By Thomas Cooley, Ben Griffy and Peter Rupert

The Federal Reserve, as expected, increased the target Federal Funds rate by 25 basis points today in a sign the monetary policy is returning to normal after years of historically low interest rates. With inflation near the target level and continued strong employment growth the stage was set for the FOMC to continue pushing up the Federal Funds Rate and Fed officials for the past few weeks have been signaling strongly that a rate hike was imminent. Todays announcement set expectations for two more rate hikes this year conditional on the data.

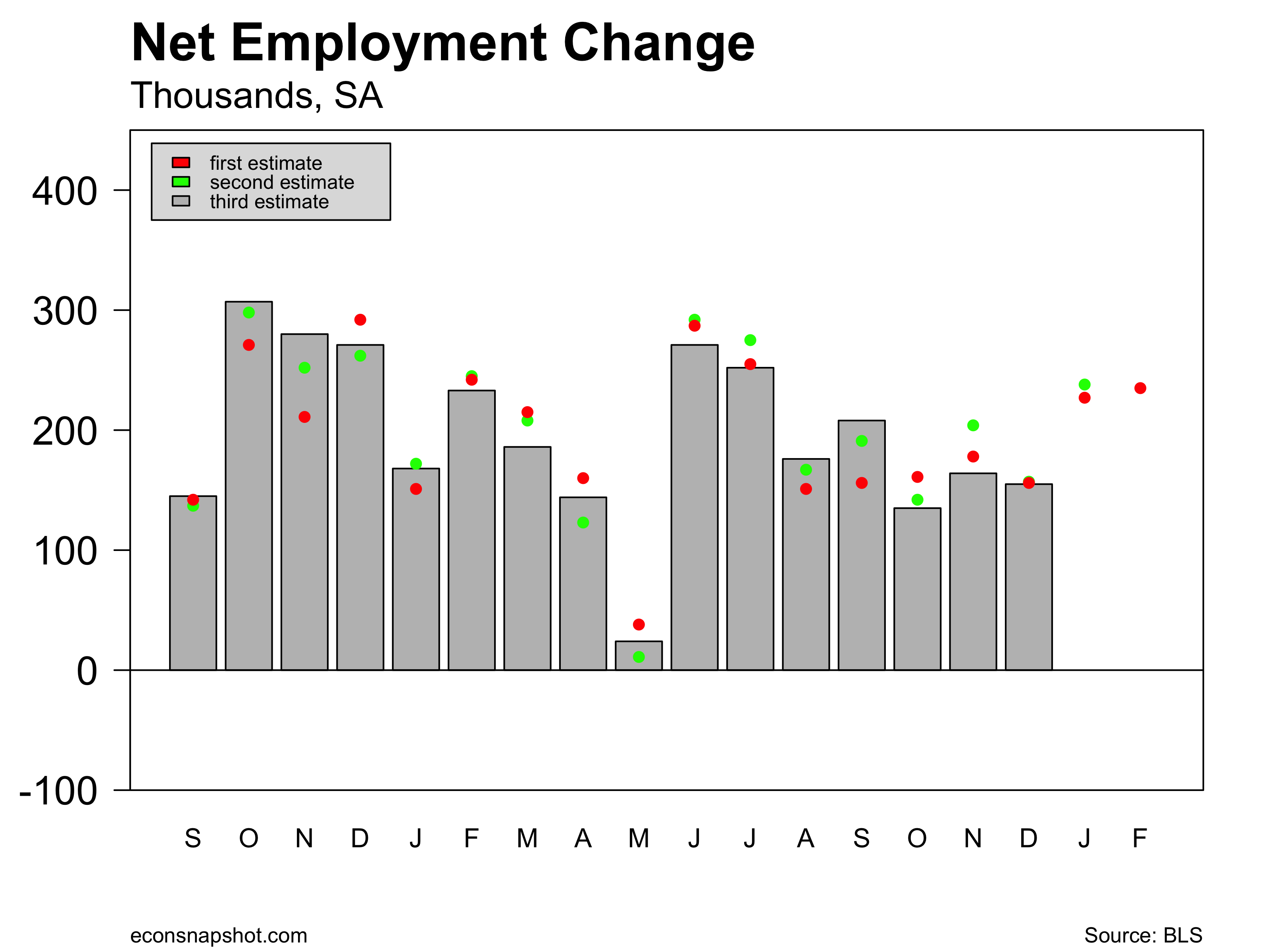

The last compelling piece of evidence fell into place with the release of the establishment survey last Friday by the BLS. It showed continued strength in the labor market. Payroll employment increased 235,000, with gains spread across almost all sectors. Retail trade, however, was down 26,000 and employment in motor vehicles and parts declined by 8,000. The private sector added 227,000 and government added 8,000. The mining sector (oil and gas mainly) added 9,000. Payrolls were revised up 11,000 in January and down 2,000 in December.

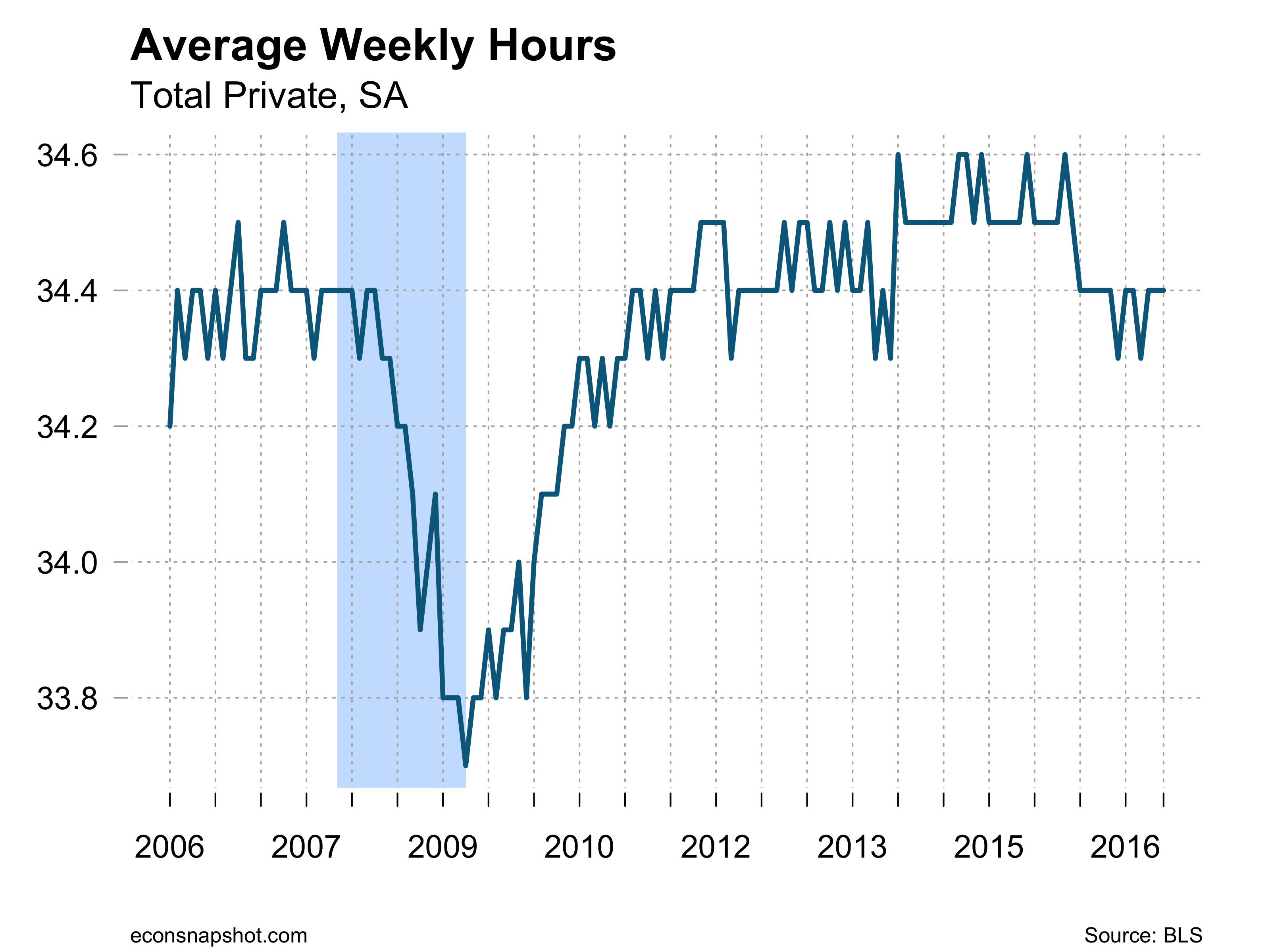

Average weekly hours remained at 34.4, although the index of aggregate weekly hours increased 0.2%. Average hourly earnings moved up slightly, from $26.03 to $26.09.

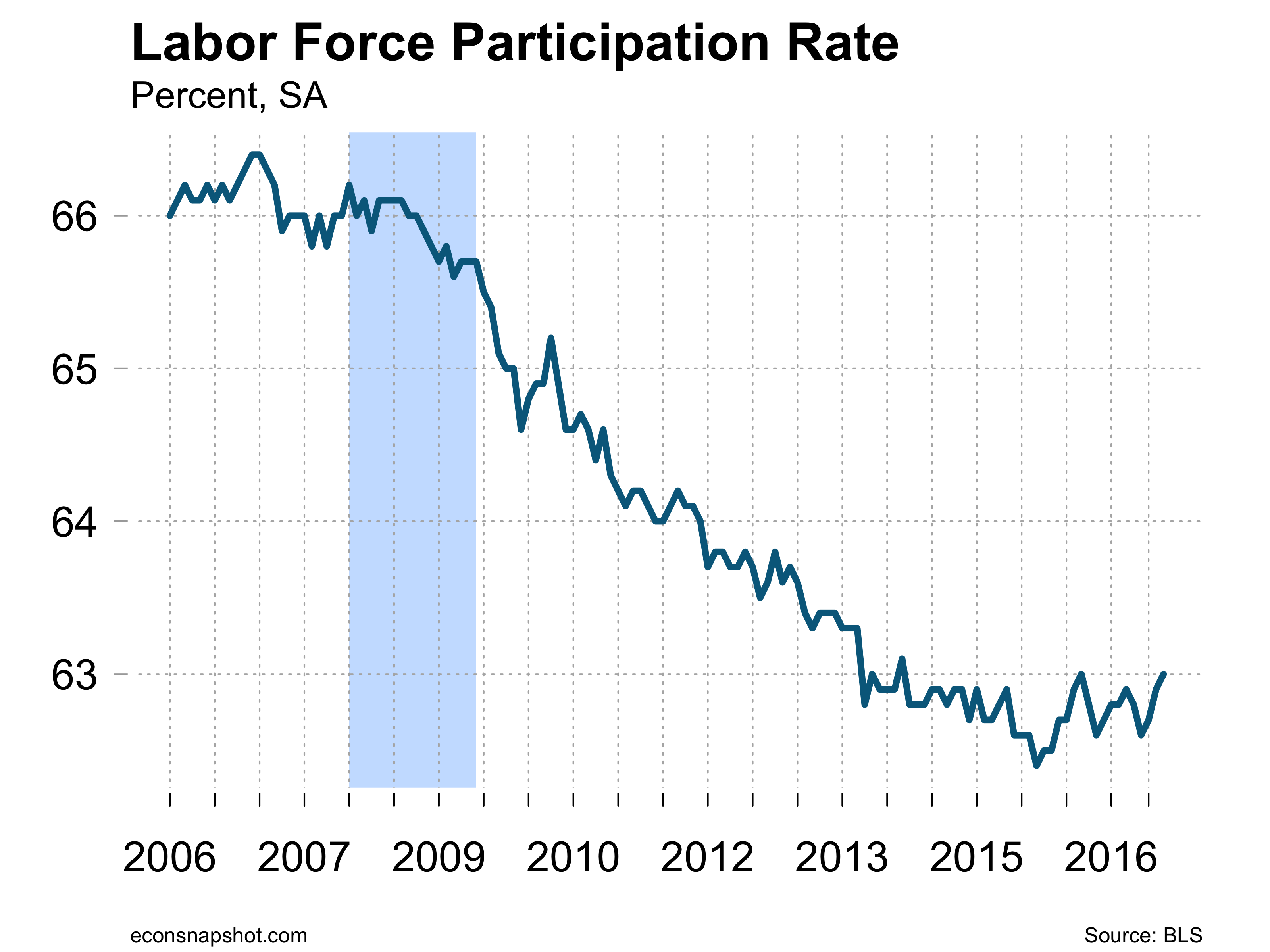

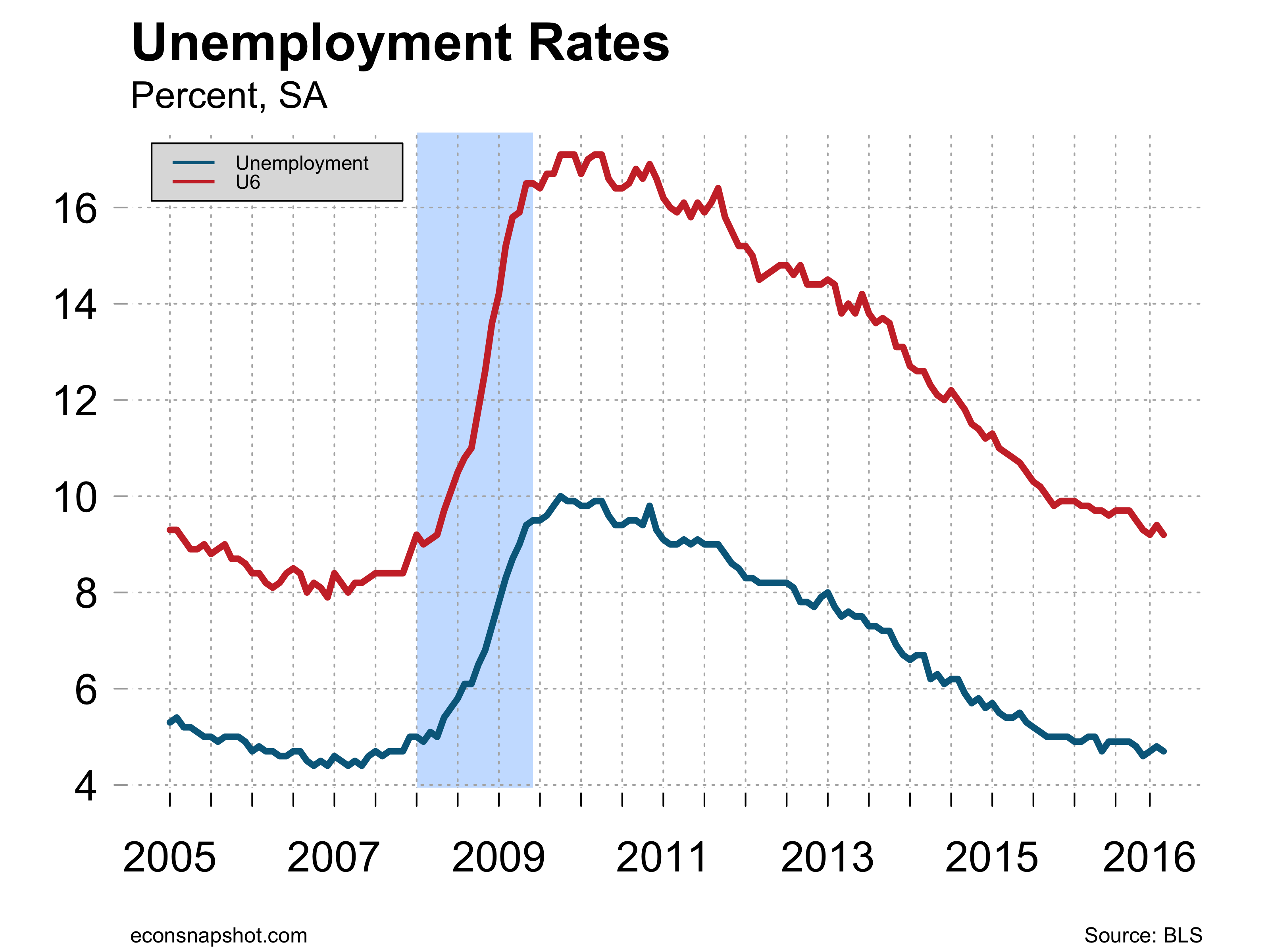

The household survey admitted a surge in employment of 447,000. The employment to population ratio also increased, from 59.9 to 60.0. The labor force participation rate increased, from 62.9 to 63.0 as a result of a 340,000 increase in the labor force. The number of persons unemployed dropped by 107,000, leading to a drop in the unemployment rate from 4.78% to 4.70%. In addition, the number of persons unemployed more than 15 weeks dropped by 184,000.

This is a remarkably healthy picture of the labor market, a contrast to the way it was depicted by the President Trump prior to his election. But our analysis of the election results in November highlighted the importance of manufacturing job losses for Trump’s victory. His primary message to voters was a promise to save and create traditional blue collar jobs. In this and subsequent posts we are going to track where the jobs are being added with the goal of providing a more nuanced picture of how the labor market evolves under this administration.

Where the Jobs Are

As a starting point it is useful to note that for several decades employment growth has been dominated by increases in service sector jobs. Manufacturing jobs have been in secular decline as a share of the labor force. That is the underlying reality of this economy.

Against this long term background, we can contrast recent employment growth in what are traditional blue collar jobs – manufacturing, construction, mining. Manufacturing has not recovered from the decline following the great recession, while construction has been steadily rebounding from it’s trough. Mining, which includes the energy sector, rebounded rapidly from the recession, driven by high oil prices, and has since collapsed as prices fell. The least volatile component of employment is services, rebounding steadily since 2009. Although much attention has been focused on manufacturing and other traditional blue collar jobs the blue collar jobs of this economy in the future are in the service sector – in health care, retail and the like. So it is misleading to focus only on the traditional blue collar jobs.

Ultimately, the test of this administration will be how many jobs it generates relative to the working population. There is no perfect indicator of this, but one useful benchmark is the employment to population ratio. In the graph below we show how the employment to population has evolved over various presidential regimes. The clear champion job creator was Ronald Reagan followed by Bill Clinton. In subsequent posts we will track how the current administration compares as well as tracking where the jobs are created.