Welcome to the Cooley-Rupert Economic Snapshot–our view of the current economic environment. Click here to go to the latest snapshot in one pdf document. Or, read on….

In the following pages we present a snapshot of the U.S. Economy in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. There has been much discussion of the current cycle as a “Great Recession” and many over-stretched comparisons to the Great Depression. Our view is that the best way to characterize the current state of the economy is to present the data in a way that allows comparison to the other post-1970 business cycles. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles, the dates as identified by the National Bureau of Economic Research. We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components – Consumption, Investment and Government Spending – and some relevant subcomponents. The next section summarizes the labor market and its important indicators. The third section shows the activity in credit markets and the final section summarizes the features of industrial production and inflation. All of the charts presented are based on data that is updated continuously. We welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data.

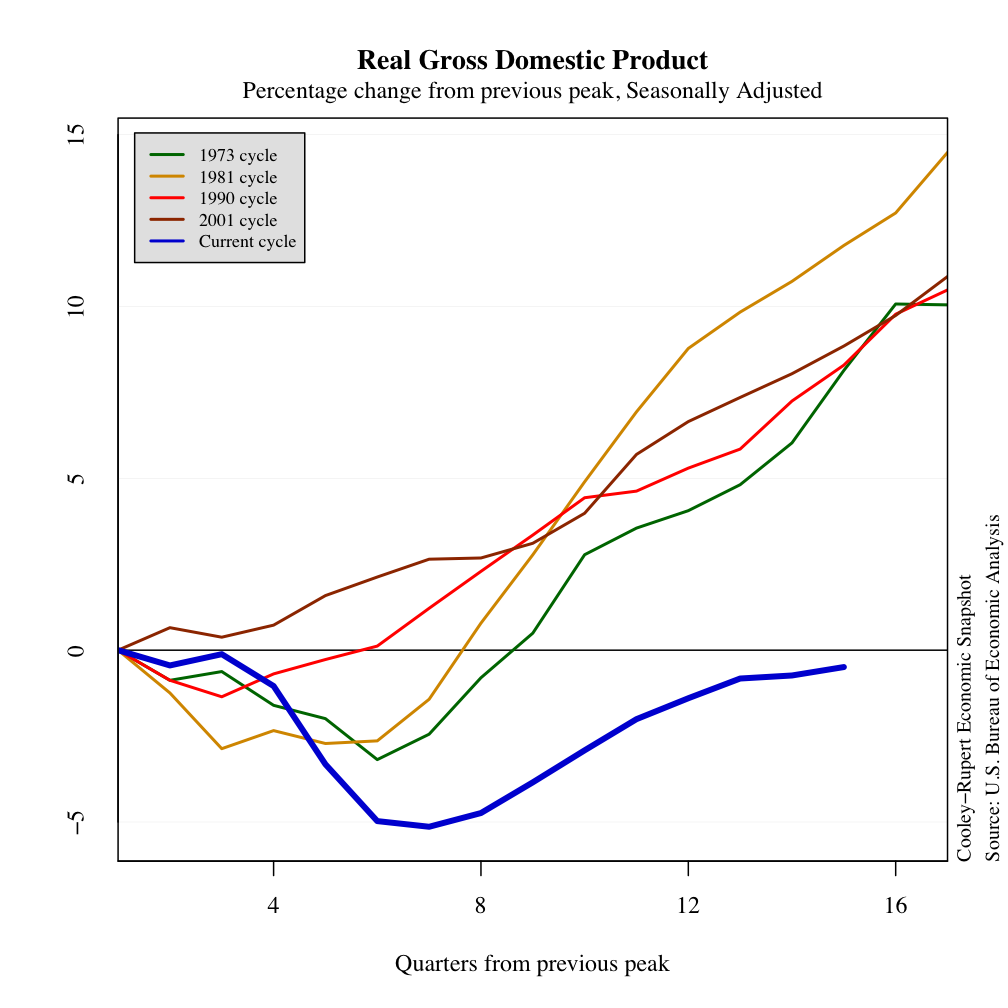

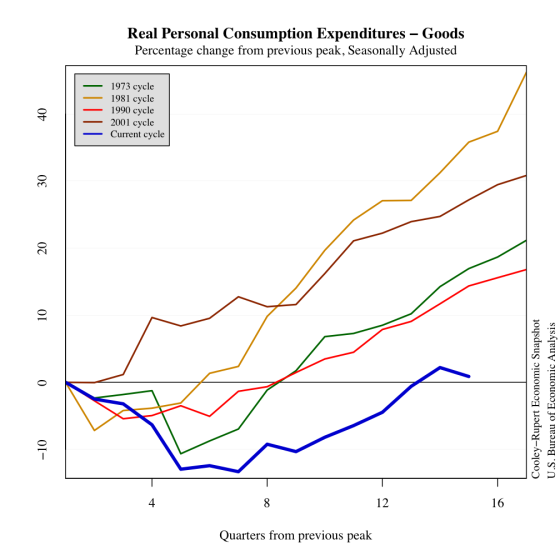

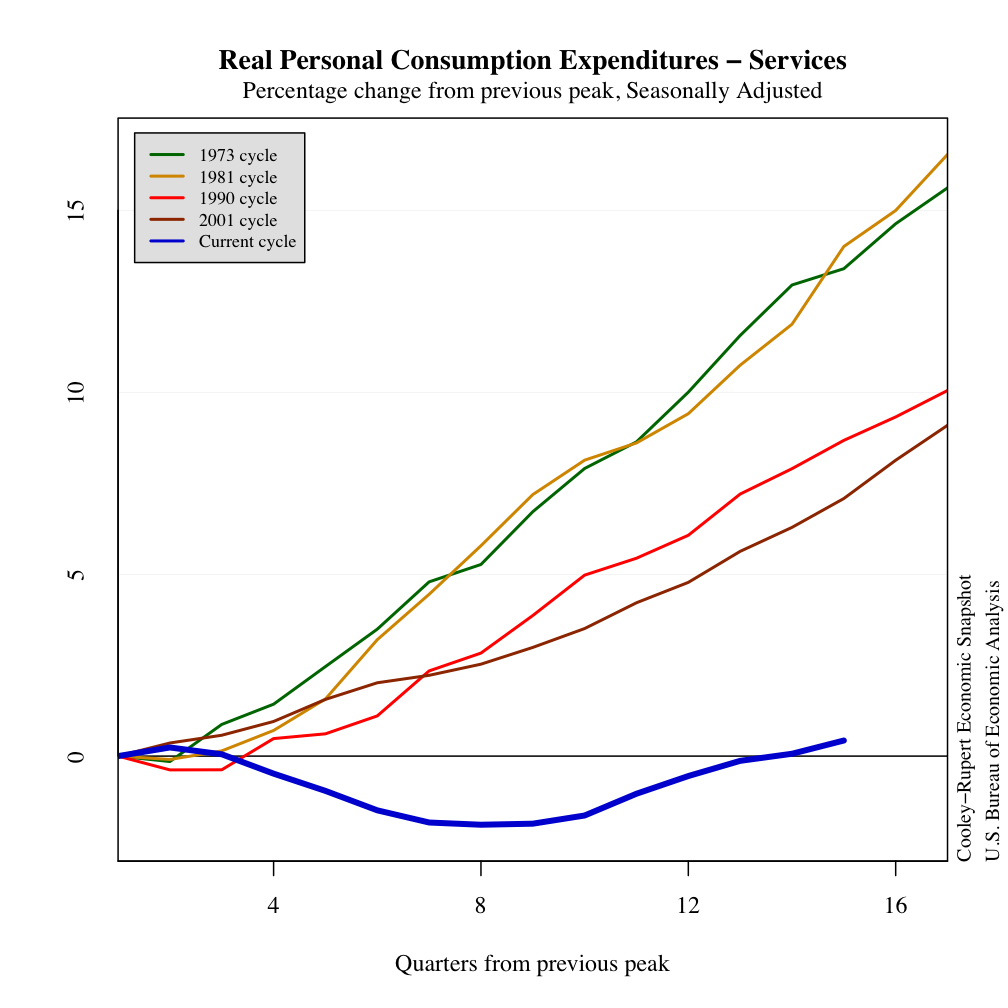

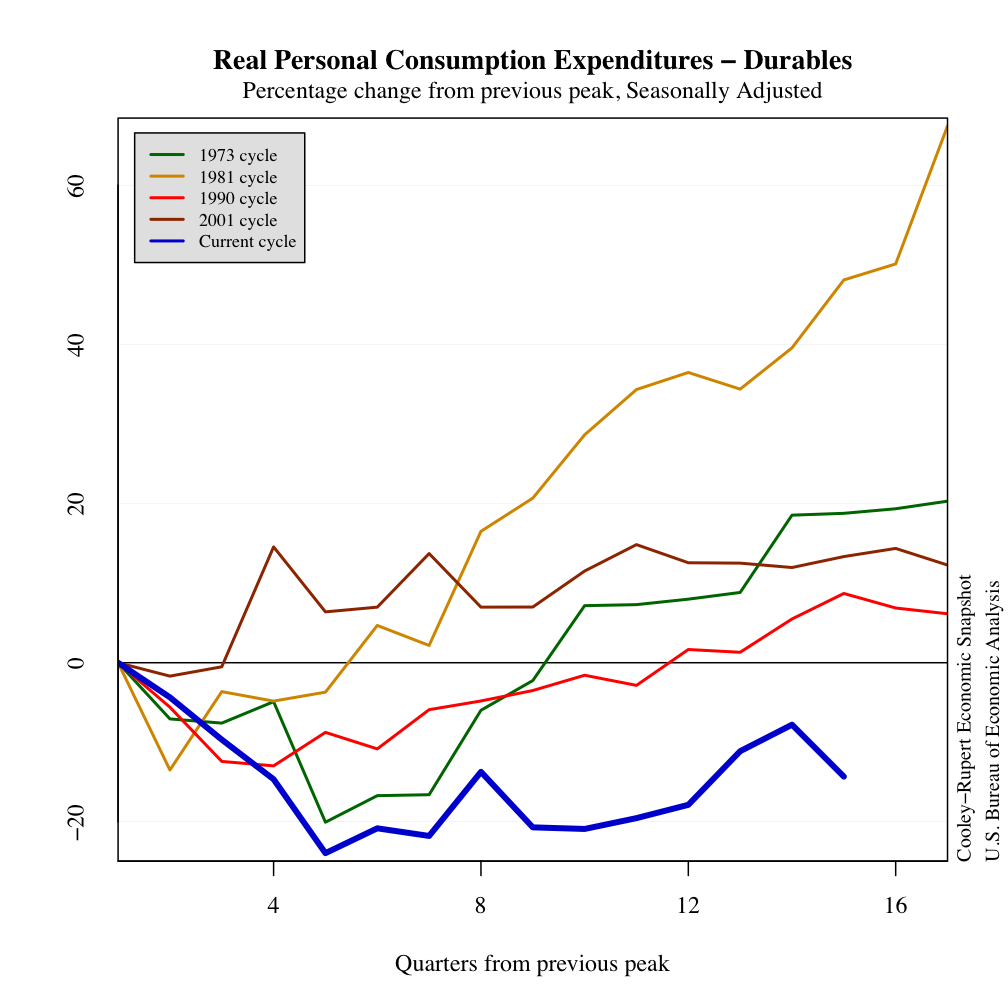

Gross Domestic Product

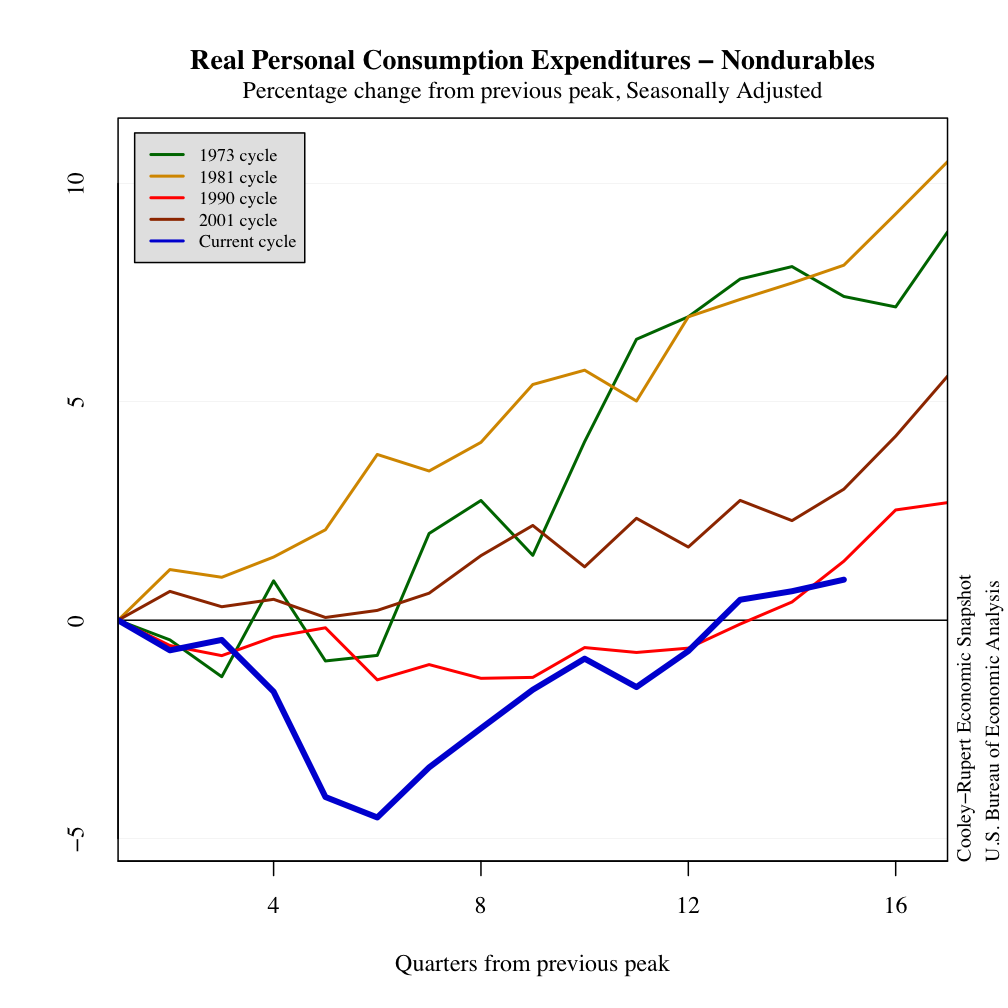

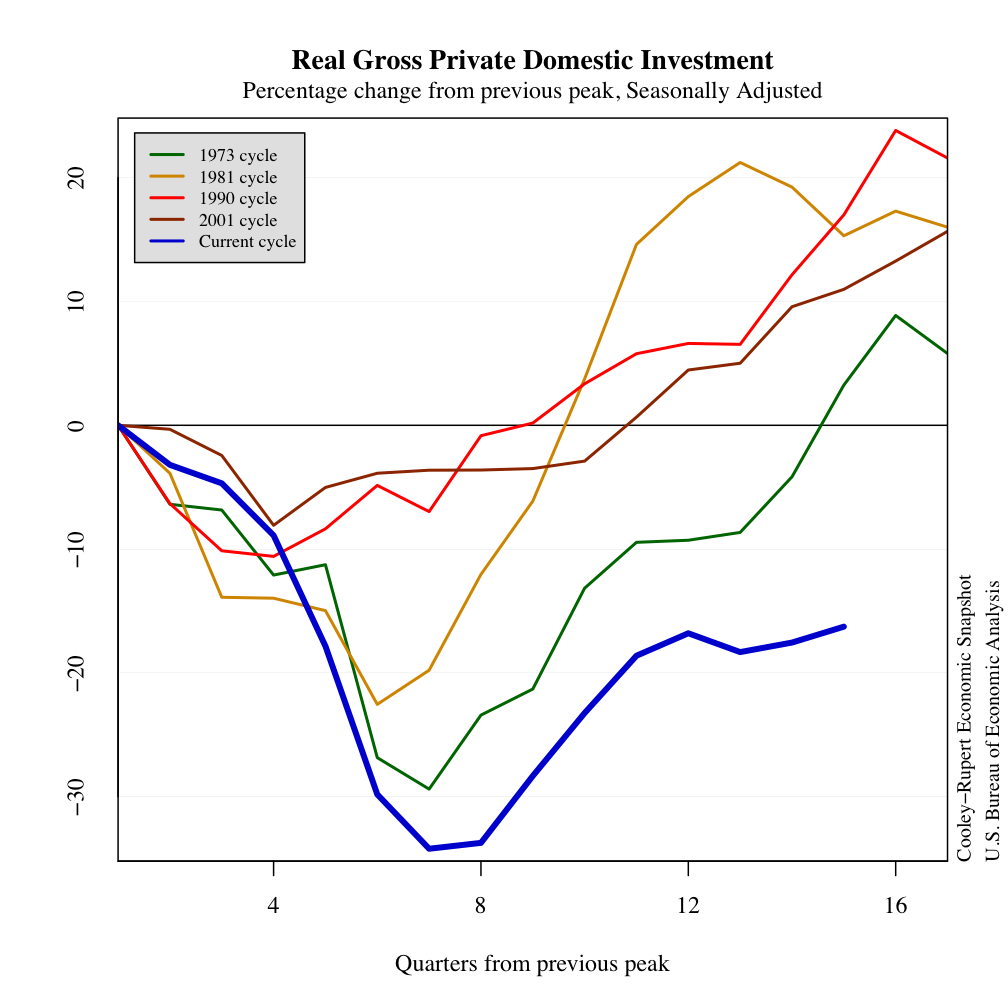

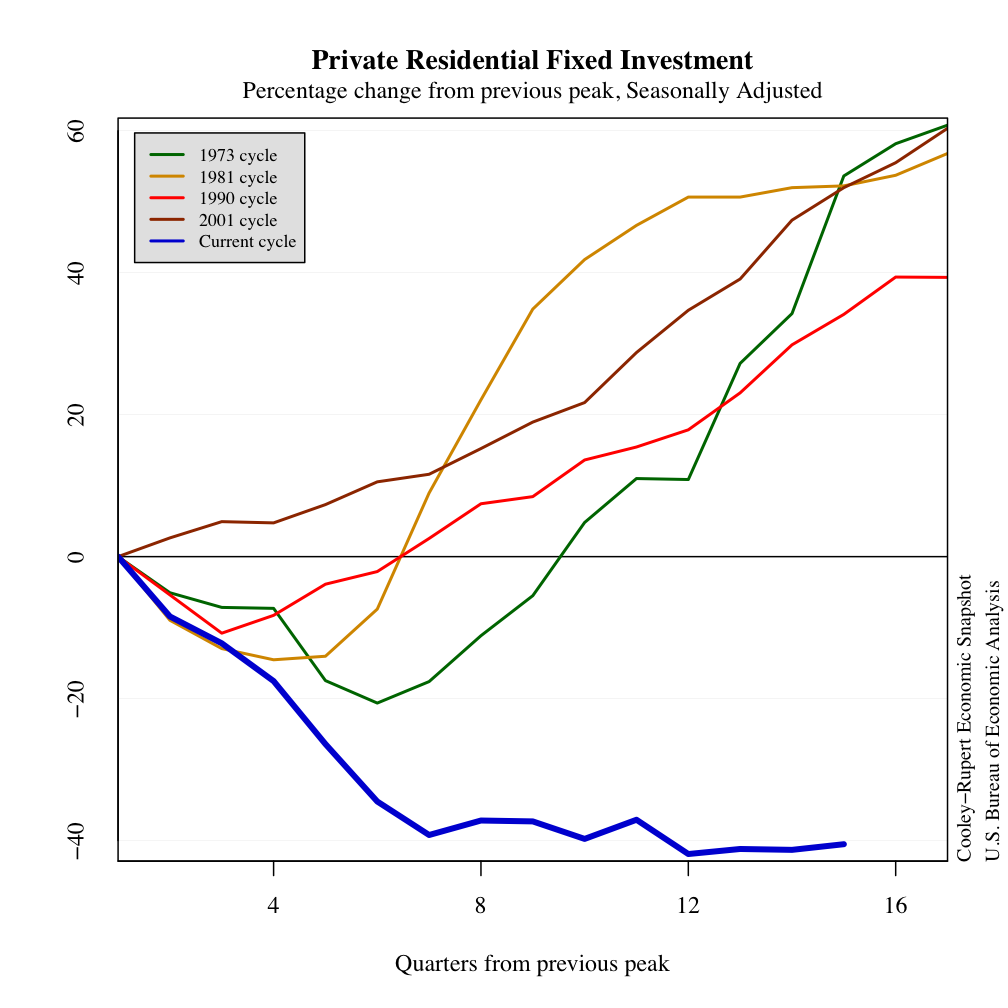

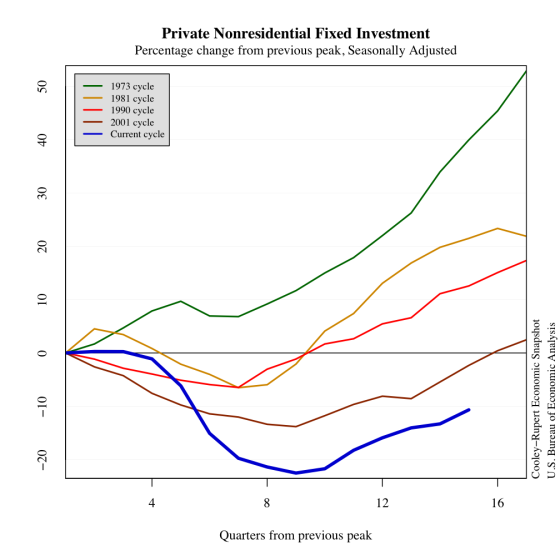

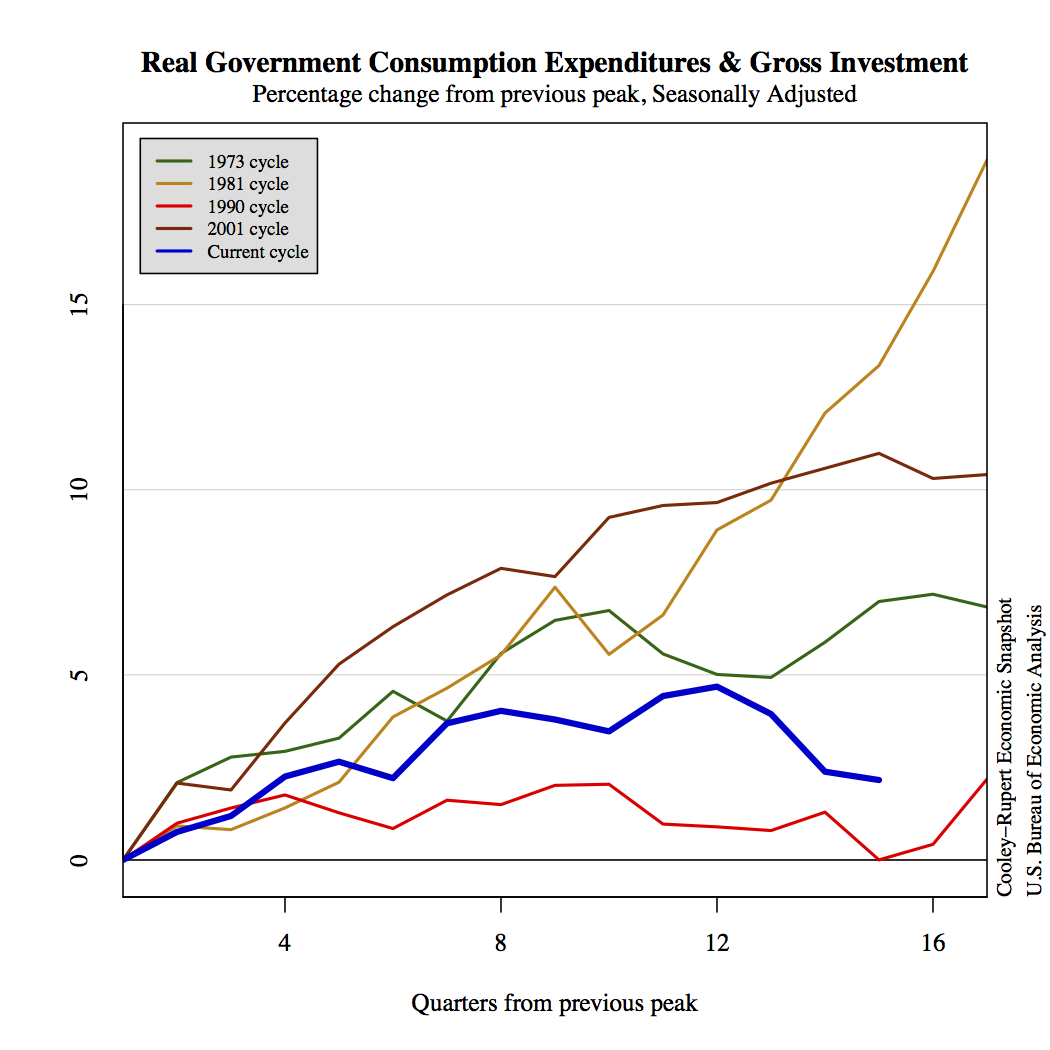

The most recent GDP numbers and the revised data for the first and

second quarter of this year show why there is renewed concern about a

double-dip recession. The economy has been largely stagnant this

calendar year after showing sign of recovery in 2010. Particularly

noteworthy is the behavior of Real Gross Private Domestic Investment

and in particular the component Private Residential Fixed

Investment. The latter continues to drag down GDP and is at levels not

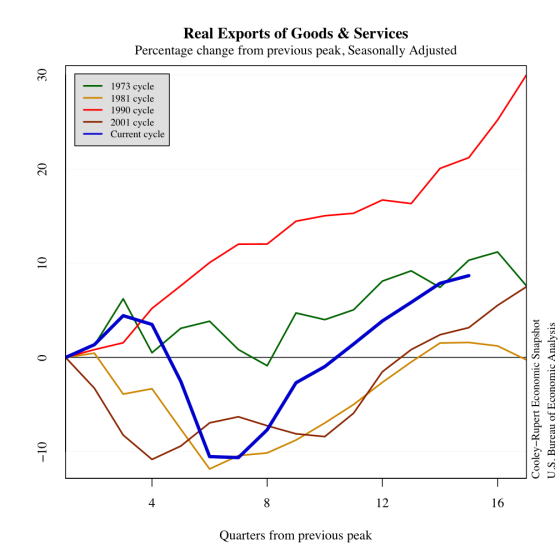

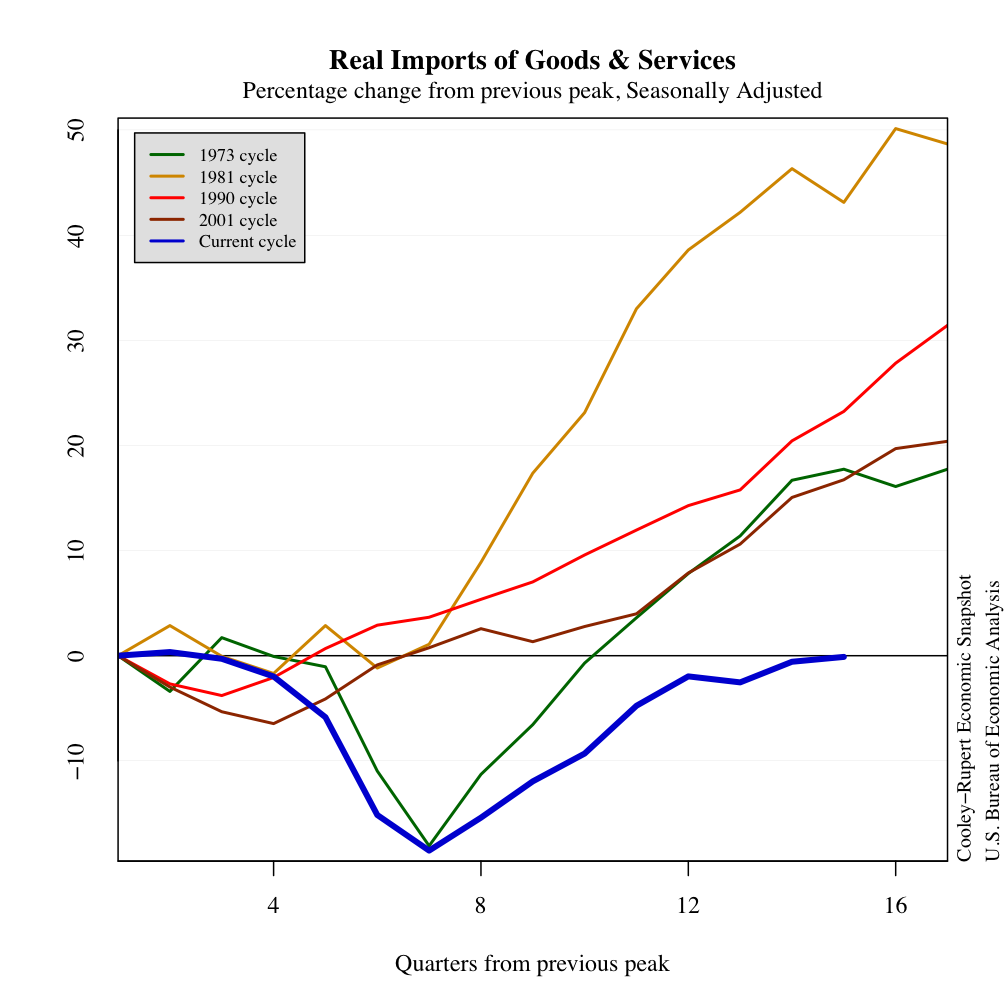

seen since the early to mid 1990’s. Exports and Imports are evolving

in a way that is similar to previous recessions.

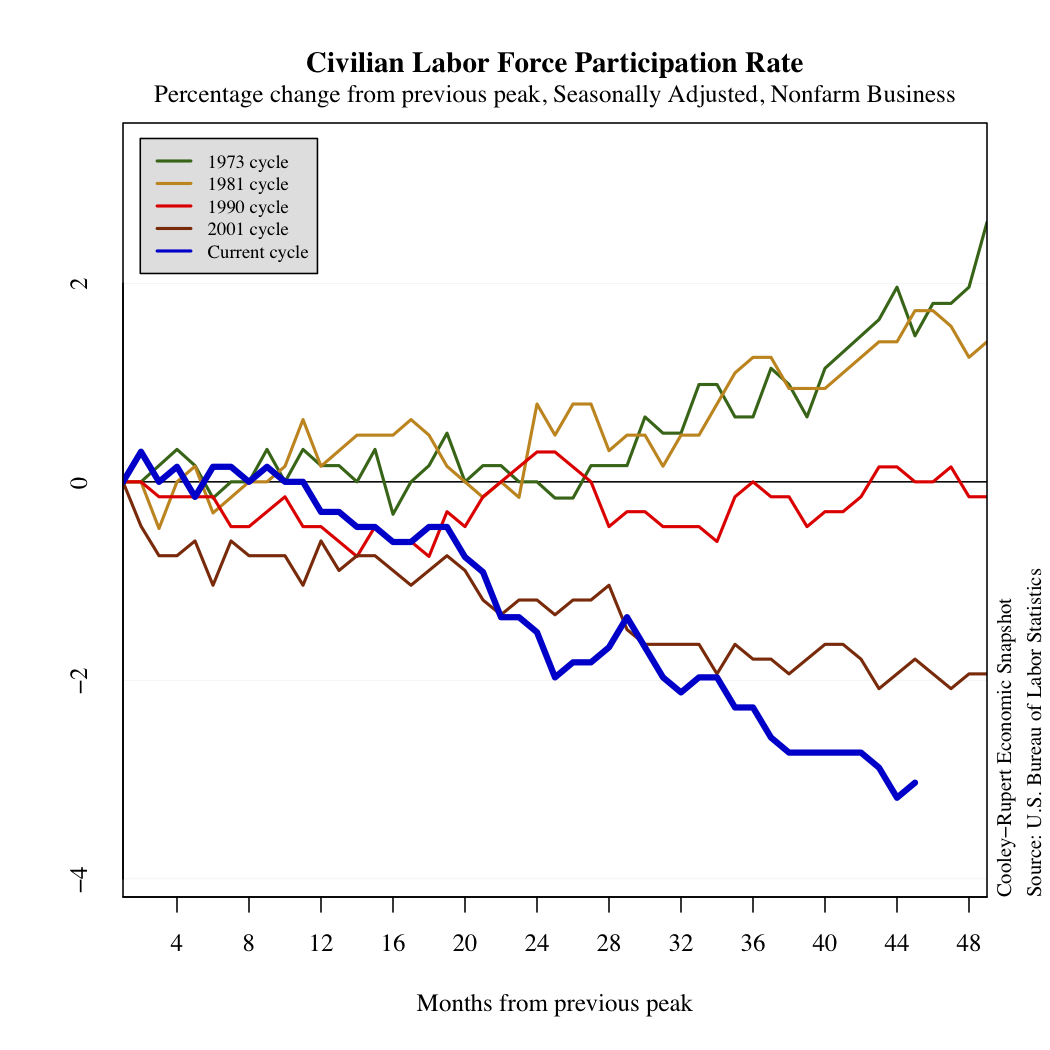

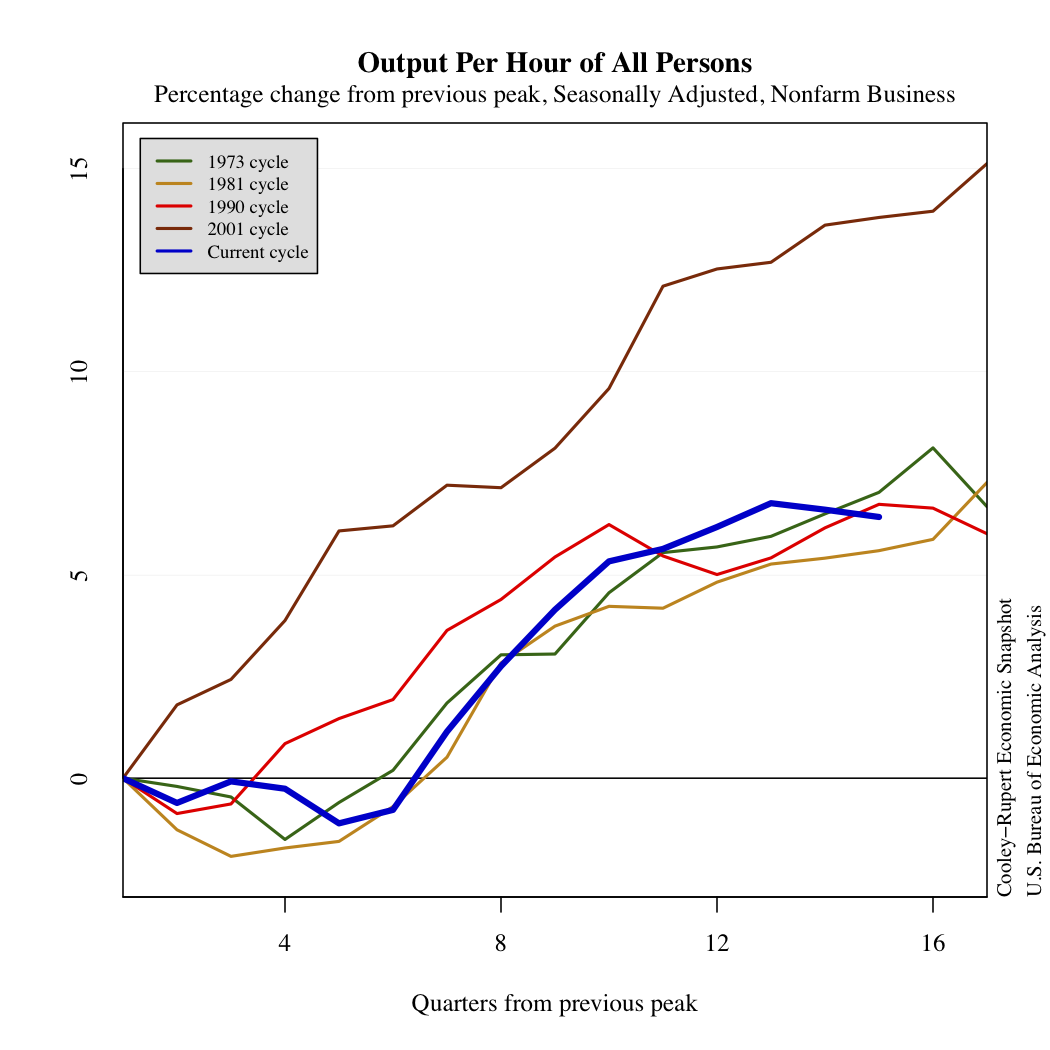

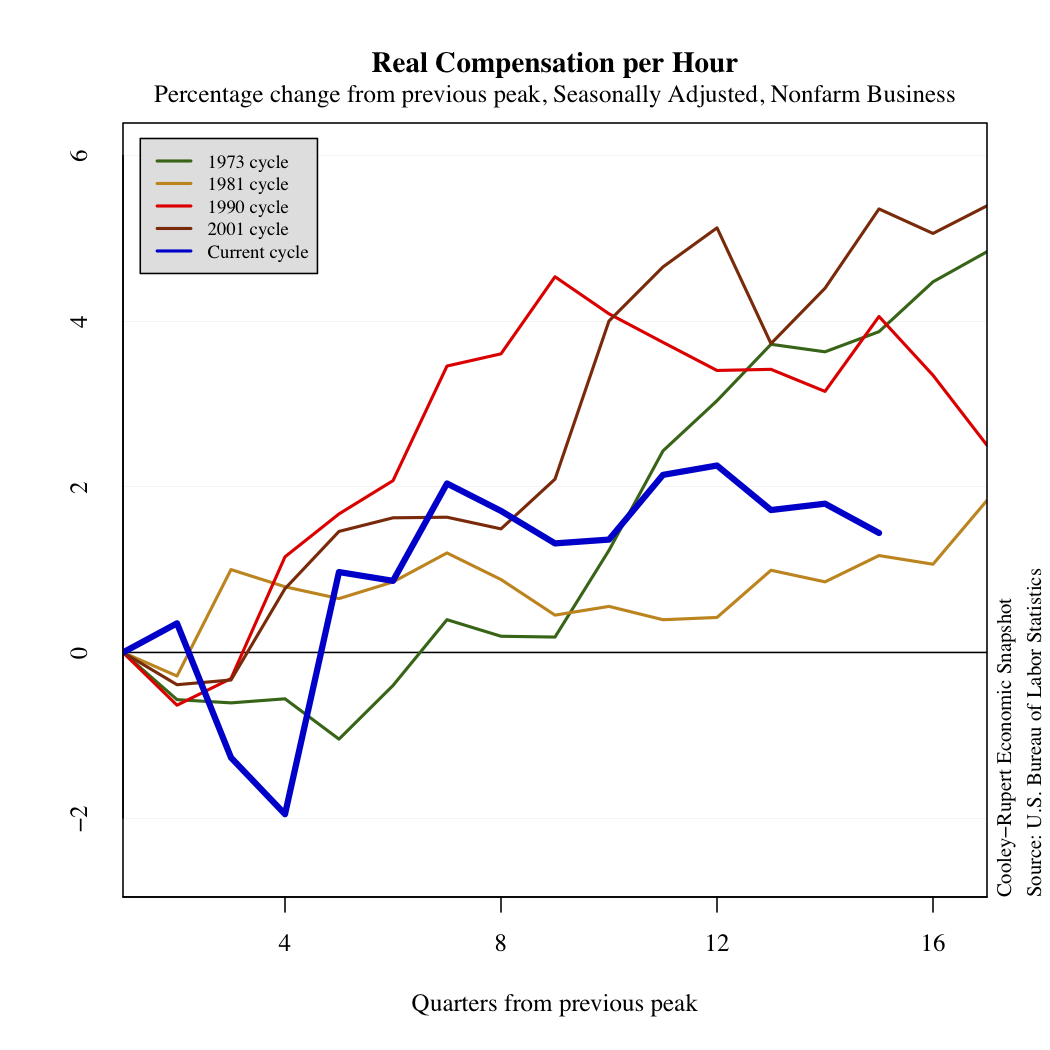

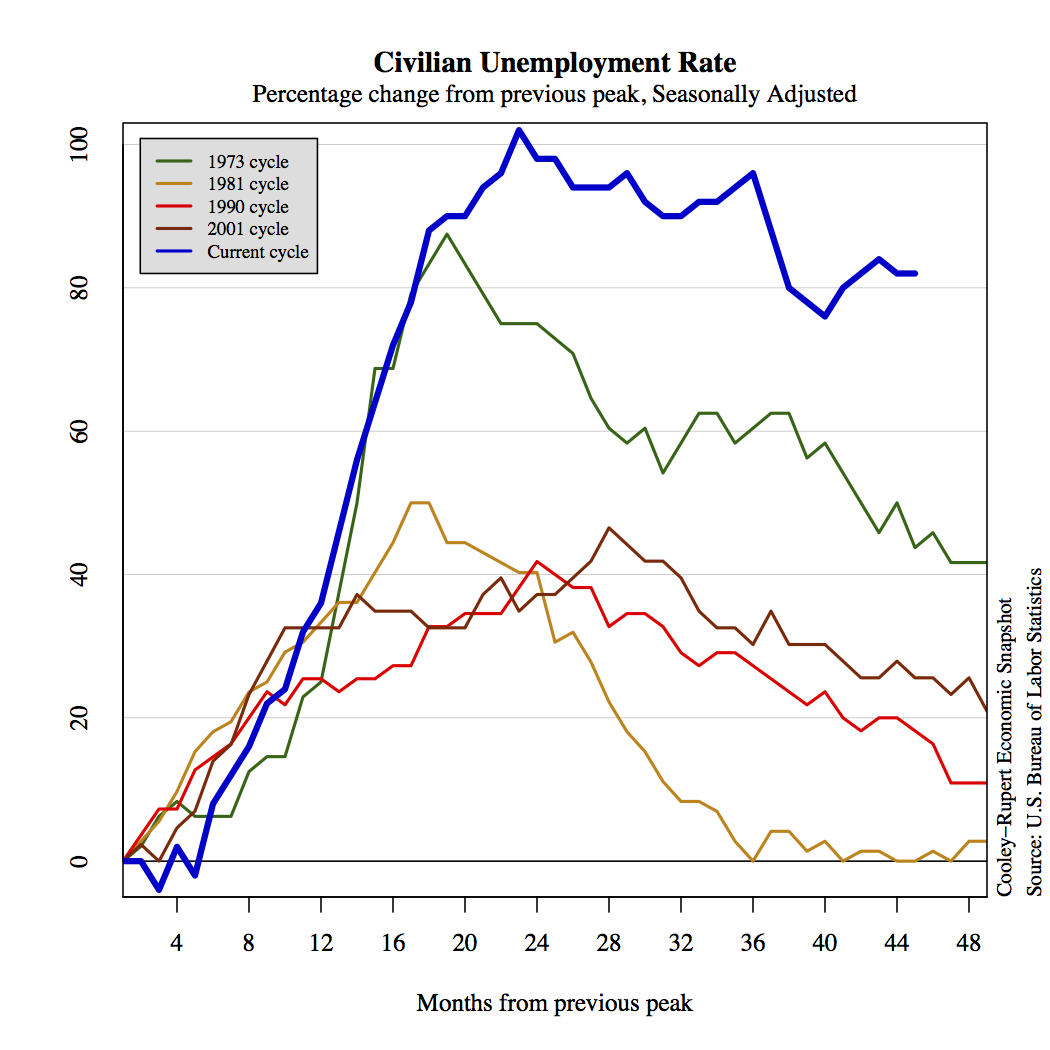

The Labor Market

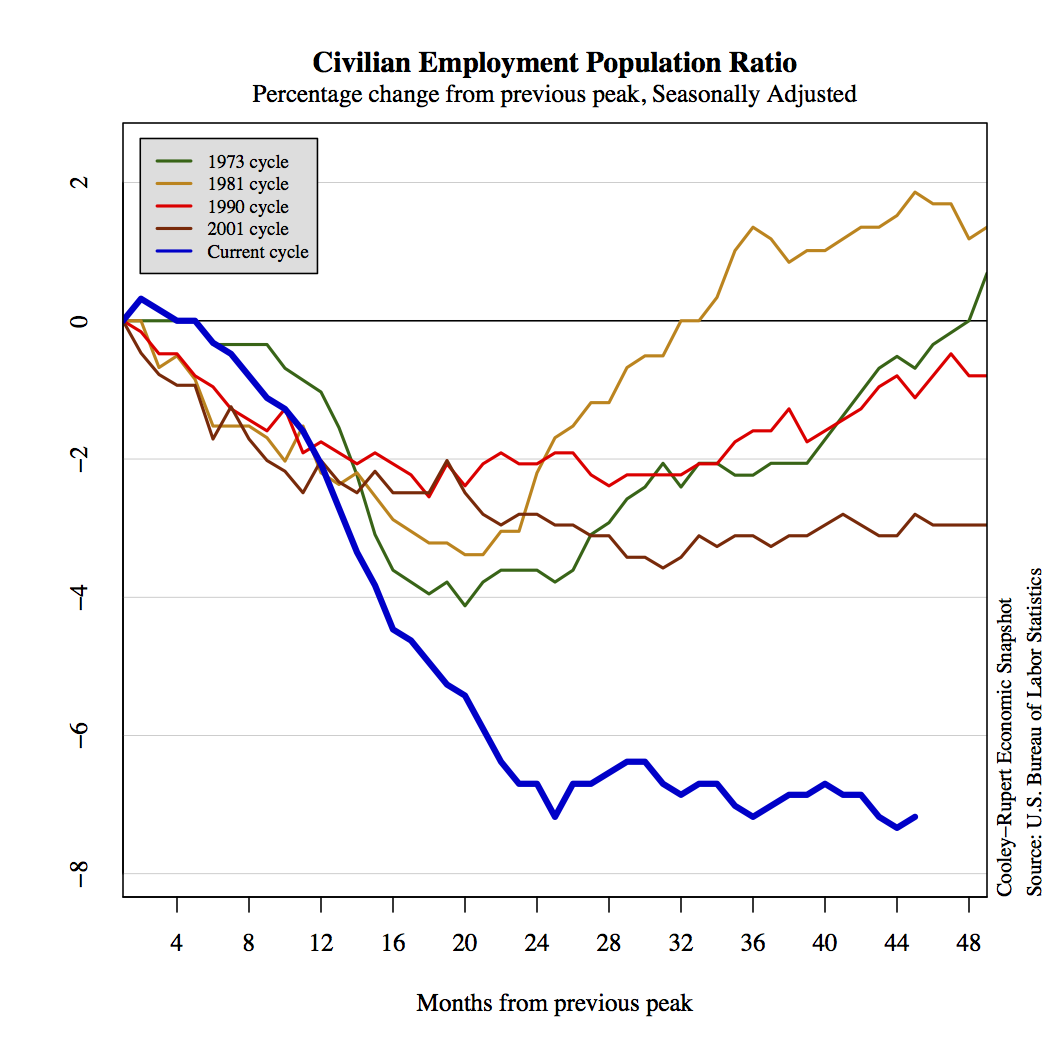

It is easy to understand why attention in this recession has focused

on the labor market and the stubbornly high unemployment

rate. Indeed, when the NBER dating committee dated the beginning of this past recession, they made it clear that the labor market was a key variable in their decision, as can be seen here. However, when the committee announced the trough there was no mention of the labor market, which has not shown any signs of recovery. Indeed, the paths of the employment/population ratio and the labor force participation rate make the strongest case for concern about a double dip recession.

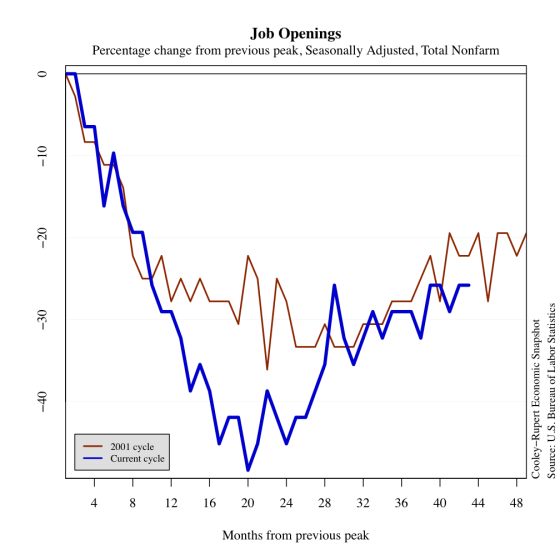

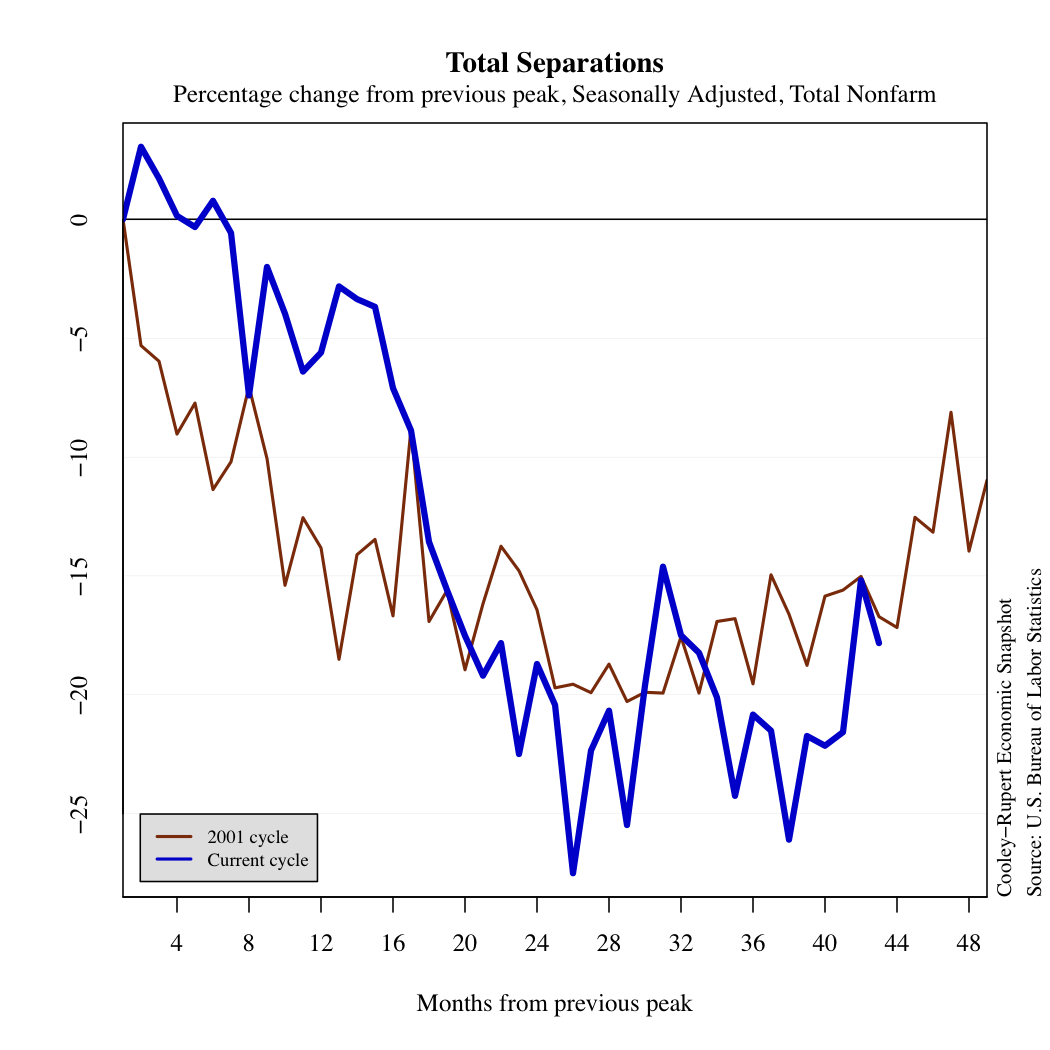

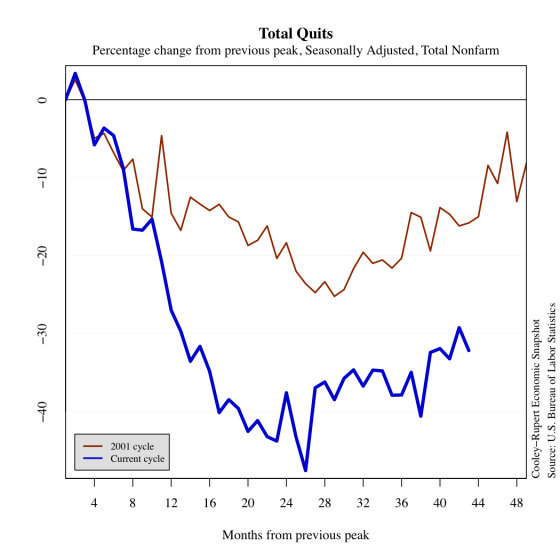

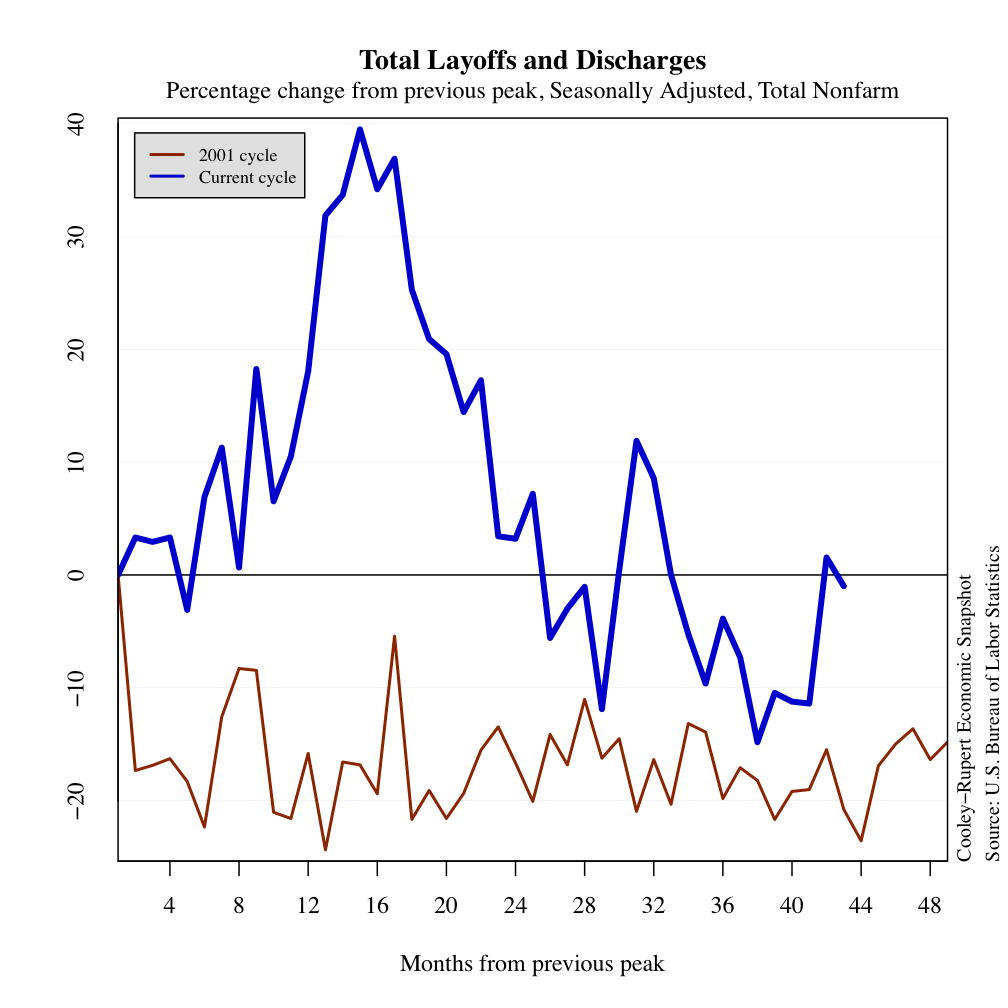

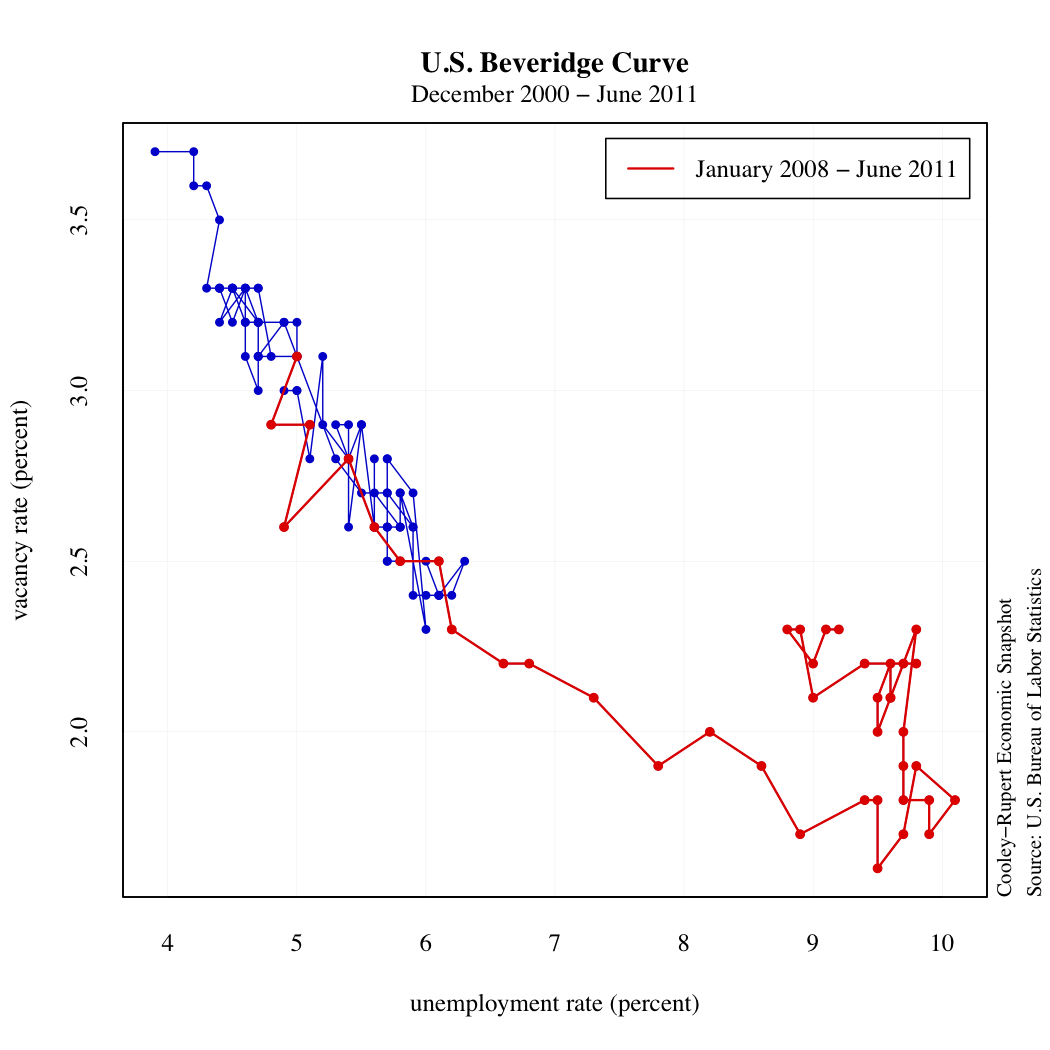

We also include data from JOLTS, the Job Openings and Labor Turnover Survey. These show some more refined features of the labor market and permit comparison to the 2001 business cycle. What stands out in these data is that, while separations look similar to the 2001 cycle, this masks the extraordinarily abrubt increase in layoffs and discharges and the sharp decline in quits.

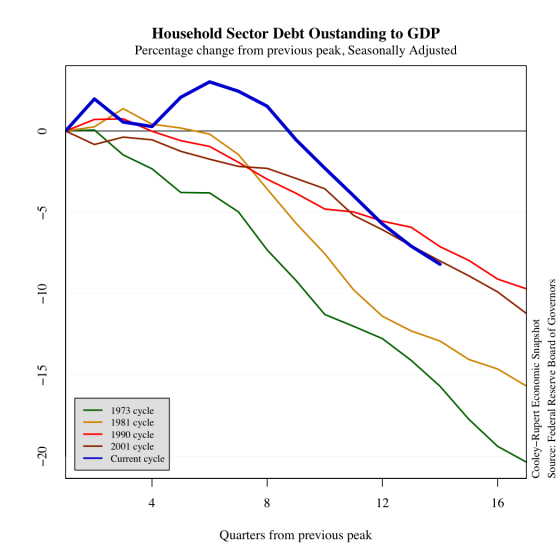

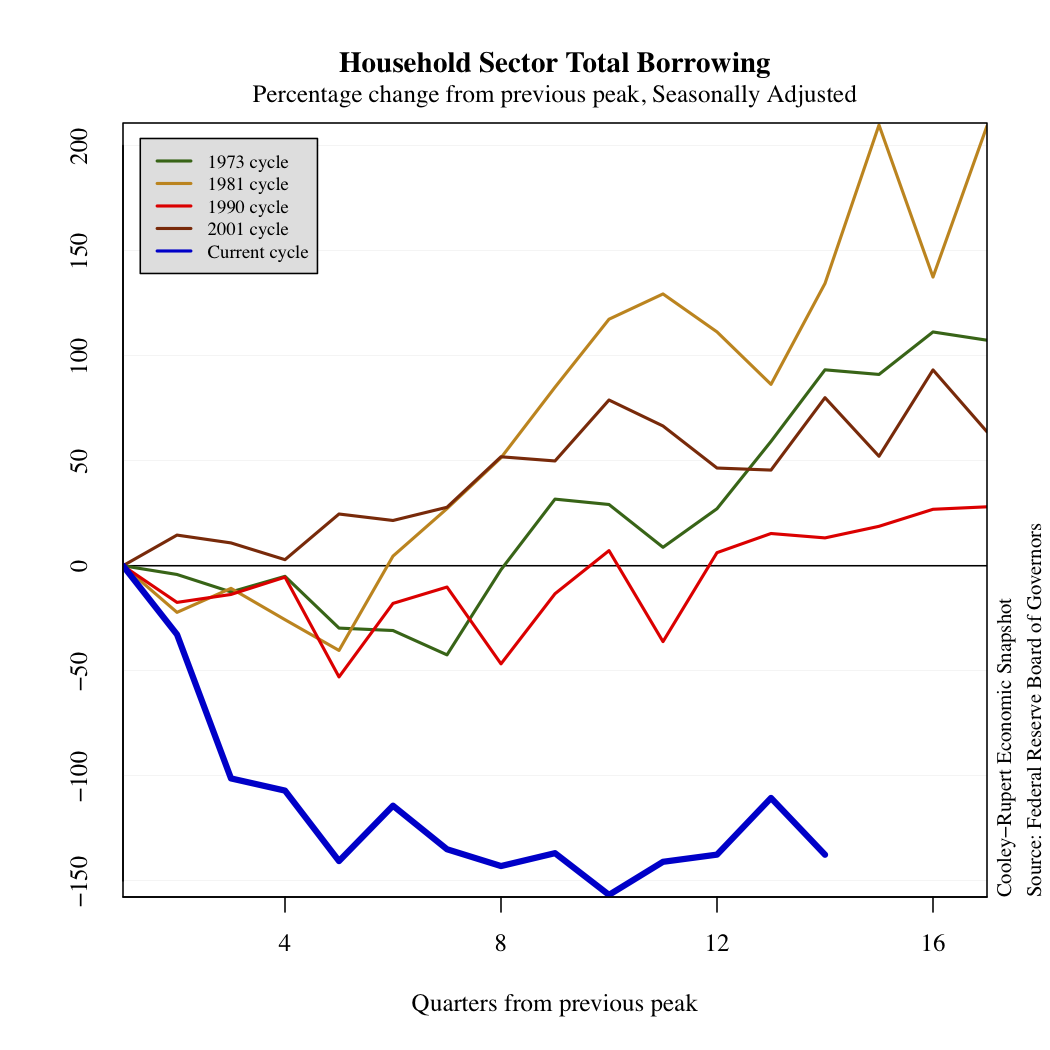

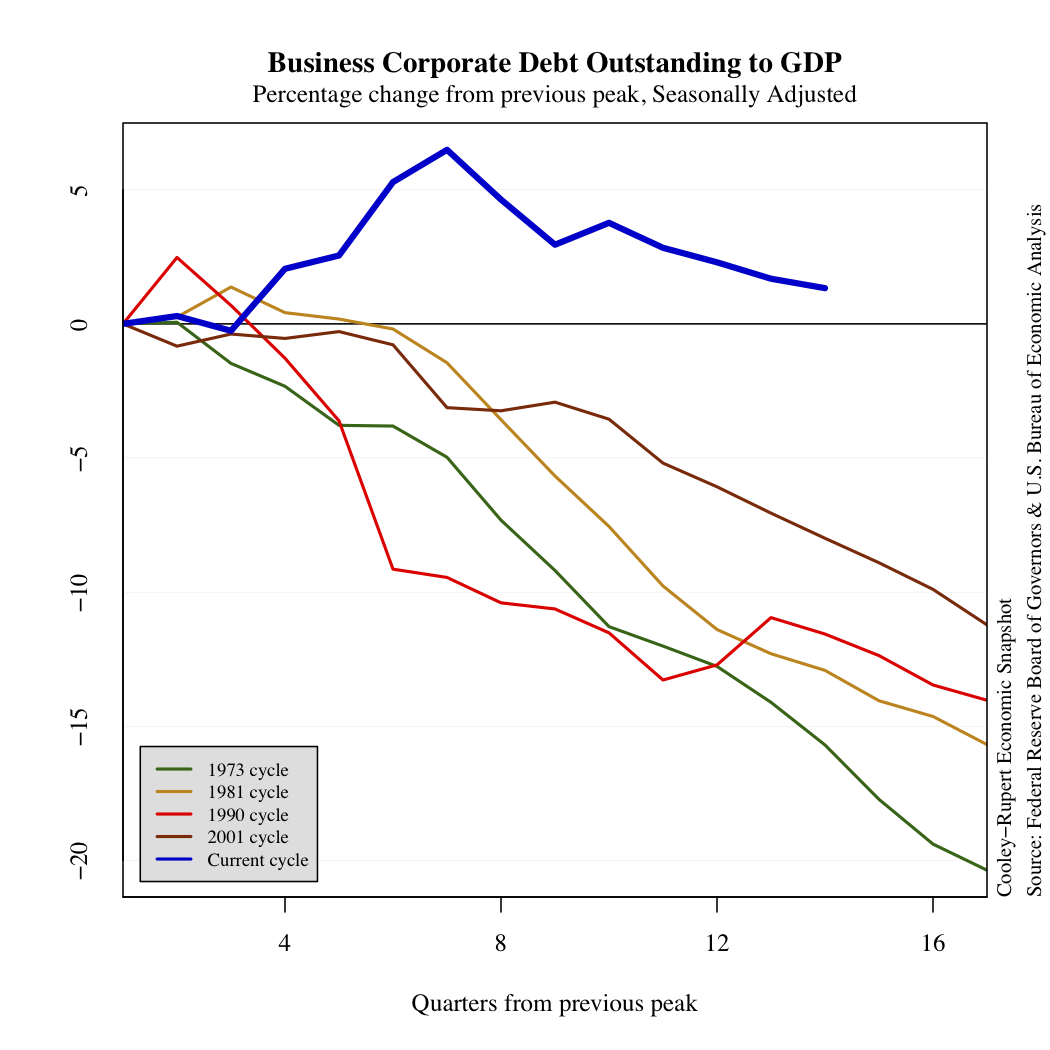

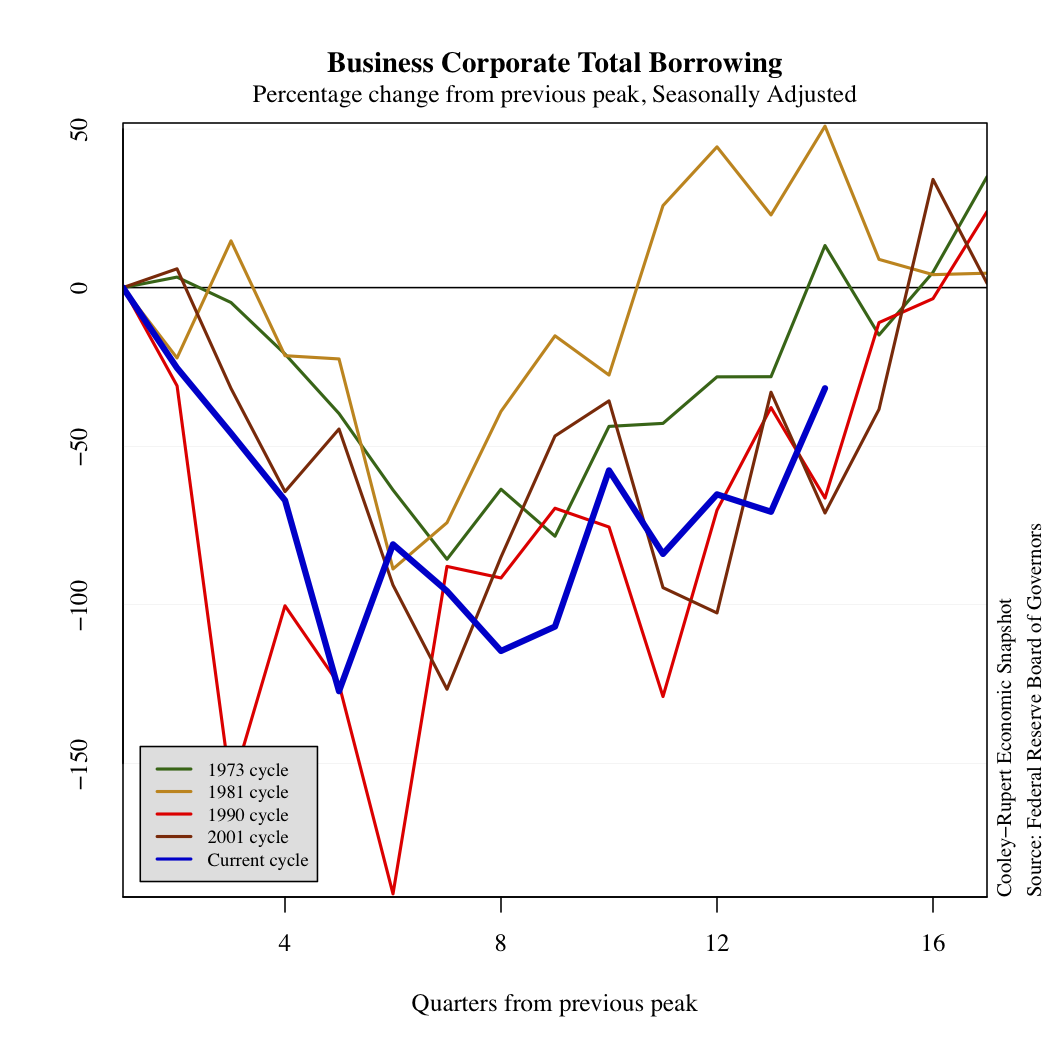

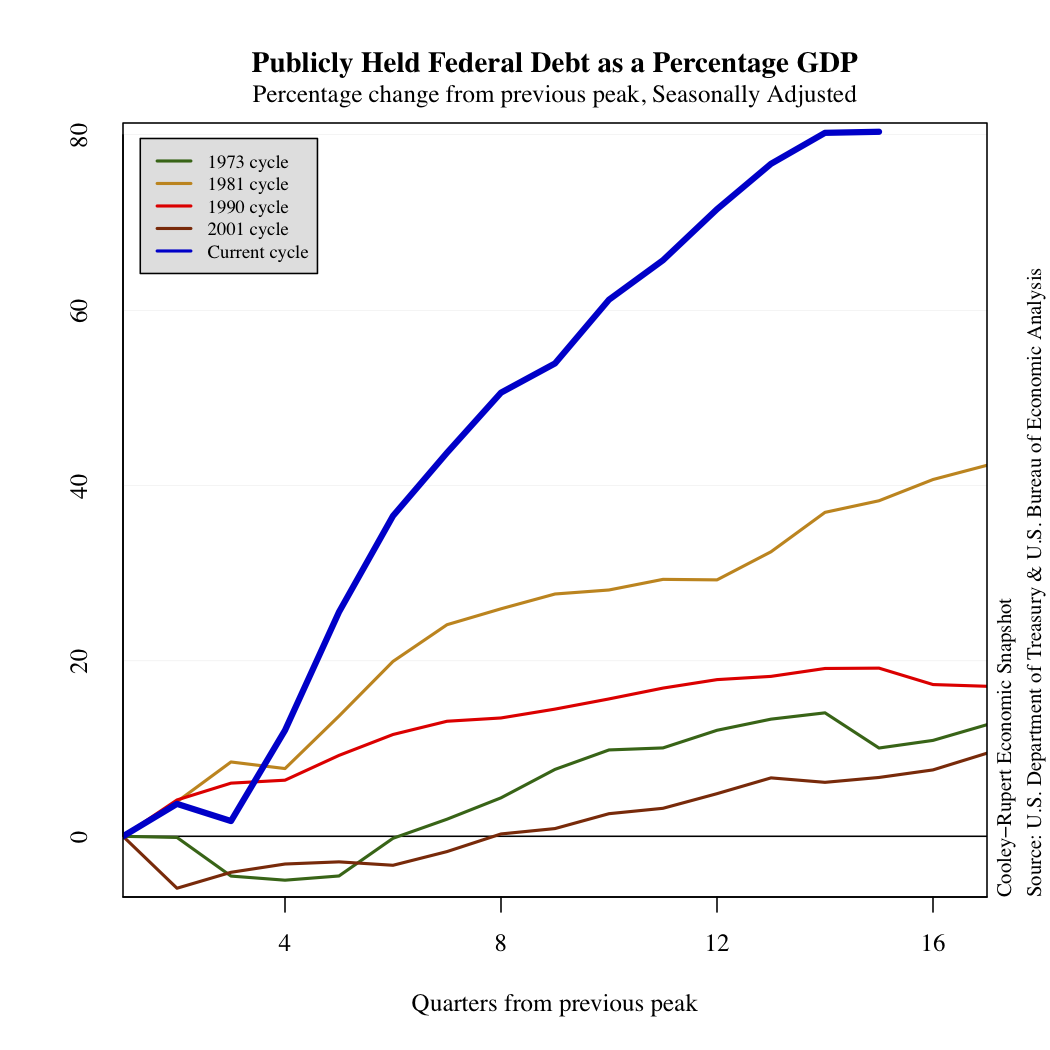

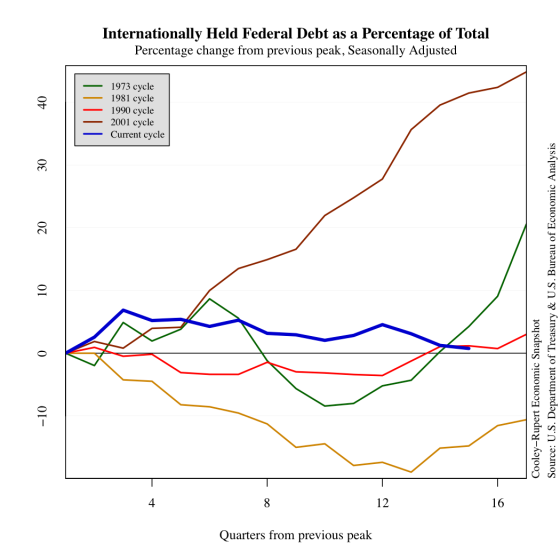

Credit Markets

Credit markets show the after-effects of the tremendous increase in

leverage that took place prior to the 2007-2009 crisis. Households are

continuing to reduce their debt and corporate sector borrowing is

following a path that is typical of prior recessions. The big story in

credit markets, however, is the dramatic shift of leverage to the public sector.

Public sector debt outstanding is reaching levels unprecedented in the

post-war economy.

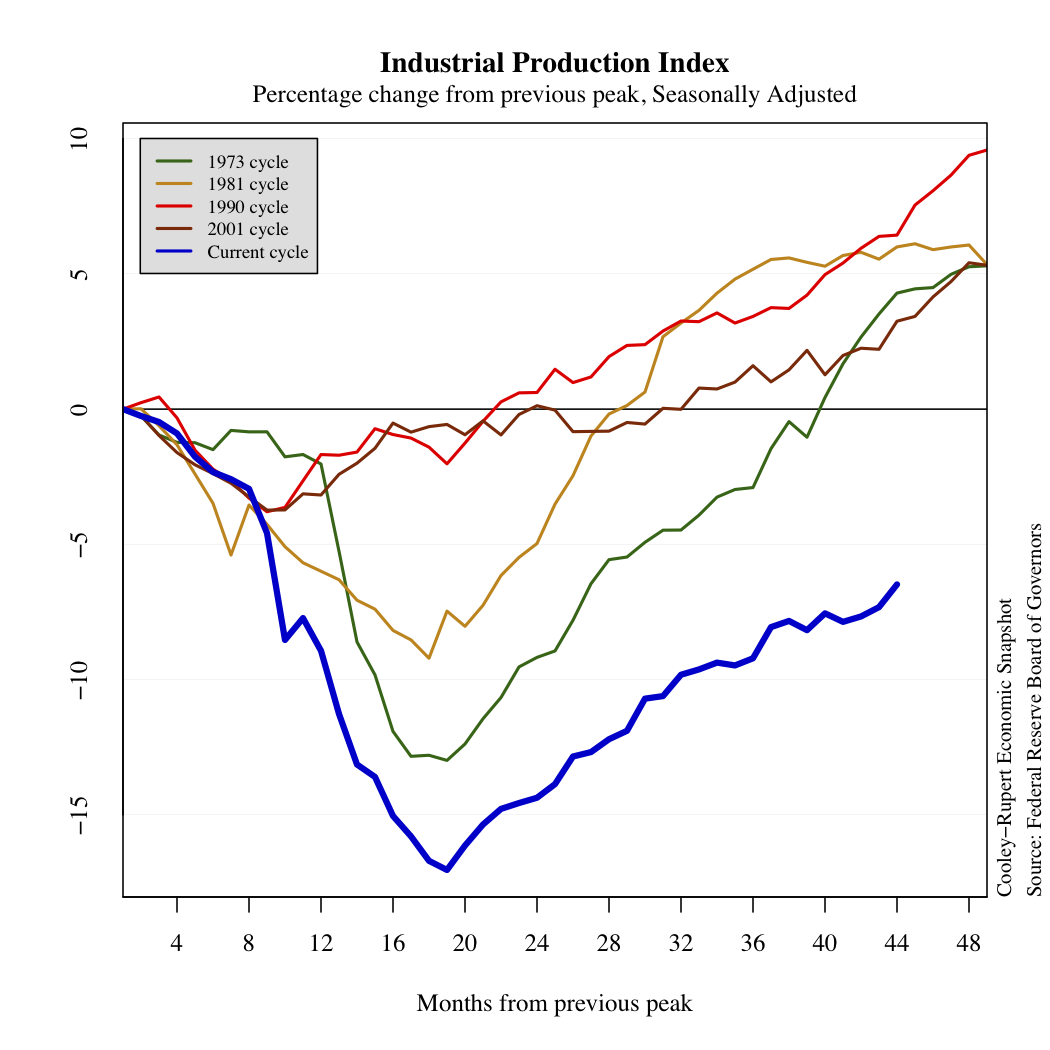

Industrial Production and Inflation

In this section we present some plots of miscellaneous series that

reflect other characteristics of this business cycle. The decline in

industrial production is dramatic. There is no evidence of inflation or deflation.

Glossary

Compensation includes accrued wages and salaries, supplements,

employer contributions to employee benefit plans, and taxes.

Consumer Price Index measures the price paid by urban consumers

for a representative basket of goods and services. Prices are

collected from 87 urban areas and from approximately 23,000 retail and

service establishments.

Debt Outstanding measures the current level debt owed on credit market

instruments. Credit market instruments include open market paper,

Treasury securities, agency and GSE-backed securities, municipal

securities, corporate and foreign bonds, bank loans, mortgages, and

consumer credit.

Durables are goods that have an average useful life of at least 3

years.

Employment Population Ratio is the ratio of the number of

civilians in the labor force to the total civilian population.

Exports consist of goods and services that are sold or

transferred by U.S. residents to foreign residents.

Goods are tangible commodities that can be stored or inventoried.

Government Consumption Expenditures and Gross Investment measures

current consumption expenditures by the government in order to produce

goods and services to the public and investment in structures and

equipment and software.

Gross Private Domestic Investment measures additions and

replacements to the stock of private fixed assets without deduction of

depreciation.

Imports consist of goods and services that are sold or

transferred by foreign residents to U.S. residents.

Industrial Production Index measures real output of

manufacturing, mining, and electric and gas utilities industries.

Job Openings or Vacancies are all positions that are open (not

filled) on the last business day of the month.

Labor Force is defined as the number of unemployed persons plus

the number of employed persons.

Labor Force Participation Rate is the ratio of unemployed persons

to the number of persons in the labor force.

Net Worth equals to total assets minus total liabilities. Assets

include owner-occupied real estate, consumer durables, and equipment

and software owned by nonprofit organizations.

Nondurables are goods that have an average useful life of less

than 3 years.

Nonresidential Fixed Investment measures investment by businesses

and nonprofit institutions in nonresidential structures and in

equipment and software.

Personal Consumption Expenditures measures the value of goods

and services purchased by households, nonprofit institutions that

primarily serve households, private noninsured welfare funds, and

private trust funds.

Residential Fixed Investment measures investment by businesses

and households in residential structures and equipment, primarily new

construction of single-family and multifamily units.

Services are commodities that cannot be stored or inventoried and

that are usually consumed at the place and time of purchase.

Total Borrowing measures the flow of new credit market

liabilities during the period. Credit market liabilities include open market paper,

Treasury securities, agency and GSE-backed securities, municipal

securities, corporate and foreign bonds, bank loans, mortgages, and

consumer credit.