By Thomas Cooley, Ben Griffy and Peter Rupert

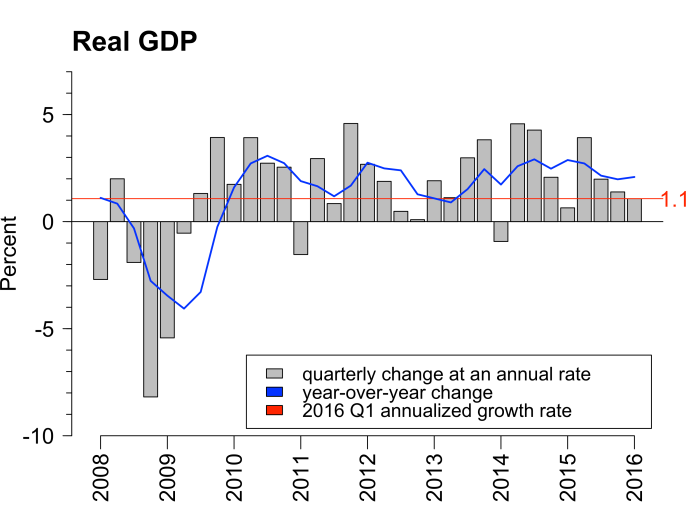

Today’s announcement of a 1.1% increase for the final estimate for Q1 real GDP from the BEA produced a small upward revision from the second estimate (was 0.8%), but more than doubled the advance estimate (was 0.5%). While the upward revision was certainly welcome, the overall picture is still one of weak growth overall.

Consumption spending drove most of the increase in growth, personal consumption expenditures grew +1.5% and the services component at +2.1%. Gross private domestic investment declined -1.8% and has declined for three consecutive quarters. Nonresidential structures and equipment fell substantially, -7.9% and -8.7%. Residential structures, on the other hand, grew at its highest rate in over two years, +15.6%.

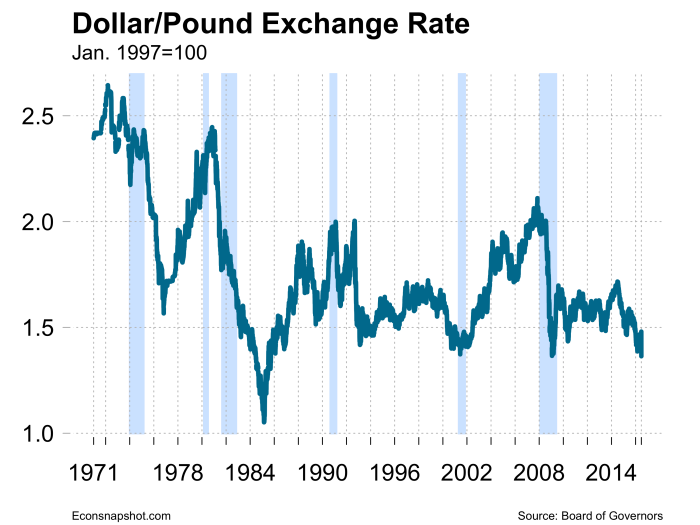

The weak-ish growth and the Brexit have contributed to the overall global uncertainty concerning future growth–and future policy. The dollar-pound exchange rate fell to its lowest level in about 30 years, as of this writing on July 1, it is 1.33 dollars per pound. Not to mention England lost to Iceland 2-1 (which we term “Brexit II”)!

The real effects of Brexit will take some time to sort out. How the EU reacts remains to be seen. In the short run, however, uncertainty can have real effects. Investment is likely to decline in both the UK and EU given the uncertainty surrounding future policy, such as tariffs and labor mobility. But note that tariffs and immigration controls are policy choices. If free and open trade and open borders benefit the citizens of the two areas then the choices by government should reflect that. However, as Chancellor Angela Merkel remarked, “Whoever decides to leave that family cannot expect all obligations to be omitted while keeping its privileges.”

Within the US, Brexit has been influential in causing the Fed to taper its stated goals of two interest increases during the year. Given the uncertainty surrounding Brexit and the EU, as well as the upcoming presidential election, this seems prudent. As the economy has been displaying tepid progress over the past few months in the United States, we can only hope that Brexit is not the final push for a teetering US and global economy.