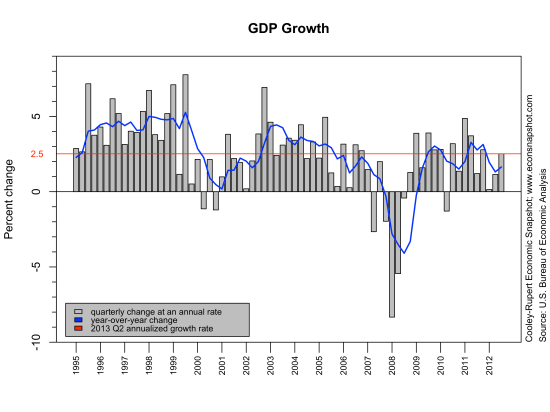

Upward revision of Q2 real GDP was announced by the BEA here , indicating that Q2 real GDP increased at a seasonally adjusted annual rate of 2.5%; revised up 0.8 percentage points from the advance estimate of 1.7%. Note that analysts expectations for that advance estimate had been somewhere around 1.0%. Q1 real GDP growth was unchanged by the revision, remaining at 1.1%.

As can be seen in the graph above, compared to other recoveries real GDP is growing significantly slower, as is consumption, shown below.

The large upward revision in output stemmed from higher growth in net exports, with both exports (up 8.6%) and imports (up 7.0%) rising. The Commerce Department releases a monthly trade report that already indicated a large tick up in the US trade balance during the second quarter. There was also a larger accumulation of private inventories. This wasn’t much of a surprise. The real question is if these revisions shed any light on the upcoming employment report (due out Sept. 6) as well as expectations of the future path of the labor market…as this will provide rationale for a so-called “Sep-taper.”

However, it seems as if there is no indication that trade is contributing much to employment growth. Below we plot year-over-year changes in exports and employment for services and goods separately. Exports as a whole have been on a decline since mid 2010 and (at least for services), have diverged from employment growth.

A better sign of future declines in unemployment is in the reported drop in unemployment benefit claims, from the initial claims report. Declines in claims are consistently followed by falling unemployment.

Below we show the snapshot of the remaining variables from the National Income and Product Accounts and remember you can always get a pdf copy of the entire economic snapshot here.

Nonresidential investment in structures was revised up a lot – from 6.8% in the advance estimate to 16.1%. Residential construction, on the other hand, was revised down slightly, from 13.4% to 12.9%.