By Thomas Cooley and Peter Rupert

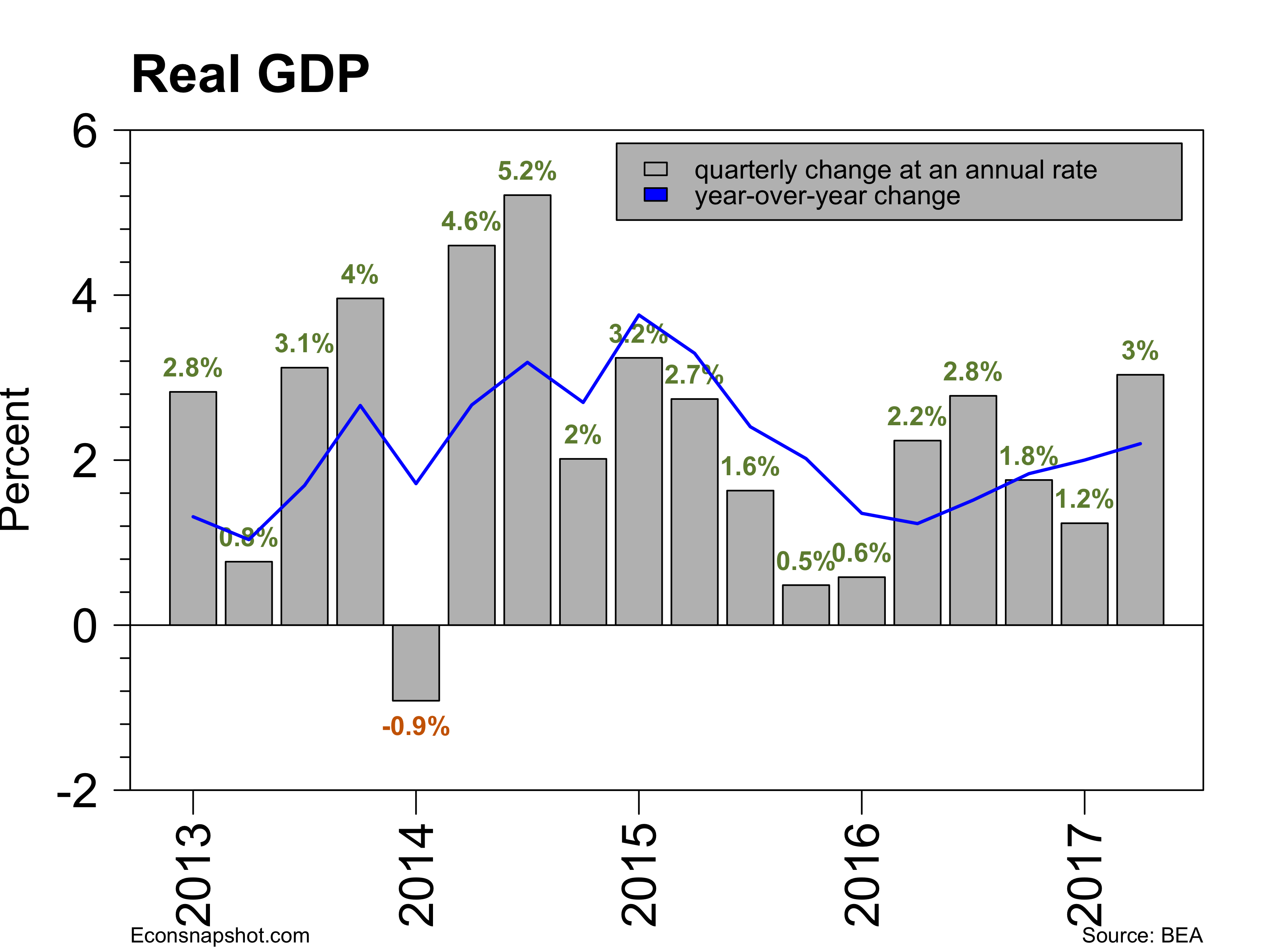

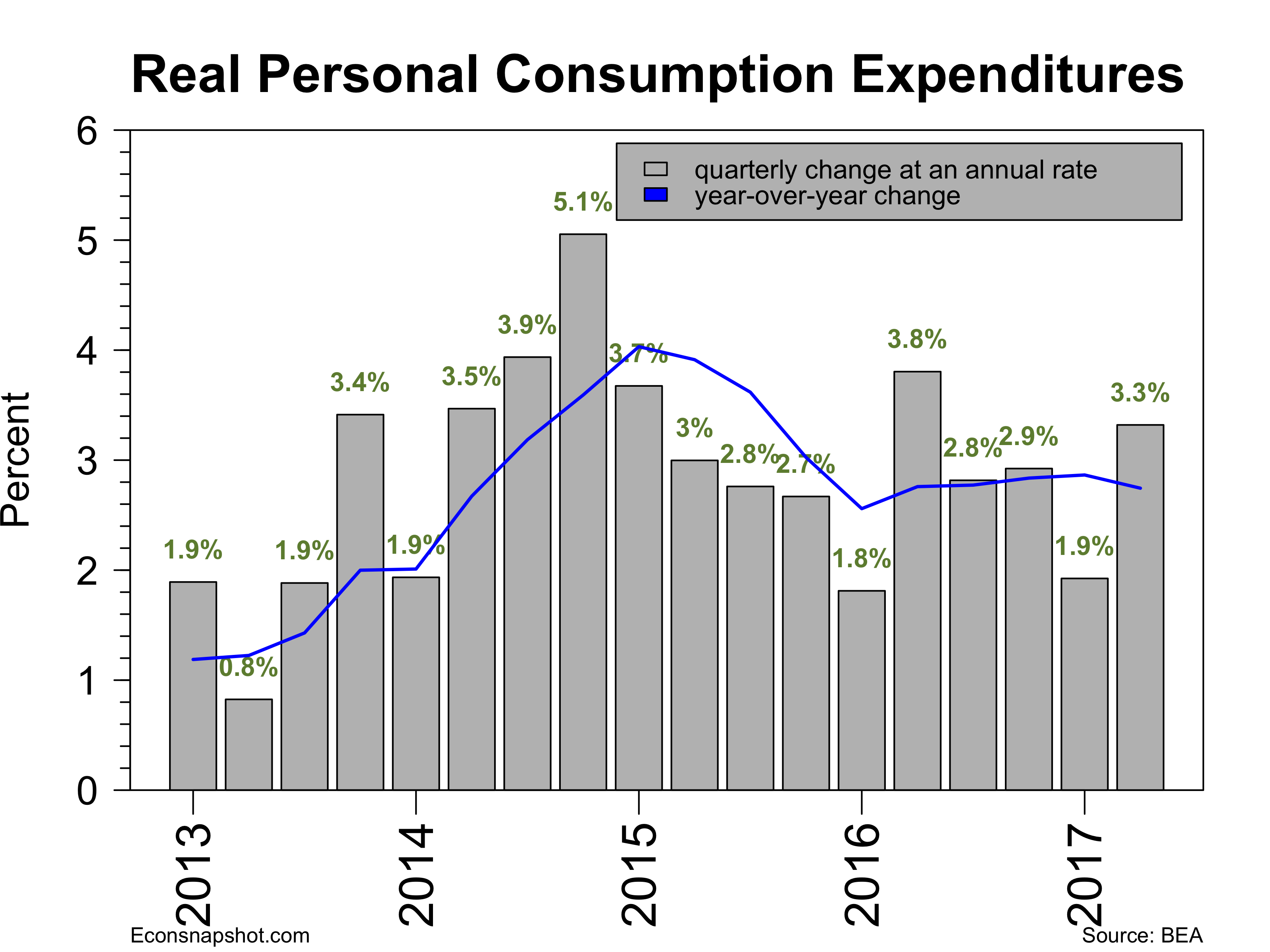

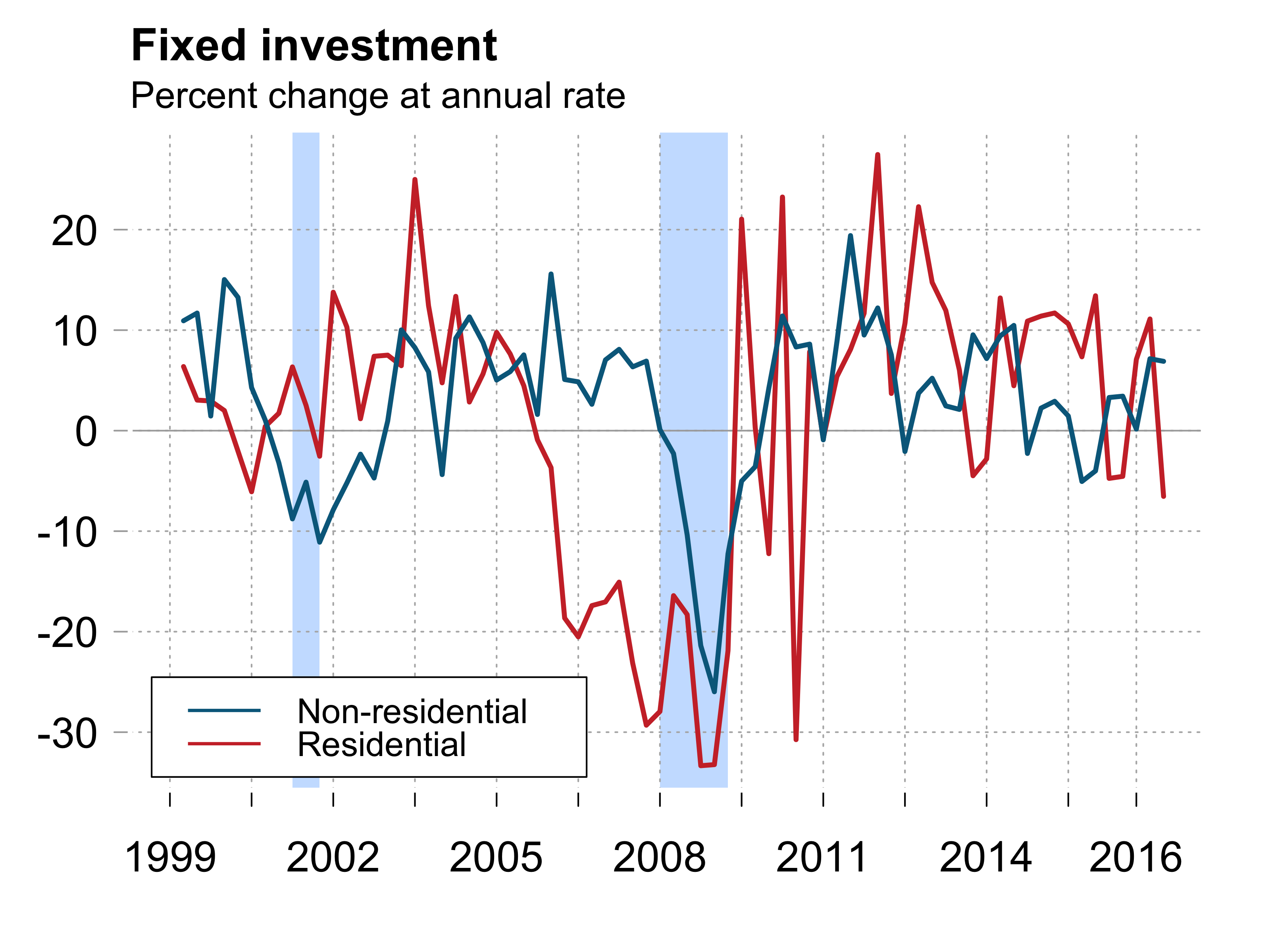

The BEA released the 2nd estimate for Q2 real GDP and hiked it from 2.6% in the “advance” estimate to 3.0%. Real GDP increased 1.2% in Q1. The 3.0% increase is the largest since Q1 of 2015. The boost from the advance to the 2nd estimate came largely from PCE (up 3.3%) and non-residential fixed investment (up 6.9%) being larger than previously estimated. Residential fixed investment, however, fell 6.5%.

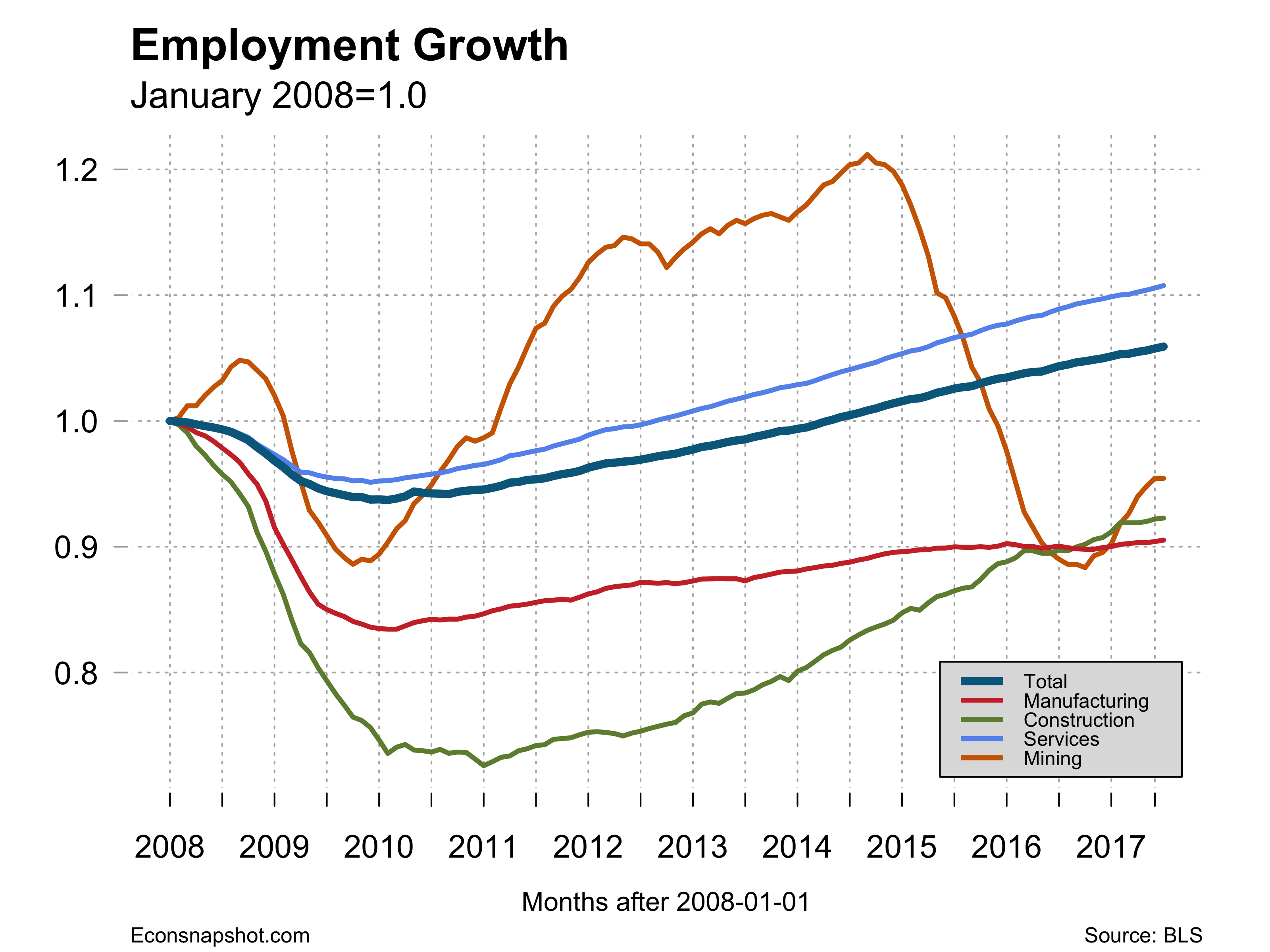

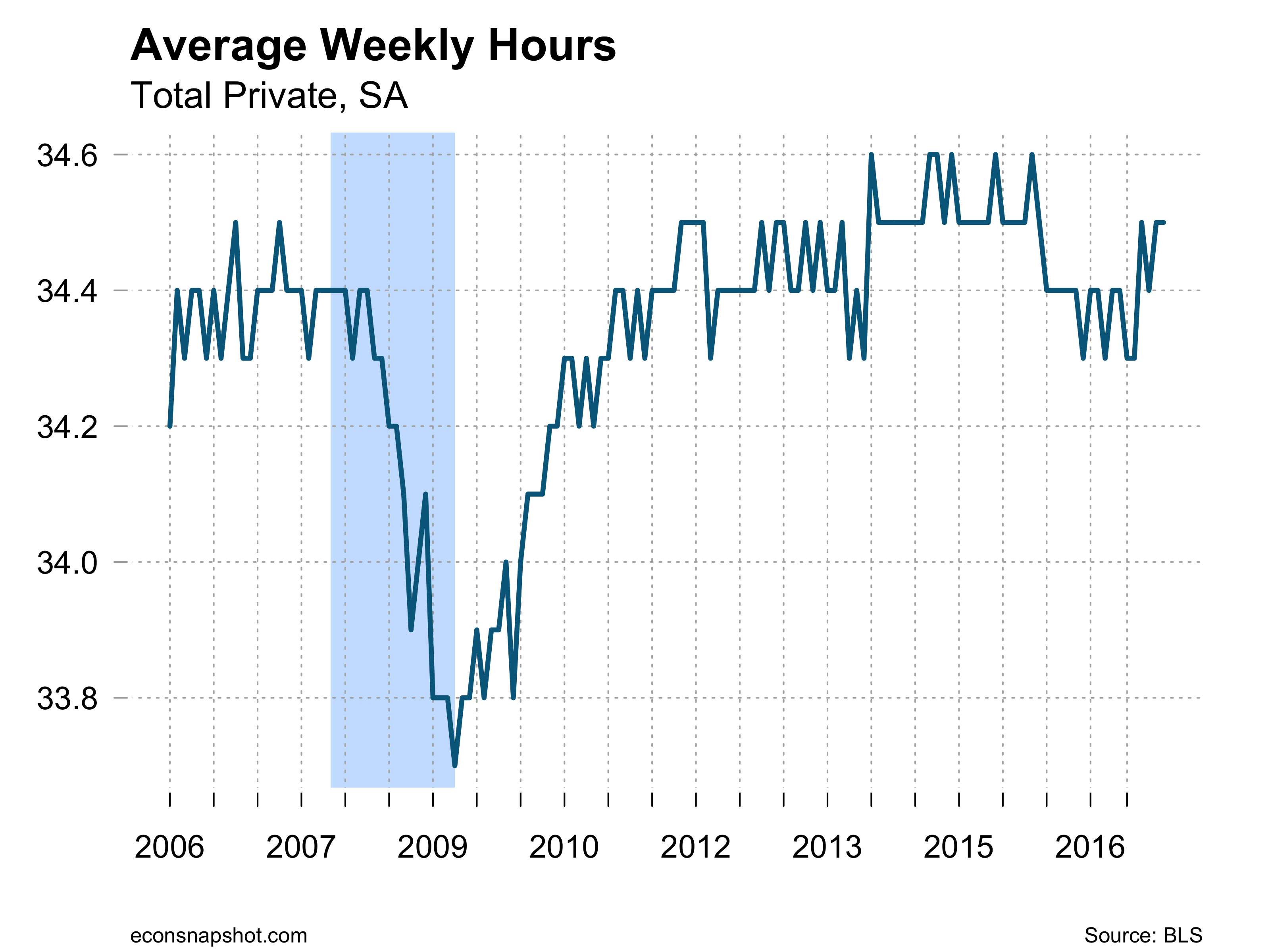

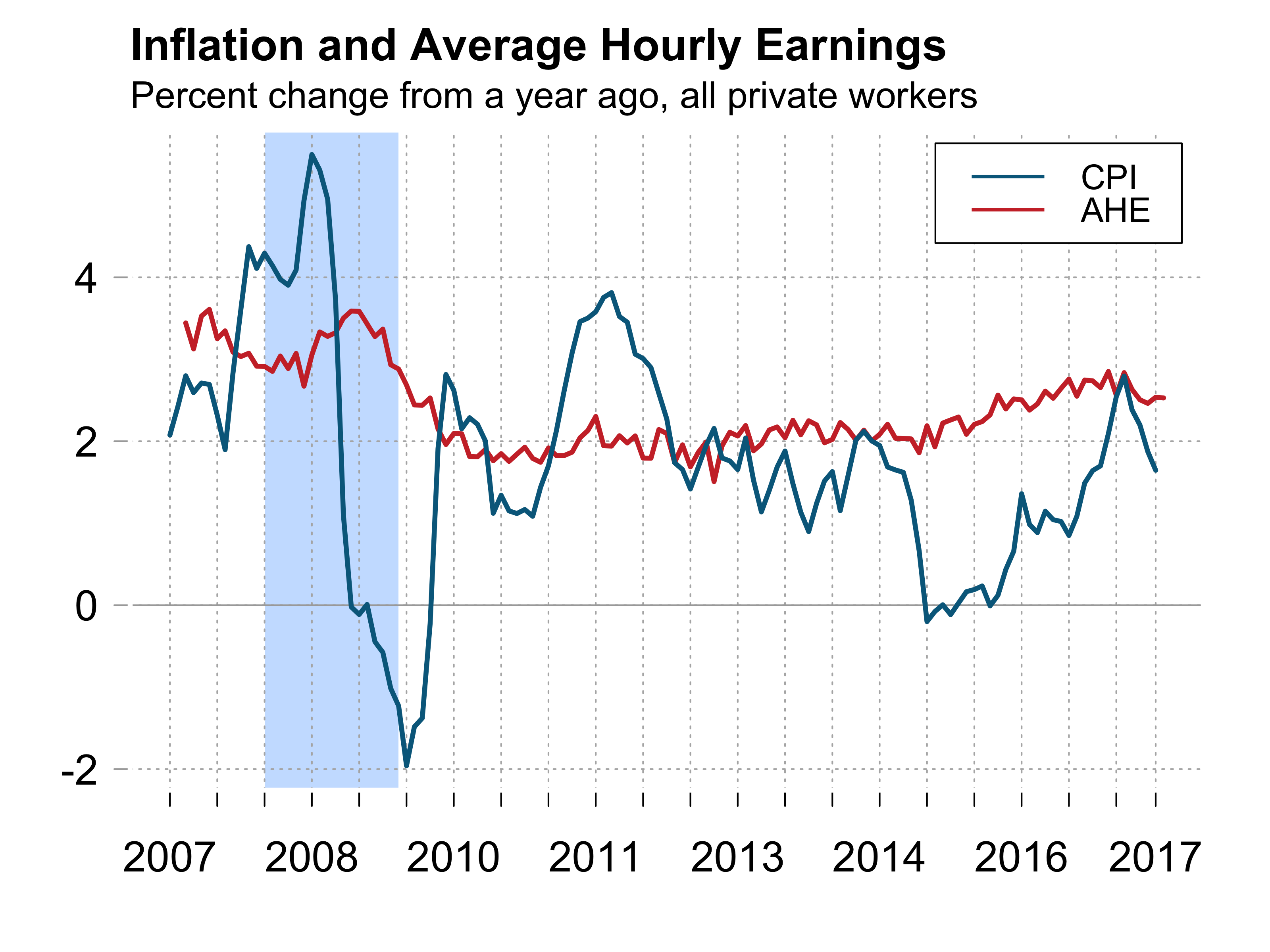

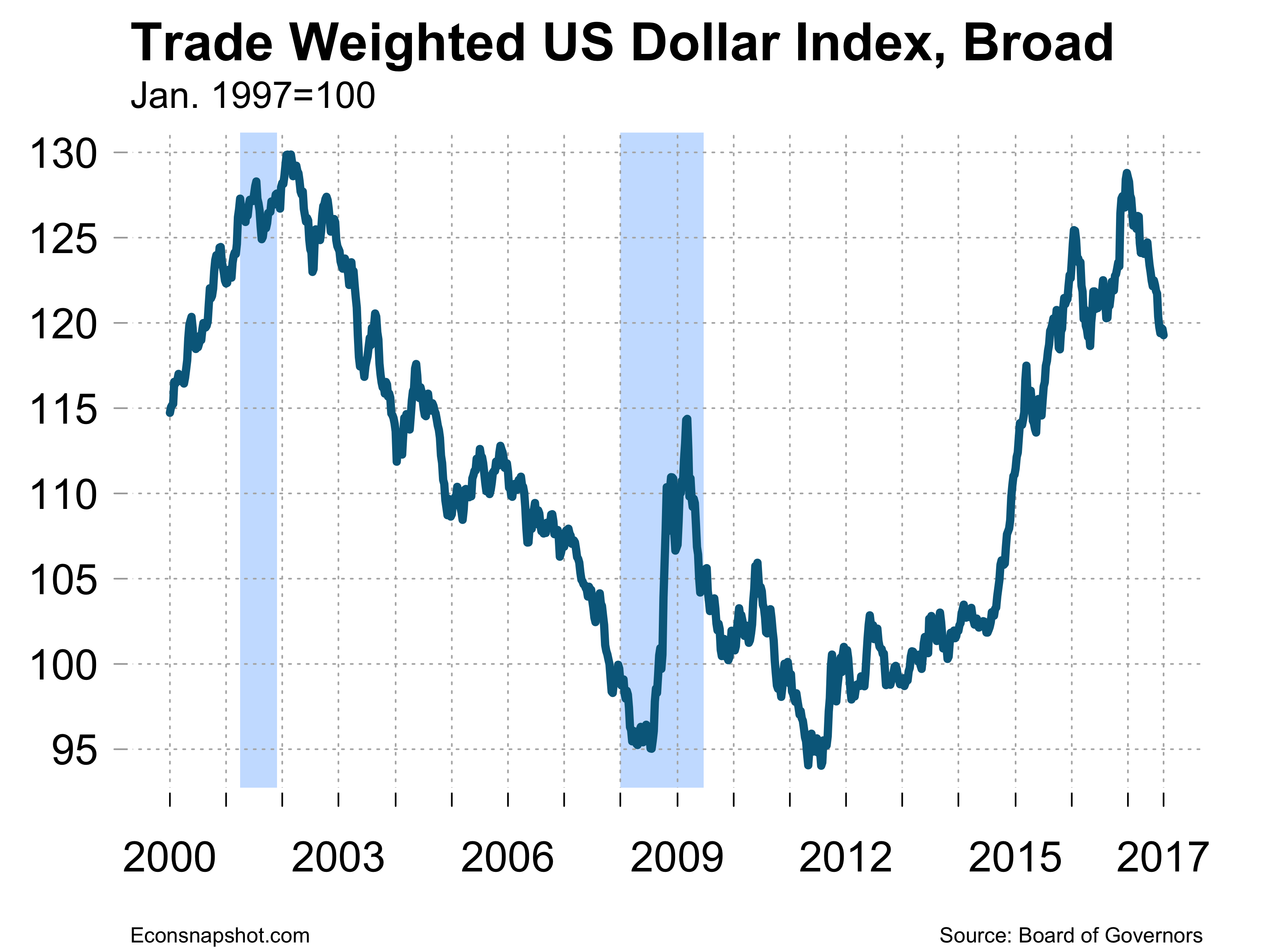

The strong growth in consumption occurred despite continued slow growth in wages and incomes. The rise in equity prices and the strong labor market have increased optimism that fueled more consumption. In fact the Conference Board reported an increase in consumer confidence that is hovering around a 16 year high. Investment growth is driven by a period of strong corporate profits. The US dollar continues to decline against a broad set of currencies, down about 7% since the beginning of the year and the Euro has also gained strength this year, up about 12%, despite increases in interest rates. This may stimulate future export growth which would keep the economy going strong.

Hurricane Harvey creates a lot of uncertainty for the future. On the one hand it foretells a big short term hit to local GDP from lost economic activity and the hit to the oil and gas sector. This will be balanced against future stimulus from the massive recovery effort. Evidence from prior national disasters – specifically Hurricane Sandy disrupted New York and Hurricane Katrina that devastated New Orleans – showed big short term impacts on the local economies but not a noticeable impact on aggregate GDP. It seems that it shouldn’t affect forecasts of Q3 and Q4 growth very much.