By Thomas Cooley and Peter Rupert

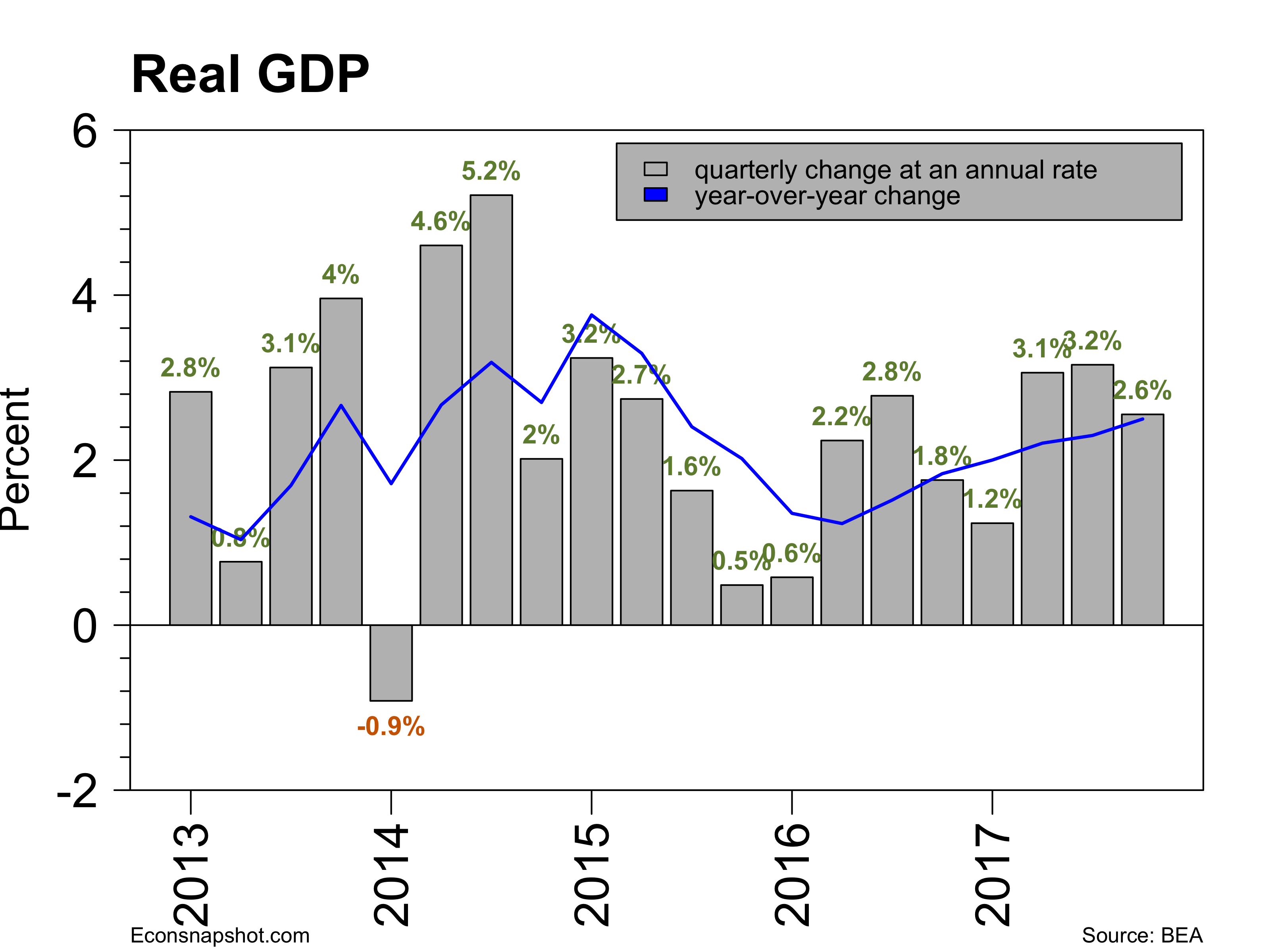

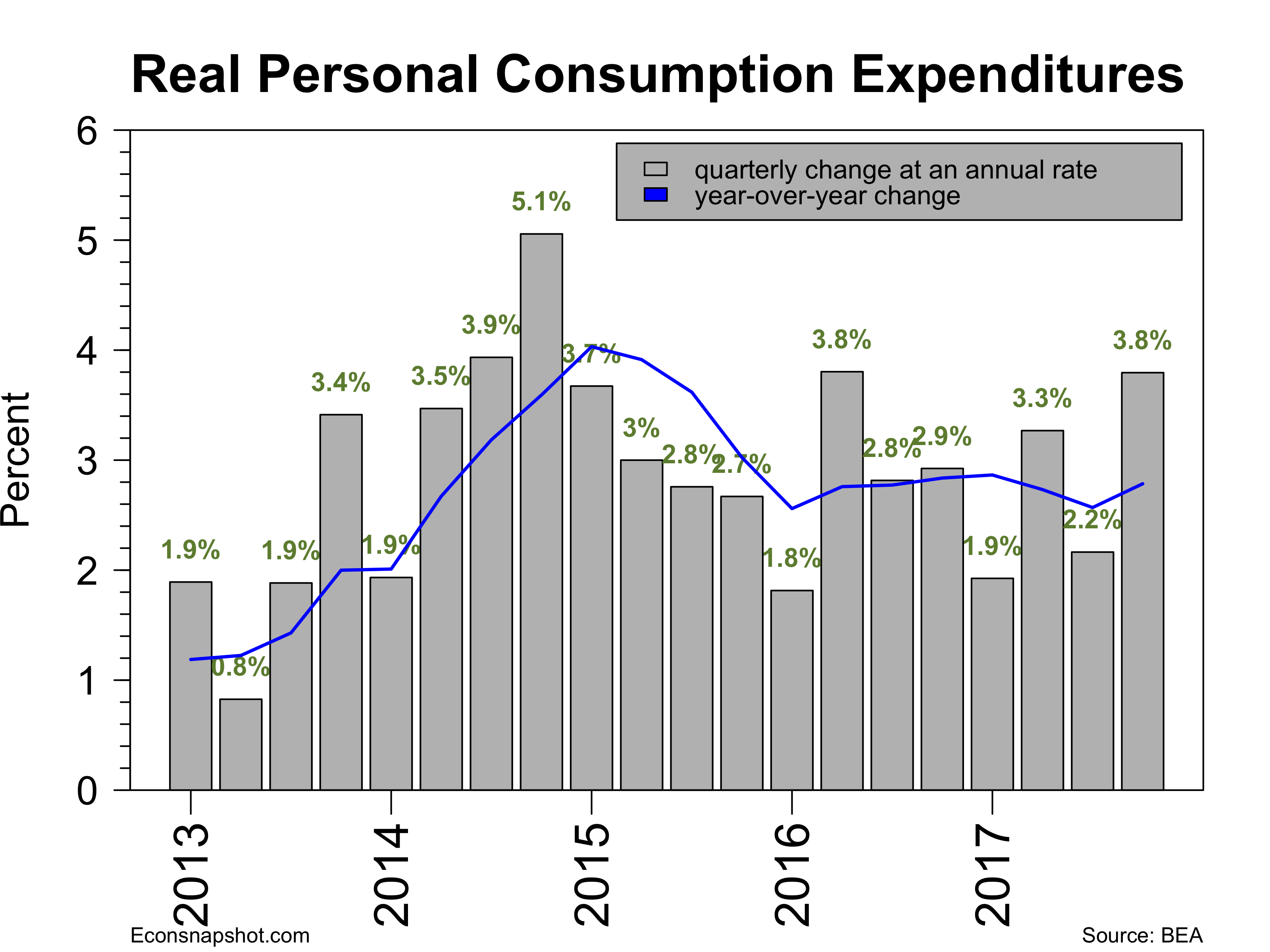

Fourth quarter real GDP increased 2.6% according to the advance estimate from the Bureau of Economic Analysis and 2017 finished up 2.3% overall. Personal consumption expenditures was the leading contributor, rising 3.8%, with durable goods purchases up 14.2%. Investment also came in strong, rising 3.6%, with residential fixed investment increasing 11.6% and non-residential equipment up 11.4% after being in negative territory for the past two quarters. On the negative side, inventories declined $29.3 billion and imports increased 13.9%, the latter being a subtraction in the GDP accounts.

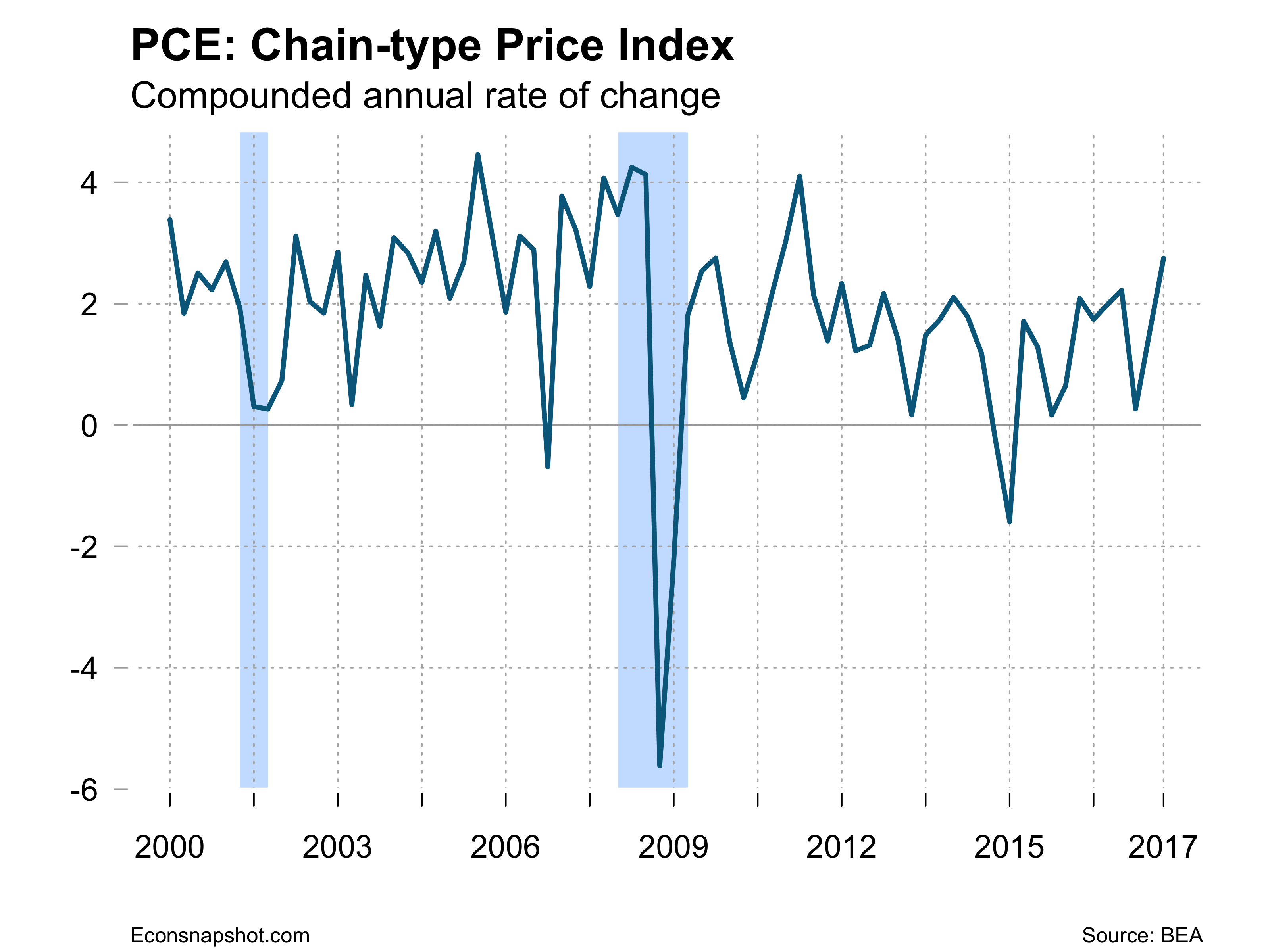

The PCE chained price index increased 2.8%, the largest increase since 2011. It may signal an increase in pricing power in the economy. If so, it will give the Fed further justification for the ongoing increase in interest rates.

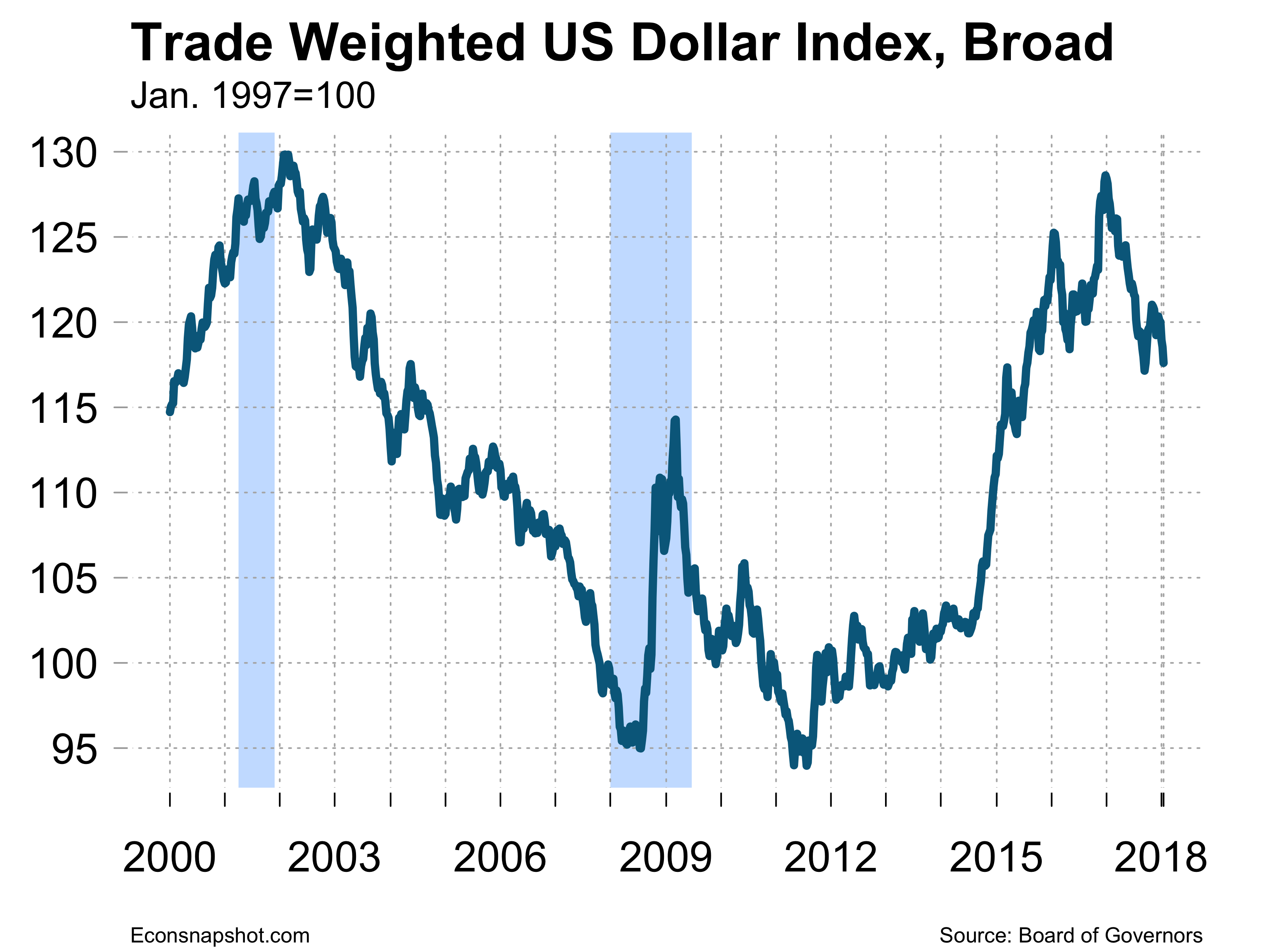

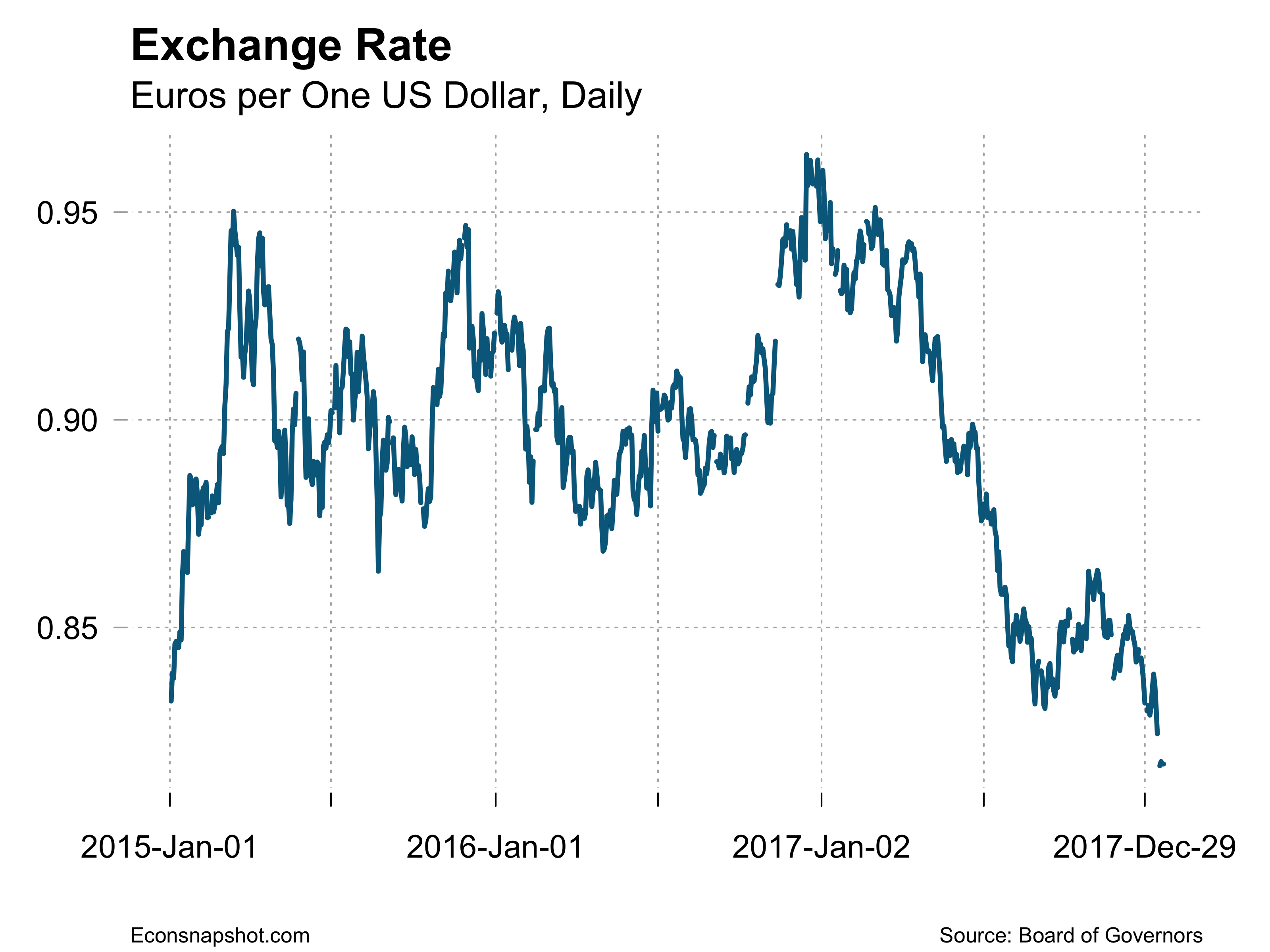

The dollar has been sliding and has recently been the talk of Treasury Secretary Mnuchin and President Trump from Davos. The Davos bump pushed the dollar to some of the lowest levels it has seen against the Euro.

The steady growth in the overall economy keeps the Fed in ready mode, although today’s strong, but not spectacular numbers, likely means no move at the upcoming meeting.

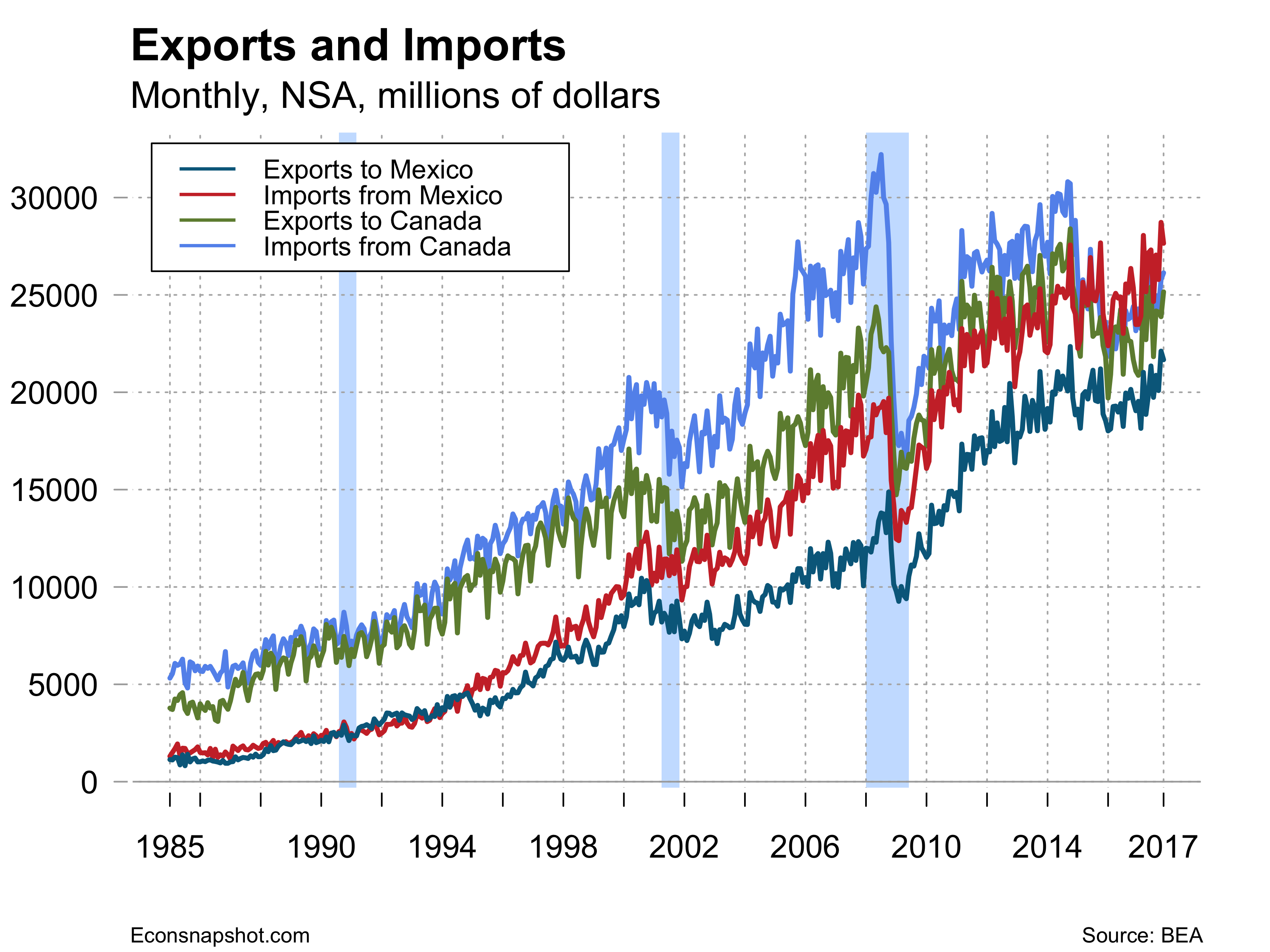

The U.S. is engaged in the sixth round of a scheduled seven rounds of negotiation of the NAFTA Treaty. The U.S. is pressing for changes that would benefit U.S. manufacturing and transportation. The Countries seem far apart on the issues. The chart below makes it clear that the NAFTA has had a tremendous effect on trade between the three countries. Eliminating NAFTA would have severe consequences for all of the economies involved.