The latest Employment Situation report from the Bureau of Labor Statistics shows non-farm payroll employment increased by 80,000 jobs in June. Note that prior payrolls were revised down for April (from +77,000 to +68,000) but up in May (from +69,000 to +77,000). The meager gain was fairly broad-based, both goods producing and service producing employment increased. Professional and business services posted the largest gain, +47,000 with more than half (25,200) coming from temporary help services. The decline in Government employment moderated a bit, declining by 4,000 jobs. Further, there was also a setback in the diffusion index (that measures the percent of industries with expanding employment plus one half of the industries with no change) from 59.8 to 57.9–after two months of consecutive increases.

Author: Peter Rupert

Snapshot – JOLTS, Vacancies, and Hires

Are all jobless recoveries alike?

On Tuesday, the BLS released information on job openings, hires, and separations in April as reported in the Job Openings and Labor Turnover Survey. The job openings rate (the number of aggregate vacancies divided by total employment plus vacancies) decreased to 2.5% from 2.7% and the rate of hires (total hires divided by total employment) also decreased to 3.1% from 3.3%; two signs that the labor market is still having a difficult time recovering.

The JOLTS survey provides a more complete view of what comprises changes in total employment reported in the Employment Situation. The relationship between job openings and vacancies tells us to what extent employment growth is being affected by labor demand. If job openings and hires are growing at the same rate, then the counter-factual would be that hires could grow even faster if only there were more demand (job openings). Payroll employment increased by 77,000 in April (revised down from 115,000), a number that was seen to be far away from what is needed to bring the unemployment rate back down to pre-recession levels, and the numbers today highlight a little what is behind the constantly weak employment reports.

As we do elsewhere in the blog, the graphs below compare the path of both job openings and hires in the 2001 cycle versus the current one from the peak. Data only permits looking at the last two cycles, both of which have been characterized as having a particularly slow recovery in employment (popularly coined ‘Jobless Recoveries’). Looking at JOLTS openings and hires, both of these series seem to track each other fairly closely, at least from the peak. In this regard, one would be led to believe that whatever mechanism is causing the slow response of employment must have been present in both cycles, or that all jobless recoveries are made alike.

Snapshot – 2012 Q1 GDP (Advance Estimate)

Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the preliminary first quarter data on National Income and Product from the Bureau of Economic Analysis as well as the March Employment Situation released by the Bureau of Labor Statistics. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. We also include the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data. Click here to go to the latest snapshot in one pdf document. Or, read on–

Lackluster GDP Growth

This morning’s advance estimate for GDP for the first quarter of 2012 reveals annual growth of 2.2%. After a 3.0% annualized growth rate in the fourth quarter, expectations were in the 2.2 to 2.5% range. The biggest contributors to the increase were personal consumption expenditures (PCE), up 2.9% at an annual rate, contributing about 2.0 percentage points to the overall increase. Durable goods consumption increased 15.3%, the second consecutive quarter of double-digit growth, and contributed 1.13 percentage points to the overall increase. Residential structures investment also has seen double-digit increases in consecutive quarters, up 19.1% this quarter after increasing 11.6% in the previous quarter. Nonresidential structures, -12.0%, and government, -3.0%, were the only negatives to be found, see BEA’s Table 1 for details.

Continue reading “Snapshot – 2012 Q1 GDP (Advance Estimate)”

Snapshot – The March Employment Report

Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the new employment numbers released today by the Bureau of Labor Statistics. The complete Snapshot based on the latest revisions to fourth quarter GDP from the Bureau of Economic Analysis can be found in our previous post.

As in all of our snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

You can also find the most recent version of the entire snapshot in pdf form here. As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data.

The Labor Market

The latest Employment Situation report from the Bureau of Labor Statistics shows non-farm payroll employment rose by a disappointing 120,000 jobs in March. Prior payrolls were revised down for January (-9,000) and up for February (+13,000). Many economists had expected the labor market to add about 210,000 jobs, having witnessed three consecutive months of 200,000+ increases, averaging 246,000 per month. The total number of unemployed persons remained essentially constant at 12.7 million and the unemployment rate ticked down slightly to 8.2%. The labor force participation rate ticked down to 63.8%, as did the employment to population ratio, falling to 58.5% from 58.6% in February. For comparison, as we did last month, we plot employment as reported by ADP, an association of payroll processors. Many observers view this as a useful early indicator of the BLS numbers.

Continue reading “Snapshot – The March Employment Report”

Update: Final Revisions to Fourth Quarter GDP

Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the final revisions to fourth quarter data on National Income and Product from the Bureau of Economic Analysis. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. This post primarily updates GDP and its components based on preliminary estimates of fourth quarter activity from the BEA. We also include the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data. Click here to go to the latest snapshot in one pdf document. Or, read on

Final Fourth Quarter GDP Revisions

The third and final estimate of GDP and its components confirms that real GDP grew at an annual rate of 3% in the fourth quarter of 2011. While there was no change in the total, there were changes to the components of GDP that roughly offset each other. Personal consumption expenditures on goods were revised up further from 4.9% to 5.4% annual growth. Growth in services, however, was revised down further from 0.7% to 0.4% and continues to drag down growth in total consumption. It remains at least 5 percentage points below where its path should be compared to “typical” previous cycles and is showing signs of slowing down. Gross private investment was revised upward to 22.1% from 20.6%. Notably, growth in nonresidential structures was revised up to -0.9% from -2.6% in the ‘second’ estimate and -7.2% in the preliminary estimate.

Continue reading “Update: Final Revisions to Fourth Quarter GDP”

Update – Fourth Quarter Revisions (Second Estimate)

Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the revisions to preliminary fourth quarter data on National Income and Product from the Bureau of Economic Analysis. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. This post primarily updates GDP and its components based on preliminary estimates of fourth quarter activity from the BEA. We also include the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data. Click here to go to the latest snapshot in one pdf document. Or, read on–

Fourth Quarter Revisions – Confirms Recovery…in What?

The “second” estimate of GDP and its components showed that real GDP grew at an annual rate of 3% in the fourth quarter of 2011. The growth rate was revised up from a preliminary estimate of 2.8%. The new estimate mostly reflected an upward revision in gross private domestic investment led by a revision to growth in nonresidential structures. The preliminary estimate showed nonresidential structures declining at an annual rate of 7.2%, while the second estimate showed it declining at a rate of 2.6%. As this is the only component of private GDP that experienced negative growth, the new revisions were largely optimistic.

This newest data confirms that output growth has regained some momentum seen earlier in the recovery. The slowdown in growth led some to worry of a potential ‘double-dip’ recession as output sputtered in the first three quarters of 2011 (around 13 quarters after the peak of business cycle activity). The slowdown can clearly be seen across most components of GDP. The seasonally adjusted annualized quarterly percent change in Personal Consumption Expenditures (PCE) were 2.7%, 2.9%, 2.6%, and 3.6% for the four quarters in 2010 and then slowed to 2.1%, 0.7%, and 1.7%, for the first three quarters of 2011 then picked up some steam in the fourth quarter, growing at 2.1%. The slowdown is particularly evident in the graph for PCE-goods below. Investment even experienced negative growth after steady recovery, mostly led by a reduction in the change in private inventories. Government consumption and investment also started to show signs of decline beginning around the same time period.

Continue reading “Update – Fourth Quarter Revisions (Second Estimate)”

Snapshot – Fourth Quarter GDP Estimates – Growth Improves, Concerns Remain–January Labor Market Update

Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the preliminary fourth quarter data on National Income and Product from the Bureau of Economic Analysis as well as the January Employment Situation released by the Bureau of Labor Statistics. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. This post primarily updates GDP and its components based on preliminary estimates of fourth quarter activity from the BEA. We also include the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data. Click here to go to the latest snapshot in one pdf document. Or, read on–

How bad is this recession and how should we assess the recovery?

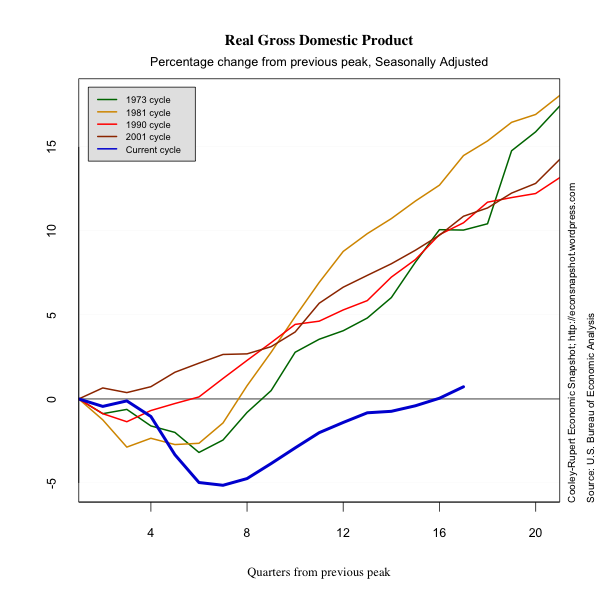

The preliminary estimates of fourth quarter GDP and its components show that the economy picked up a little momentum with GDP increasing at an annual rate of 2.8% compared to the rather anemic 1.8% growth rate in the third quarter. We should caution that preliminary estimates have been revised downward in both of the previous two quarters, so the 2.8 percent figure could be optimistic. The figure below shows that the recovery has now brought GDP above the previous peak.

Several things become apparent when looking at the above picture. First, the length of the downturn of the current cycle was close to what it has been in previous cycles. However the depth was much more severe bringing real GDP more than 5% below its peak level. Second, and more discouraging, the length of the recovery has been much longer and the pace much slower. It has taken 16 quarters for real GDP to reach its previous peak level. In all other post-war cycles, the longest GDP has taken to reach previous peak was 8 quarters during the 1973 cycle. It is obvious why this last episode has been called the “The Great Recession,” but we may want to add to that “The Abysmal Recovery.”

Continue reading “Snapshot – Fourth Quarter GDP Estimates – Growth Improves, Concerns Remain–January Labor Market Update”

Snapshot – The December Employment Situation: A Few More Jobs, Participation Steady

Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the new employment numbers released today by the Bureau of Labor Statistics. The complete Snapshot based on final revisions to third quarter GDP from the Bureau of Economic Analysis can be found in our previous post.

As in all of our snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

You can also find the most recent version of the entire snapshot in pdf form here. As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data.

The Labor Market

The latest Employment Situation report from the Bureau of Labor Statistics shows a net addition of 200,000 non-farm jobs in December. Prior payrolls were revised lower for November (100,000 from 120,000) and higher for October (112,000 from 100,000). These indicate a continued improvement in labor market conditions but at the same glacial pace of recent months. When we look at total employment relative to the long term trend in employment, not only are we well below the previous peak, we are very far below where a healthy economy might be. An encouraging sign is that the manufacturing sector and the construction sector both added jobs while the Government sector continues to shed them. For comparison, as we did last month, we plot employment as reported by ADP, an association of payroll processors. Many observers view this as a useful early indicator of the BLS numbers.

Continue reading “Snapshot – The December Employment Situation: A Few More Jobs, Participation Steady”