By Thomas Cooley and Peter Rupert

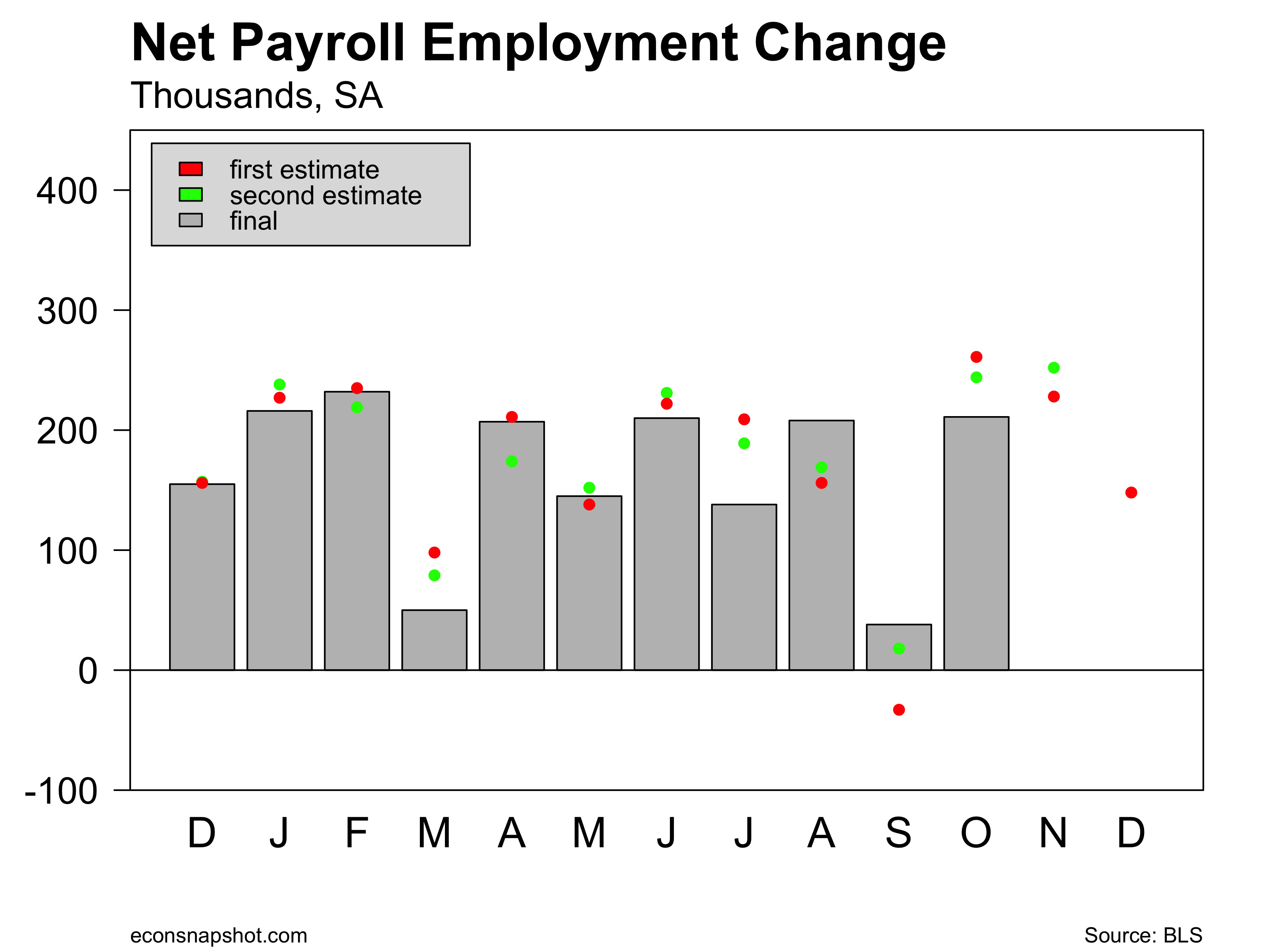

The BLS announced that December employment rose by 148,000. The gains were broad-based, the only declines were found in retail trade, -20.3, and utilities, -0.9. This is well off the trend rate of job growth of the last few months. It is also significantly softer than the ADP estimate based on payroll data of 250,000 new private sector jobs. But employment growth has been volatile month-to-month and this softening is not statistically meaningful. The unemployment rate remained steady at 4.1% and other features of the labor market remained much the same.

Average hours of work remained at 34.5 and average hourly earnings ticked up 9 cents to $26.63.

Average hourly earnings increase was 0.3% which signals some upward pressure on wages but nothing like a the break through increases that observers have been looking for as evidence of a tight market.

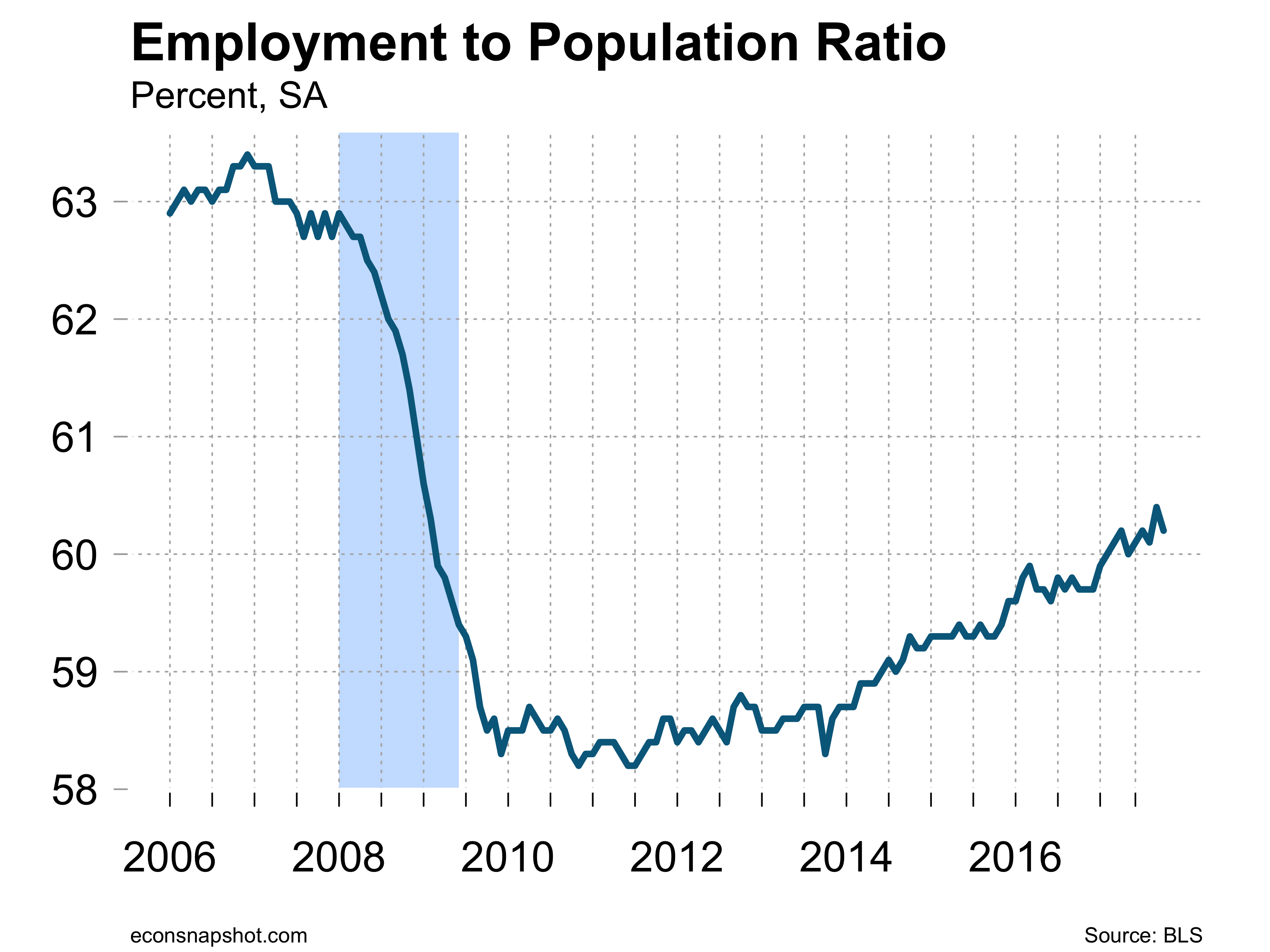

The household survey shows that labor force participation and the employment population ratio remain largely unchanged at historically low levels. This represents a degree of slack in the labor market and it isn’t changing.

Weather and recurrent natural disasters have had a fairly steady damping effect on the aggregate labor market over the past 12 months. Observers report emerging signs of tightness and rising wages in some regional markets that have not been so affected. We should expect to see some significant strengthening of labor markets over the next 12 months that have nothing to do with changes to the tax law. If that also turns out to have an impact on employment then we should begin to see that show up in wage growth and labor force participation.