by Thomas Cooley and Peter Rupert

Today’s GDP report reveals Q2 growth of 2.3% for the advance estimate. Overall, this tepid increase provides is not going to be an inducement to hike rates at the next meeting of the FOMC. First quarter GDP was revised upward to 0.8%, better than the initial estimate of a -0.2% decline.

But, as the above graph makes clear, the last three quarters do not show much evidence of robust growth. The bad news in the report is that second quarter growth was fueled in part by a big surge in inventories, a fact that could weigh on growth prospects in future quarters. Also discouraging was the downward revision to the longer term picture of GDP growth.

Annual Revision

Each year the BEA performs an annual revision, mostly covering the previous three years, but for some components goes back even farther. The result of the revisions show somewhat weaker growth compared to the previously published estimates. From the BEA release:

- From 2011 to 2014, real GDP increased at an average annual rate of 2.0 percent; in the previously published estimates, real GDP had increased at an average annual rate of 2.3 percent. From the fourth quarter of 2011 to the first quarter of 2015, real GDP increased at an average annual rate of 2.0 percent; in the previously published estimates, real GDP had increased at an average annual rate of 2.2 percent during this period.

- The percent change in real GDP was revised down 0.1 percentage point for 2012, was revised down 0.7 percentage point for 2013, and was unrevised for 2014.

Since the “end” of the recession in 2009 growth has been lackluster, although investment has experienced faster growth, having declined more dramatically as is usual over the business cycle.

The FOMC and Moderate Growth

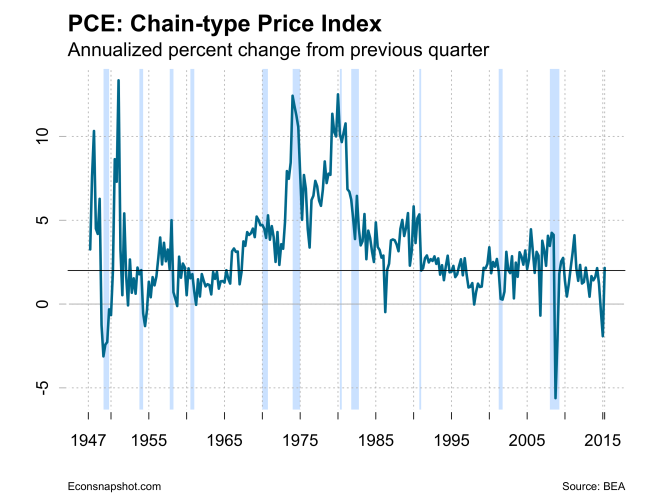

The recent policy statement from the FOMC used the word “moderate” twice in the first two sentences when talking about economic activity and household spending. As can be seen in the graphs above, both GDP and PCE grew in lock step over that past several years, and grew 2.3% and 2.9%, respectively for Q2. The GDP price index grew at 2.0% (1.4% for the core) and the PCE price index grew at 2.2% (1.8% for the core PCE price index), all of them right around the 2.0% FOMC target. And, while they mentioned the housing sector has shown additional improvement, “business fixed investment and net exports stayed soft.”

Evidently, the FOMC is putting more weight on what happens in the labor market: “The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.”