By Paul Gomme and Peter Rupert

It was a pretty busy week for incoming data. Bottom line: The economy continues to reveal strong economic growth and maybe we have not “landed” at all, we are still flying.

Employment Situation

The BLS establishment survey showed that employment rose 187,000 in August. Although the gain was higher than in the previous two months, the June employment numbers were revised down by 80,000 and July down 30,000…employment was 110,000 less than previously reported entering August. The gain was less than the 271,000 average gain over the previous 12 months. Private employment gains led the charge at 179,000 with the service sector adding 143,000. The biggest gain came in health care, up 97,000.

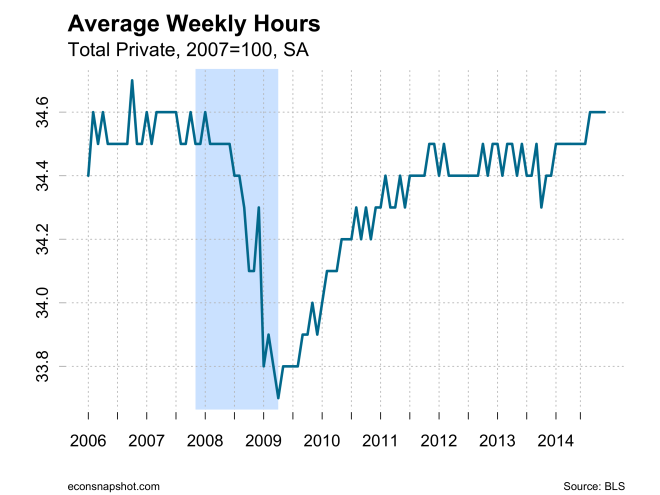

Average hours of work increased from 34.3 to 34.4. That, combined with the 179,000 increase in private employment led to a large increase in total hours of work.

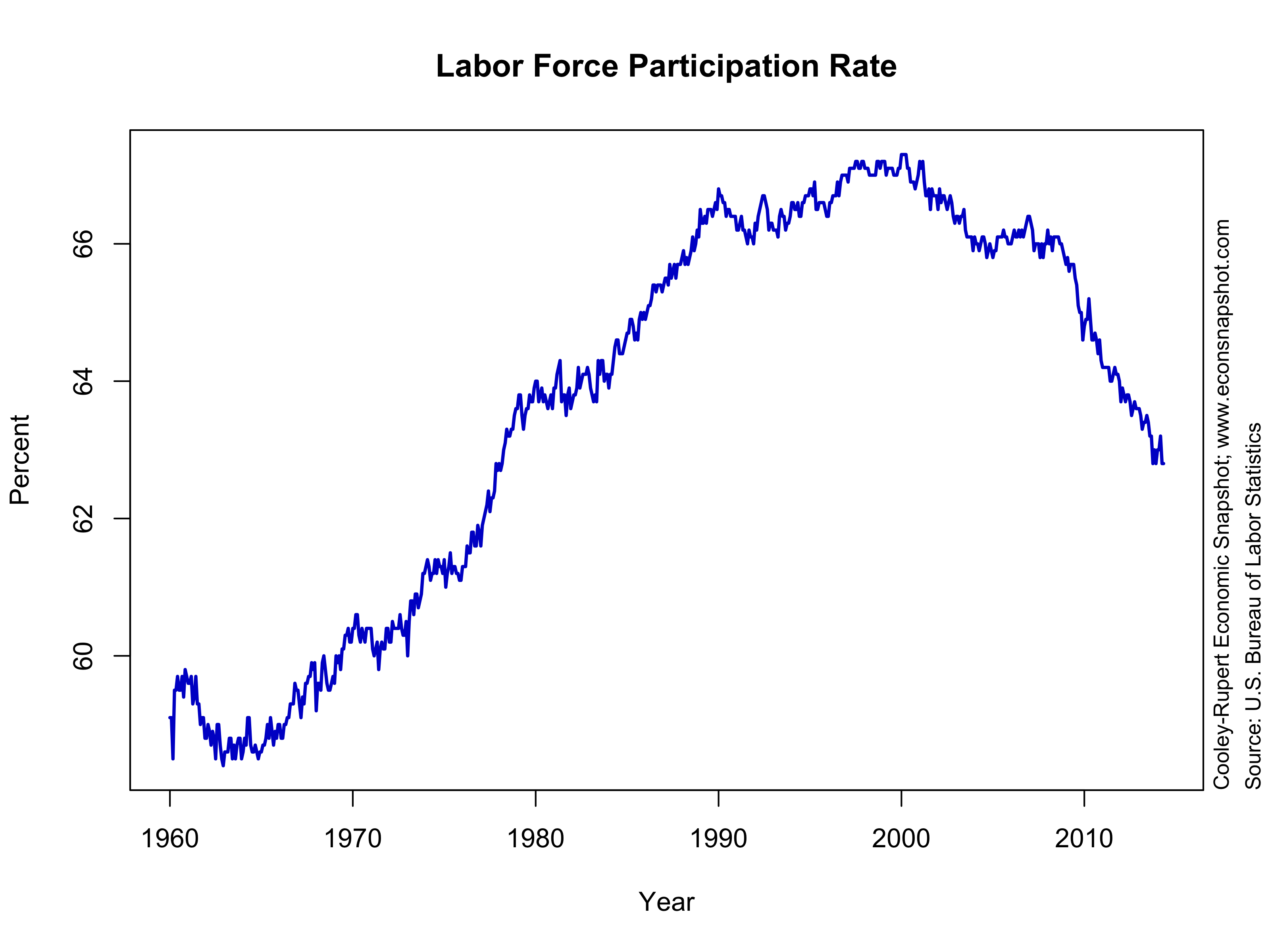

The household survey showed an increase in the unemployment rate from 3.50% to 3.79%. The number of people unemployed did rise by 514,000, however, there was also a 736,000 increase in the labor force. The labor force participation rate has been steadily increasing but is still below the pre-pandemic level. Basically, once the effects of the pandemic have receded there has not been much of a change in the reasons for showing up as unemployed.

Since the unemployment rate is the ratio of the number of people unemployed divided by the labor force (the number of people employed and unemployed), the unemployment rate can increase either because the numerator (the number unemployed) increased, or because the denominator (the labor force) decreased. Which one accounts for the 0.29 percentage point increase in the unemployment rate in August? According to the Household Survey, the number of unemployed rose by 514 thousand in August while employment rose 222 thousand. In other words, the labor force increased by 736 thousand. For August, the increase in the unemployment rate came about due to an increase in the number of individuals unemployed.

The figure below digs deeper into the labor market flows. The arrows reflect flows of people between employment (E), unemployment (U), and not-in-the-labor force (N). The change in employment is obtained by adding the numbers with arrows pointing into E, and subtracting the flows associated with arrows out of E: a net increase in employment of 146 thousand. This number is different from the 222 thousand obtained directly from the employment data from the Household Survey. The reason being that there are some additional inflows and outflows found in this table that have to do with adjustments to population, teenagers turning 16, etc. We can similarly compute the change in the number of unemployed by looking at the flows in and out of U: an increase of 512 thousand (rather closer to the actual change of 514 thousand obtained from the number unemployed with the adjustments). Relative to the flows in and out of unemployment, 512 thousand is not a huge number: the total flows (regardless of sign) sum to 6,180 thousand, and so 512 thousand is 8.3% of the total flows.

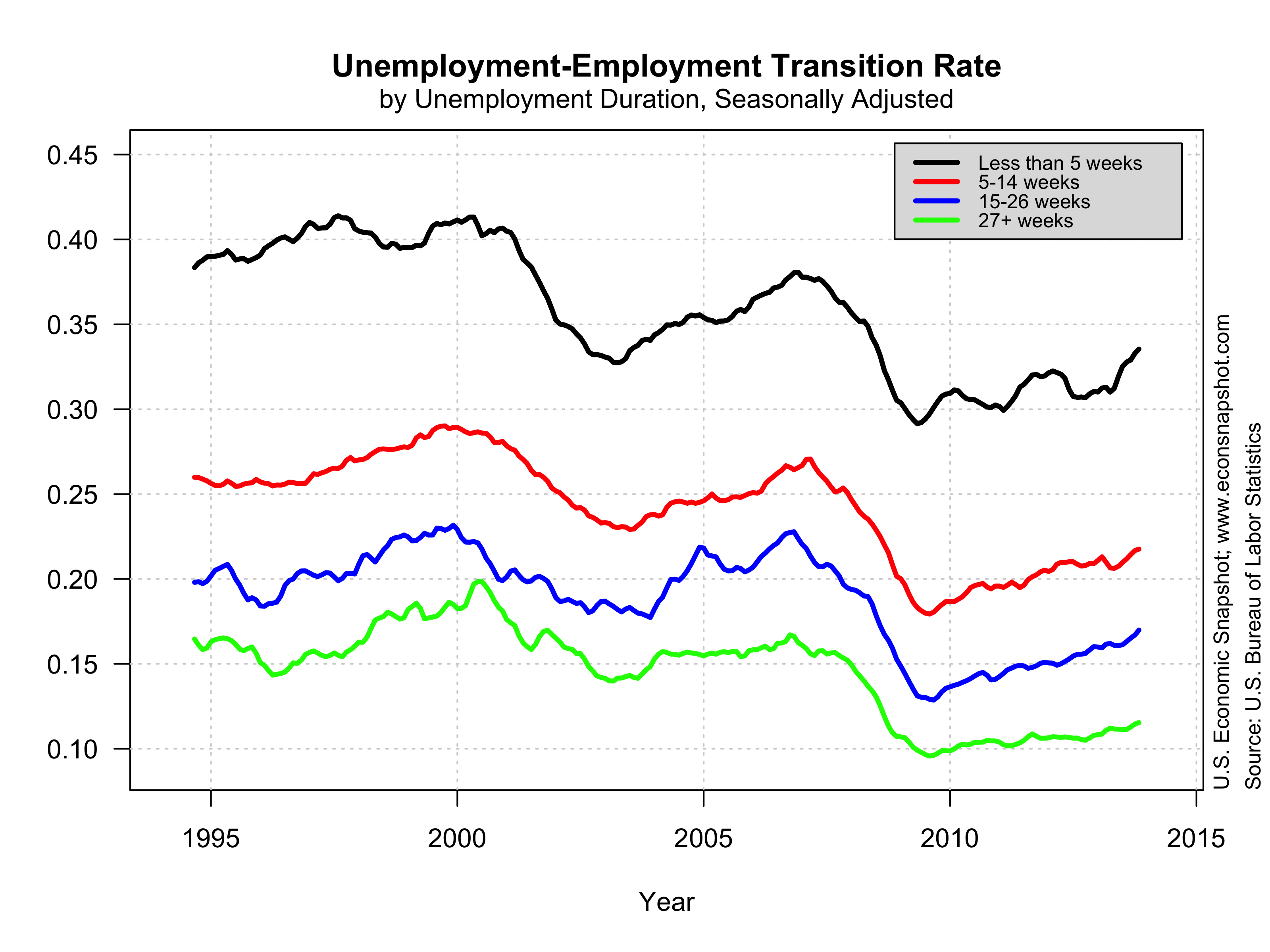

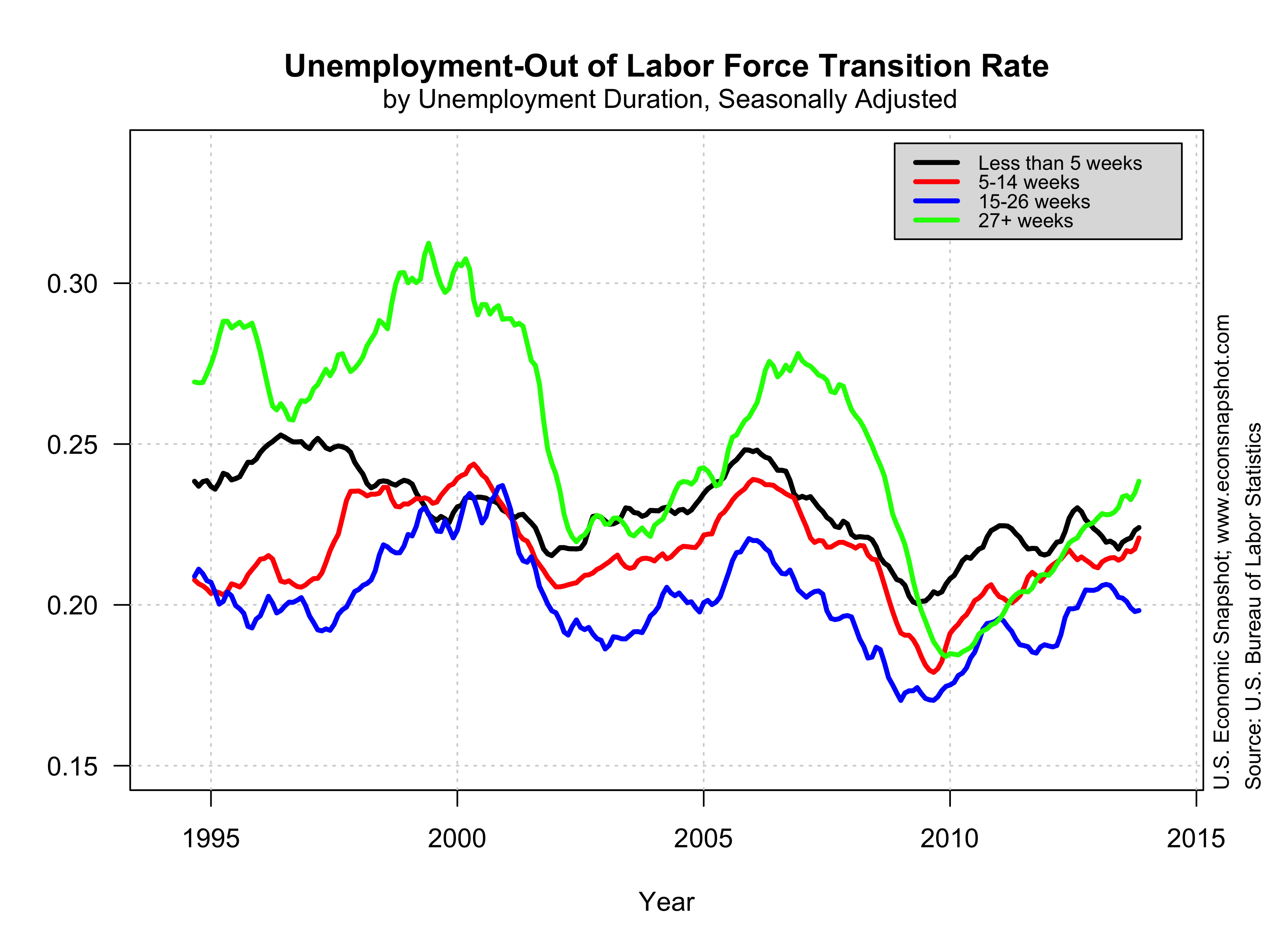

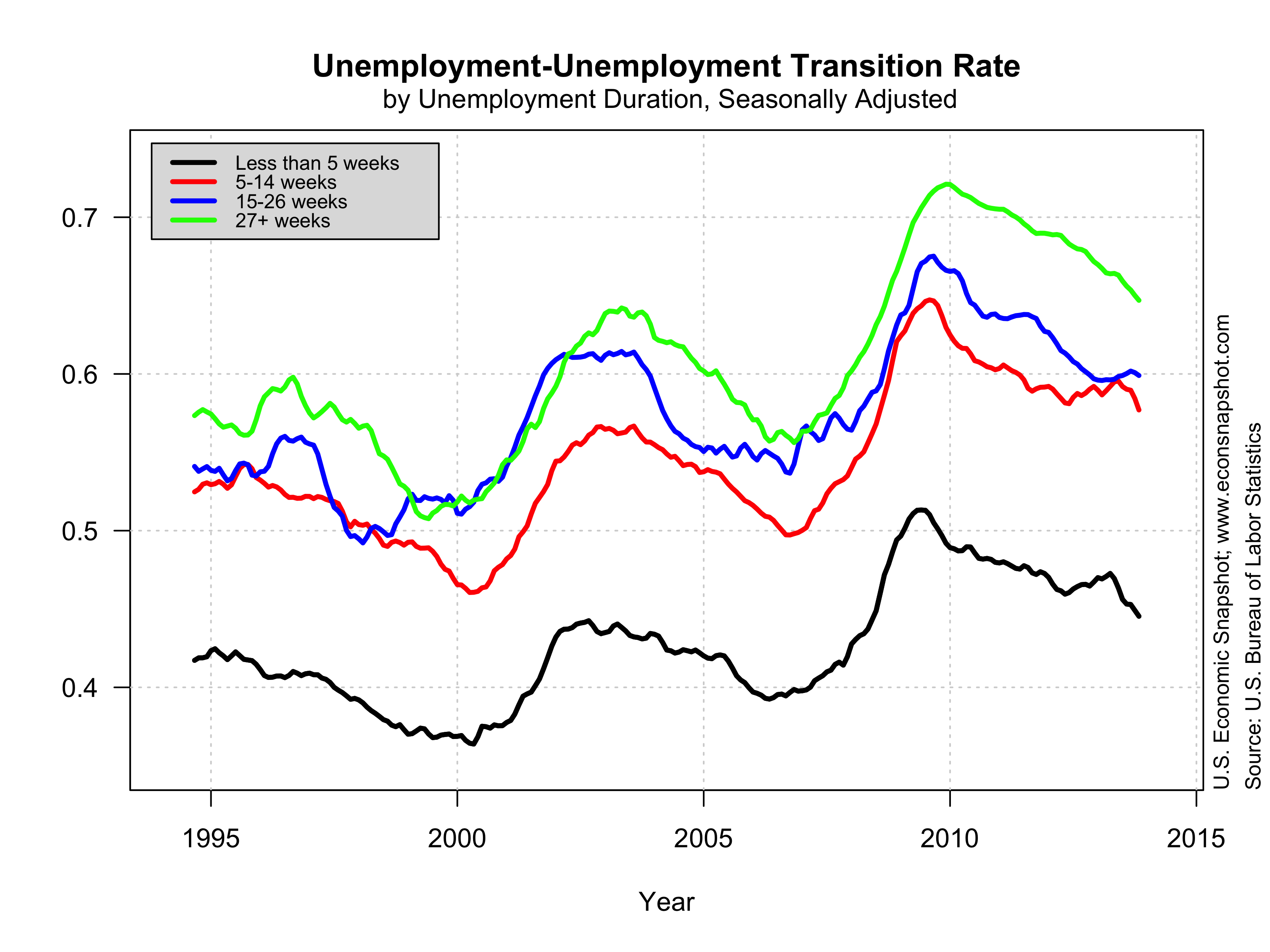

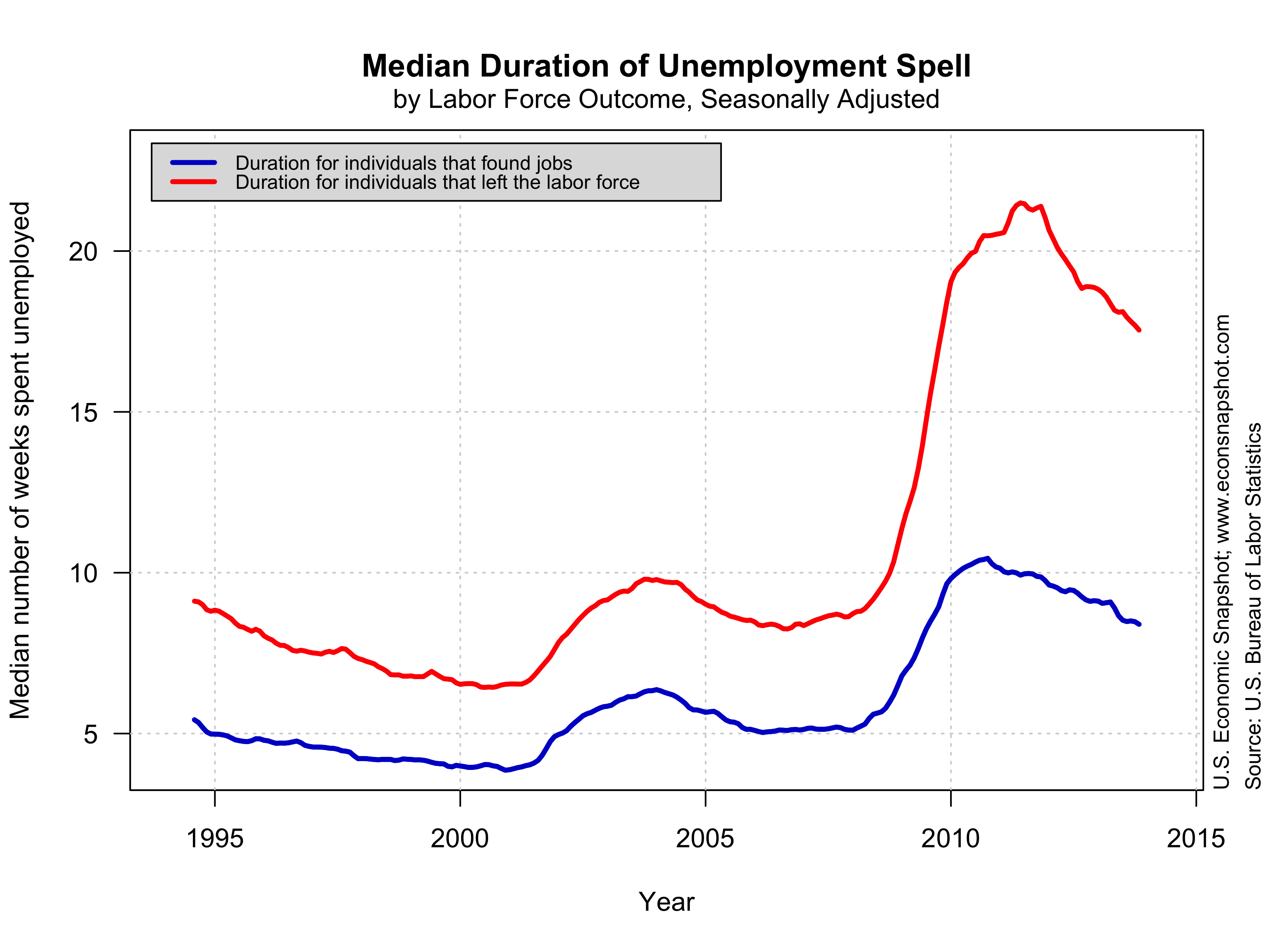

The charts below show that the number unemployed rose by 99 thousand due to an increased number of people out of the labor force moving into unemployment, by 75 thousand owing to a decrease in those transiting between unemployment and out of the labor force, by 175 thousand by virtue of more employed people becoming unemployed, and by 281 thousand as a result of fewer unemployed shifting into employment.

Job Openings and Labor Turnover Survey

The JOLTS data came out 8/29 and showed the number of job openings declined to 8.8 million in July from 9.2 million and 11.4 million in July of 2022. Having said that, the difference between the number of people unemployed and the available jobs are still much higher than any time pre-pandemic. The quit rate has come down somewhat, but, like the openings rate, still higher than its pre-pandemic level. One interpretation of the quit rate is that quitting and moving to better jobs helps one climb the job and income ladder. Said differently, quit rates fall during recessions as there are fewer opportunities to move. Layoffs remain very subdued as well. The rate of job hiring as fallen considerably over the past year or so and now back to the average rate since 2014 (excluding the pandemic).

Output, Income and Consumption

The second estimate for Q2 real GDP was released by the BEA on August 30, and showed a downward revision from 2.4% to 2.1%. Consumption was revised up from 1.6% to 1.7%.

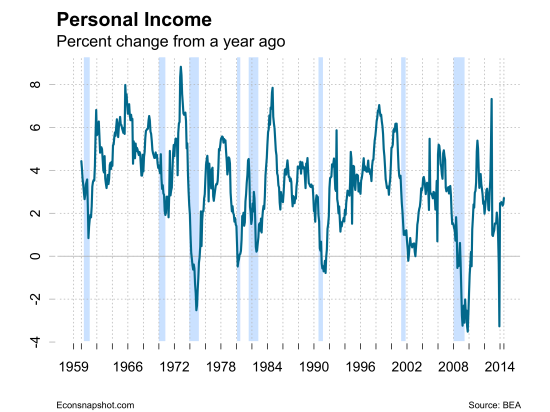

While the downward revision in Q2 real GDP was not small, the monthly consumption data released on 8/30 by the BEA showed a large increase in consumption for July. Consumption expenditures increased 0.8% in current dollars (9.9% annualized) and 0.6% in chained 2012 dollars, the largest increase since January. The personal savings rate as a fraction of disposable income declined by nearly a full percentage point, from 4.3% to 3.5%

Takeaways

The data describe a growing economy with little, if any, signs of braking. Looking at the headline numbers and article titles, such as this in the 9/1 WSJ: “Job Gains Eased in Summer Months; Unemployment Increased in August,” might suggest a faltering labor market. However, a deeper dive into the underlying data suggests no such thing.