By Paul Gomme and Peter Rupert

The BLS announced that employment rose by a very subdued 114,000 according to the establishment survey, 97,000 of which came from the private sector. The bulk of the increase came from Health Care and Social Assistance sector, increasing 64,000. Moreover, there were 29,000 fewer employees over the past two months than reported earlier, as May was revised down 2,000 and June revised down 27,000.

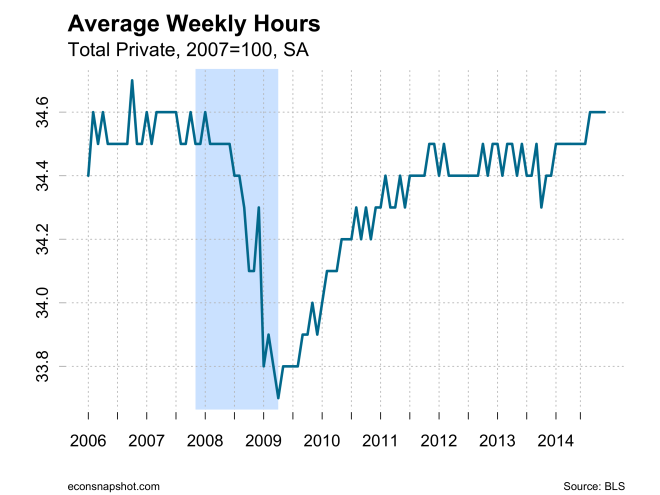

Average hours of work fell from 34.3 to 34.2. Given the weak increase in private sector employment and the decline in average hours meant that total hours of work fell about 2.6%.

To be sure, the July employment report is disappointing. The figure below plots the change in nonfarm payroll employment since 1947. To this figure, we’ve added a red dot when the change in employment was at most 114,000 (as in the most recent jobs report), and the economy was in an expansion. (We’ve excluded a few months around the start of the pandemic because these employment changes were so extreme.) The bottom line is that the US has often had weak job reports in the midst of expansions. The point being that looking only at one monthly report may be very misleading. Indeed the Fed has mentioned this in other contexts:

The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

July 31 FOMC Statement

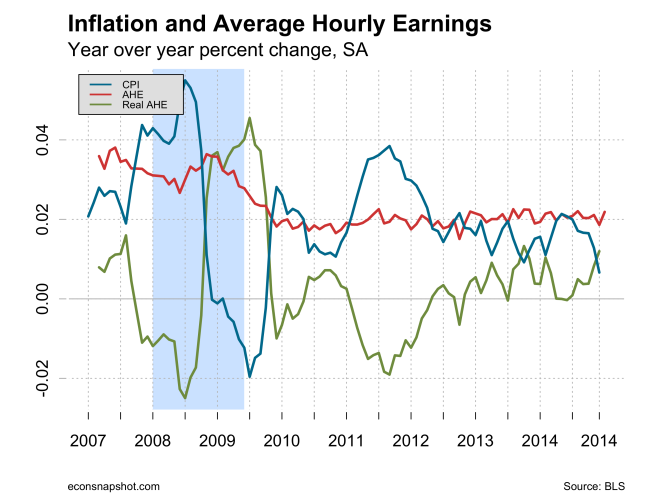

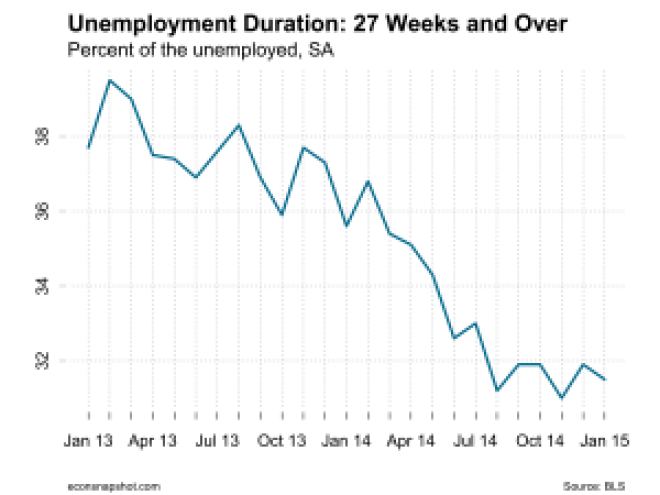

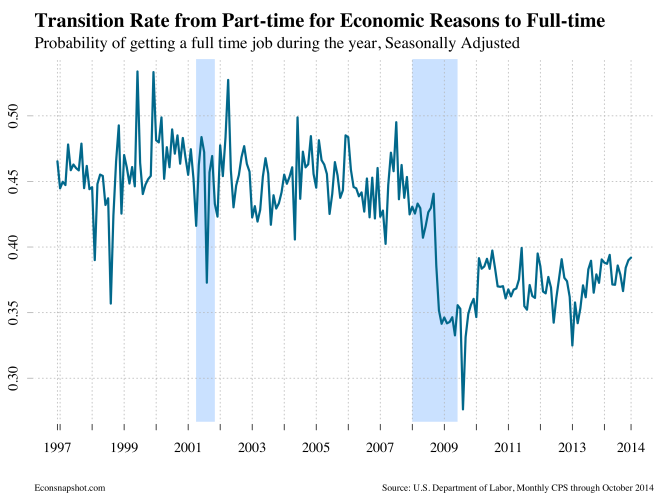

The unemployment rate, based on the household survey, rose to 4.25% from 4.05% in the previous month. Digging deeper into the unemployment data reveals that much of the increase in the unemployment rate in 2024 has been due to a combination of workers losing jobs, and workers reentering the labor market, the labor force grew by 420,000. Keep in mind that reentry may be an artifact of the rules for counting an individual as unemployed which includes a notion of active job search. According to the jobs report, in July there were 4.6 million individuals who were not in the labor force but who want a job, an increase of 346,000. When these marginally attached individuals are included in the ranks of the unemployed, the unemployment rate is nearly 8%, not the official 4.3%.

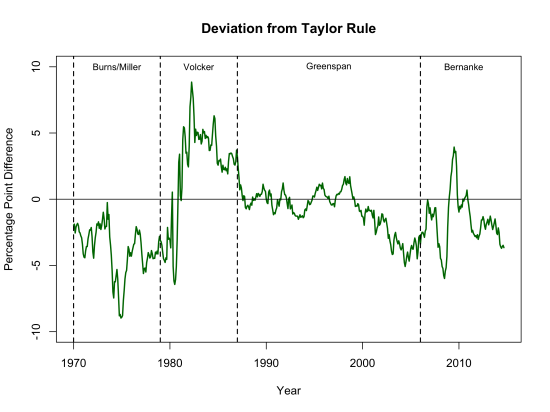

Once again there are many in the media showing the possibility that the economy is heading toward a recession. Note: definitionally, it has to be true that if we are currently not in a recession we are heading toward one since recessions do frequently occur (but have become much less frequent, see the recessions graph below. At any one time there are usually both positive and negative signs. For example, how much weight should one put on a one month decline? Or a one day decline in the stock market? Jeremy Piger uses data to infer the probability the economy is in a recession, as of July 26, the probability that we were in a recession in June was 0.26%. That said, there will be inflation reports before the next FOMC meeting, but at this point it looks more likely there will be a rate cut in September, barring any large increases in inflation.