by Thomas Cooley, Ben Griffy and Peter Rupert

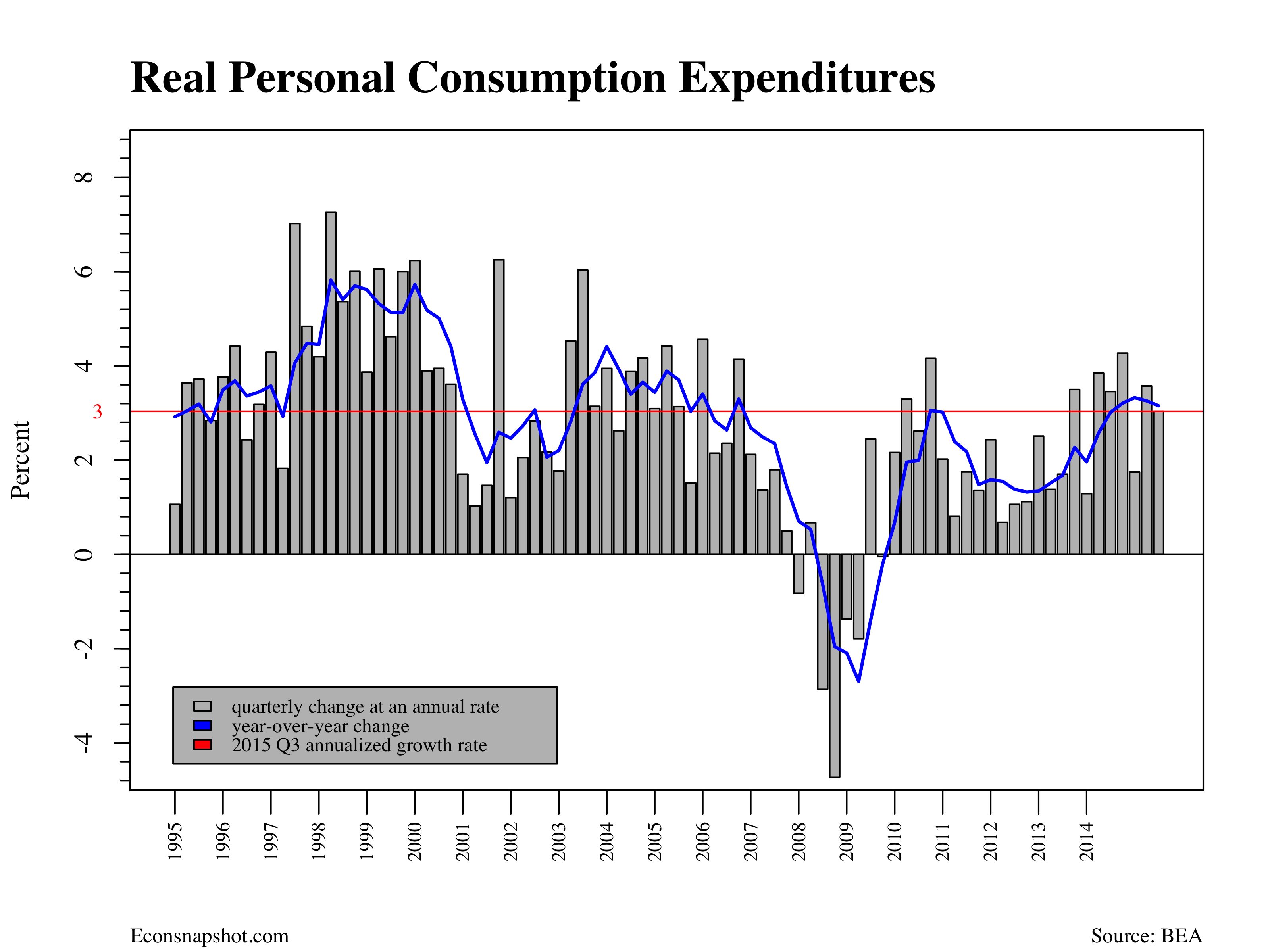

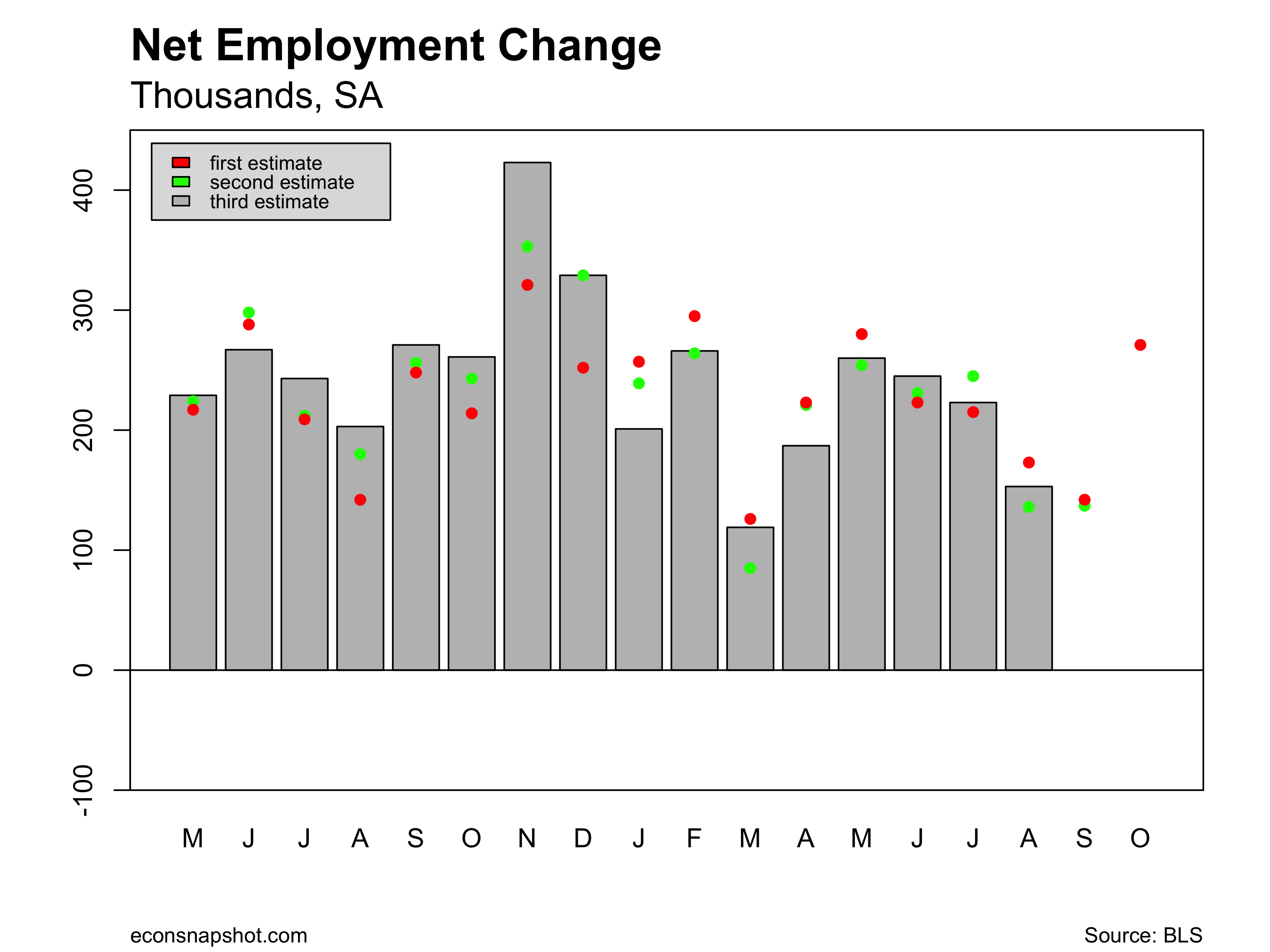

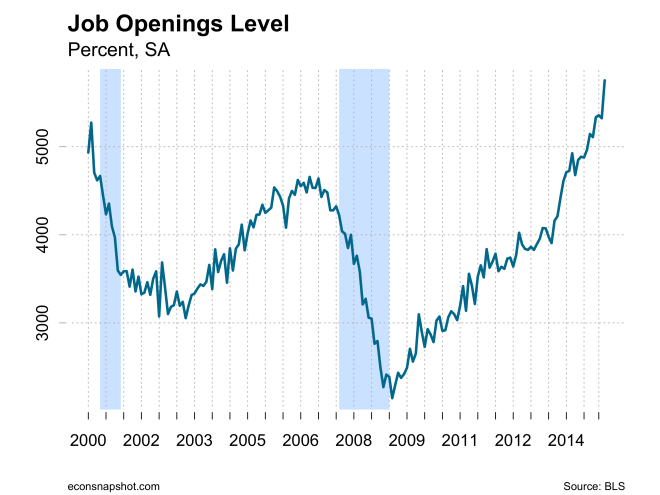

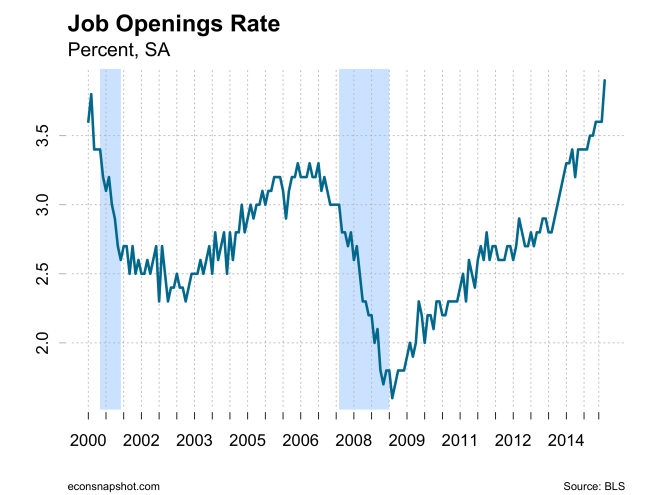

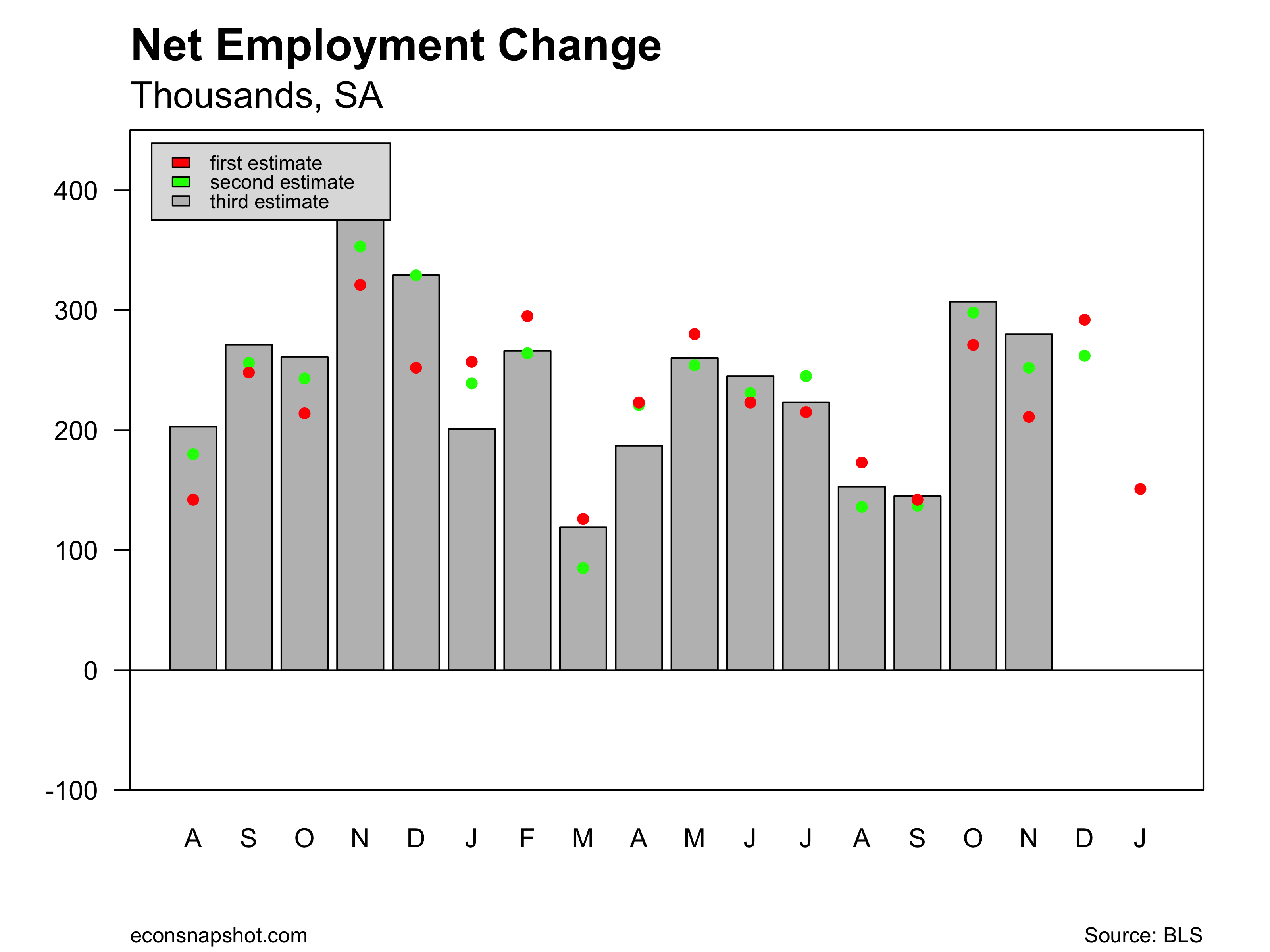

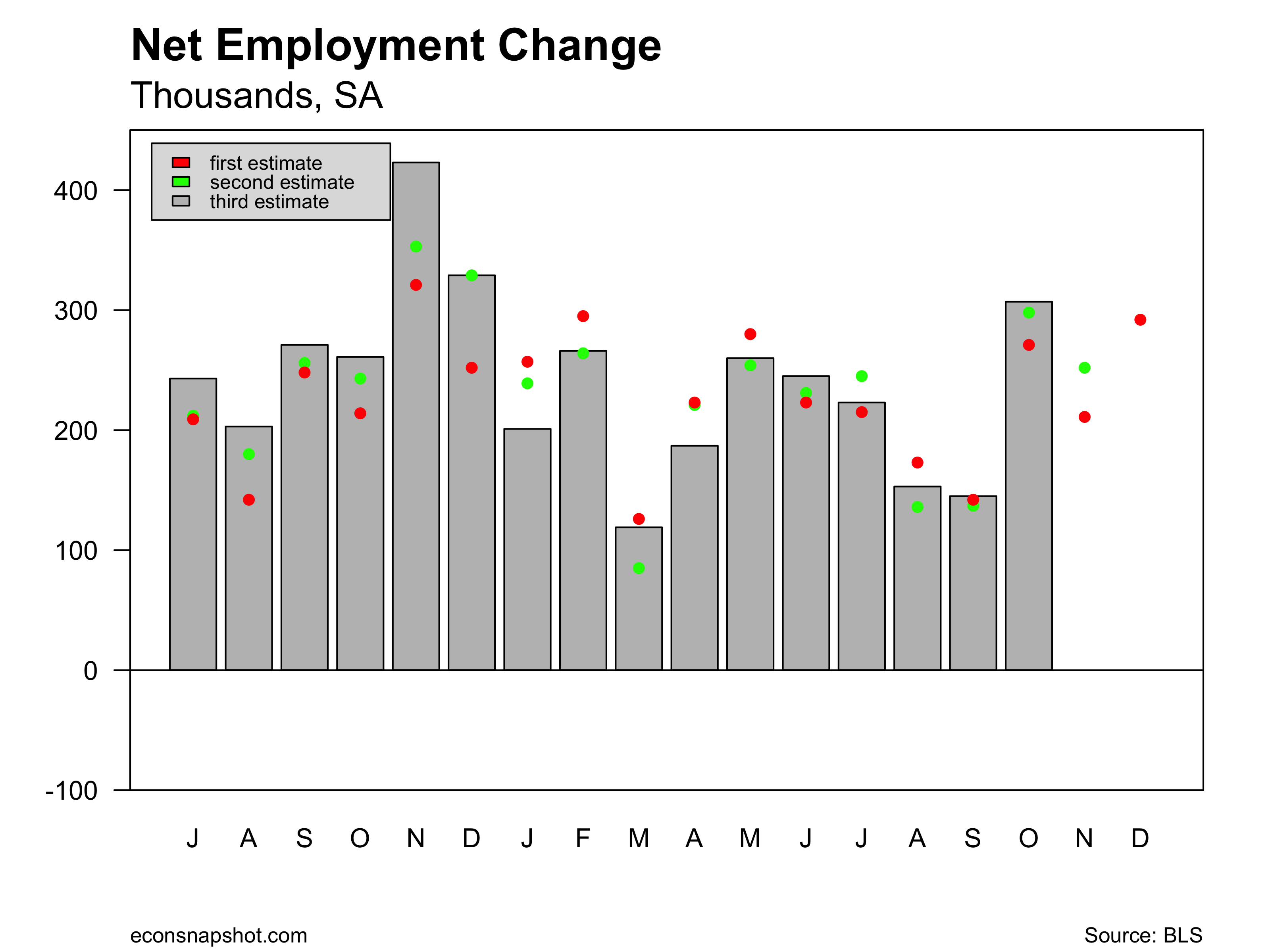

Reading through today’s release of the employment situation from the BLS one is struck by how many times the phrase “little changed” shows up. Employment gains from the establishment survey were weak, up 151,000. Revisions over the past two months were almost off-setting, up 28,000 for November and down 30,000 for December, so, little change there.

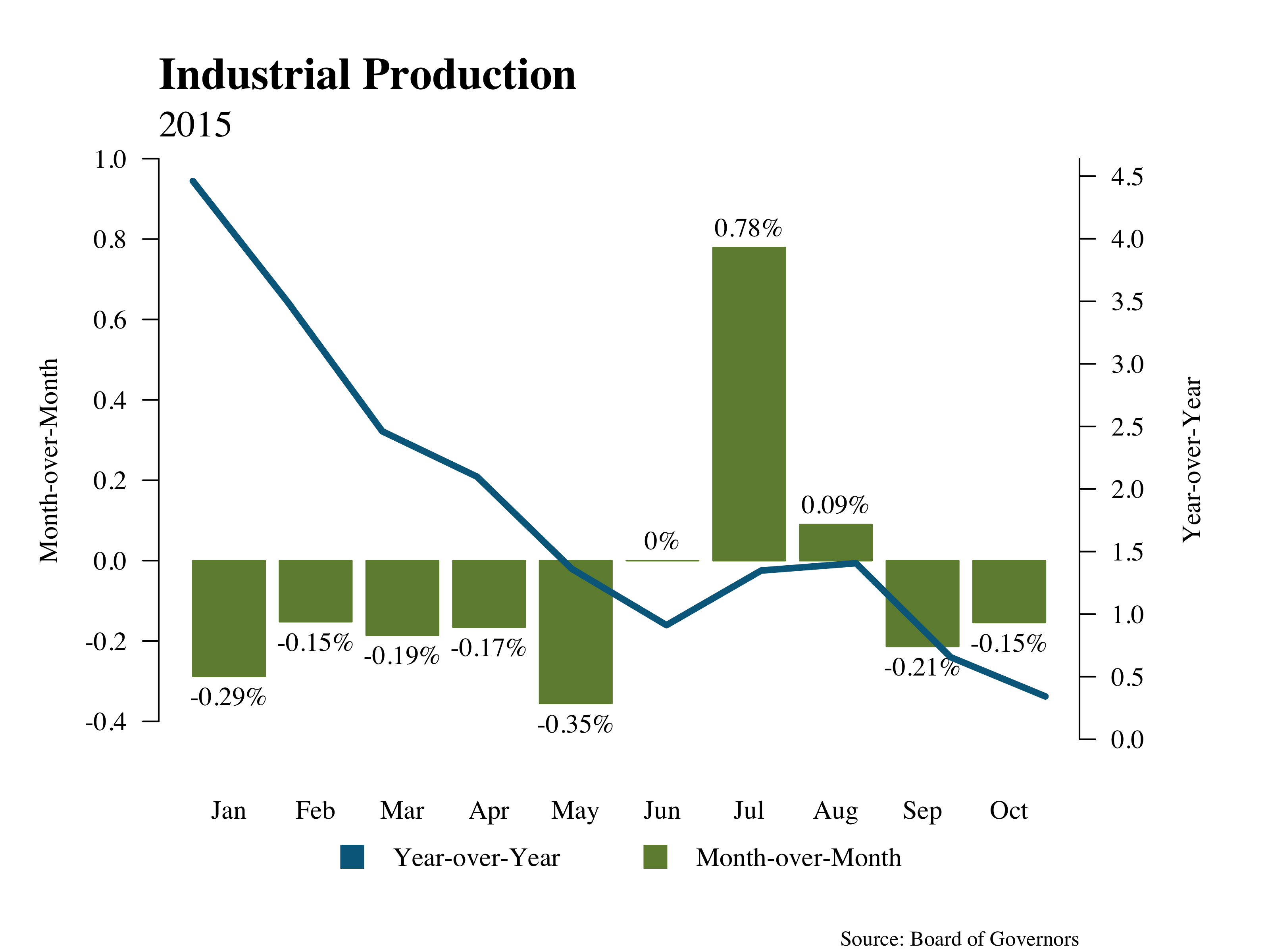

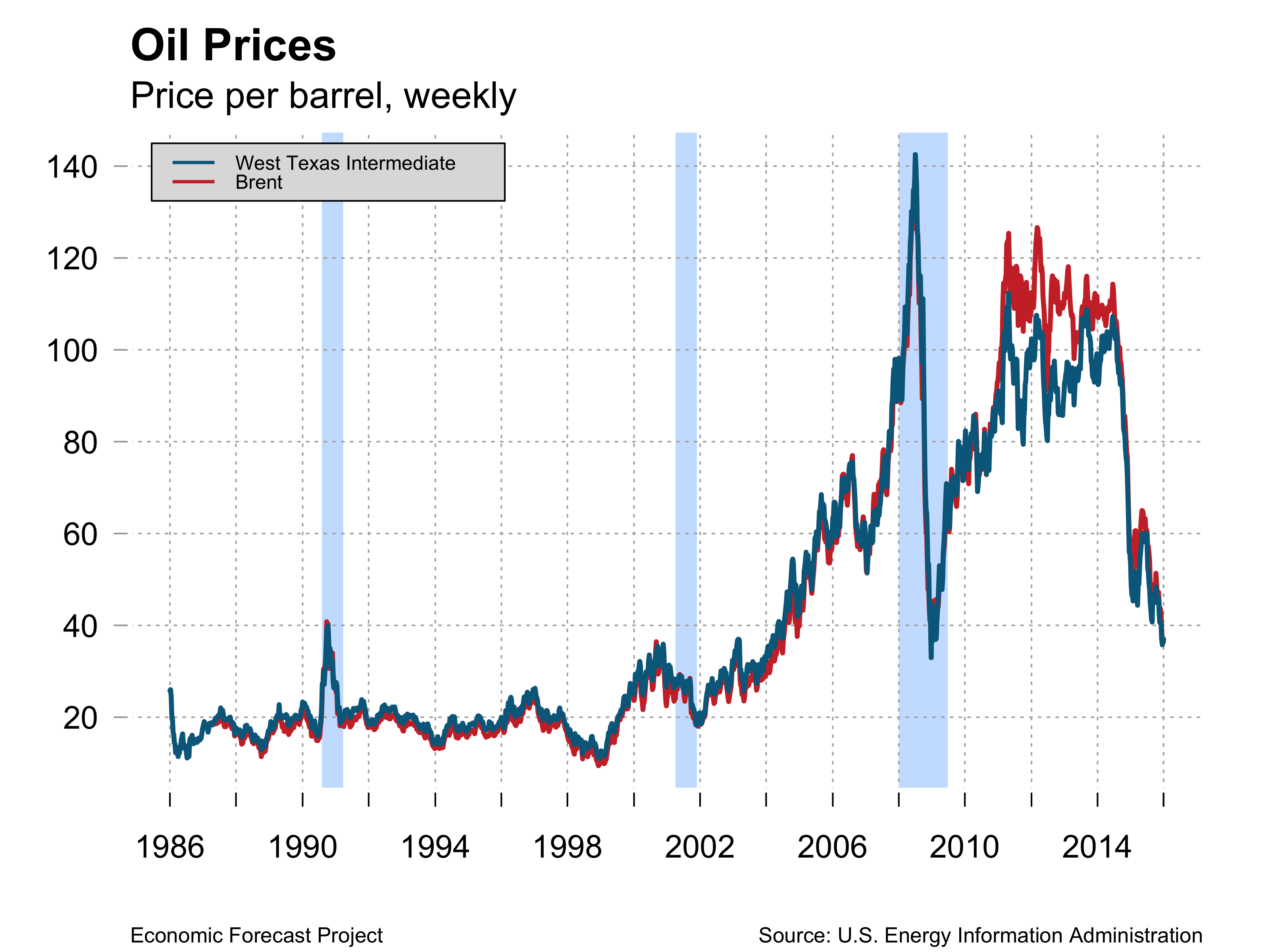

Employment in mining and logging continues to decline, down 7,000 and down 29,000 over that past three months.

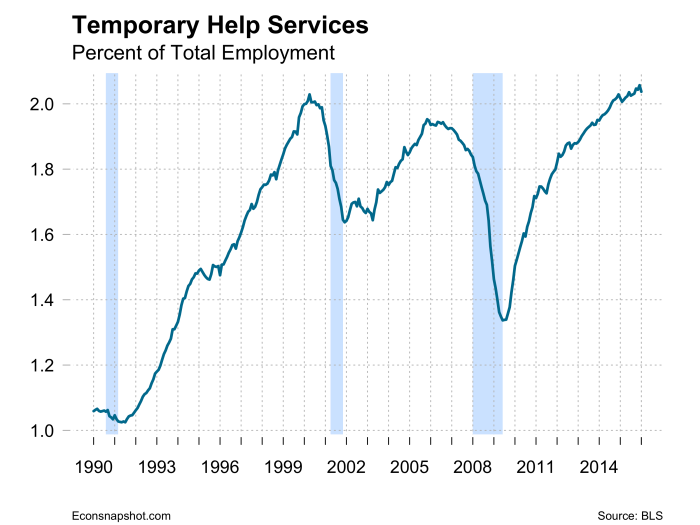

Manufacturing was up 29,000 and services up 118,000. However, temporary services declined 25,200. Health care and social assistance as well as leisure and hospitality rose by 44,000.

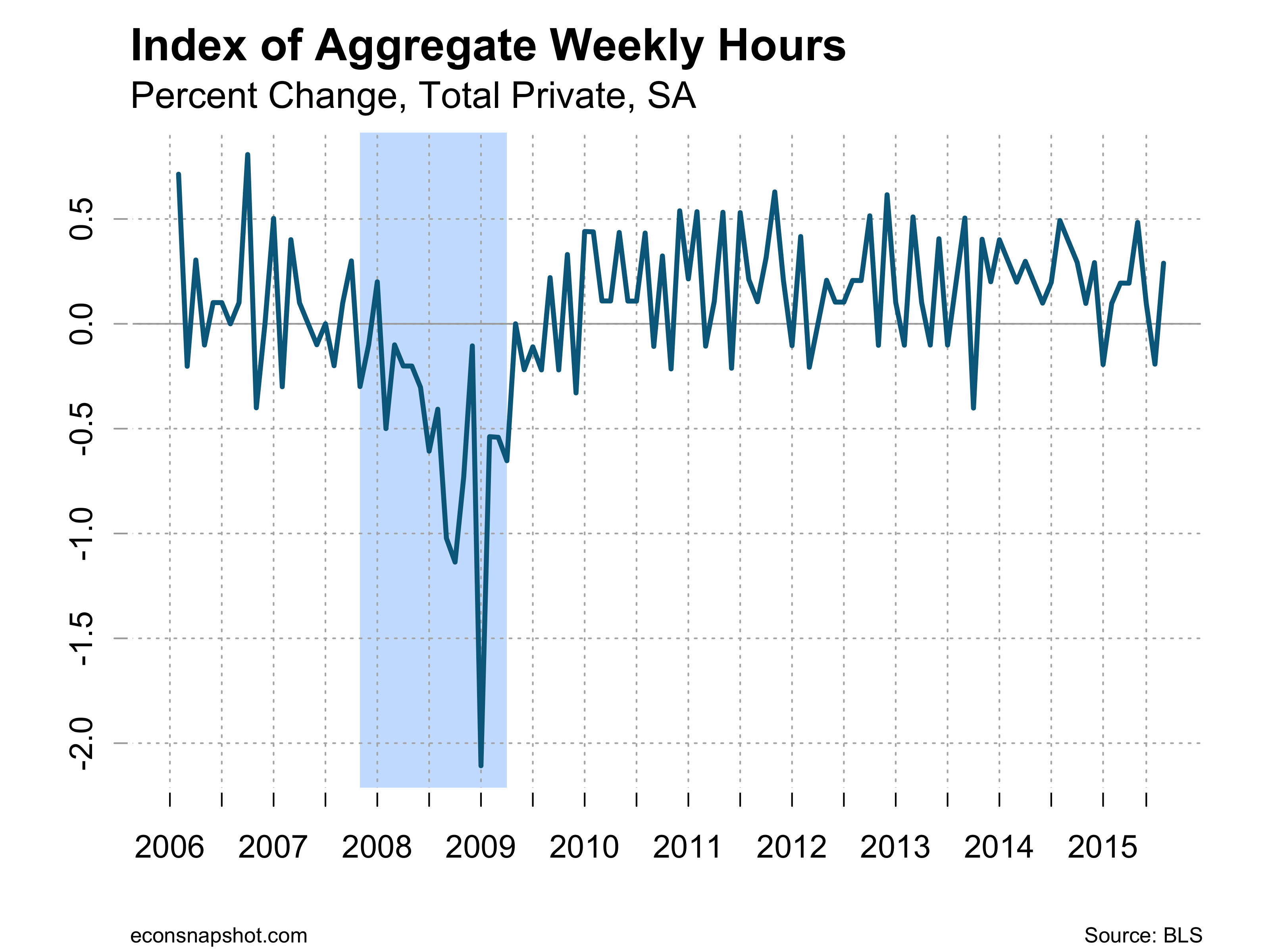

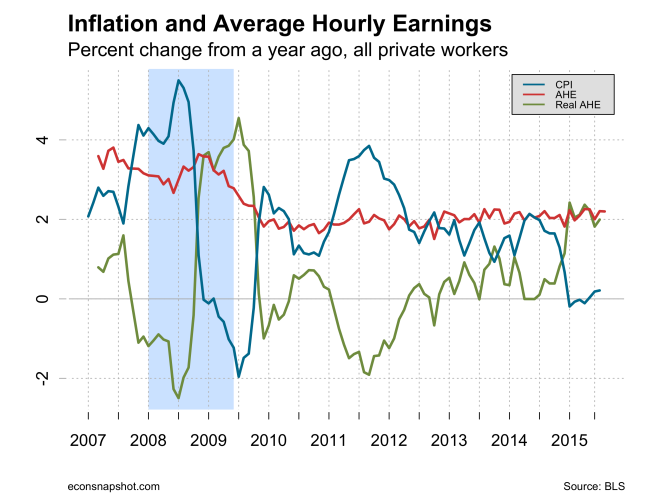

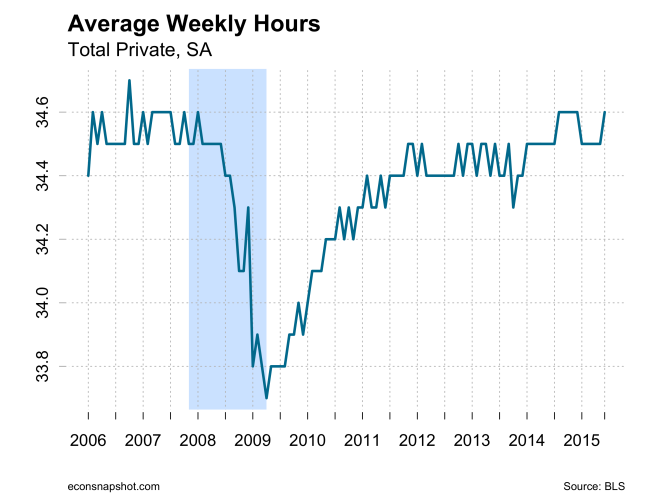

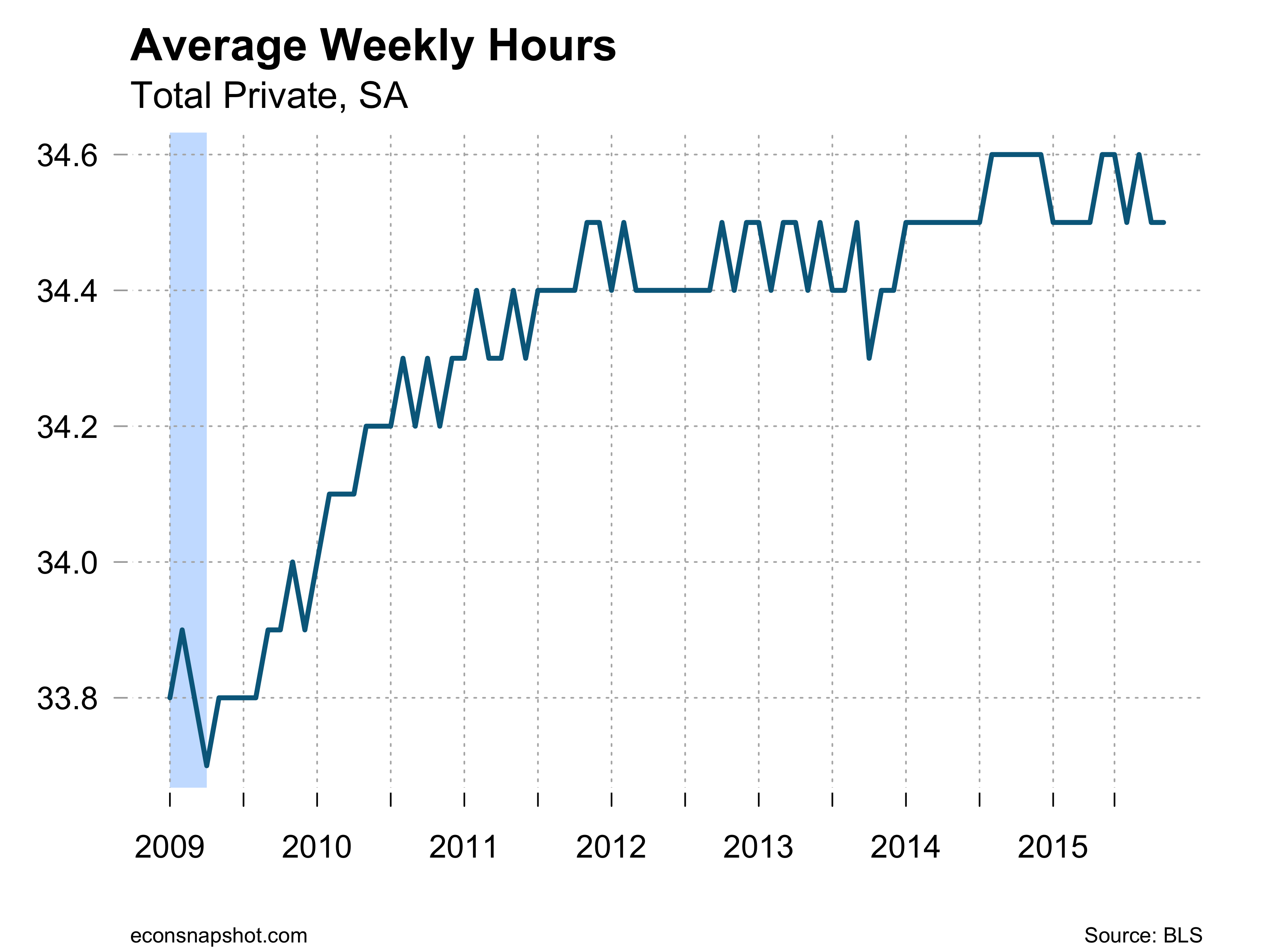

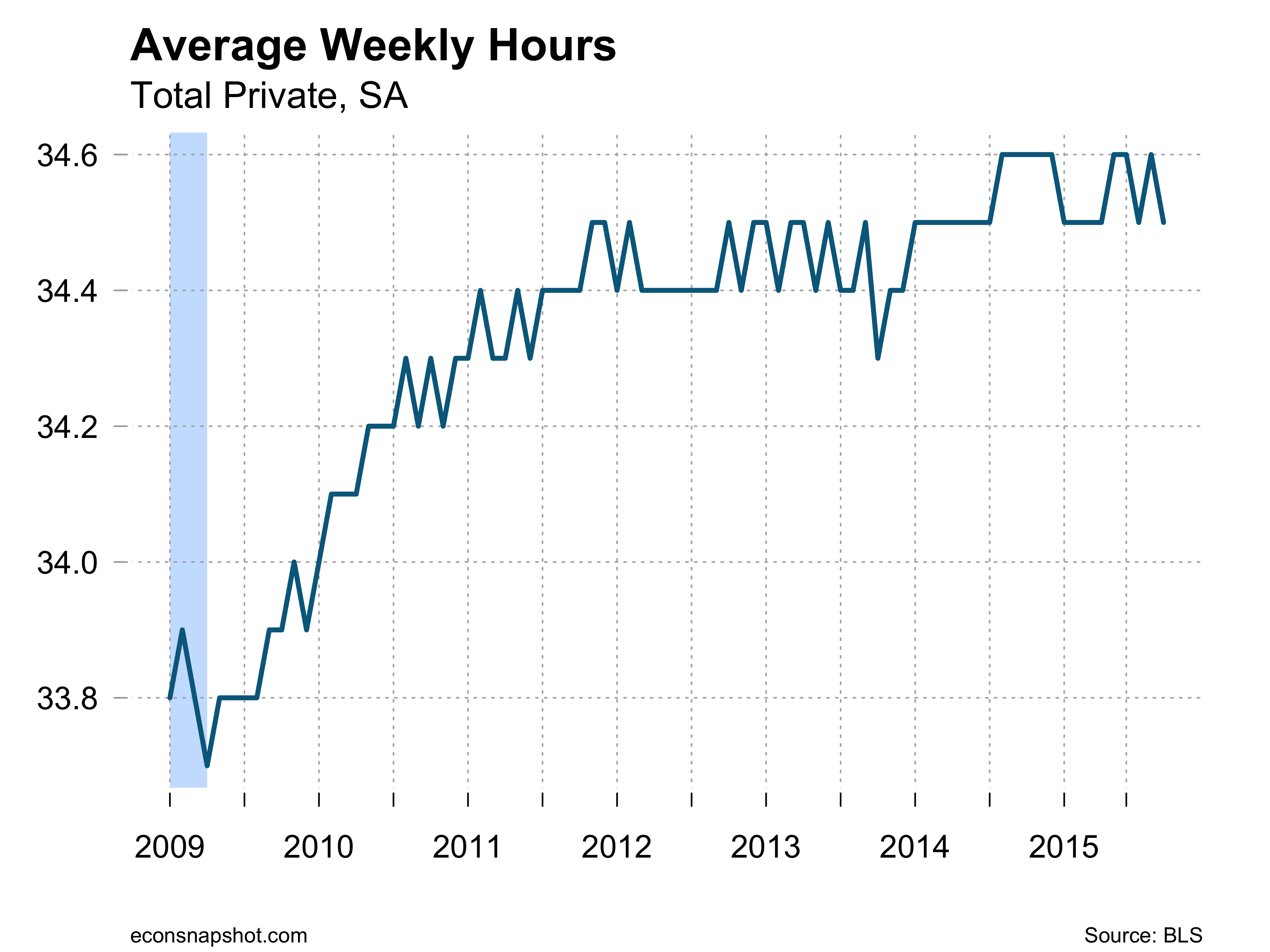

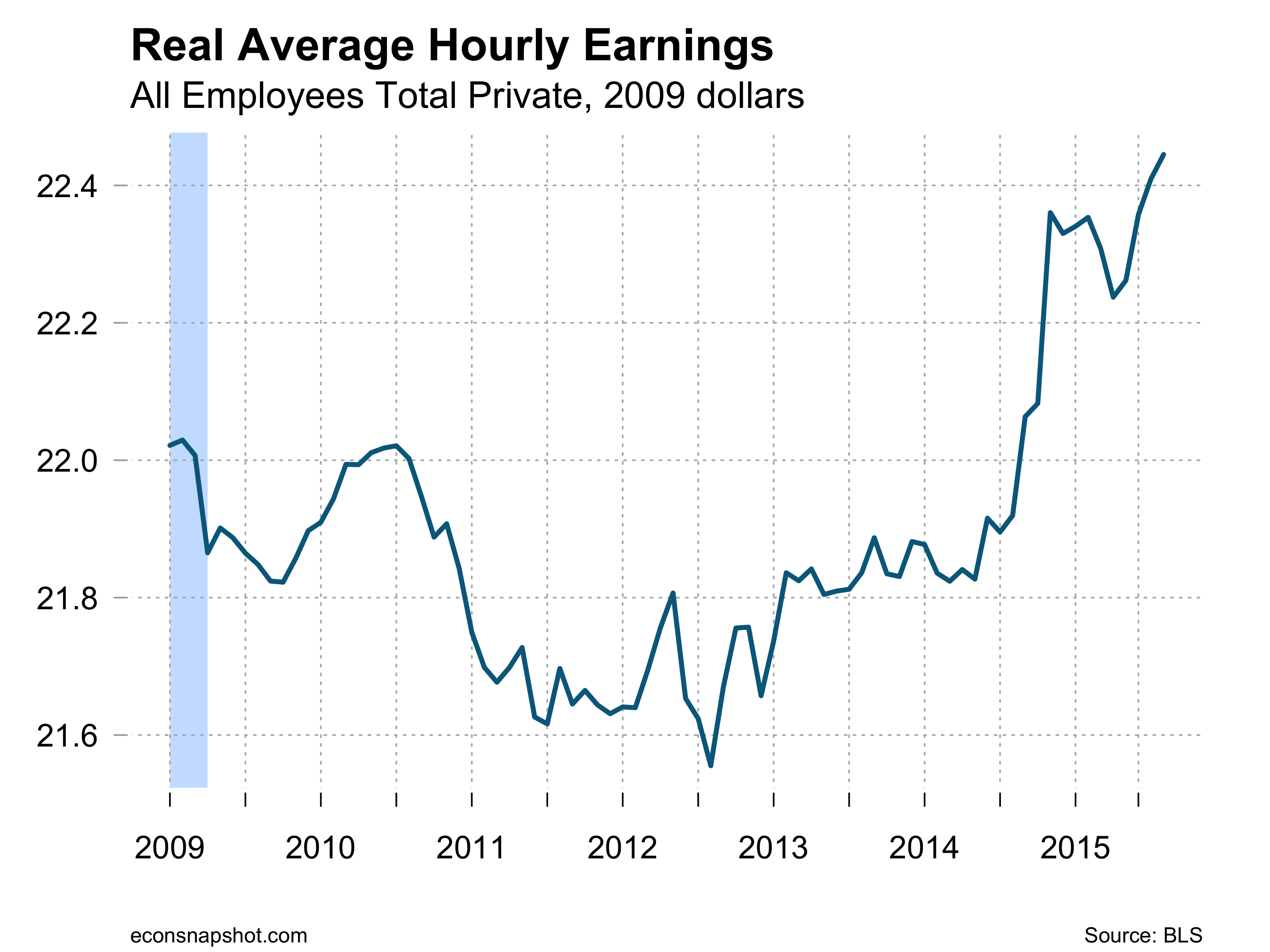

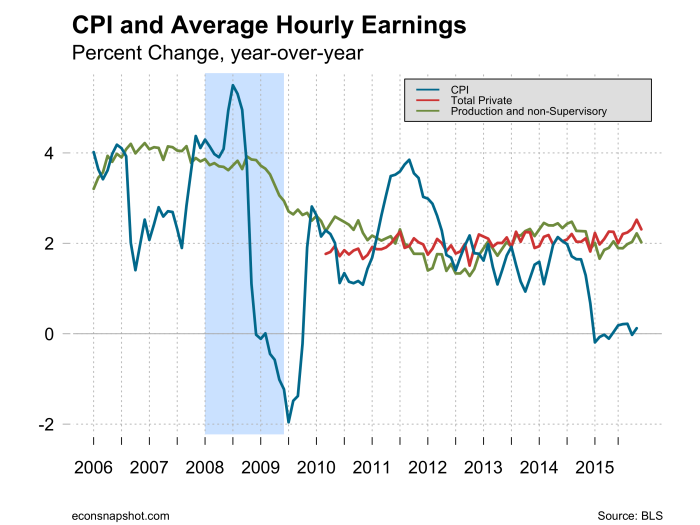

Average weekly hours were up to 34.6 but have bounced between 34.5 and 34.6 since March of 2014. Average hourly earnings rose from $25.27 to $25.39, up 2.5% over the year.

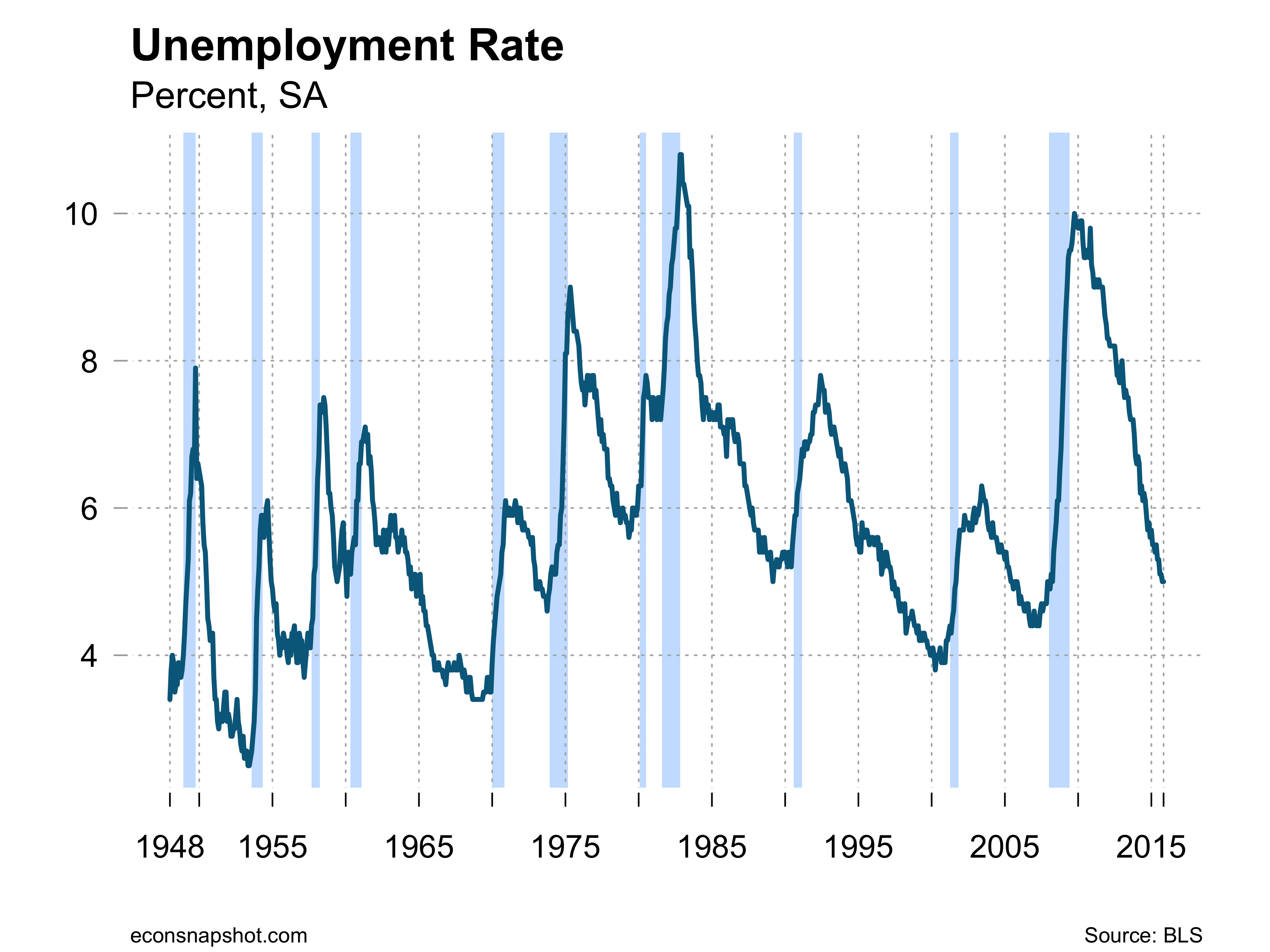

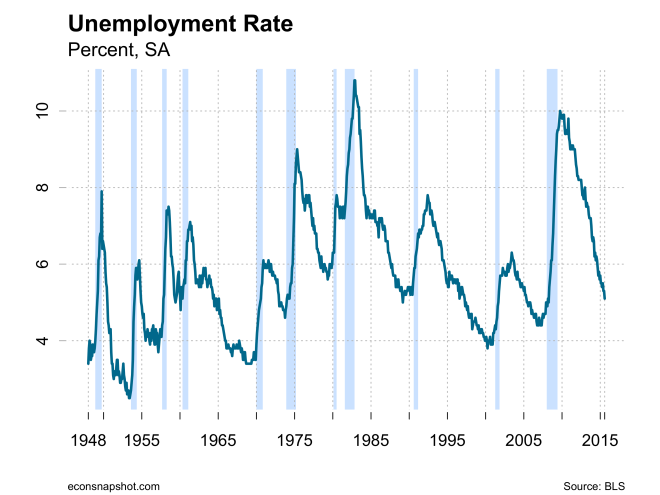

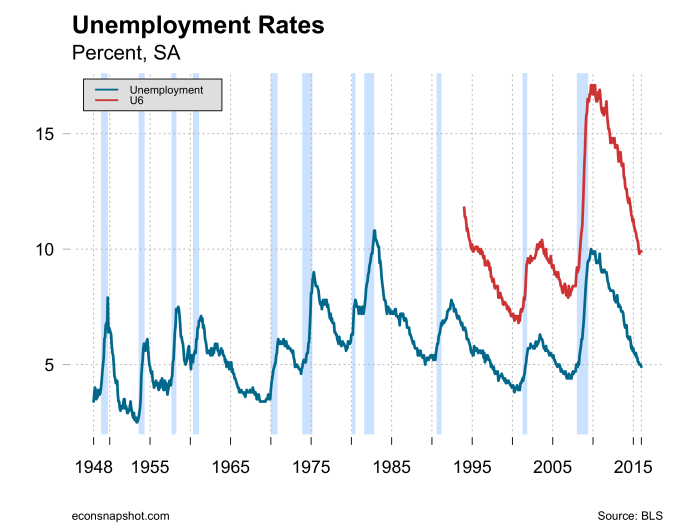

The household survey also showed very little change in most headline numbers. The unemployment rate remained at 4.9% and the unemployment rate including marginally attached workers remained at 9.9%. Here are the numbers for the unemployment rate since September, with a lot of digits:

2015-09-01 0.05052050

2015-10-01 0.05028136

2015-11-01 0.05035331

2015-12-01 0.05007825

2016-01-01 0.04920580

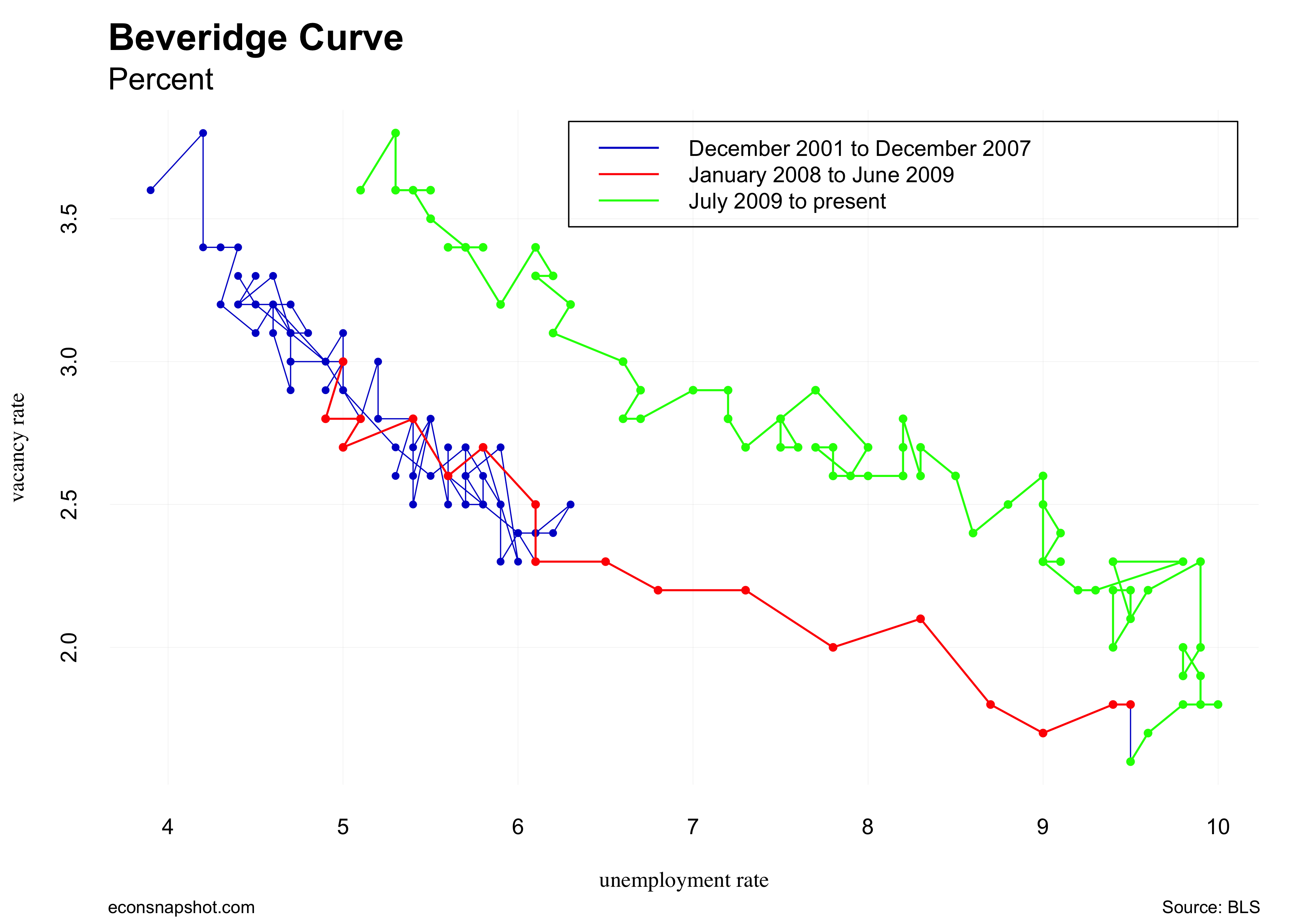

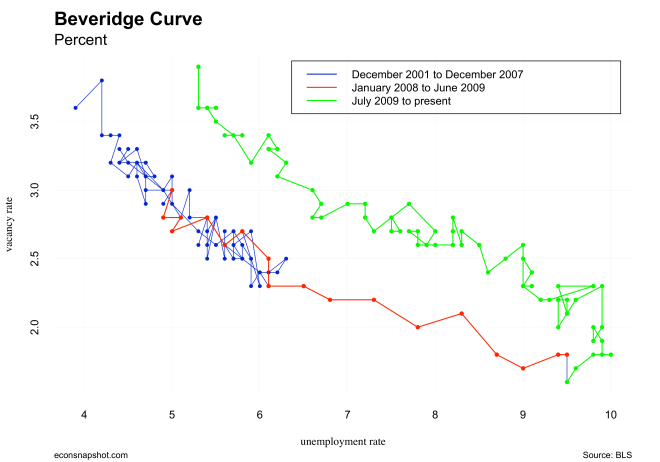

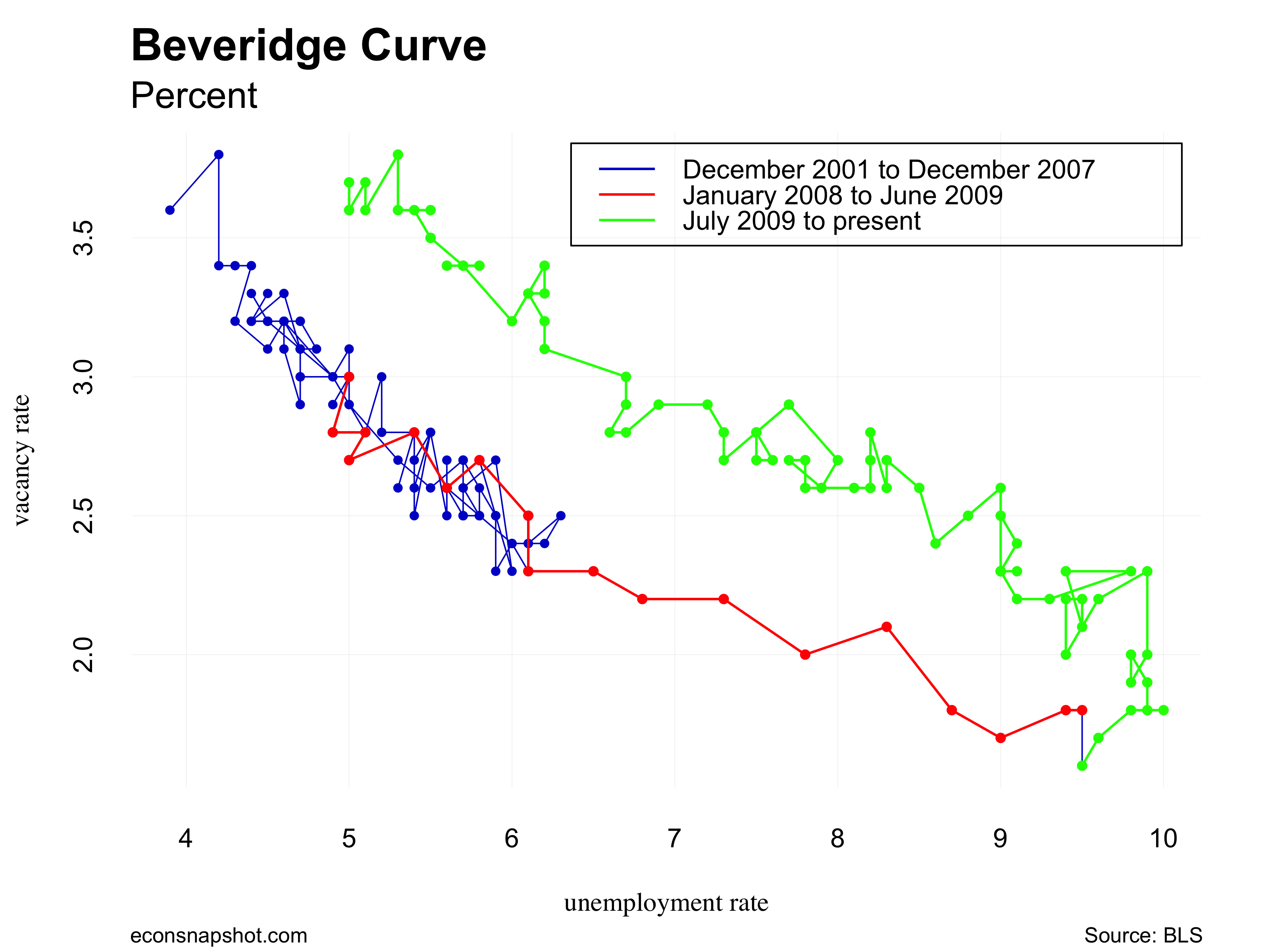

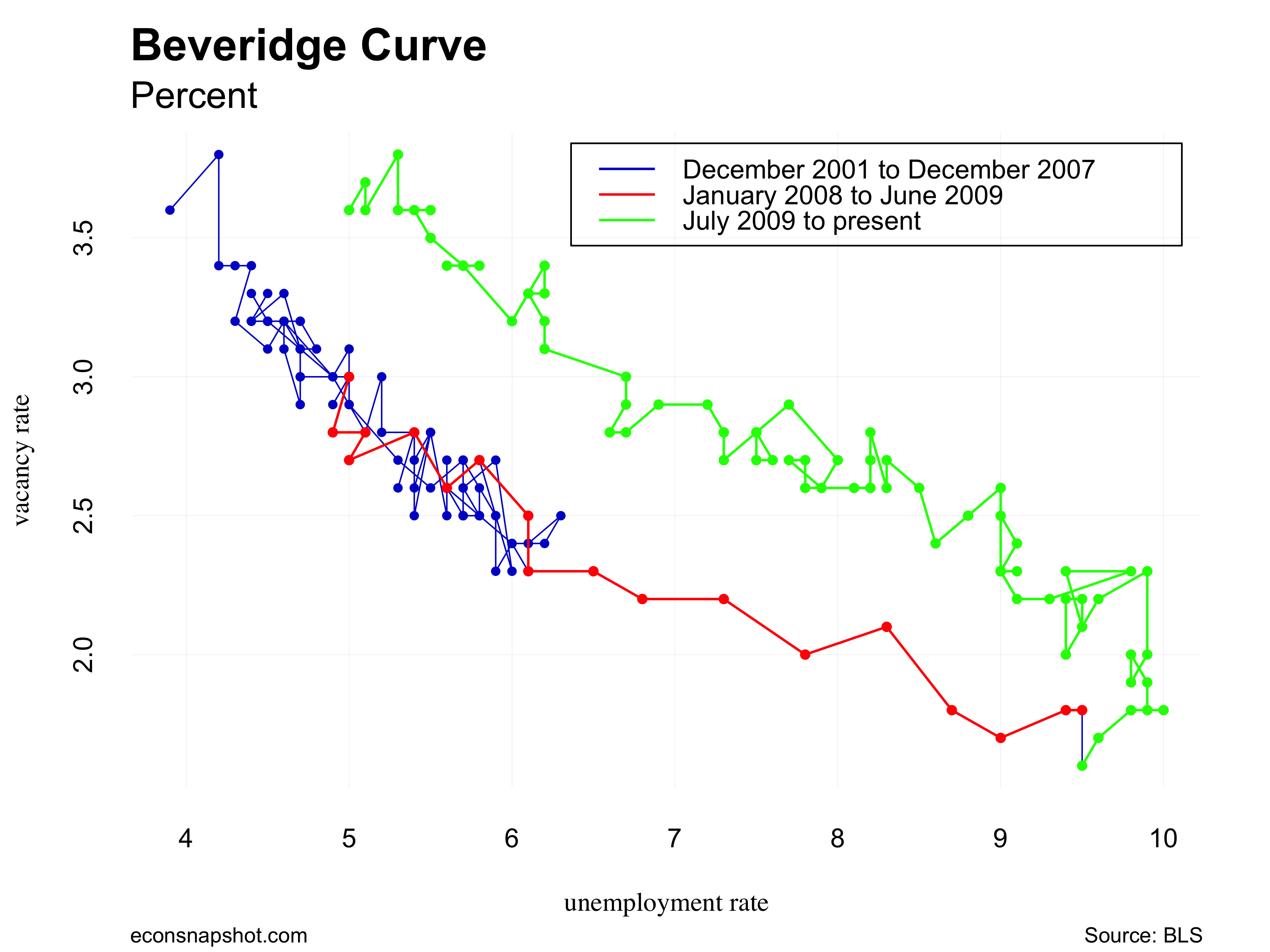

Given the amount of vacancies out there, however, the unemployment rate remains somewhat high, as can be seen in the Beveridge Curve.

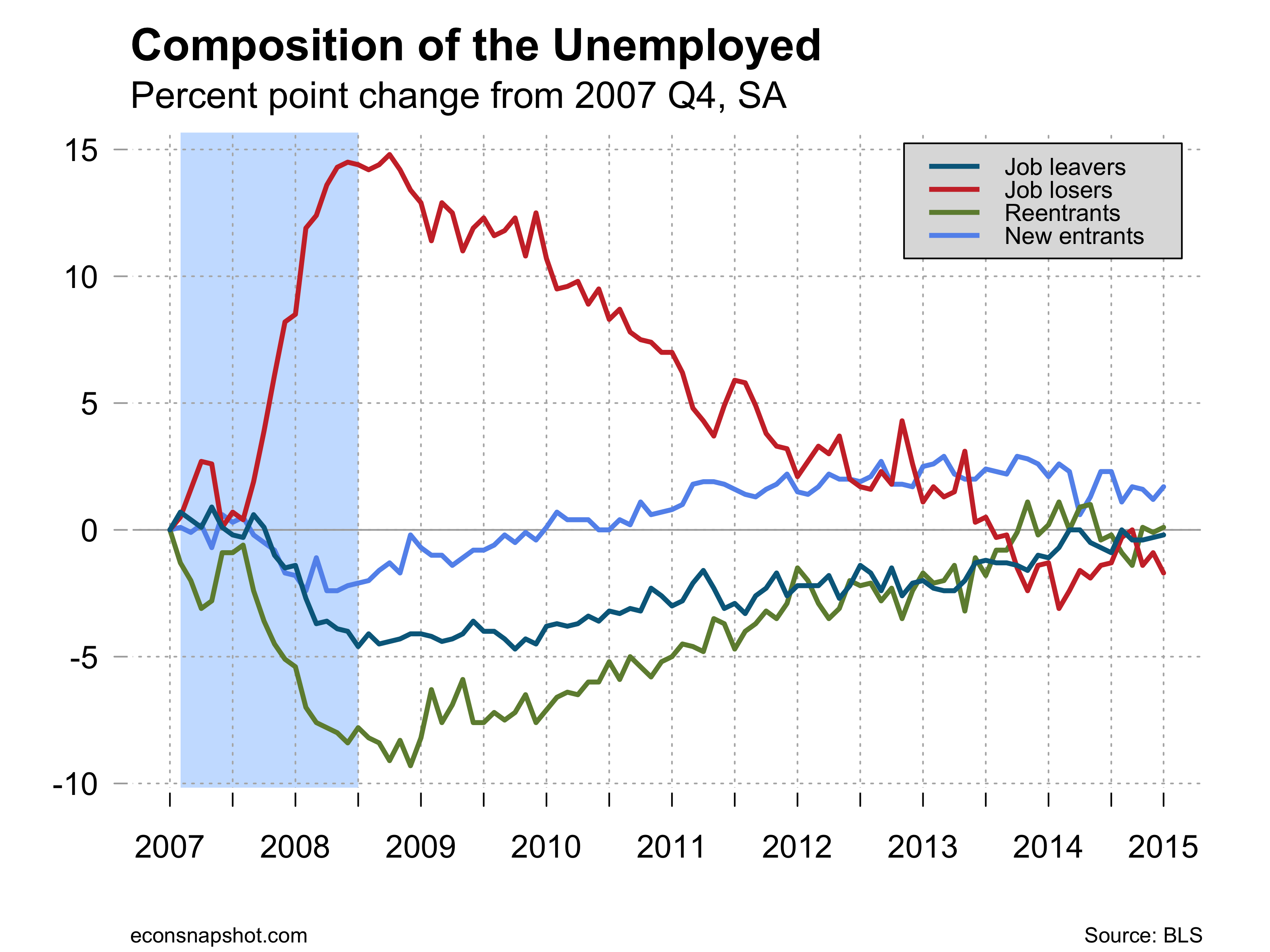

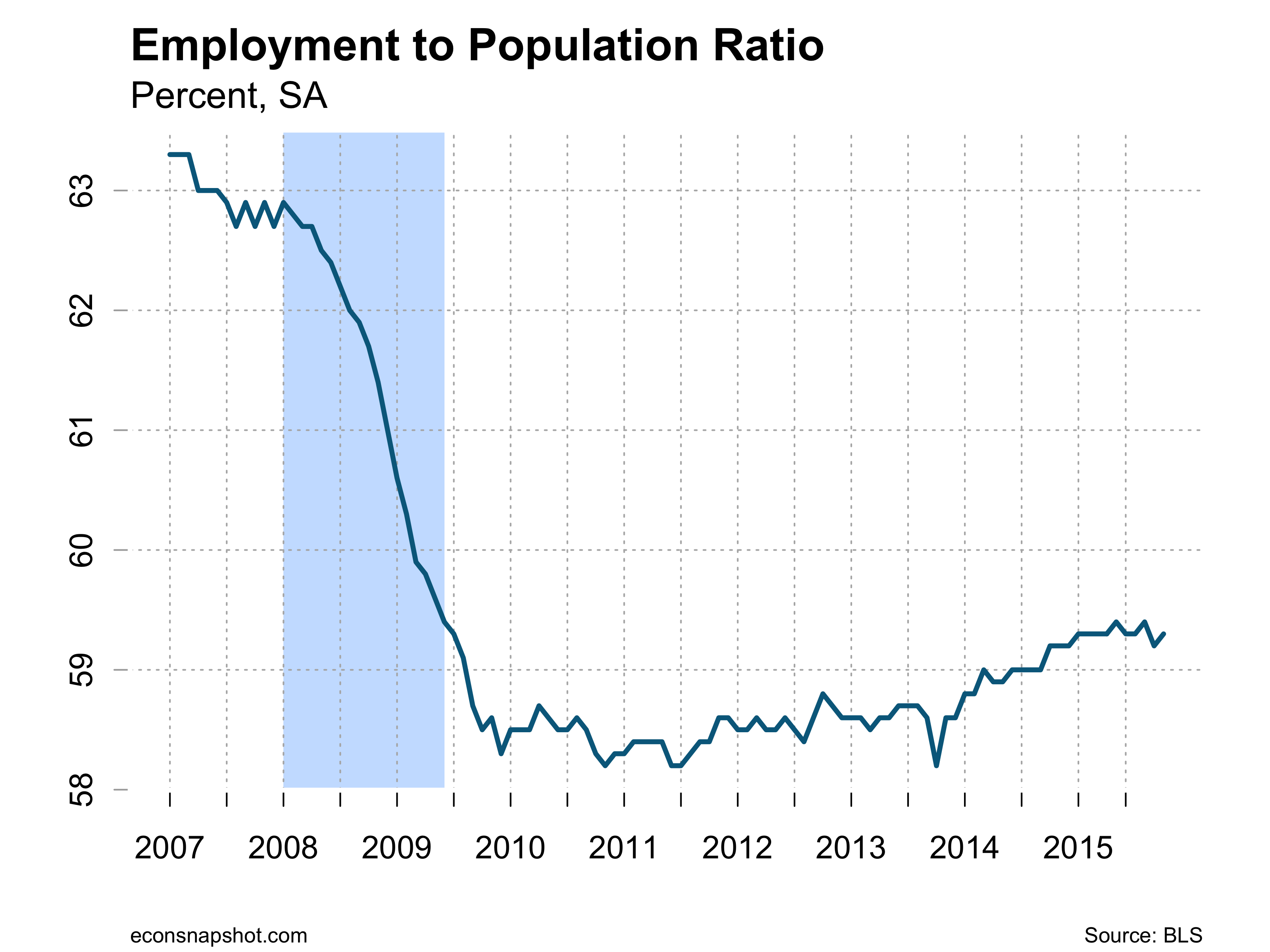

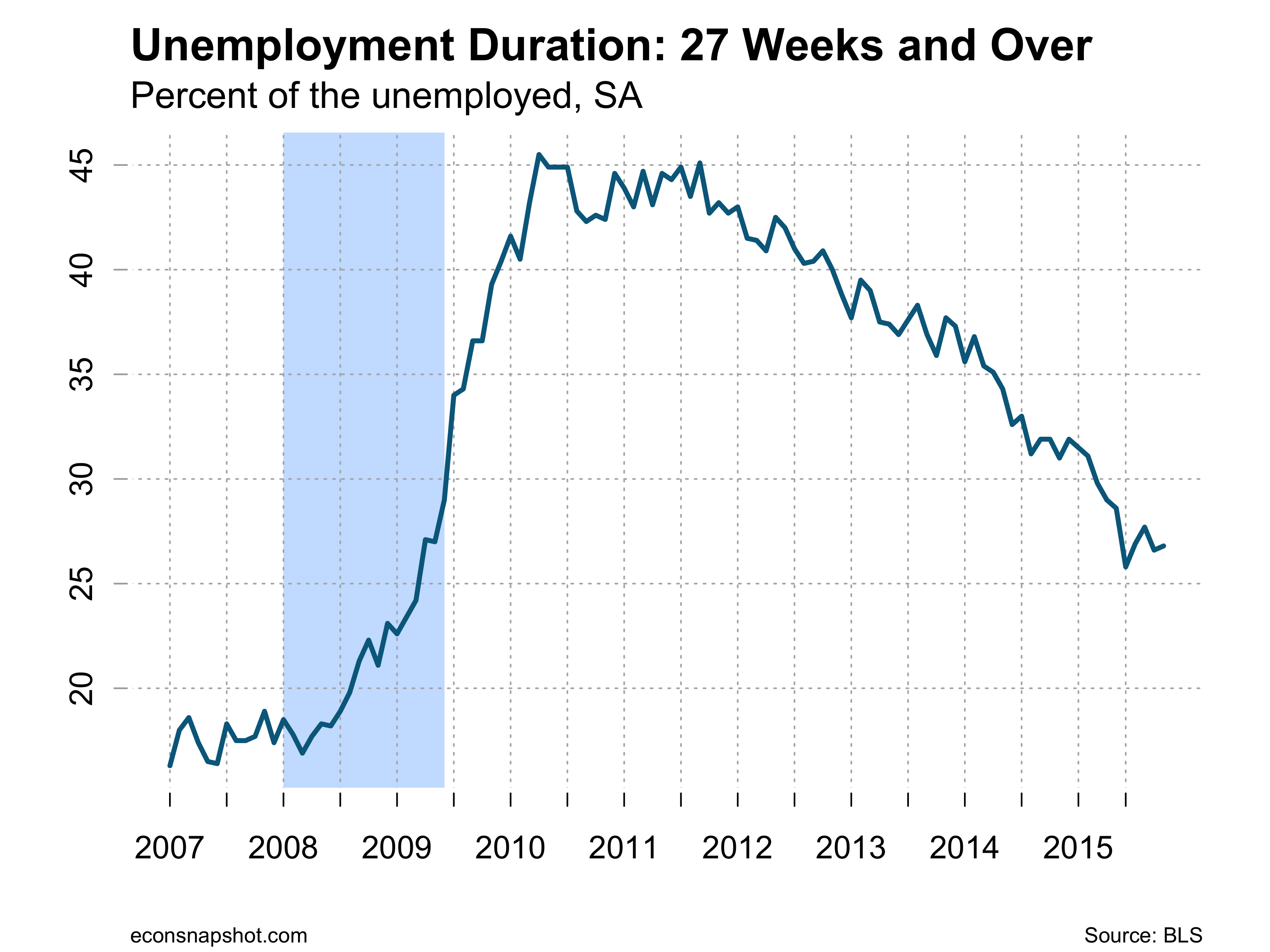

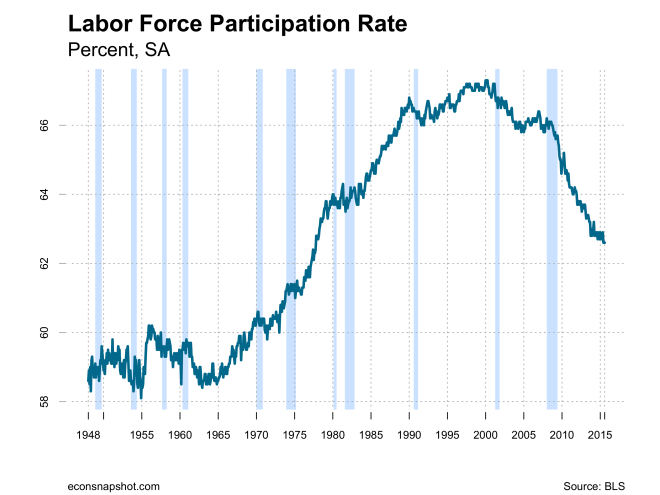

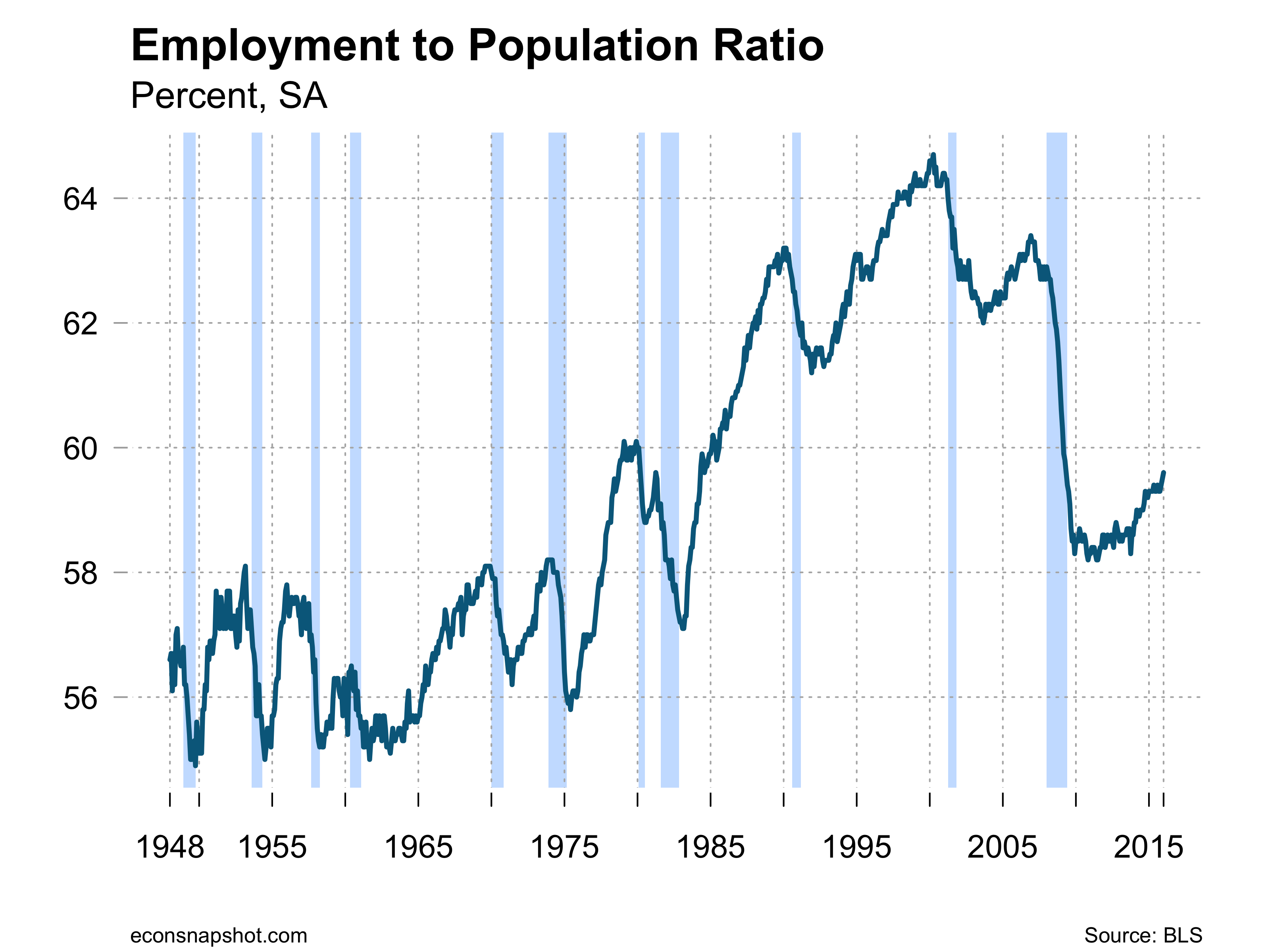

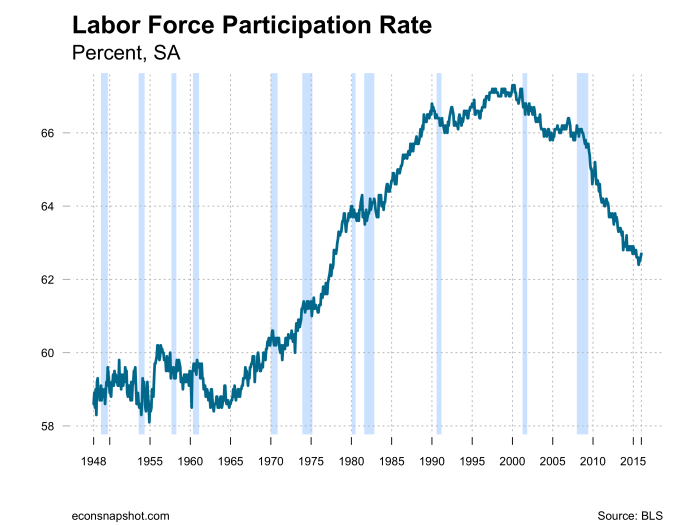

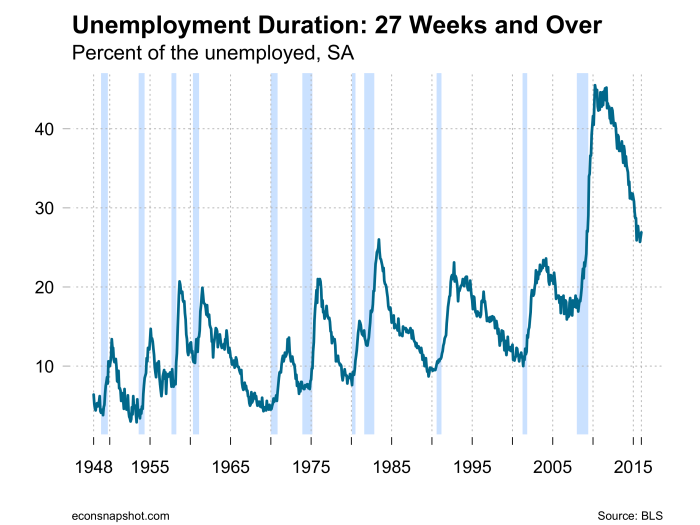

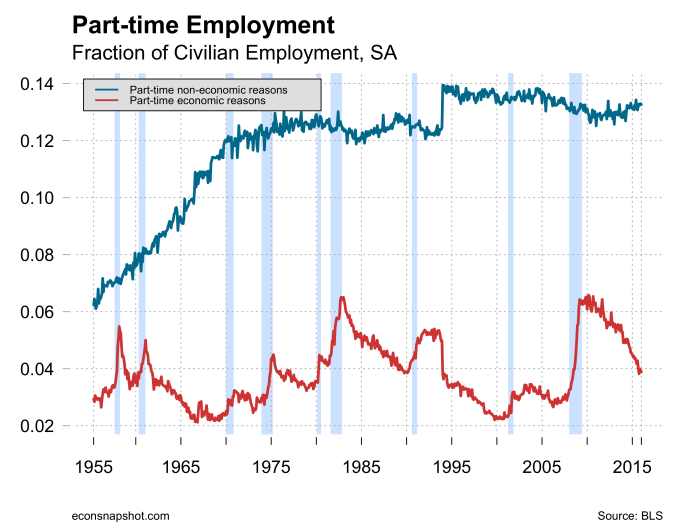

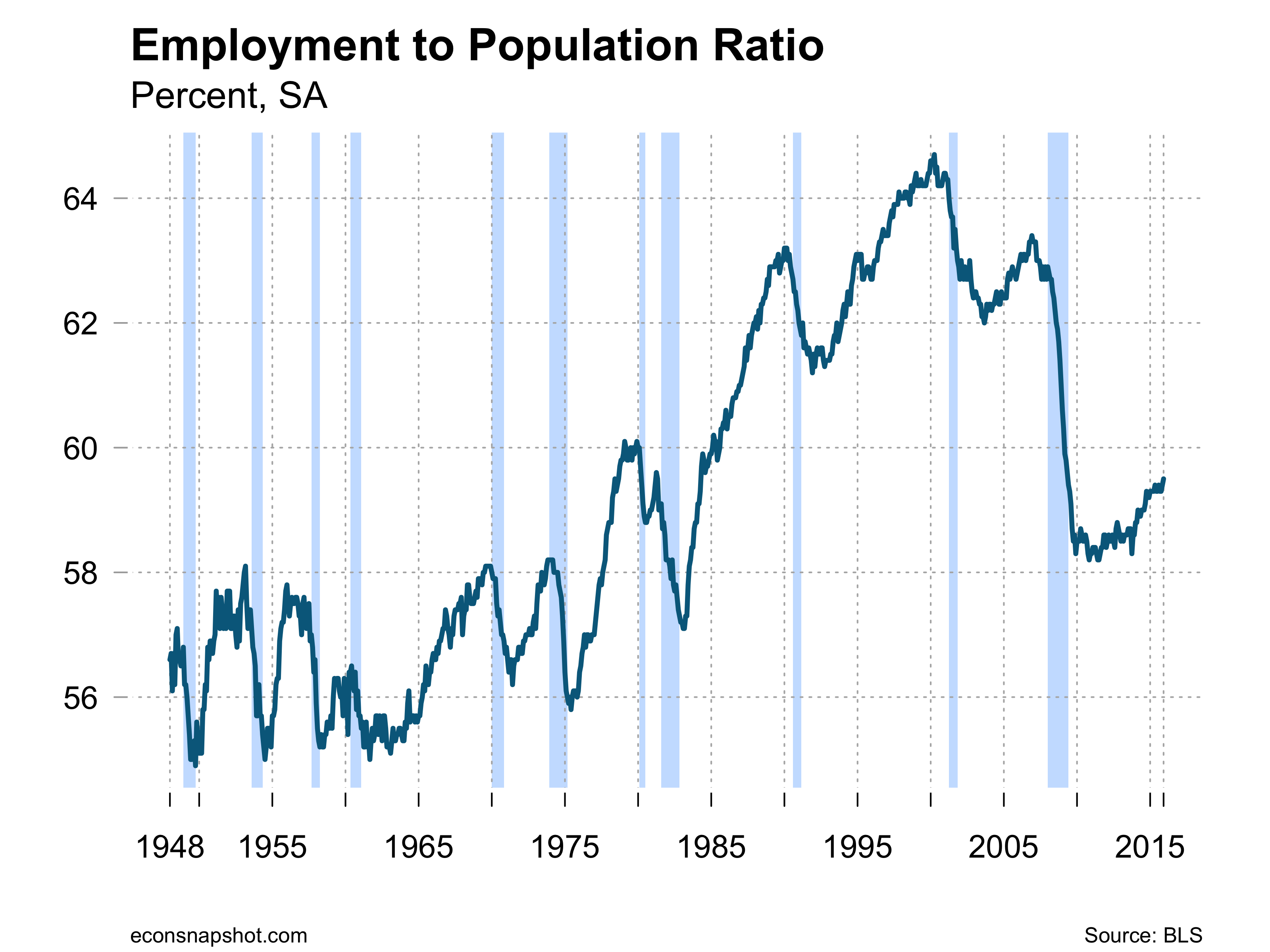

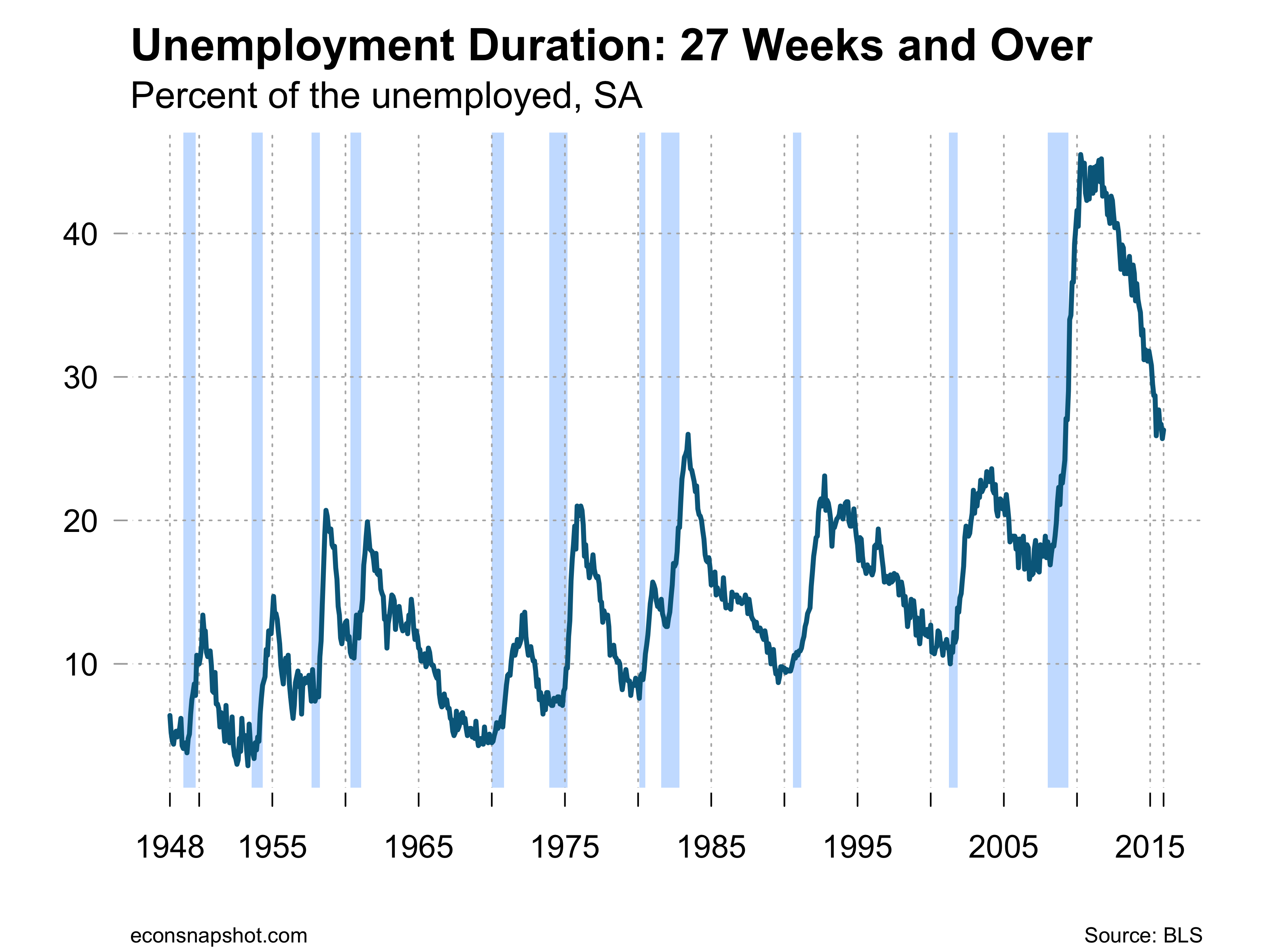

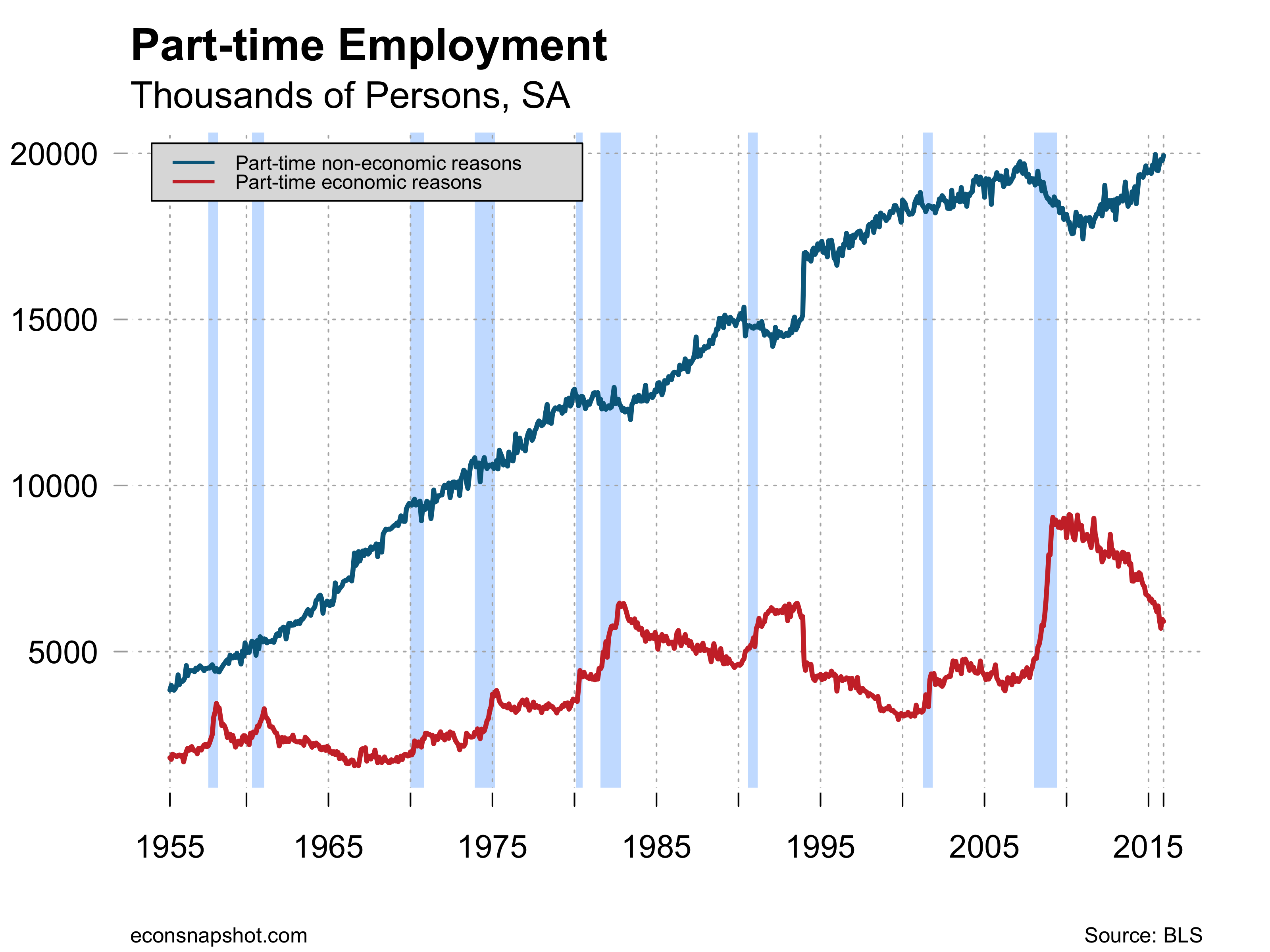

There has been no significant change in the employment to population ratio or the labor force participation rate, those unemployed 27 weeks and longer, or those working part time for economic reasons.

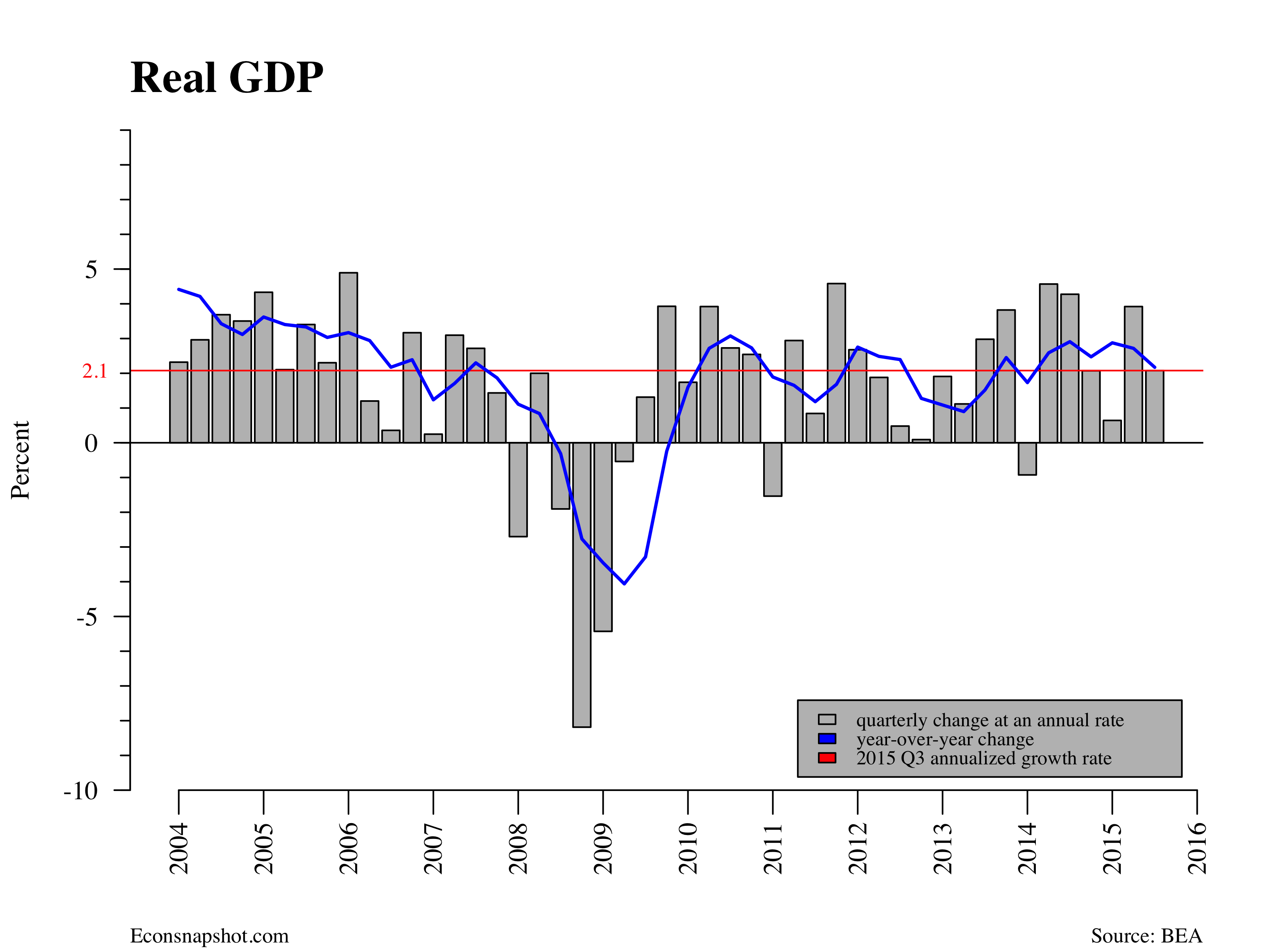

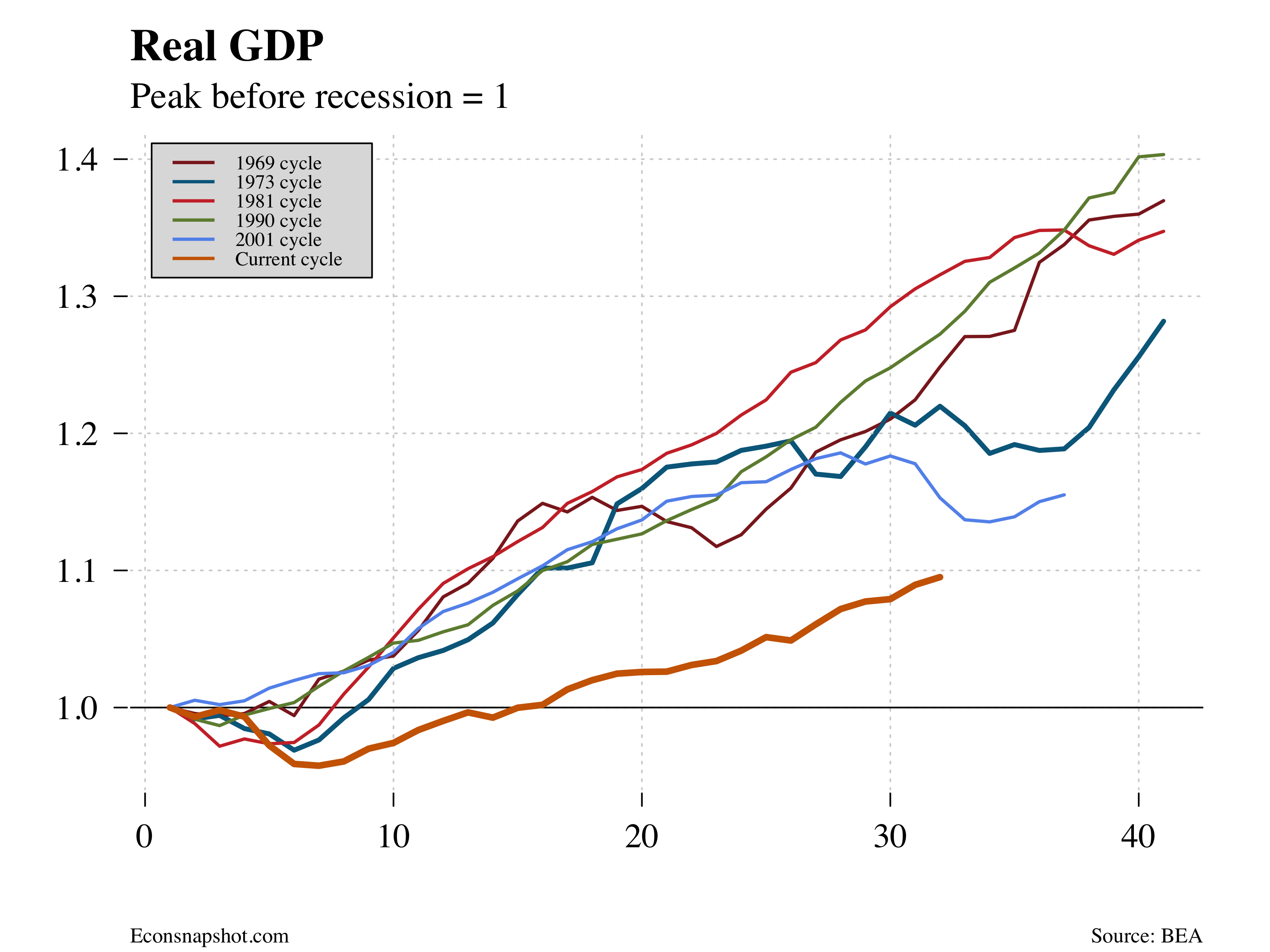

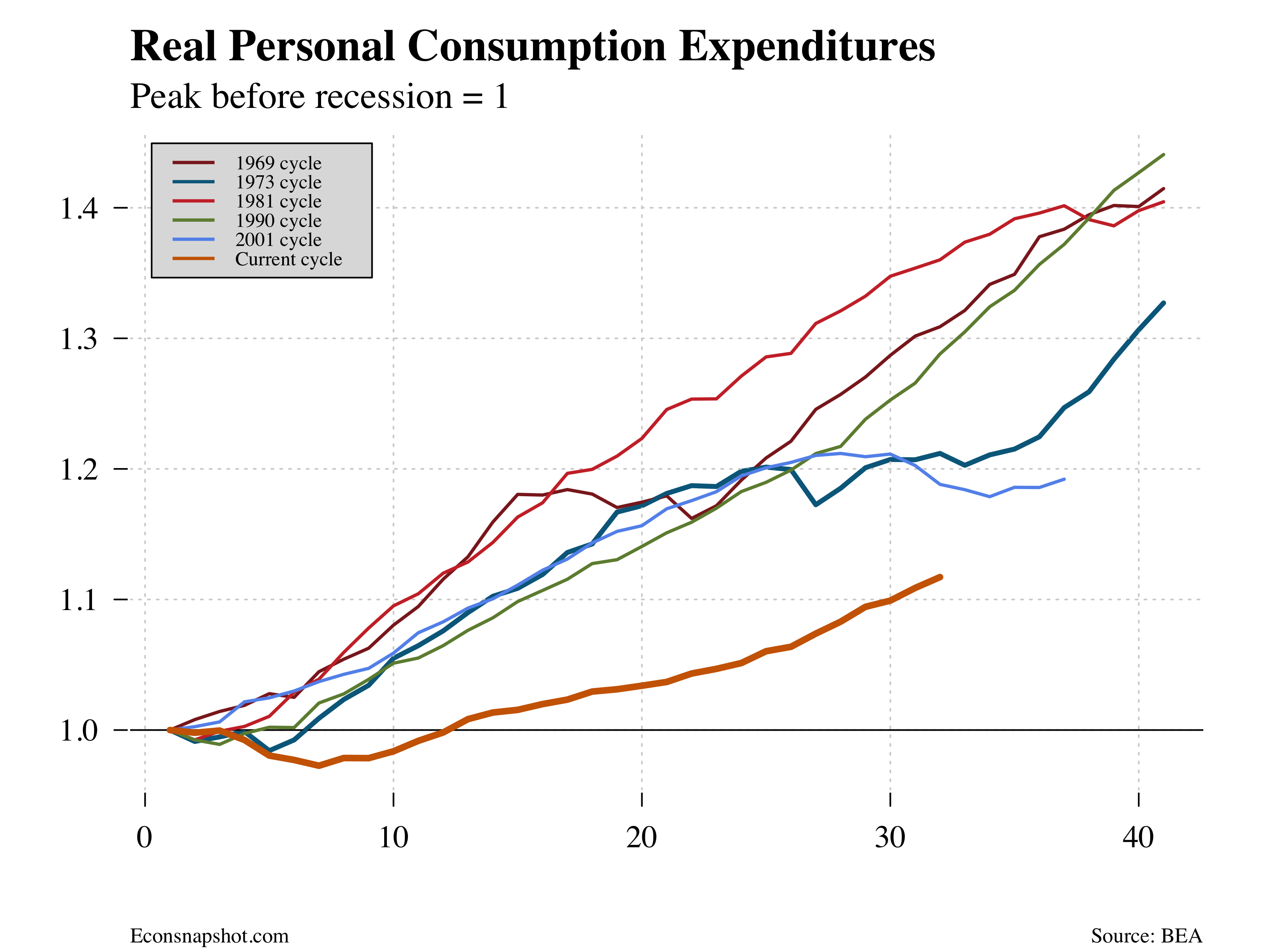

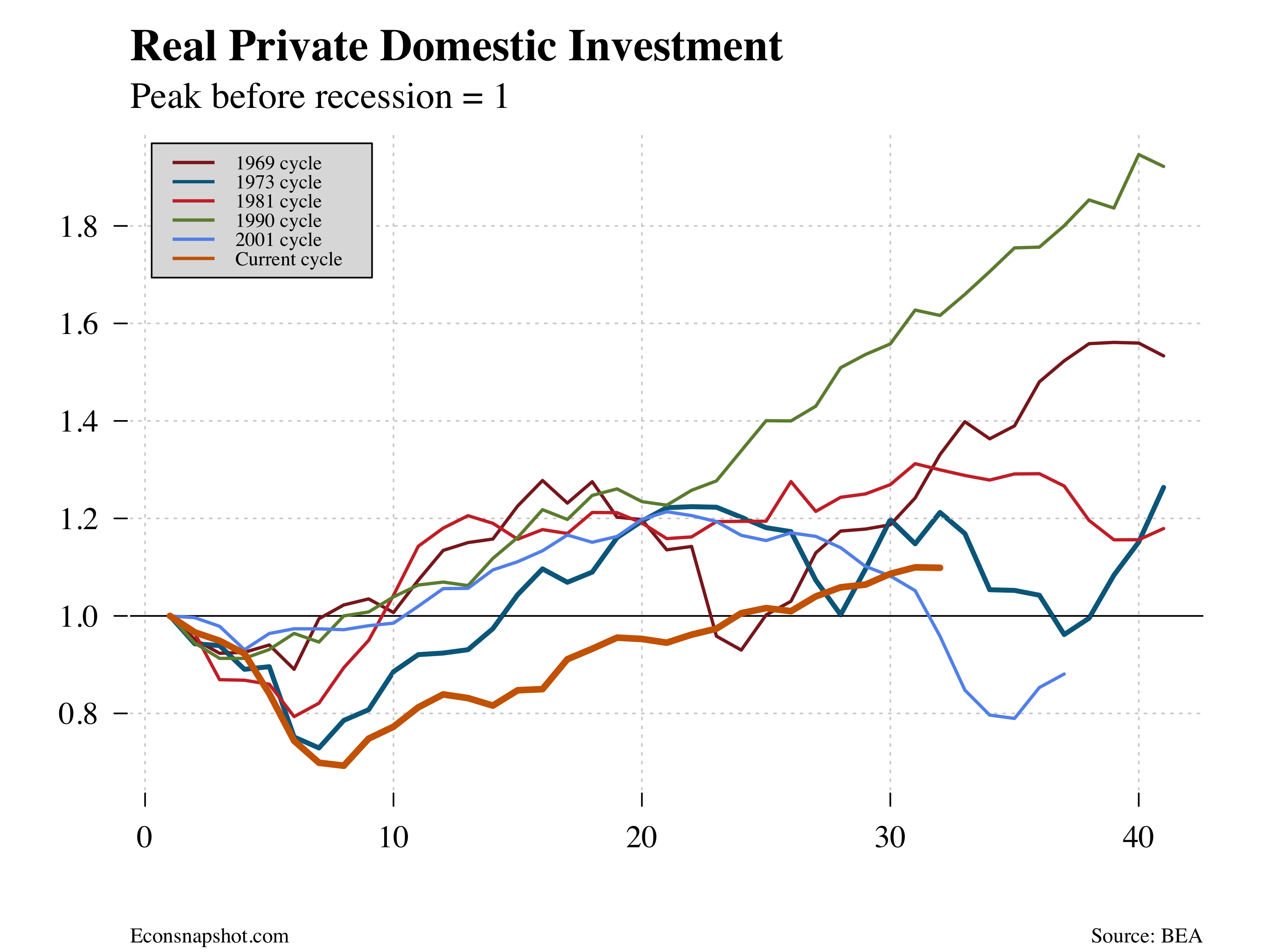

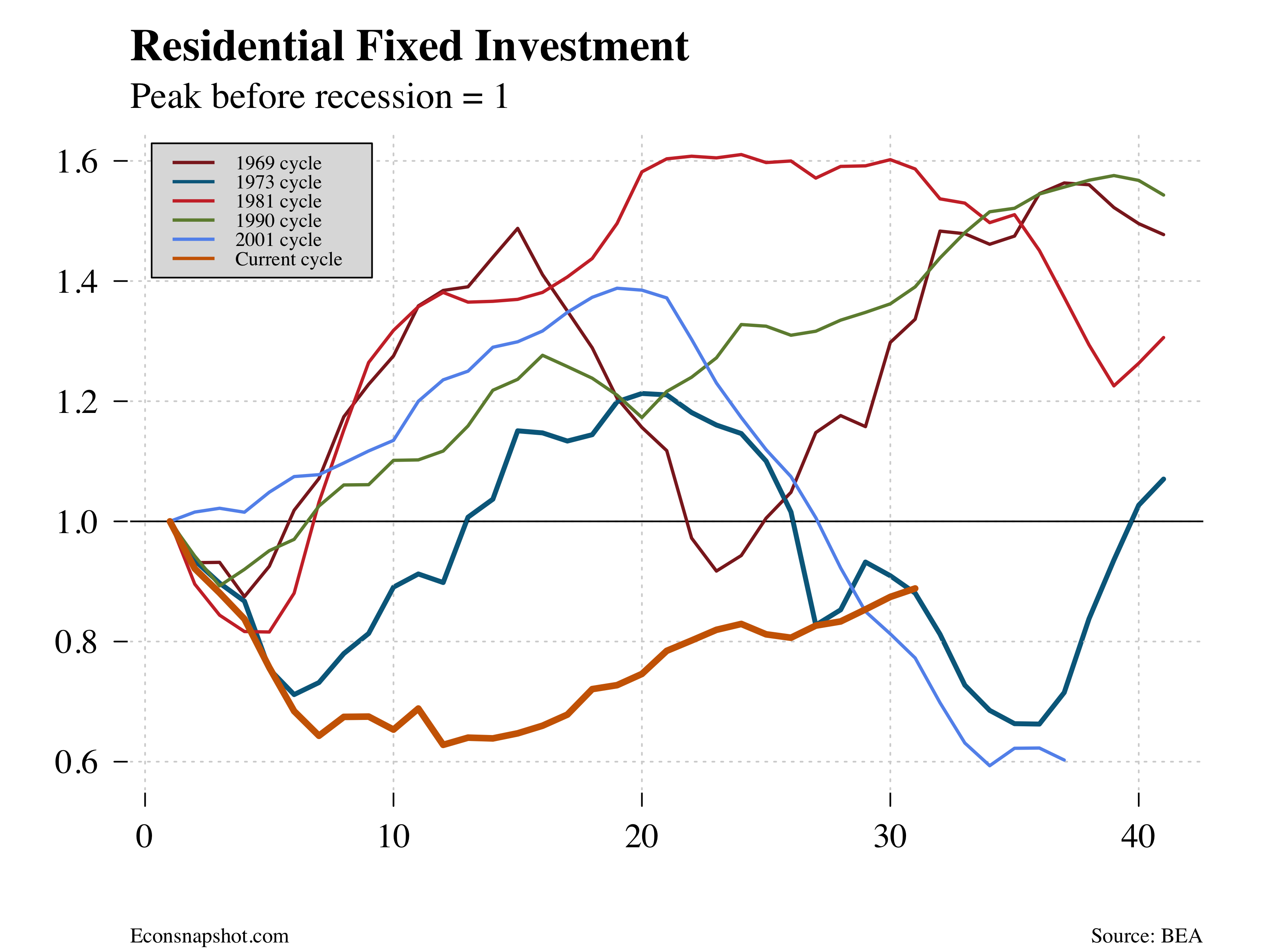

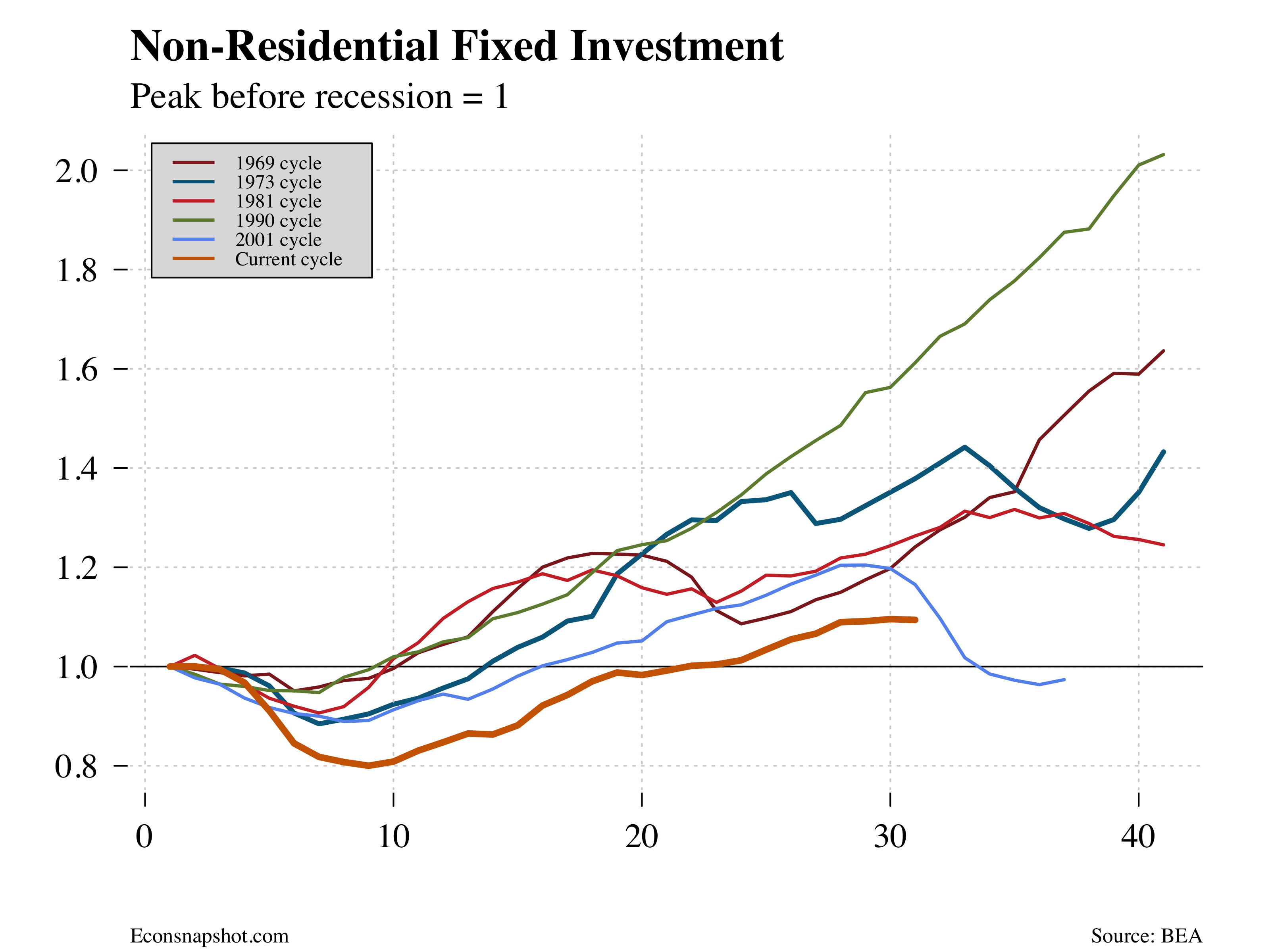

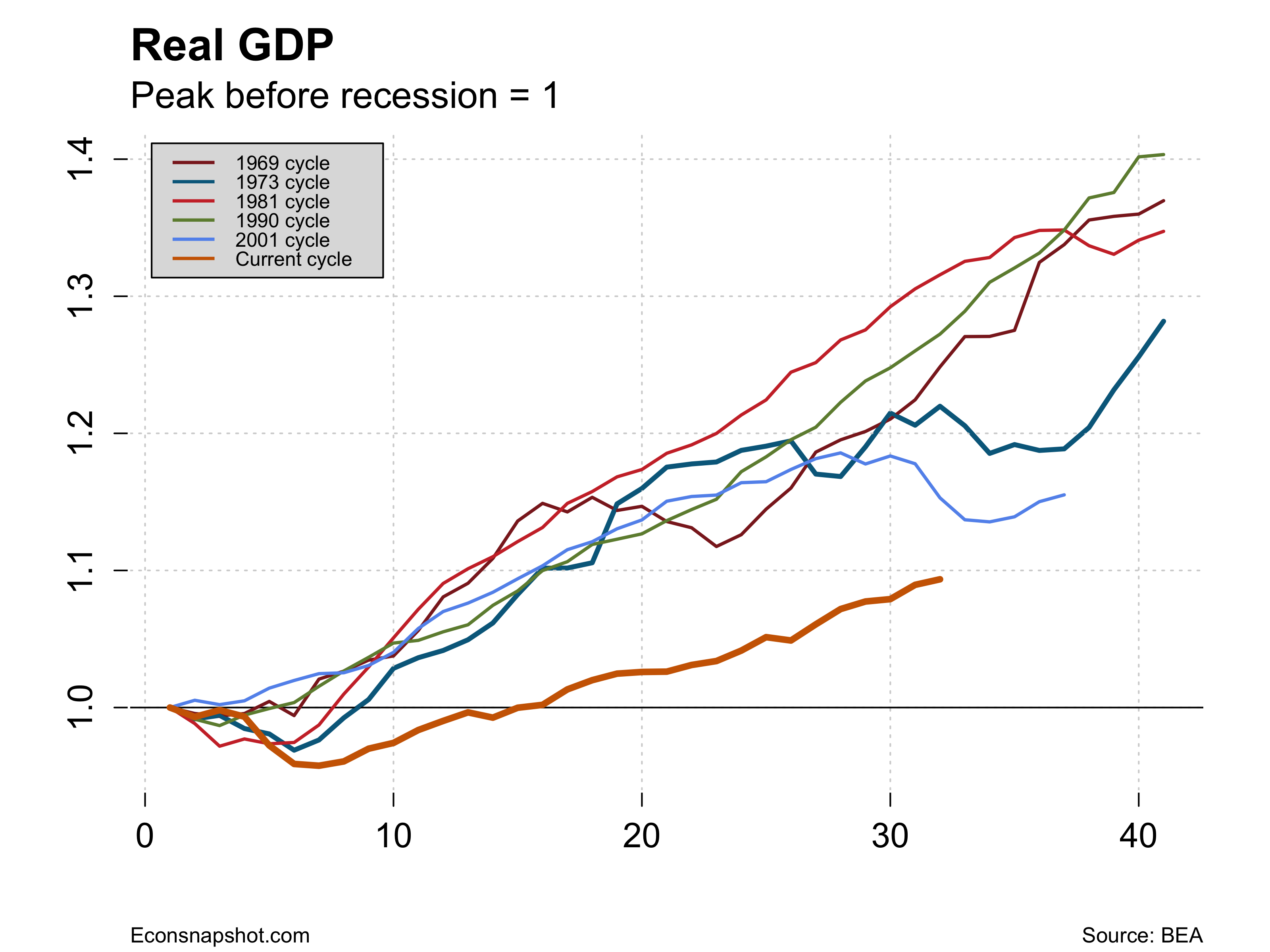

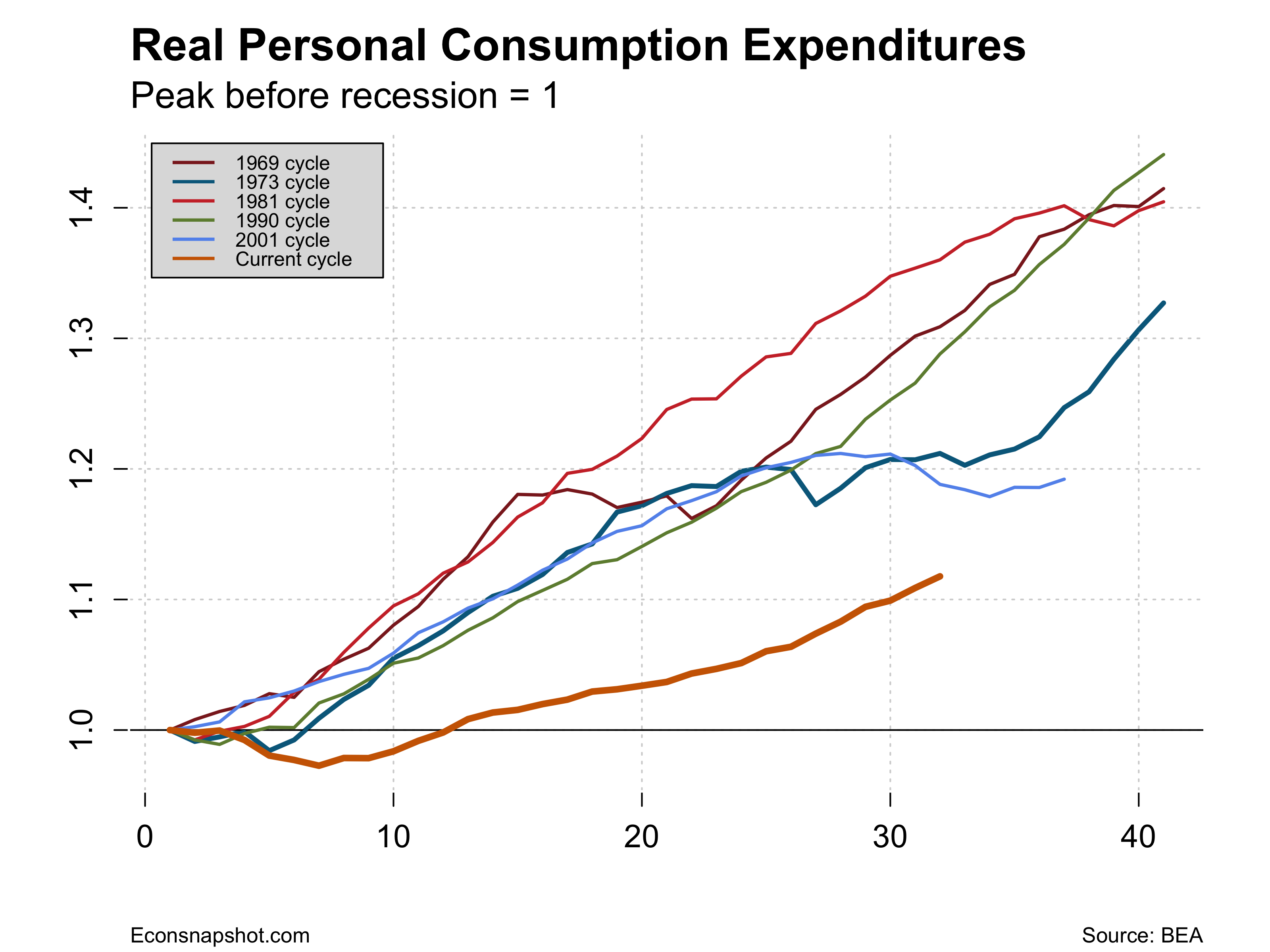

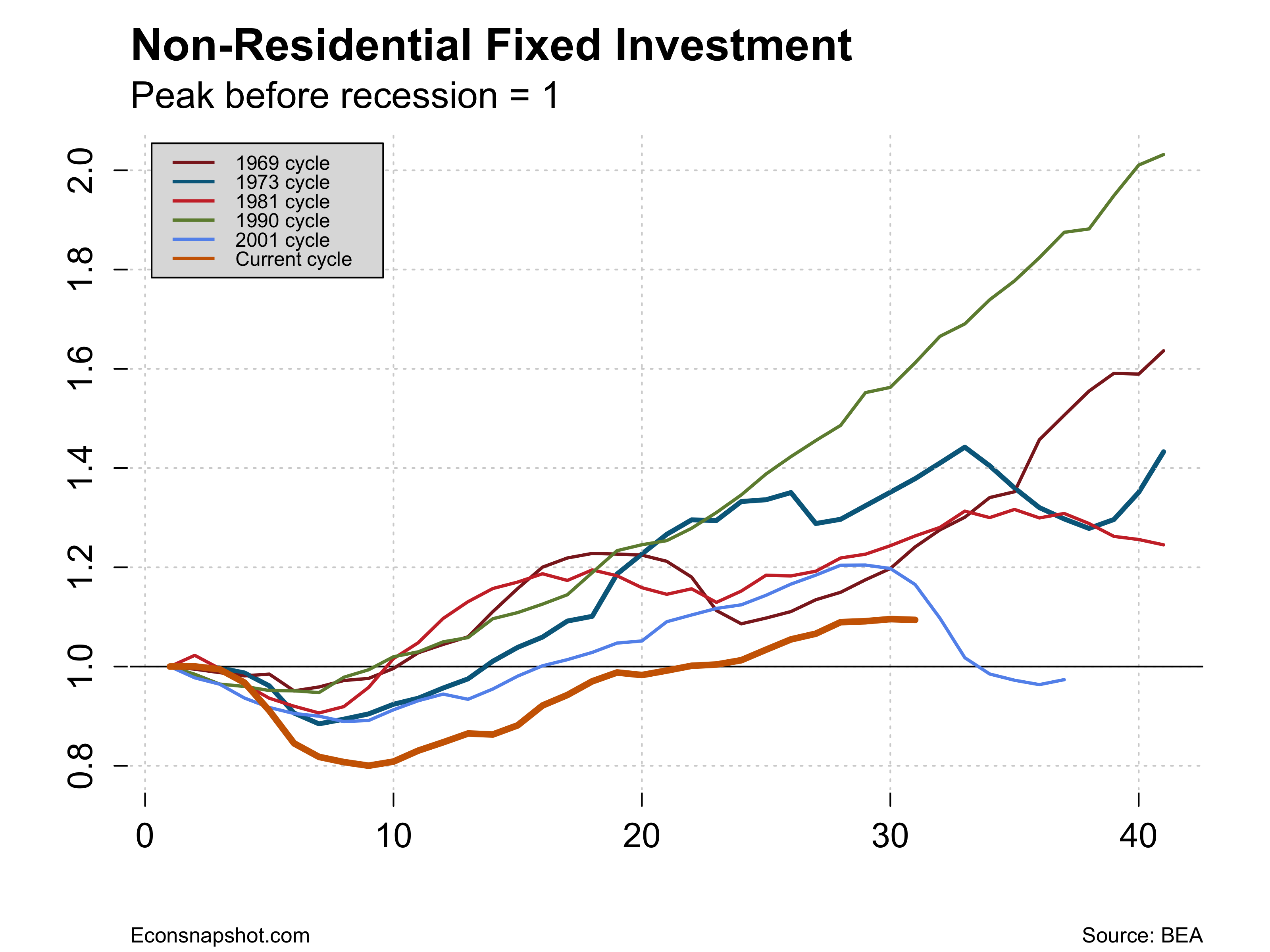

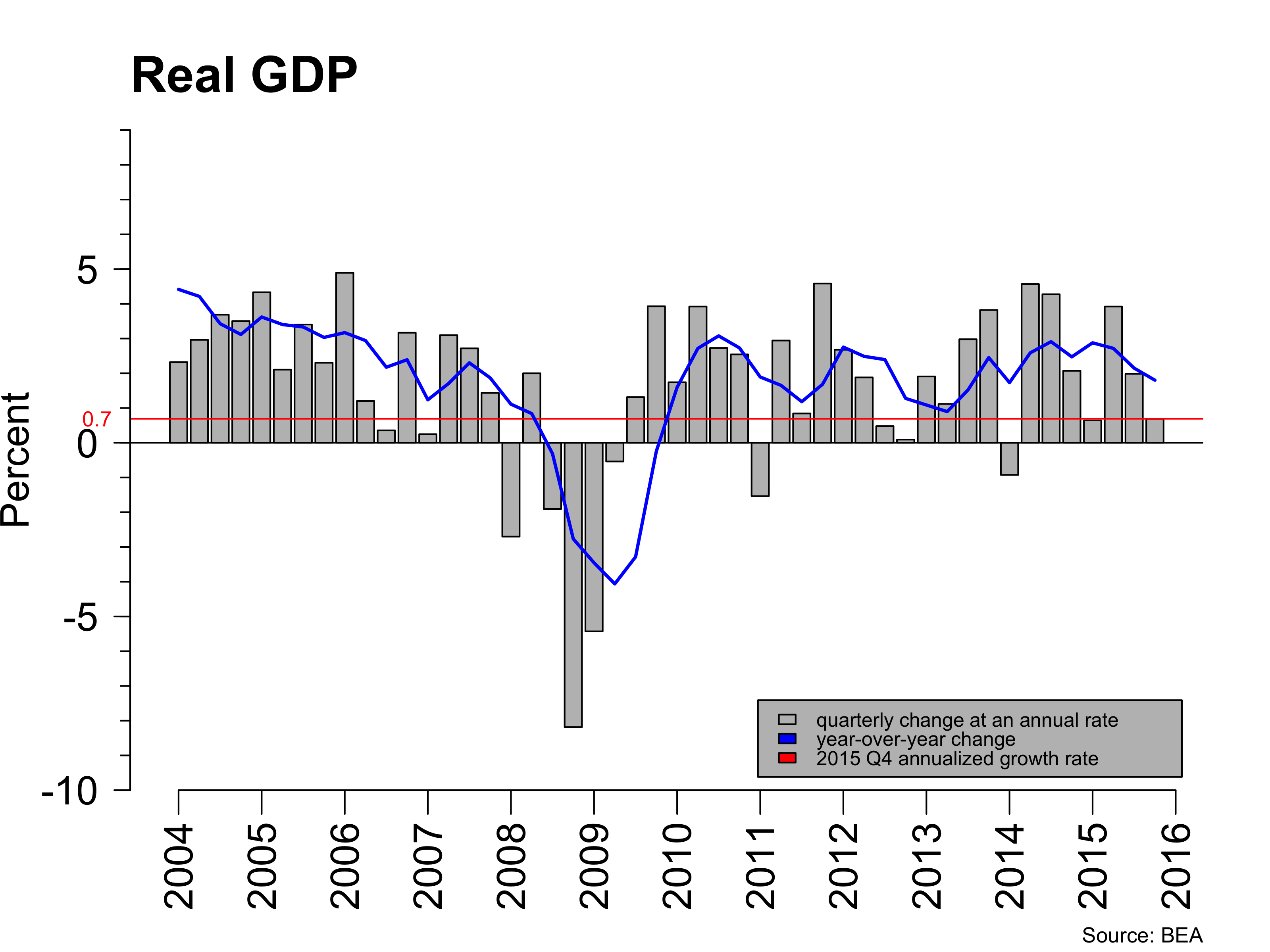

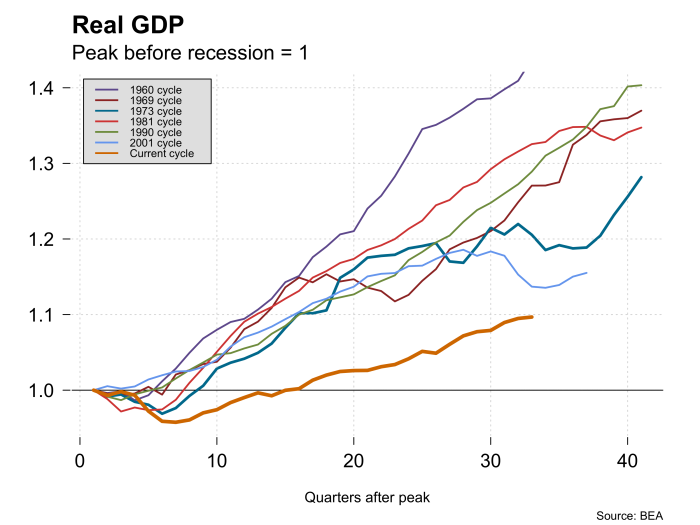

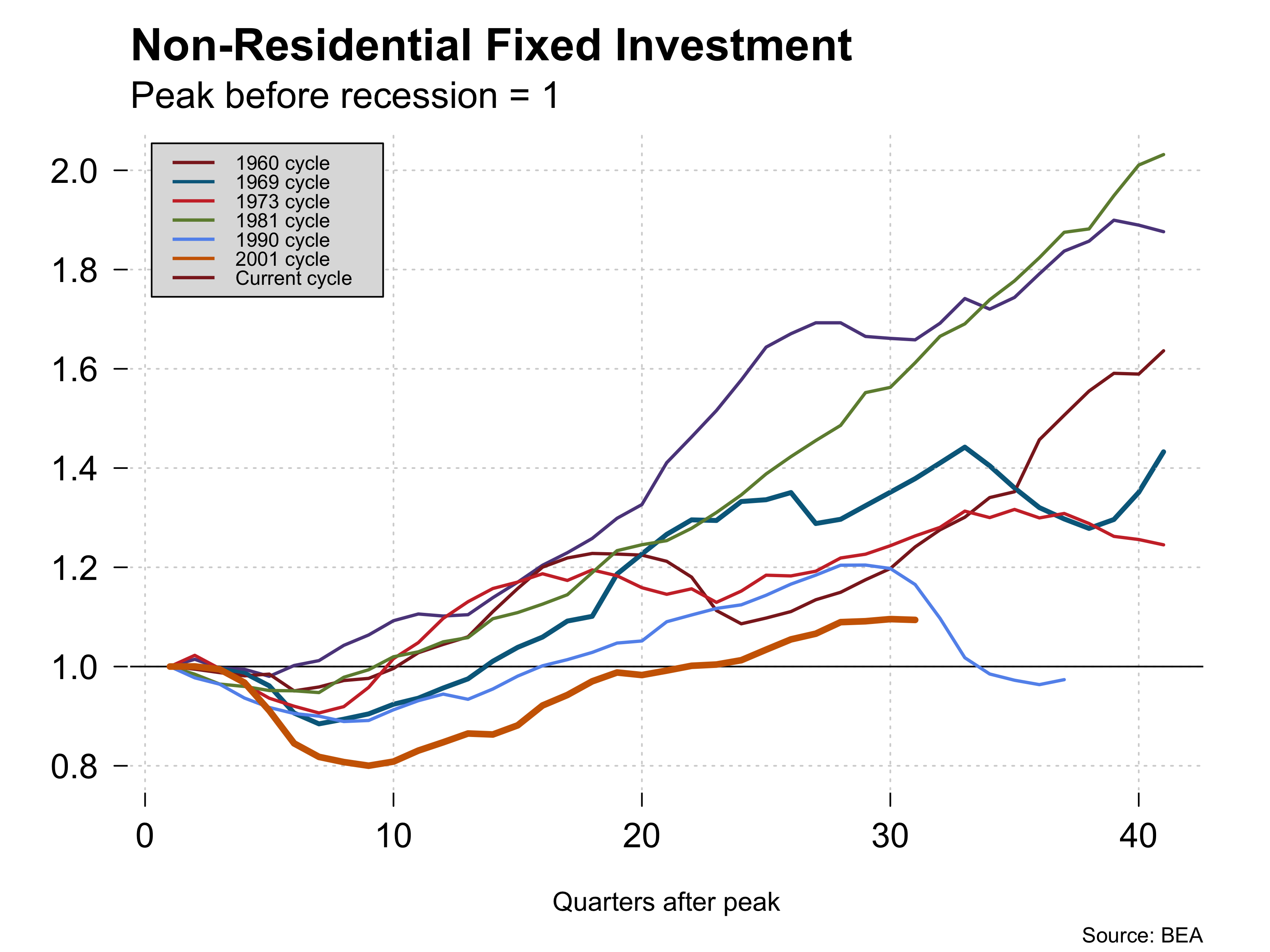

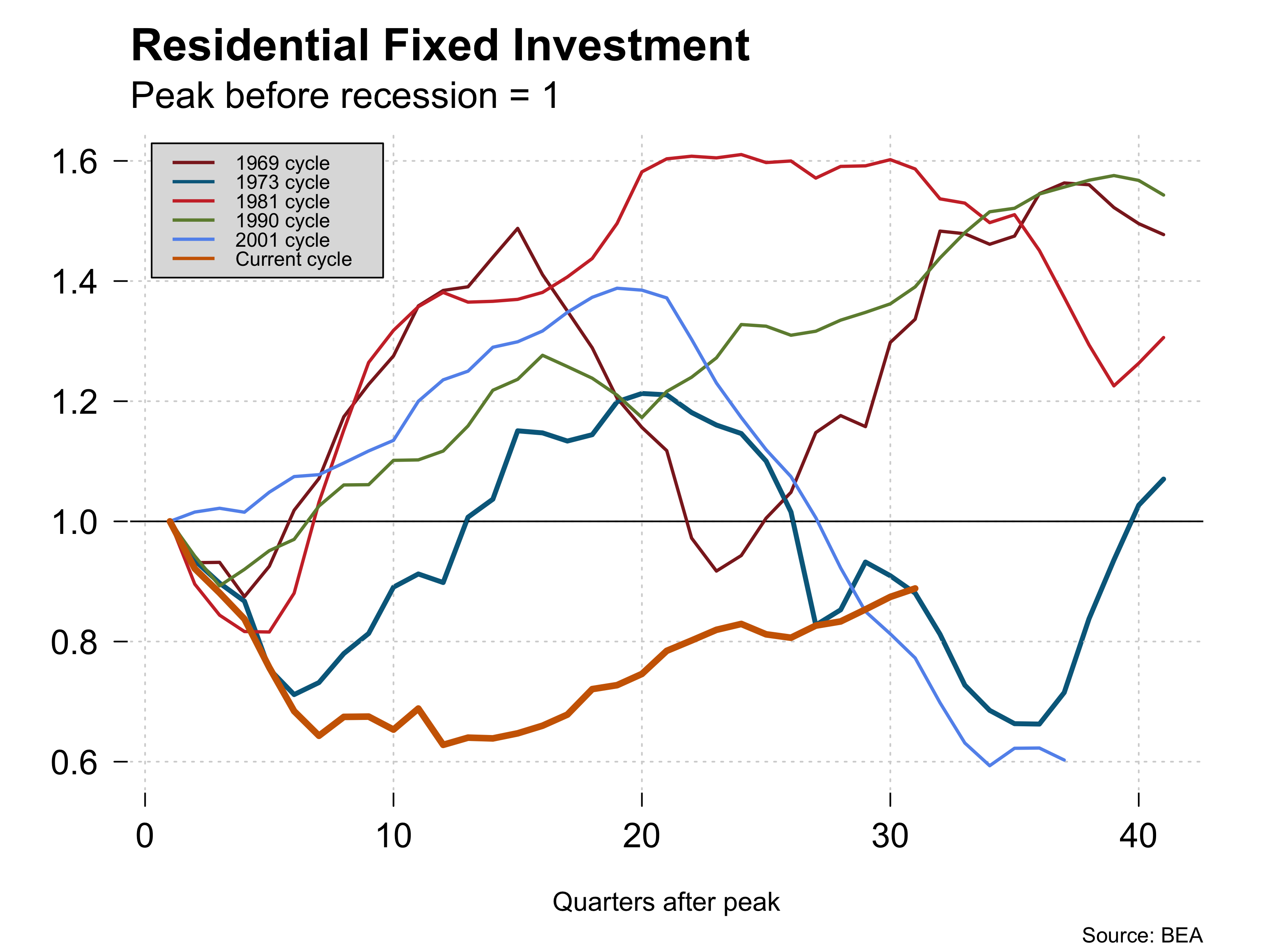

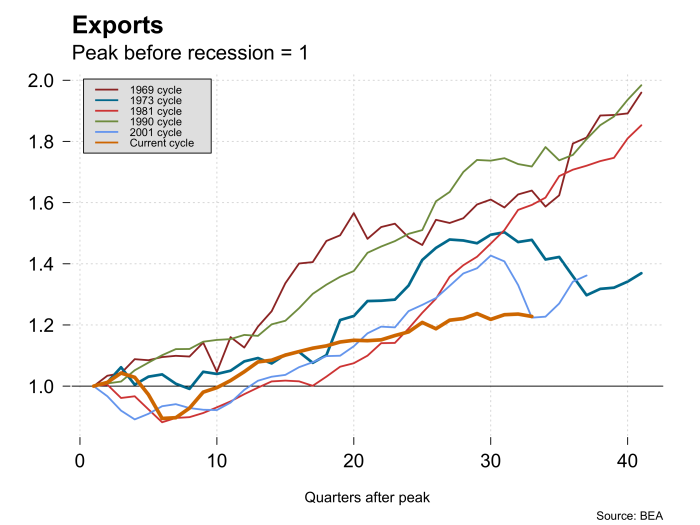

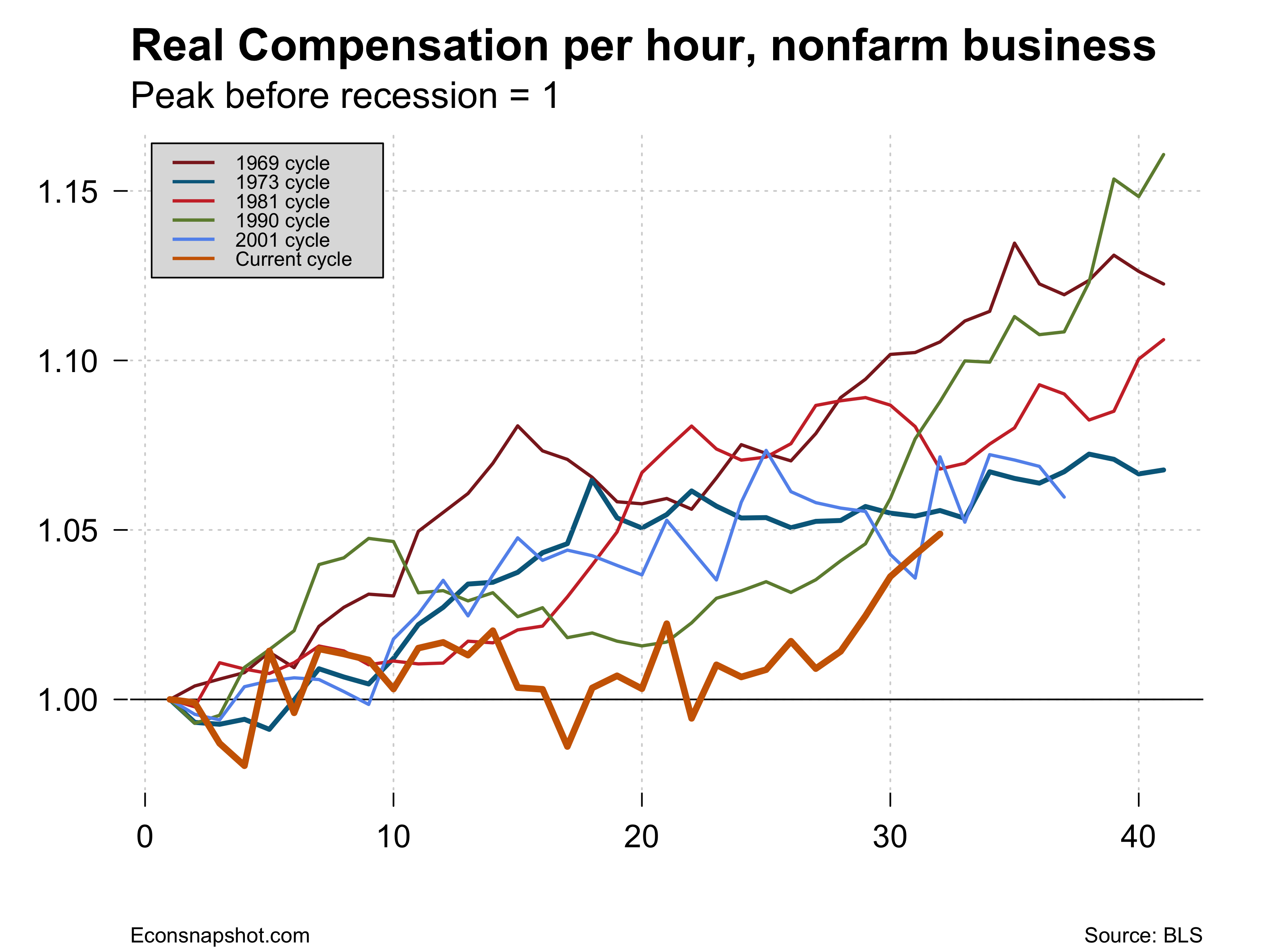

Output per hour fell 3.0% at an annual rate in the fourth quarter of 2015 and has not shown any upward trend over the recovery. Indeed, it is only about 7% higher today compared to the peak before the great recession, by far the slowest rate of growth across all recessions and recoveries since the 1960’s, except for the 1973 recovery.

The BLS also undertook the annual revision to earlier data based on a more complete set of data. The annual revisions lowered December payrolls by 105k. The total nonfarm employment level for March 2015 was revised downward by

206,000 but this left a boost for job growth as the over-the-year change in total nonfarm employment for 2015 was revised from 2,650,000 to 2,735,000.

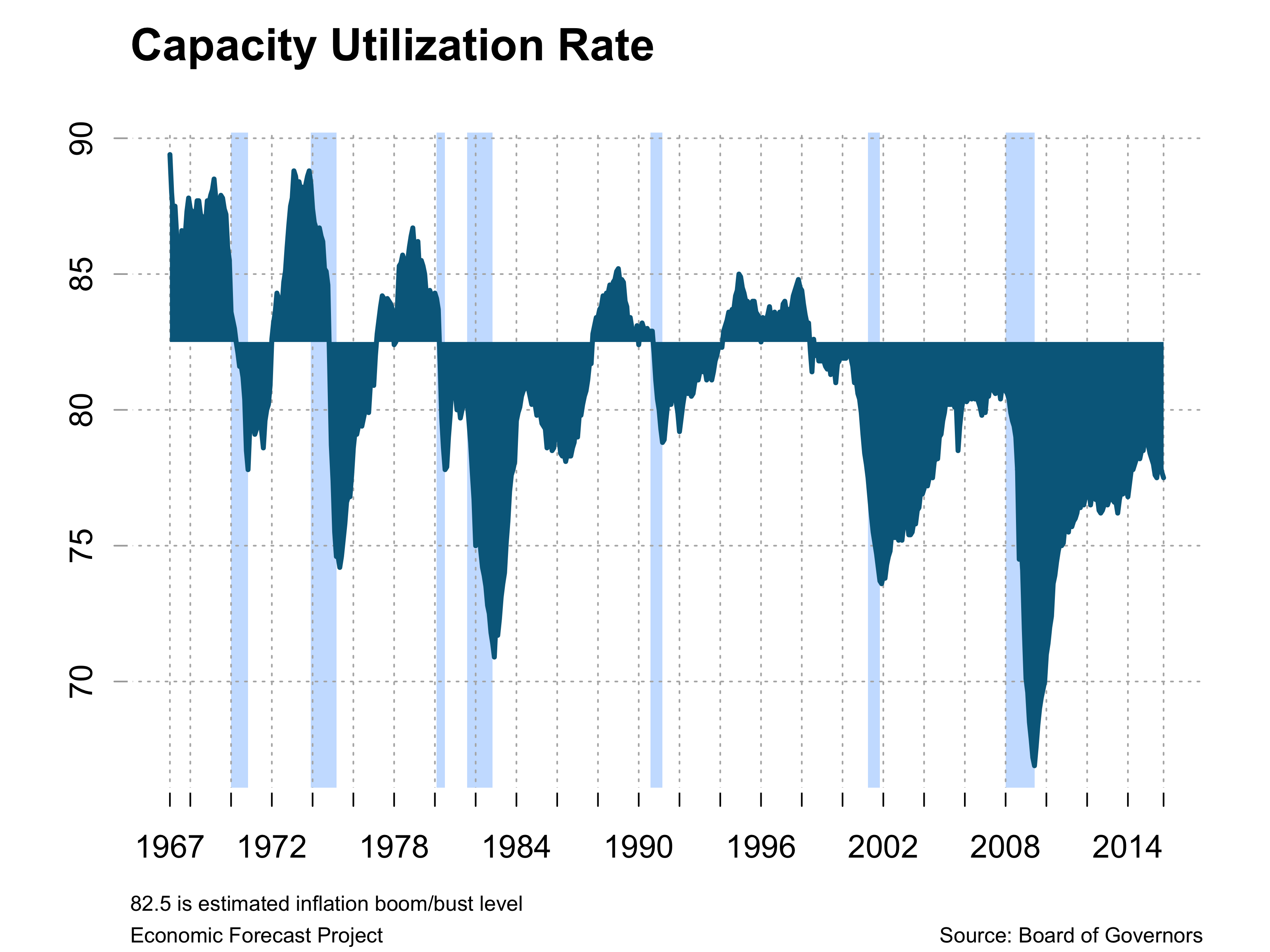

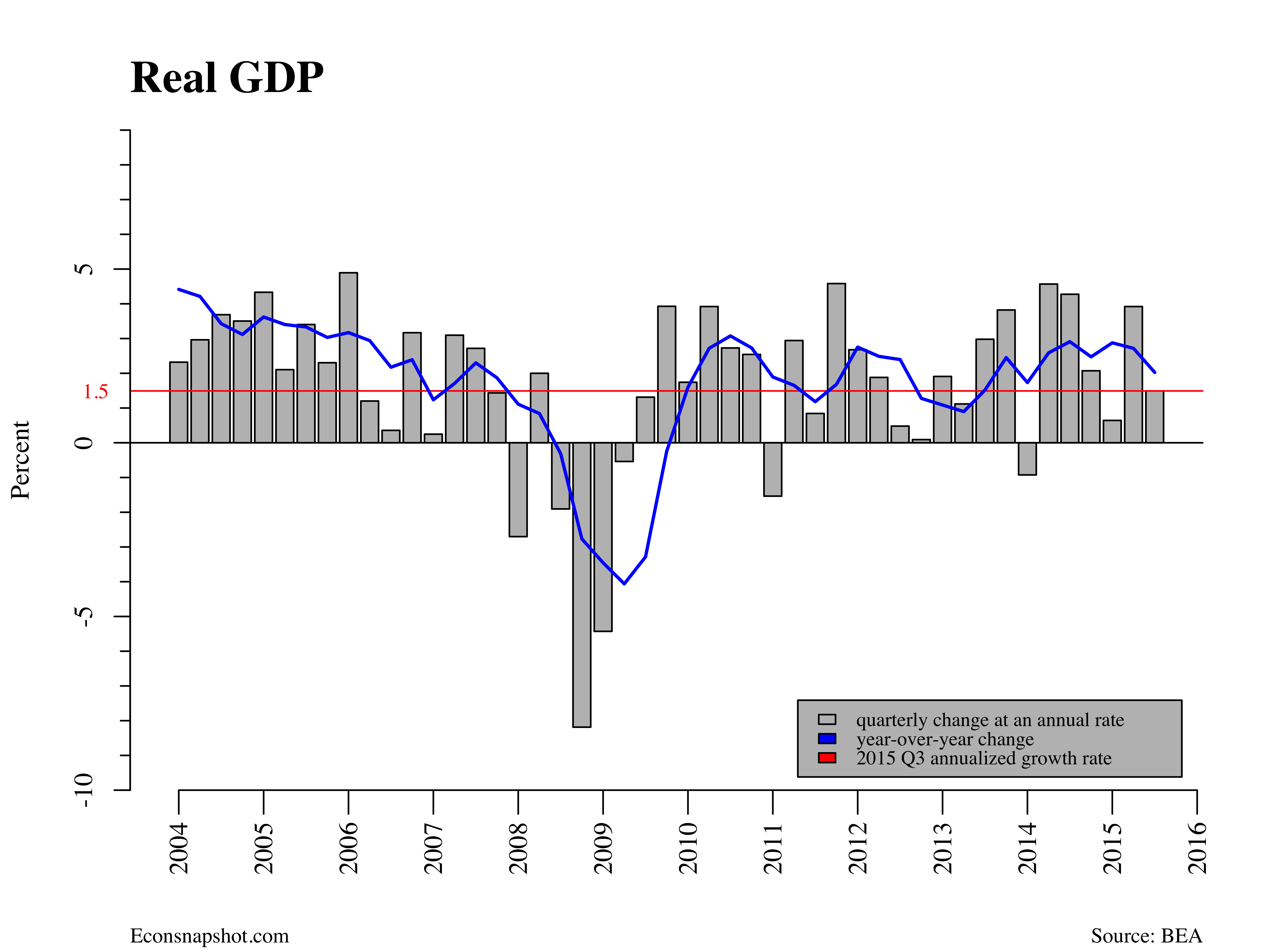

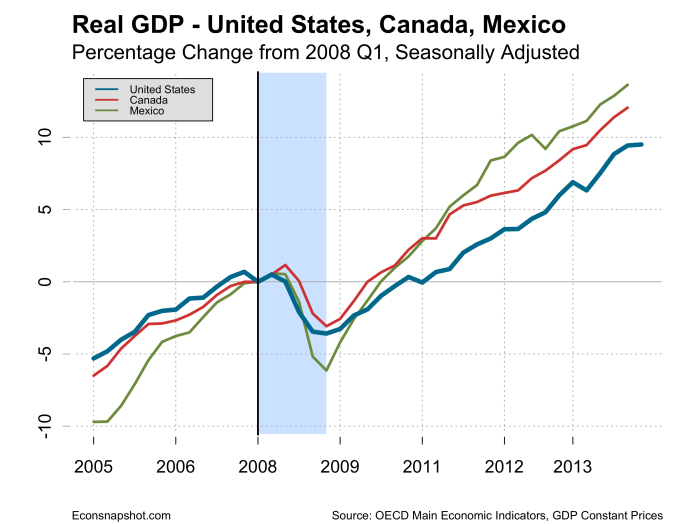

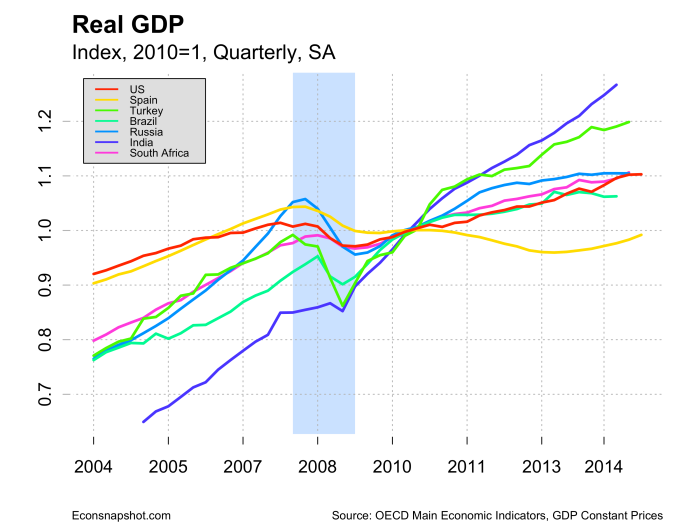

Overall, then, the slow GDP growth reported earlier this month along with the fairly weak labor report shows an economy that continues to grow at a fairly anemic pace. Moreover, it seems less likely the Fed will signal any moves in the near future.

The household survey

The household survey