By Thomas Cooley, Ben Griffy and Peter Rupert

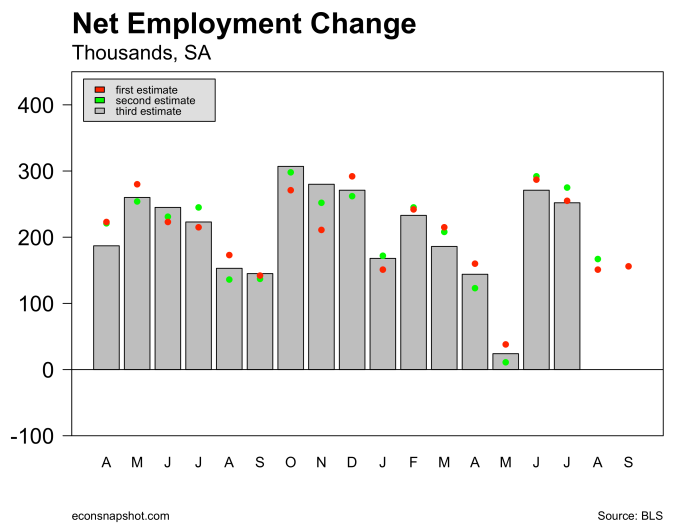

The Bureau of Economic Analysis release of the first estimate of Q3 GDP showed the economy expanded at a 2.9% clip at an annualized rate, the largest growth rate in two years. The 2.9% rate was more than double the 2nd quarter rate of 1.4%. The solid GDP report, combined with a labor market that continues to provide new jobs, will give the Fed all the leeway it needs to increase rates in December.

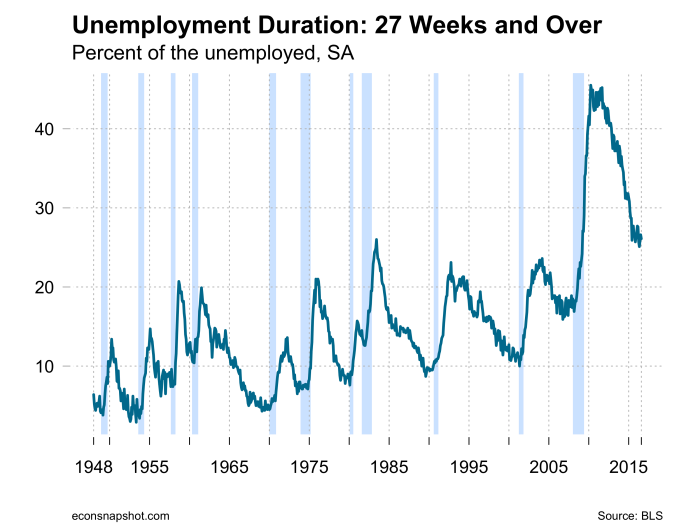

It seems important to point out that in spite of the good report, growth coming out of the recession still pales relative to growth coming out of previous recessions. That has been the story for seven years even though we have seen some robust quarters.

Personal consumption expenditures showed a somewhat muted 2.1% rise.

Residential investment has shown weakness over the past two quarters, -7.7% in Q2 and -6.2% in Q3, after two years of positive growth. Non-residential fixed investment has also been quite weak over the past year or so. In general, investment continues to be a disappointing feature of the data.

Some of the strength in GDP came from a rise in net exports. Exports rose in spite of a stronger dollar and imports stayed flat.

It remains to be seen if the improved growth can be sustained. There are many uncertainties – the election, the path of Brexit, the future of trade deals, and so on. These are weighing on expectations and may be reflected in Q4 GDP growth.