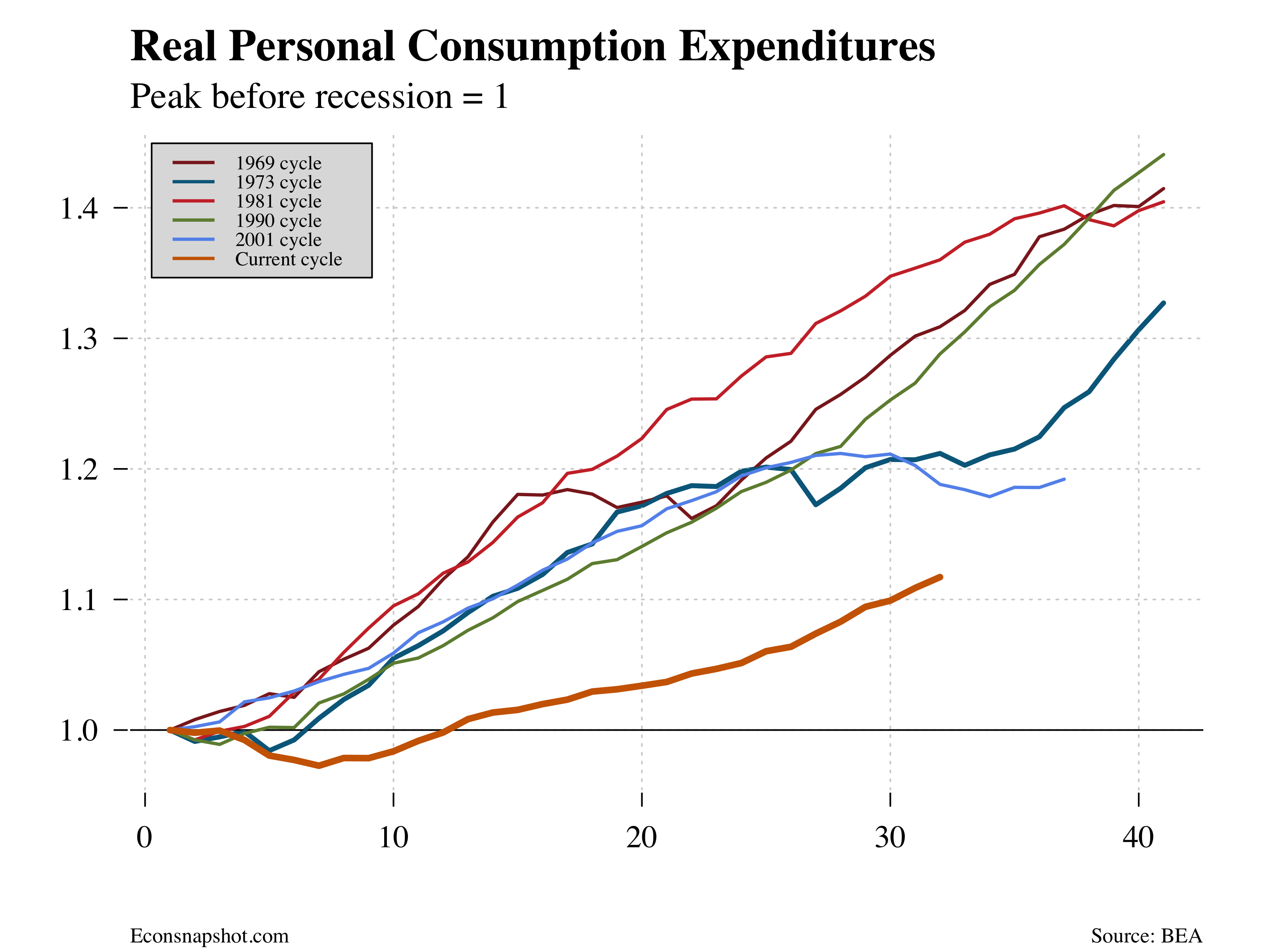

private inventory investment that was partly offset by downward revisions to PCE and to exports.” Personal consumption expenditure was revised down from 3.2% to 3.0%. The weakness in consumption and the higher than anticipated inventory investment are signs of weaknesses that are confirmed elsewhere.

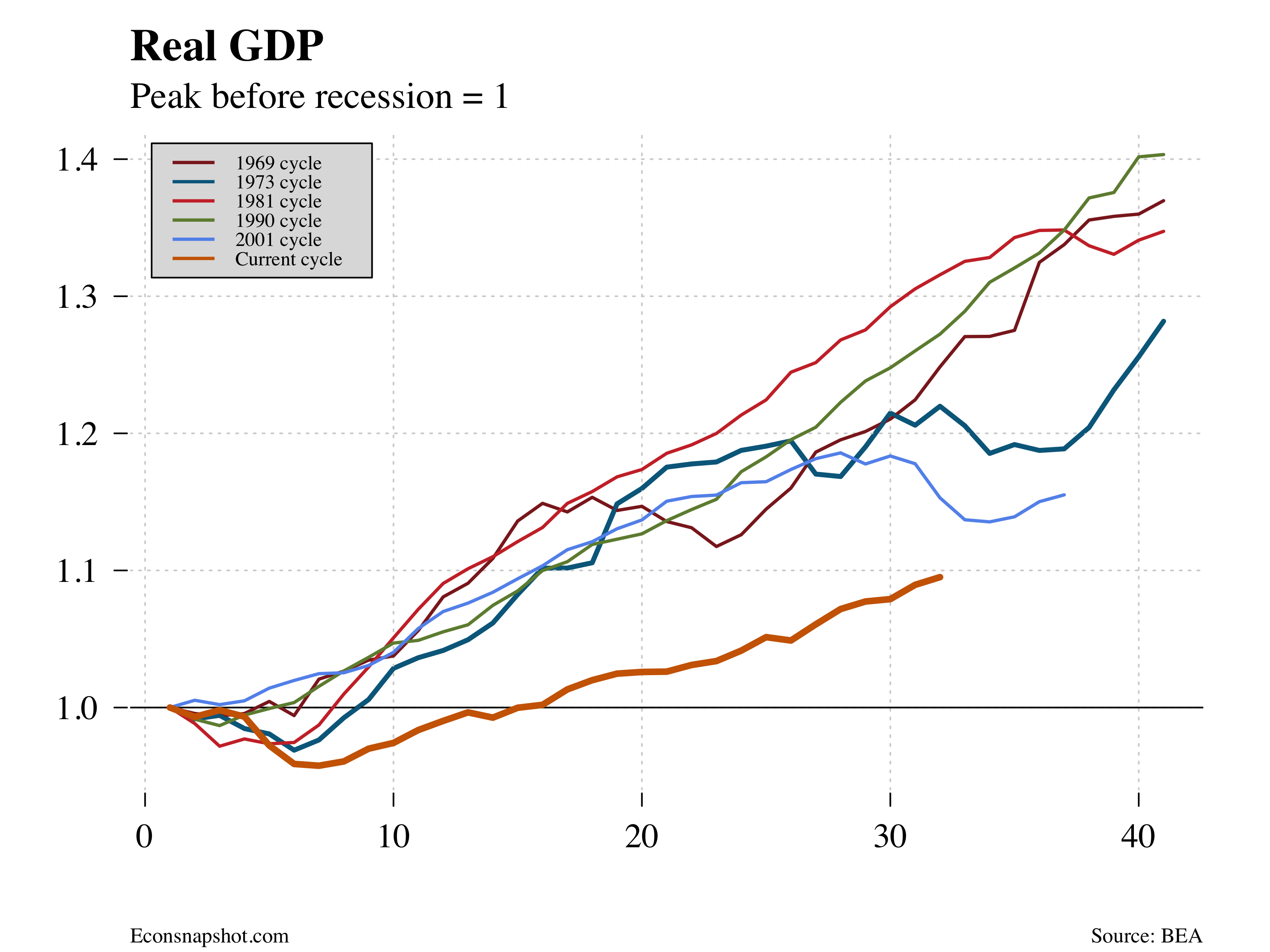

In our last post we mentioned that what looked like some bad news was not so bad. This time, what looks like good news with the upward revision reveals some troubling signs for the future path of interest rate hikes. It seems that the Fed will do what the Fed will do this December, as there is not much in the way of strong evidence to not raise rates at the next meeting and there is a strong desire to move off the zero lower bound. But weaknesses in the recovery are likely to affect the future path of the federal funds rate. Moreover, this is now quite a “mature” if tepid recovery, as can be seen in the first chart below – other recoveries had expired this many quarters out.

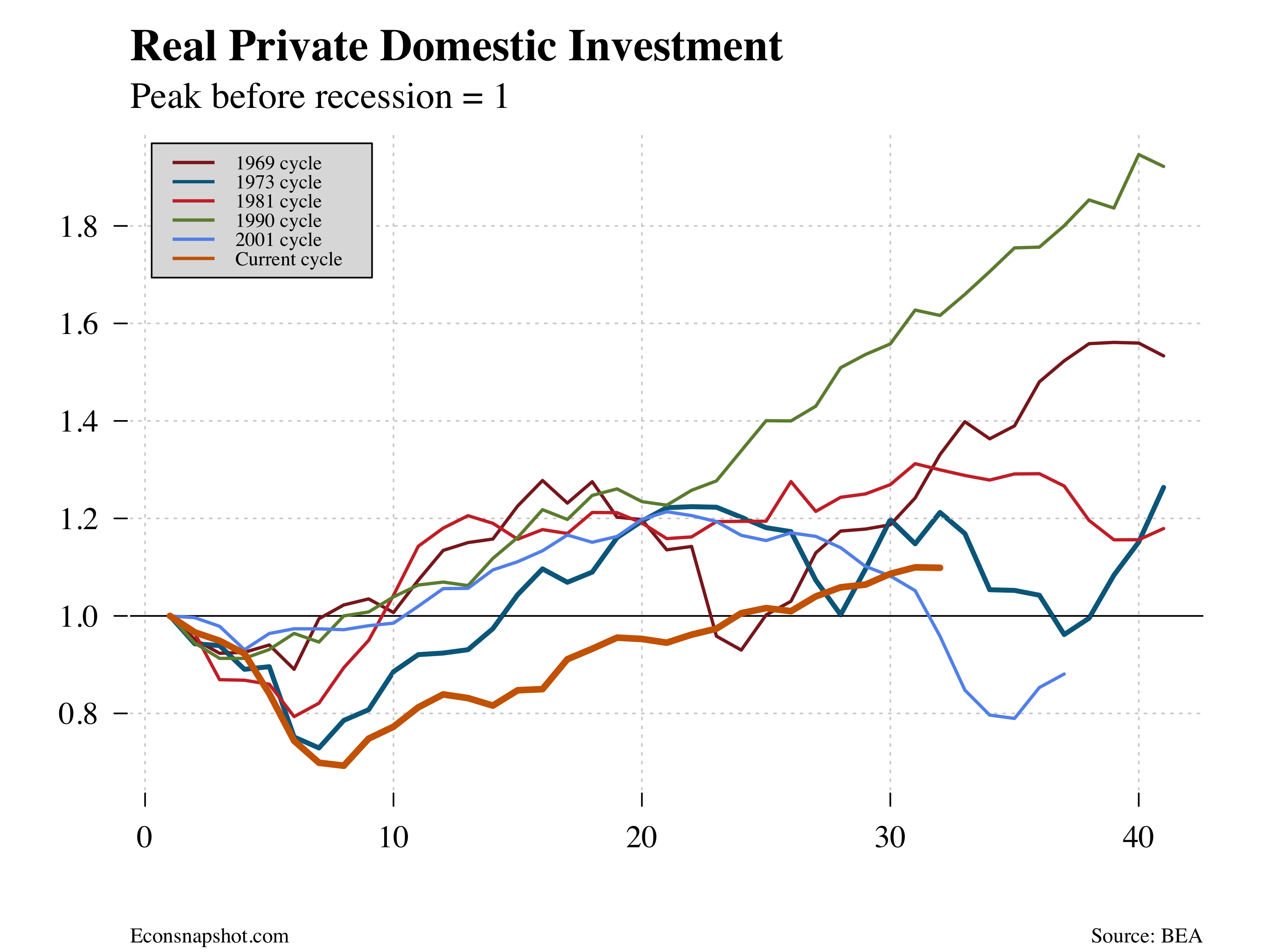

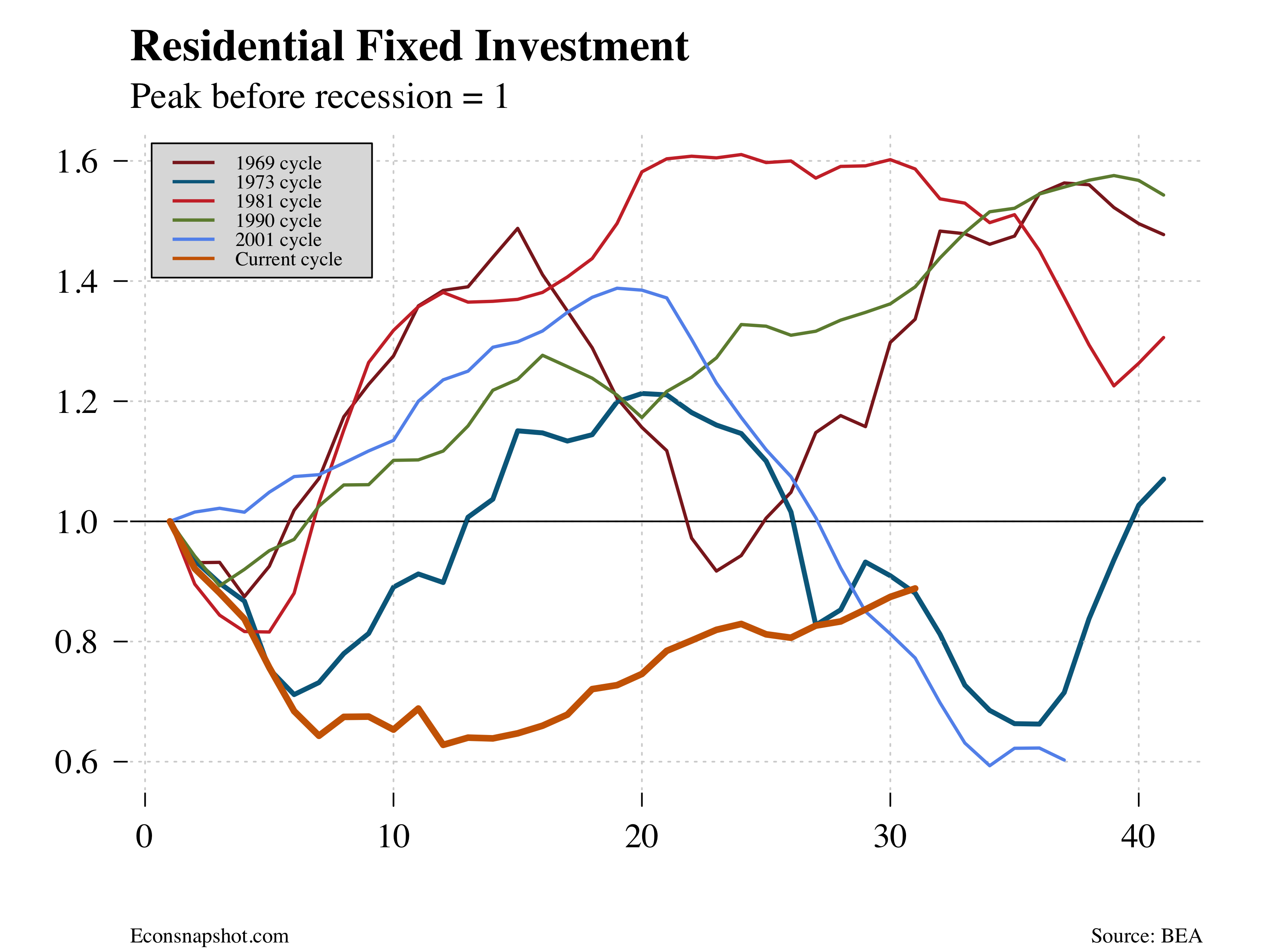

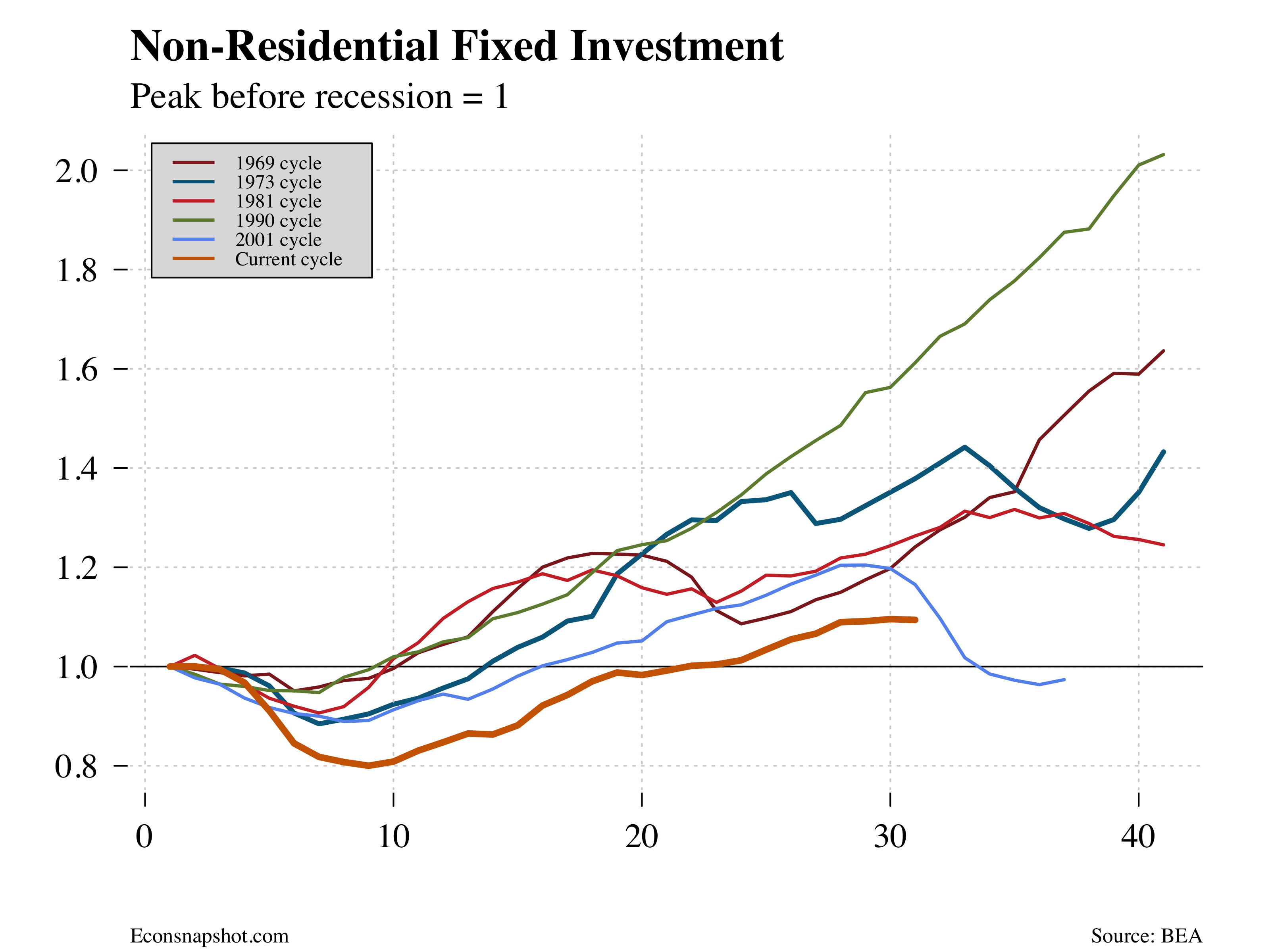

Consumption, investment and its components are all consistent with a continued, but weak, recovery; and this recovery is set in the context of a world economic order that is fragile and changing. Europe has continued to be slow to improve, Japan and China show signs of weakness and many emergent market economies are beset by the falls in commodity prices.

Weakness in Manufacturing

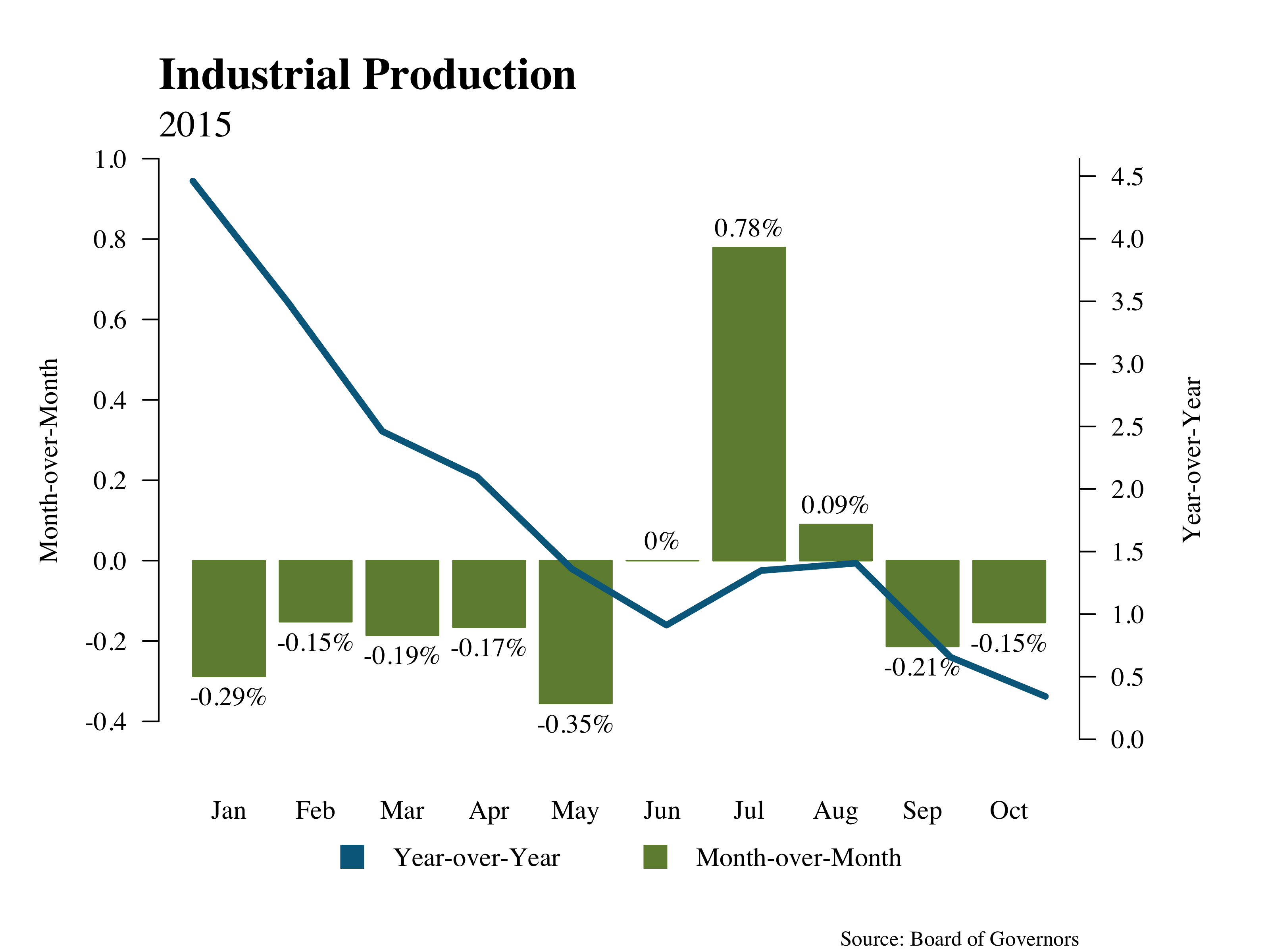

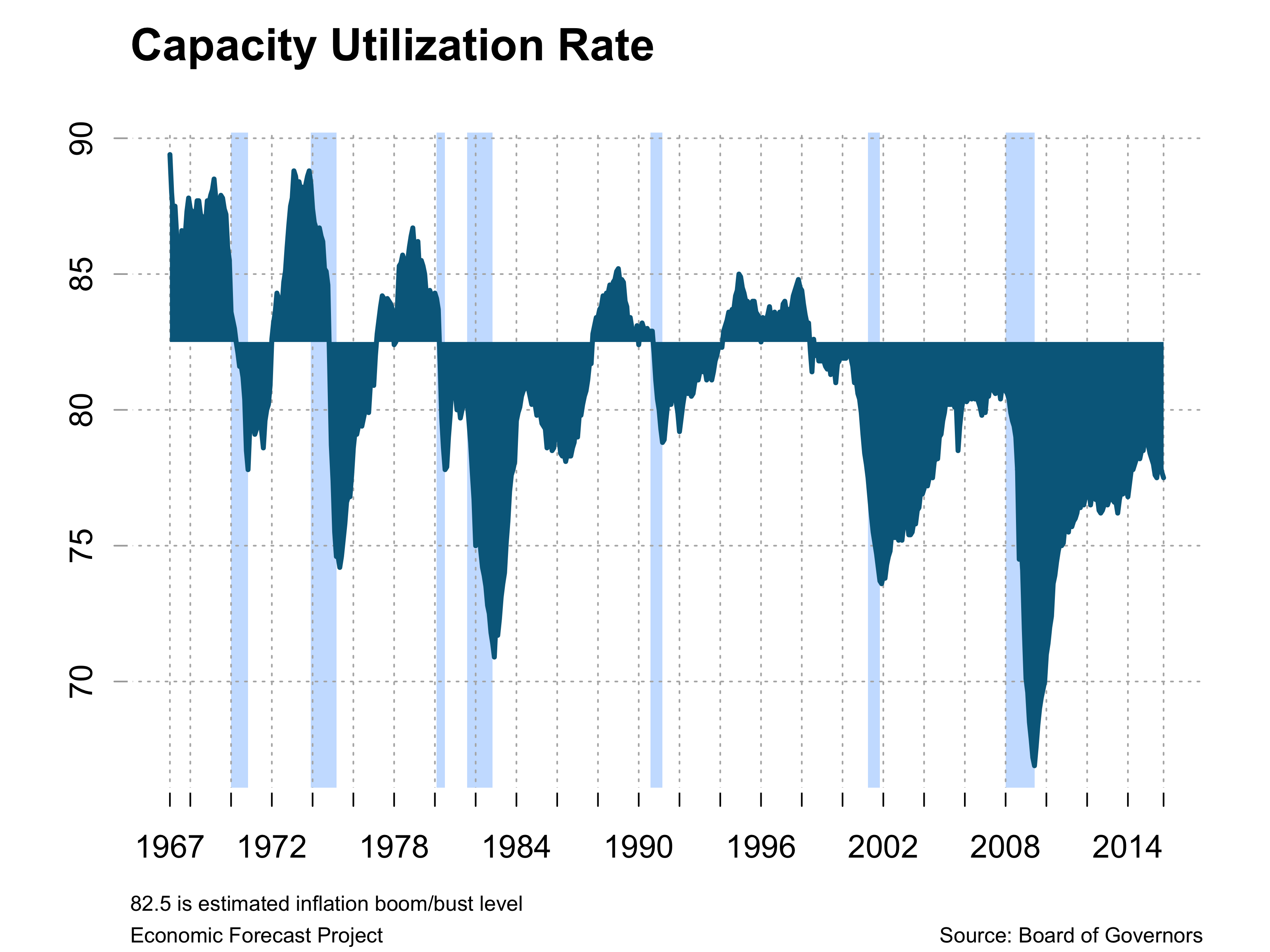

A strong dollar and aggressive monetary expansions elsewhere in the world have contributed to weakness in U.S. manufacturing. Industrial production has been weak over the past year or so and capacity utilization continues to be below the estimated “boom-bust” level of 82.5.

Barring a bad jobs report, the weakness in manufacturing is not likely to constrain the Fed from raising rates at its next meeting. But along with other factors it is likely to constrain the path of interest rates for some time to come.