By Thomas Cooley, Ben Griffy and Peter Rupert

After several months of weakening employment growth the establishment survey from the BLS showed that June payroll employment increased 287,000. The employment number for April was revised up 21,000 for a final reading of 144,000. The weak May employment number was revised down 27,000, however, to a mere 11,000.

Private sector employment was up 265,000 and government up 22,ooo. Almost all of the increase was in private service producing, however, up 256,000. Manufactuing employment rose only slightly, up 14,000 and construction employment was unchanged. Mining and logging employment continued to contract, losing another 5,000.

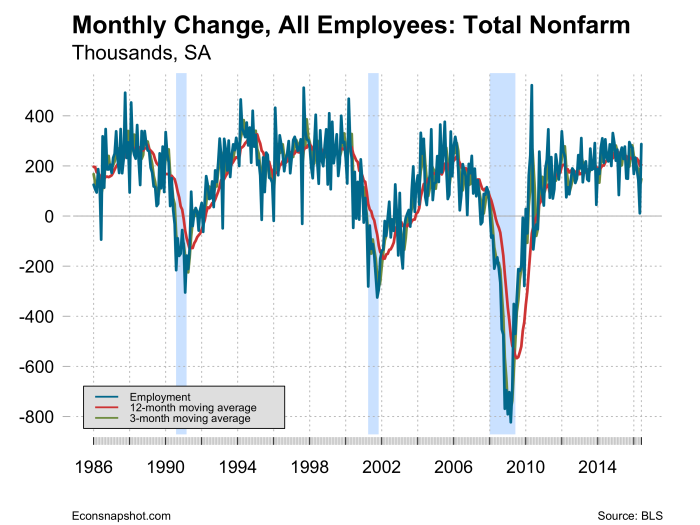

Mike Feroli observes that, “The swing between the May and June headline payroll numbers only looks extreme by modern standards. Over the past five years the standard deviation of monthly jobs adds was the lowest in the history of a series going back to the 1930s.” Here is a picture of the monthly changes going back as far as the data permit:

Of course that is a lot of data to see, here it goes back to only 1986:

And one more from 2010 on:

The data do show there appears to be decline in volatility and somewhat of a slowing down in employment growth over the past year and half or so and has likely given the FOMC reasons to not act.

The workweek held steady at 34.4 for the fifth straight month and average hourly earnings showed only a slight increase, from $25.59 to $25.61.

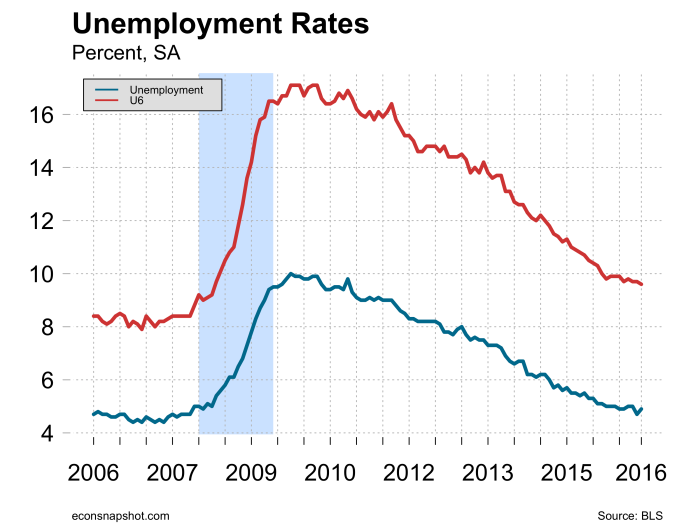

The household survey saw an increase in employment of only 67,000 however. With an increase in the civilian labor force of 414,000, the participation rate climbed 0.1 to 62.7 , the employment to population ratio fell from 59.7 to 59.6 and the unemployment rate moved up from 4.692% to 4.899%.

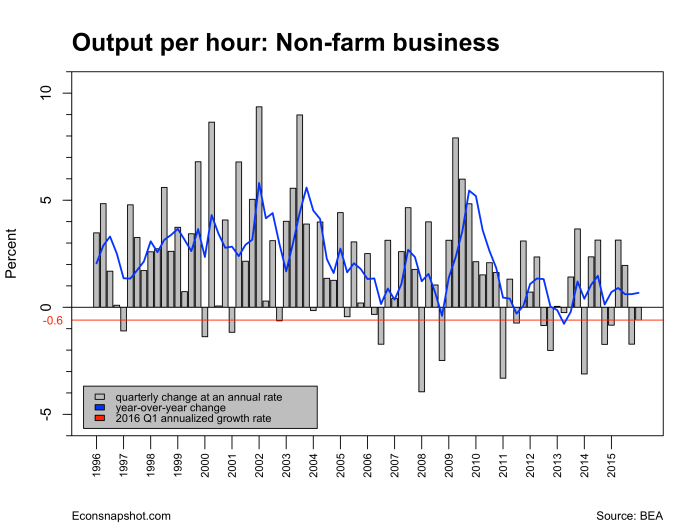

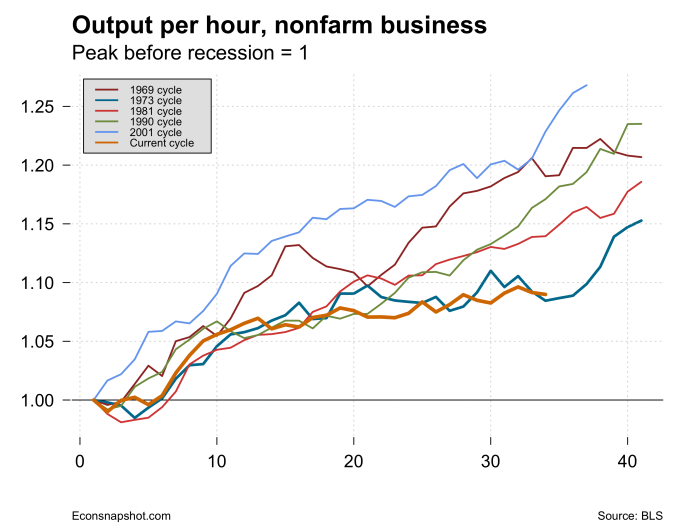

Productivity for the first quarter fell 0.6% at an annual rate, with output increasing 0.9% and hours up 1.5%. This is the second consecutive quarter of a productivity decline, with 2015 QIV falling 1.7%. Compared to other cycles, while productivity has appeared fairly weak, it had been growing at a pace similar to other cycles for the first several years coming out of the recession but then tapered off to a much more moderate growth rate.

The strength of this employment report keeps hopes alive for a rate increase by the FOMC before year end, although later rather than sooner.