Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the preliminary first quarter data on National Income and Product from the Bureau of Economic Analysis as well as the March Employment Situation released by the Bureau of Labor Statistics. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. We also include the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data. Click here to go to the latest snapshot in one pdf document. Or, read on–

Lackluster GDP Growth

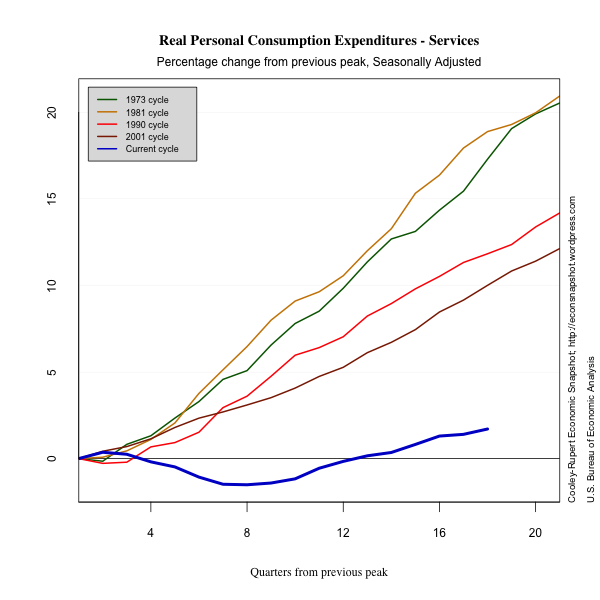

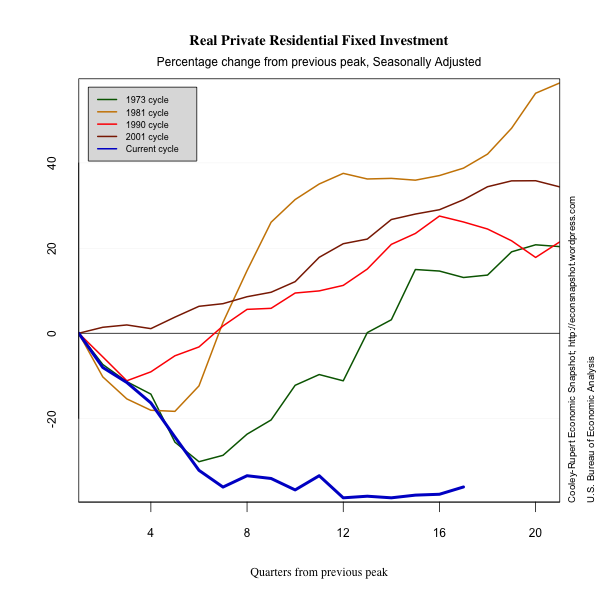

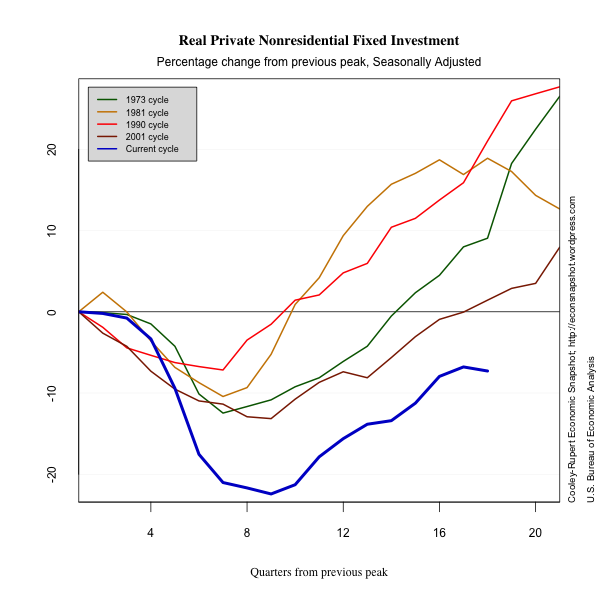

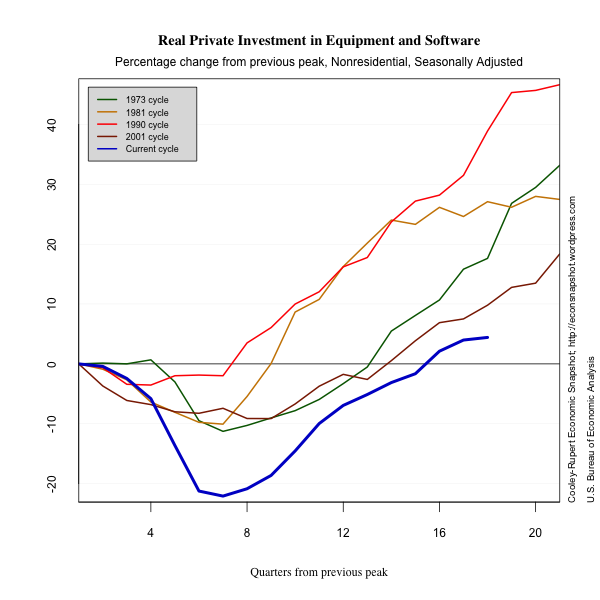

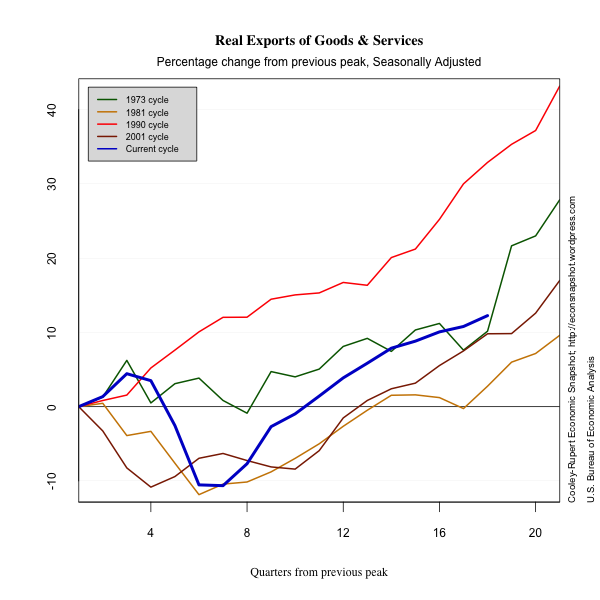

This morning’s advance estimate for GDP for the first quarter of 2012 reveals annual growth of 2.2%. After a 3.0% annualized growth rate in the fourth quarter, expectations were in the 2.2 to 2.5% range. The biggest contributors to the increase were personal consumption expenditures (PCE), up 2.9% at an annual rate, contributing about 2.0 percentage points to the overall increase. Durable goods consumption increased 15.3%, the second consecutive quarter of double-digit growth, and contributed 1.13 percentage points to the overall increase. Residential structures investment also has seen double-digit increases in consecutive quarters, up 19.1% this quarter after increasing 11.6% in the previous quarter. Nonresidential structures, -12.0%, and government, -3.0%, were the only negatives to be found, see BEA’s Table 1 for details.

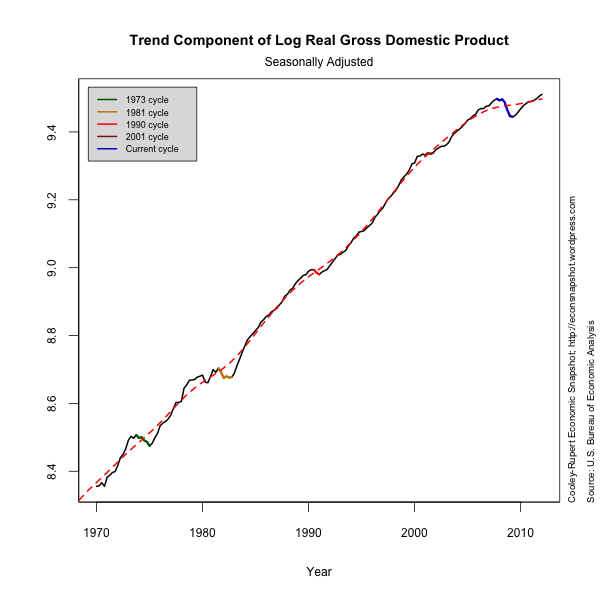

As can be seen from the figure above, real output still lags significantly behind where it has been historically at this point during a cycle, mostly due to the larger depth at the trough and longer duration of the recovery. Taking this into account, we ask how does the recovery compare to past ones? Below we plot the same graph as above of real GDP, but now taking percentage changes from the trough of the cycle. As can be seen the pace of the recovery, while not impressive, has been in line with that of both the 1990 and 2001 cycles. Growth during the current recovery has been on average 2.49%. This is compared to an average growth (over the same number of quarters past trough) of 2.92% and 2.91% in the 1990 and 2001 cycles respectively.

Compared to the previous two recessions, it appears that the current recovery is not that much different. However, given the greater depth and length of the decline, historical precedence would have predicted a much more rapid pace of recovery. Moreover, the current pace of recovery since the trough is still below that of our long run growth trend, approximately 3.0%. Of crucial concern is whether we are witnessing a change in the underlying growth trend. Indeed, the current stance of the economy has had a large effect on a measure (here the HP filter) of the underlying trend. For more details see our note about assessing the underlying trend growth of output, Bethune, Cooley, Rupert (2012).

Compared to the previous two recessions, it appears that the current recovery is not that much different. However, given the greater depth and length of the decline, historical precedence would have predicted a much more rapid pace of recovery. Moreover, the current pace of recovery since the trough is still below that of our long run growth trend, approximately 3.0%. Of crucial concern is whether we are witnessing a change in the underlying growth trend. Indeed, the current stance of the economy has had a large effect on a measure (here the HP filter) of the underlying trend. For more details see our note about assessing the underlying trend growth of output, Bethune, Cooley, Rupert (2012).

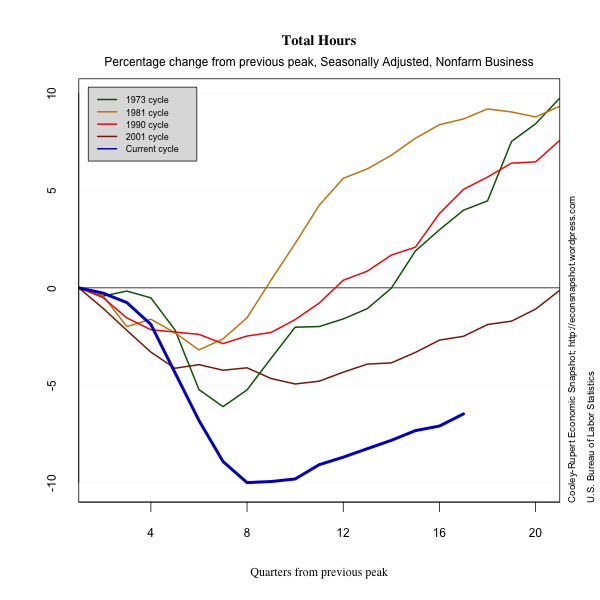

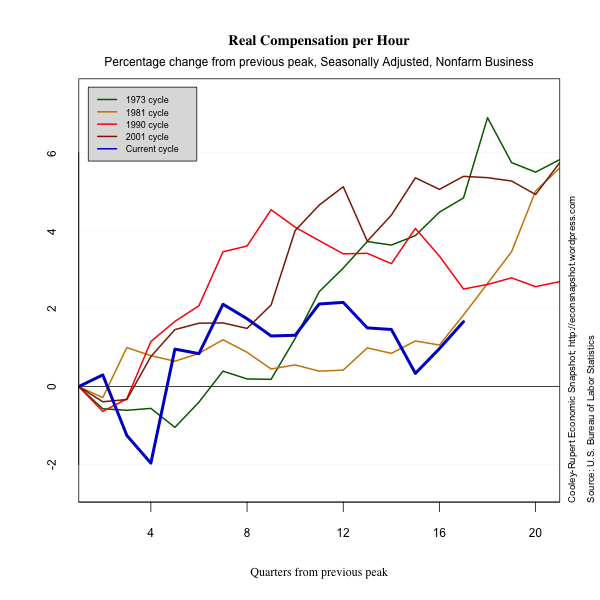

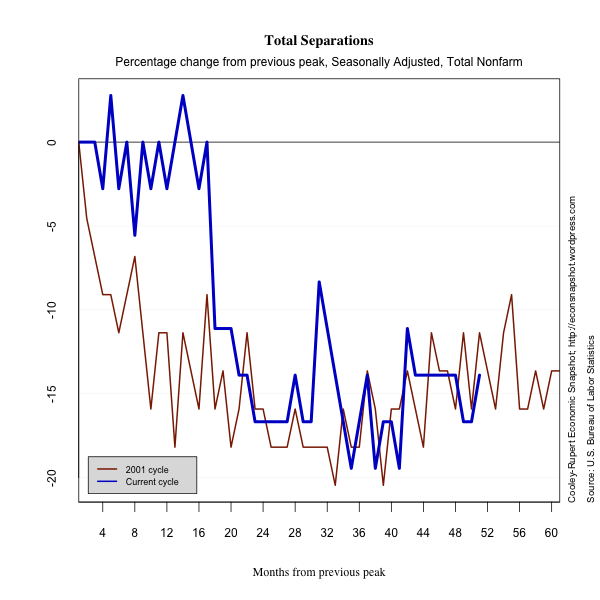

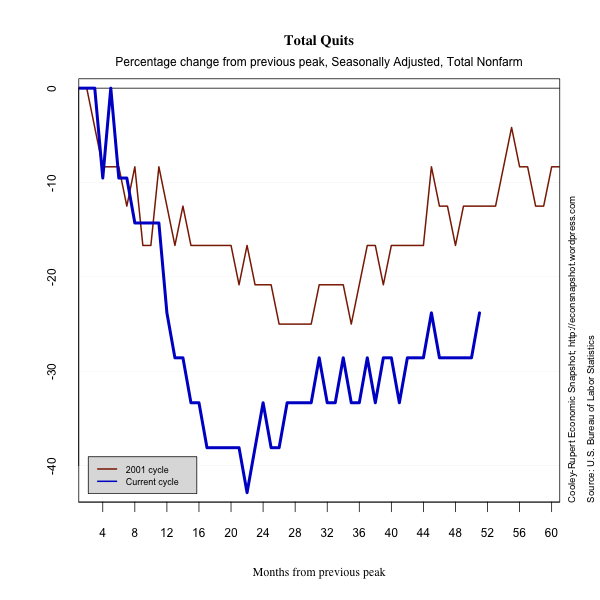

The Labor Market

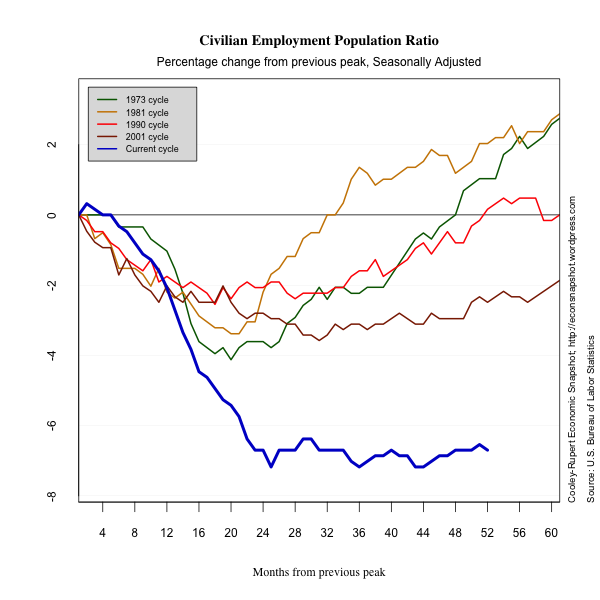

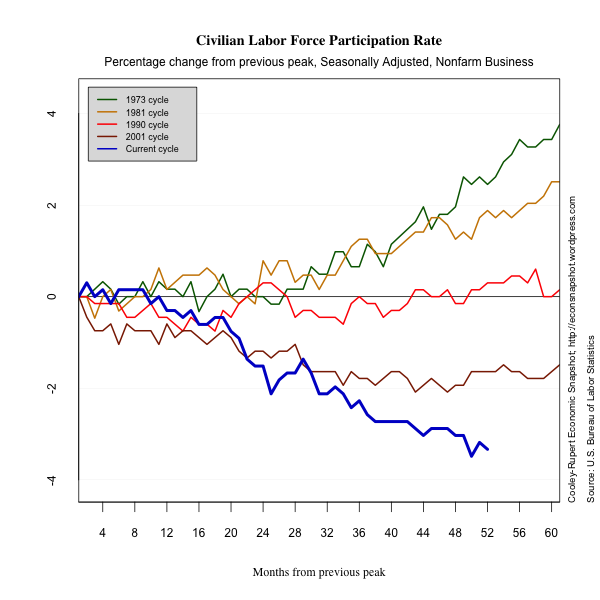

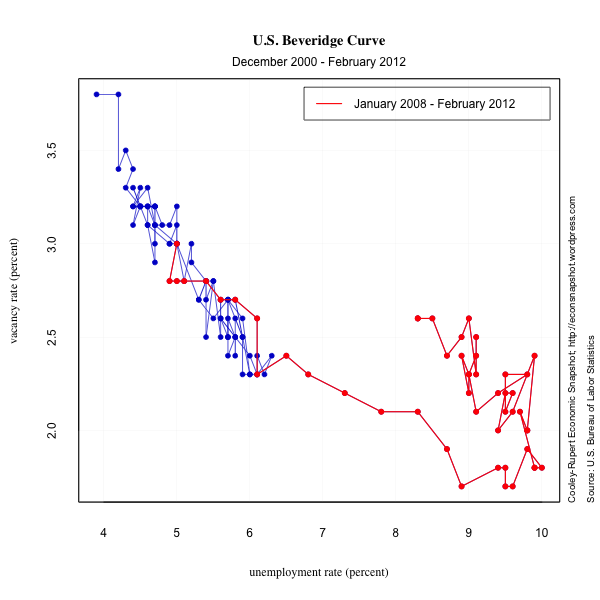

The latest Employment Situation report from the Bureau of Labor Statistics shows non-farm payroll employment rose by a disappointing 120,000 jobs in March. Prior payrolls were revised down for January (-9,000) and up for February (+13,000). Many economists had expected the labor market to add about 210,000 jobs, having witnessed three consecutive months of 200,000+ increases, averaging 246,000 per month. The total number of unemployed persons remained essentially constant at 12.7 million and the unemployment rate ticked down slightly to 8.2%. The labor force participation rate ticked down to 63.8%, as did the employment to population ratio, falling to 58.5% from 58.6% in February. For comparison, as we did last month, we plot employment as reported by ADP, an association of payroll processors. Many observers view this as a useful early indicator of the BLS numbers.

The number of long term unemployed fell by 118,000, but, as reported in an earlier post, are roughly 40% of the total unemployed. The numbers of people who are involuntarily underemployed, marginally attached to the labor force and the number of people who classify as discouraged workers also fell slightly. While these are all slight improvements, the meager job growth admits only very minor improvements in the health of the labor market.

Employment continued to increase in professional and business services, health care services and leisure and hospitality. Manufacturing jobs also increased. Retail trade employment decreased for the second consecutive month, falling 33,800 in March after declining 28,600 in February.

Credit Markets

Credit Markets

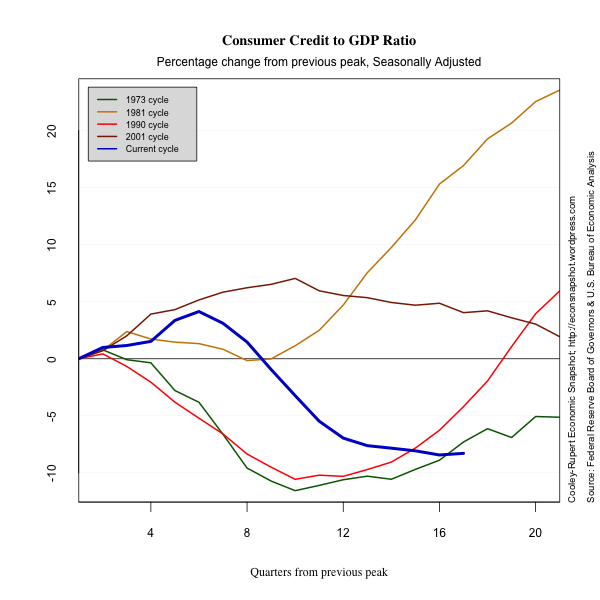

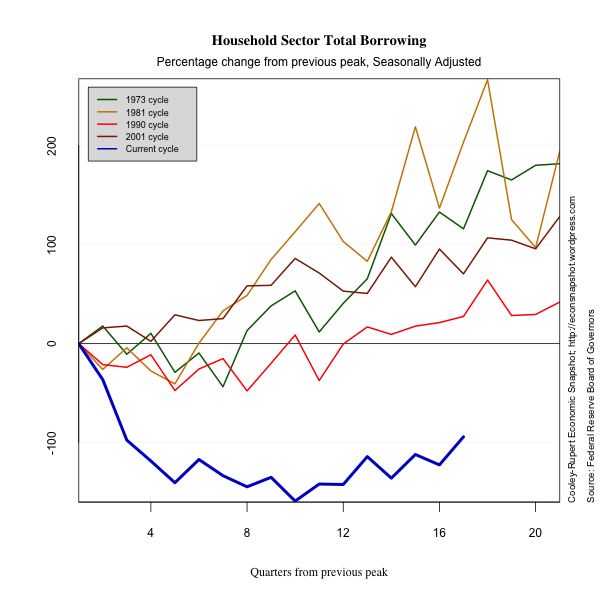

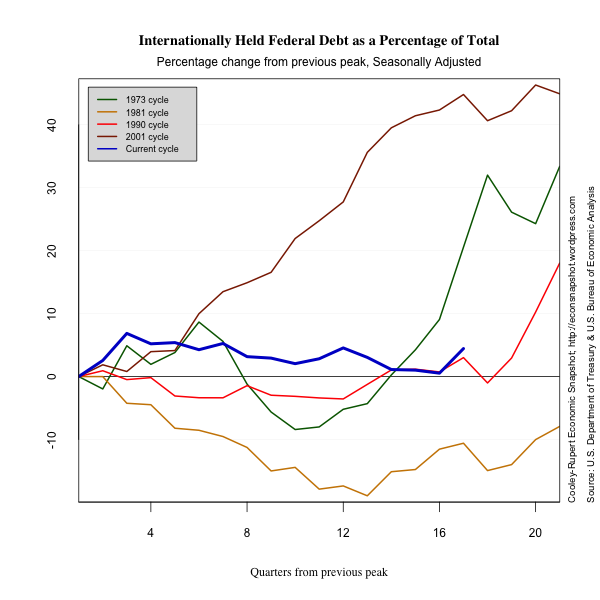

Credit markets continue to show the after-effects of the tremendous increase in leverage the took place prior to the 2007-2009 crisis. Households debt outstanding continues to decline and shows little signs of picking up. Household borrowing is only gradually increasing, but remains well below its level at the peak. Corporate sector borrowing is rising again and corporations show slow signs of increasing debt. The big story in credit markets is the dramatic shift of leverage to the public sector. Public sector debt outstanding is increasing at a faster rate.

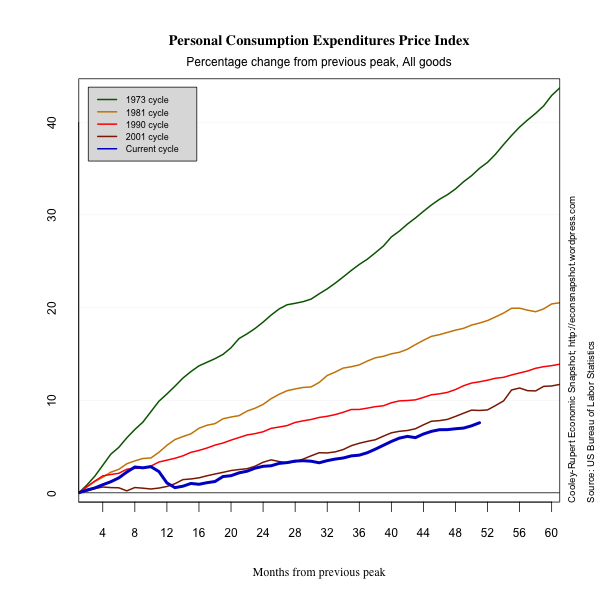

Industrial Production and Inflation

In this section we present some plots of miscellaneous series that reflect other characteristics of this business cycle. The decline in industrial production was dramatic, although its recovery seems to be closer to what we have seen historically. There is no evidence of inflation or deflation.

Glossary

Compensation includes accrued wages and salaries, supplements, employer contributions to employee benefit plans, and taxes.

Consumer Price Index measures the price paid by urban consumers

for a representative basket of goods and services. Prices are collected from 87 urban areas and from approximately 23,000 retail and service establishments.

Debt Outstanding measures the current level debt owed on credit market

instruments. Credit market instruments include open market paper, Treasury securities, agency and GSE-backed securities, municipal securities, corporate and foreign bonds, bank loans, mortgages, and

consumer credit.

Durables are goods that have an average useful life of at least 3

years.

Employment Population Ratio is the ratio of the number of

civilians in the labor force to the total civilian population.

Exports consist of goods and services that are sold or

transferred by U.S. residents to foreign residents.

Goods are tangible commodities that can be stored or inventoried.

Government Consumption Expenditures and Gross Investment measures

current consumption expenditures by the government in order to produce goods and services to the public and investment in structures and equipment and software.

Gross Private Domestic Investment measures additions and

replacements to the stock of private fixed assets without deduction of

depreciation.

Imports consist of goods and services that are sold or

transferred by foreign residents to U.S. residents.

Industrial Production Index measures real output of

manufacturing, mining, and electric and gas utilities industries.

Job Openings or Vacancies are all positions that are open (not

filled) on the last business day of the month.

Labor Force is defined as the number of unemployed persons plus

the number of employed persons.

Labor Force Participation Rate is the ratio of unemployed persons

to the number of persons in the labor force.

Net Worth equals to total assets minus total liabilities. Assets

include owner-occupied real estate, consumer durables, and equipment and software owned by nonprofit organizations.

Nondurables are goods that have an average useful life of less

than 3 years.

Nonresidential Fixed Investment measures investment by businesses

and nonprofit institutions in nonresidential structures and in equipment and software.

Personal Consumption Expenditures measures the value of goods and services purchased by households, nonprofit institutions that primarily serve households, private non-insured welfare funds, and private trust funds.

Residential Fixed Investment measures investment by businesses and households in residential structures and equipment, primarily new construction of single-family and multifamily units.

Services are commodities that cannot be stored or inventoried and

that are usually consumed at the place and time of purchase.

Total Borrowing measures the flow of new credit market liabilities during the period. Credit market liabilities include open market paper, Treasury securities, agency and GSE-backed securities, municipal securities, corporate and foreign bonds, bank loans, mortgages, and

consumer credit.