by: Zach Bethune, Thomas Cooley, Peter Rupert

The Bureau of Labor Statistics release of the January jobs report shows continued strength in the labor market, with total nonfarm employment rising 257,000. Moreover, the current increase, along with revisions over the past two months show employment growth averaging 336,000 over the past three months. The revision to November, up to 423,000, was the largest monthly increase since May of 2010.

In addition to the usual monthly revisions, the BLS also undertook annual re-benchmarking:

With the release of January 2015 data on February 6, 2015, the Bureau of Labor Statistics (BLS) introduced its annual revision of national estimates of employment, hours, and earnings from the Current Employment Statistics (CES) monthly survey of nonfarm establishments. Each year, the CES survey realigns its sample-based estimates to incorporate universe counts of employment—a process known as benchmarking. Comprehensive counts of employment, or benchmarks, are derived primarily from unemployment insurance (UI) tax reports that nearly all employers are required to file with State Workforce Agencies.

For those data geeks wanting to know more about benchmark revisions, here is the full article from the BLS. Summarizing that article, “The March 2014 benchmark level for total nonfarm employment is 137,214,000; this figure is 67,000 above the sample-based estimate for March 2014, an adjustment of less than 0.05 percent.” The BLS then uses the re-benchmarked data to revise the rest of the year, “From April 2014 to December 2014, the net birth/death model cumulatively added 968,000, compared with 841,000 in the previously published April to December employment estimates.”

Employment gains were robust, the only major sector to shed jobs was the Government sector, losing 10,000, meaning that Private sector jobs increased by 267,000.

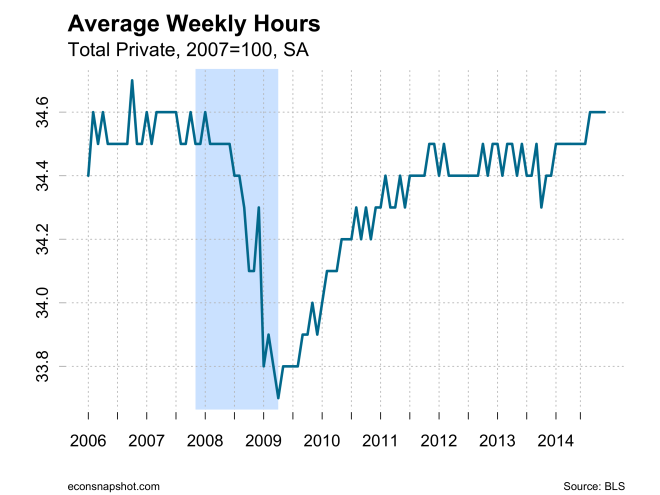

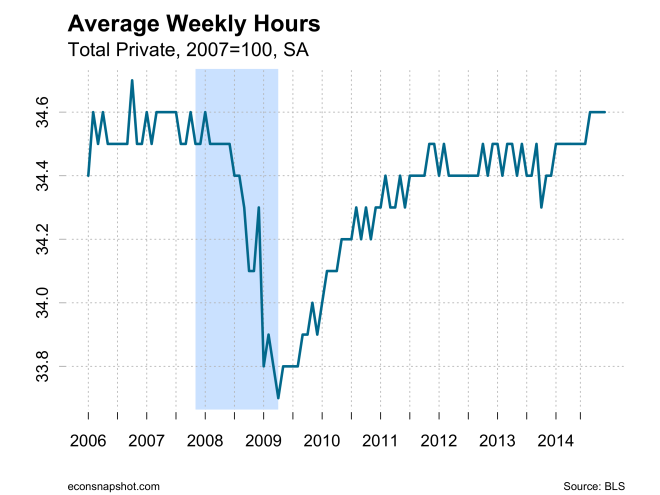

Average weekly hours, however, have shown no change over the past 3 months, stuck at 34.6.

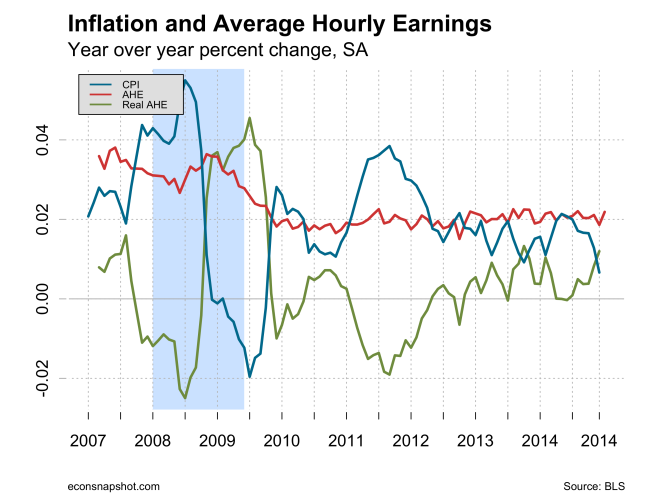

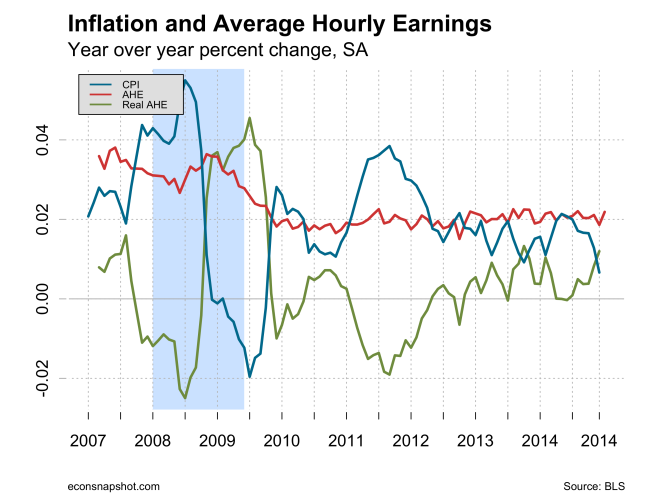

Average hourly earnings ticked up slightly to $24.75, and growth has averaged about 2% per year since 2010, but with CPI inflation running below 2% of late means real hourly earnings are growing, albeit modestly.

While the strong report certainly keeps the Fed on a steady *normalization* pace, there are still areas in the labor market that, if not troublesome, remain nagging issues. While the employment to population took a nose dive during the great recession…and is still quite low relative to its all-time (at least since WWII) peak…

…however, if one zooms in, there has been a steady increase over the past year and a half or so…

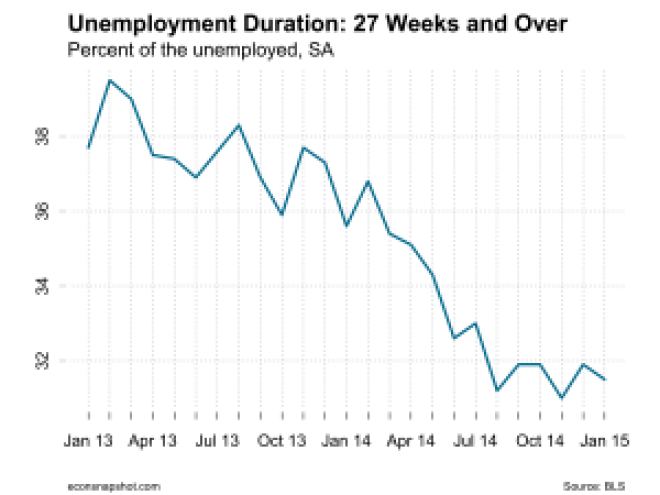

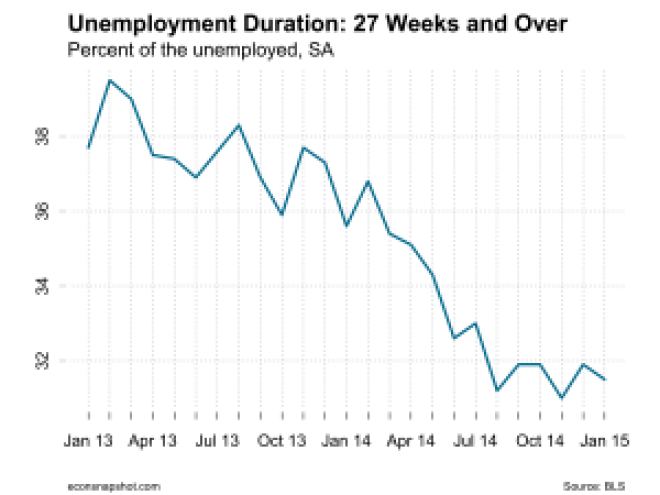

Another somewhat nagging issue is the fate of the long term unemployed. Indeed, the number of those unemployed 27 weeks or longer actually rose in January, from 2.785 million to 2.80 million persons. The percent of the unemployed who are unemployed 27 weeks or longer has been bouncing between 31% and 32% for the last six months or so….

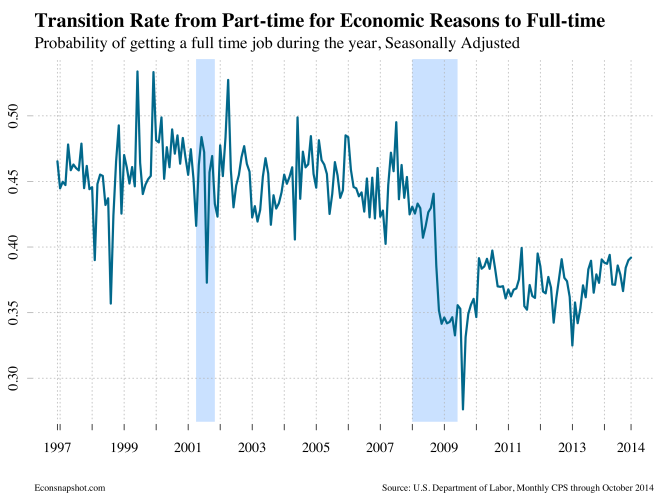

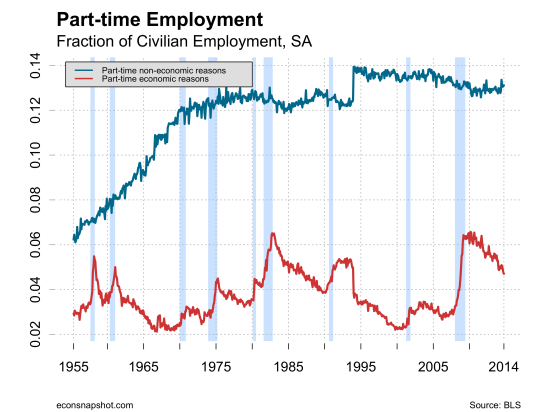

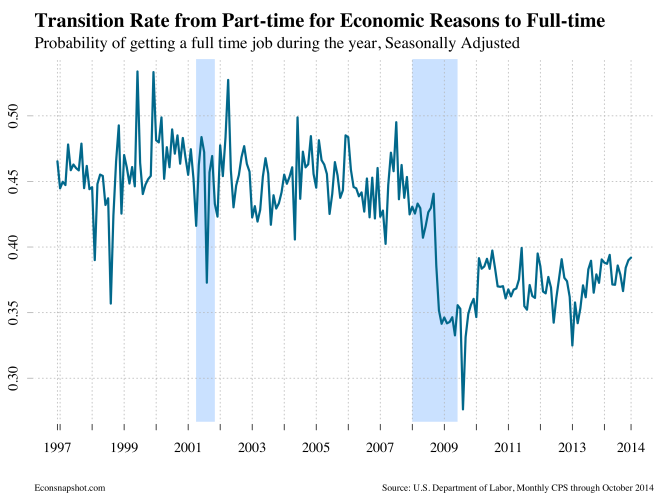

The number of persons employed part time for economic reasons (or involuntary part-time workers) also didn’t improve in January. There remains 6.8 million individuals who would like to be working full time but couldn’t because the were unable to find full time work or had their hours cut back.

The number of persons employed part time for economic reasons (or involuntary part-time workers) also didn’t improve in January. There remains 6.8 million individuals who would like to be working full time but couldn’t because the were unable to find full time work or had their hours cut back.

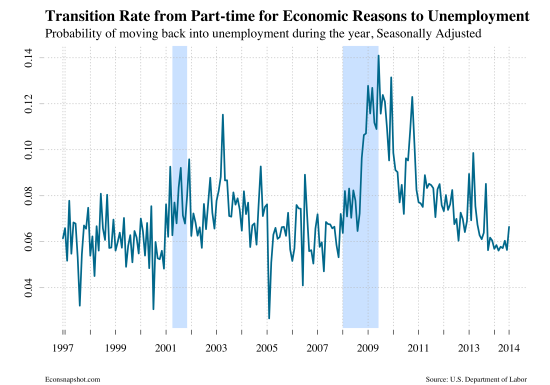

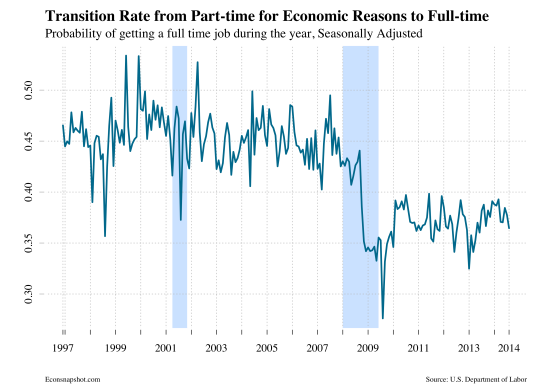

The rate at which these workers are transitioning into full time continues to show no improvement…

…and their wages are declining relative to full time workers.

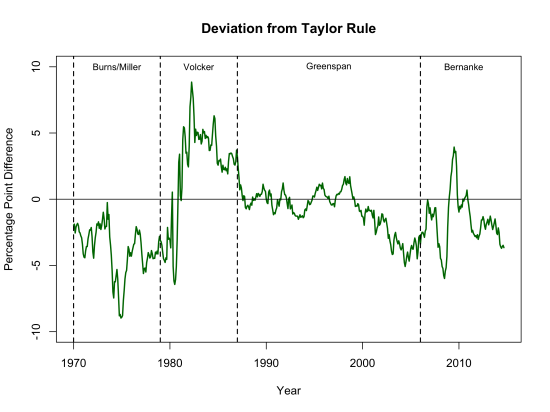

It is no surprise that, despite a low 5.7% unemployment rate since October, there is still concern about the health of the labor market.

It is no surprise that, despite a low 5.7% unemployment rate since October, there is still concern about the health of the labor market.