by Thomas Cooley, Peter Rupert, and Zach Bethune

The problem of deflation is not just a concern for fans of American Football. It has been troubling economists and financial market observers since Japan slipped into deflation in their lost decade of the 1990’s and the concern has become more pronounced as the European Economy, particularly the Eurozone, has struggled to escape from a lost decade of its own following the financial crisis of 2007-2009 and has been on the brink of deflation – a sustained fall in the price level – for the past few years. Now, with commodity prices falling and the European Economy in continued stagnation, the ECB has finally decided to undertake some serious monetary stimulus in the form of large scale purchases of sovereign debt, as has been done in most of the other major economies of the world over the past few years. Their goal is to stimulate their stagnant economy, improve their competitiveness by lowering the value of the Euro relative to the dollar, and stave off deflation. In a global economy domestic policy actions have ripple effects, sometimes large ones, on other economies. If countries were all trying to improve their competitiveness at once it can look like a currency war or at least be confusing.

The U.S. Bureau of Labor Statistics recent release showed the U.S. CPI declining at the end of 2014 raising the issue of downward price pressures in the U.S. Not all of this was a reflection of declining energy prices – they have been falling rapidly in the past year – because core inflation, excluding food and energy, has been falling as well. What is going on with world prices and how does it impact the U.S. economy? Since the economy is recovering well as we have documented in previous posts, the pressure on the Federal Reserve to normalize monetary policy and begin raising interest rates should come about largely because of concerns about inflation. But, the current environment is one in which the struggles of some our most important trading partners has incentivized them to push the value of their currencies down, lowering import prices in the U.S. but also stimulating capital inflows to the strong U.S. economy.

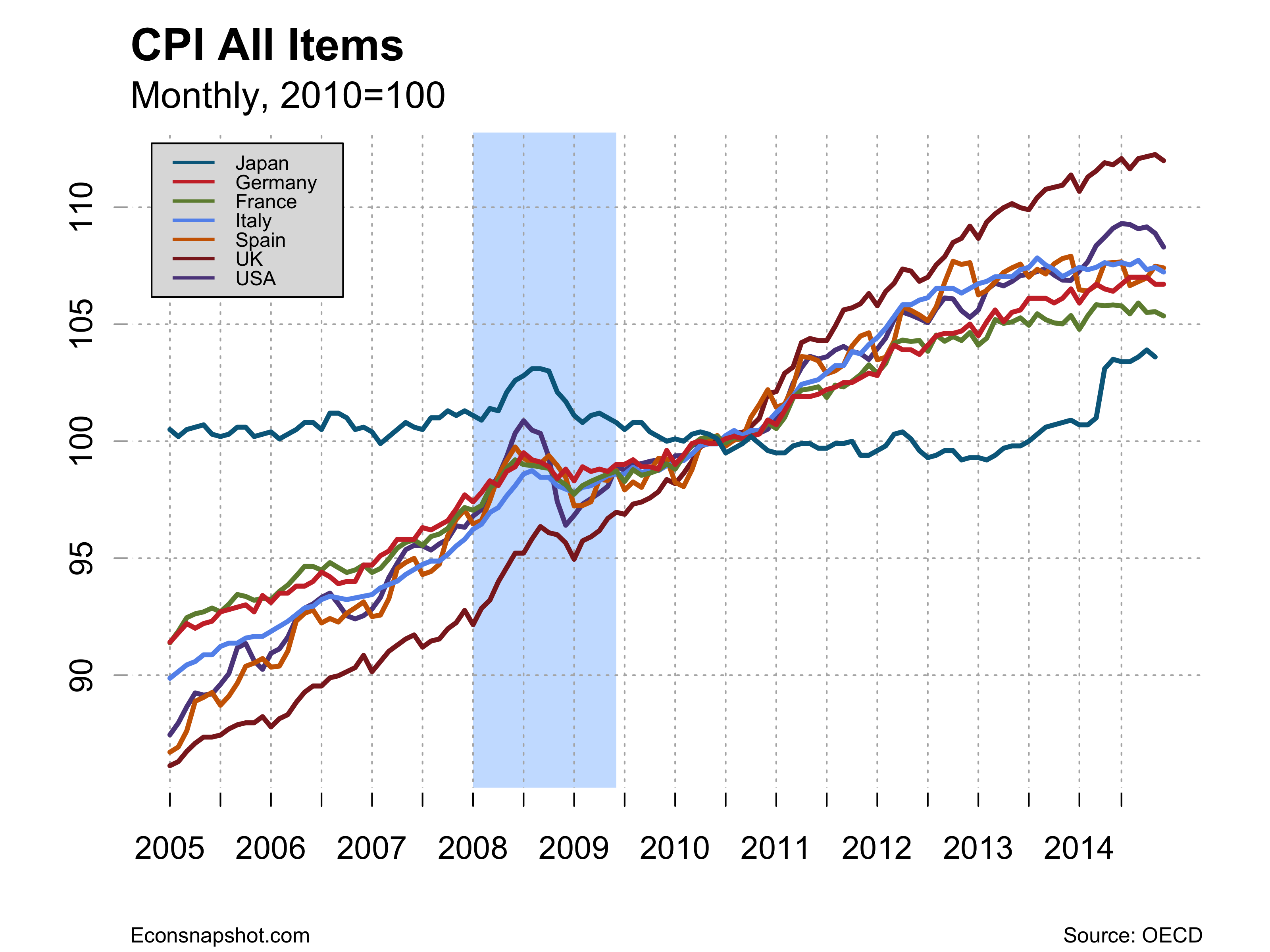

First, lets look at prices in a collection of important economies. The picture below shows the broad CPI or equivalent for Japan, the U.S. and some key European economies.

Prices have turned down, more dramatically in some countries than others, and as the following picture shows it is not just energy prices that is driving them.

These price levels reflect a complex set of drivers and ultimately what is going to be most important is the relative price of currencies. The countries that have been most stagnant are the Euro area nations and Japan. (An earlier post also contrasted these areas to the BRICs). The picture below shows the relative performance of these economies in the aftermath of financial crises. Real GDP growth is stagnant in Japan and the Eurozone economies as we have documented before. The U.S. and U.K. in contrast are recovering well and showing steady growth.

More important than the price level, however, is the relative price of the currencies. The picture below shows the real effective exchange rates for the Euro, Yen, Pound and Dollar. What they show is that the dollar and pound have appreciated sharply and the Yen has depreciated sharply. The Euro, adjusted for domestic inflation, has not moved much. The Euro zone countries need the real value of their exchange rate to decline sharply with the ECB’s policy in order to restore their competitiveness. But they are hampered in the end by the fact it is one currency that links very disparate economies. It remains to be seen how effective they are.