by: Zach Bethune, Thomas Cooley, Peter Rupert

The employment report from the BLS release this morning sobered up many who had anticipated a healthy jobs report: payroll employment increased a lean 142k. The forecasters were looking at employment to increase by about 220k. In addition, employment over the past two months was revised down a total of 28k. This is a disappointment given that monthly job growth has averaged 226,000 jobs in the first seven months of the year. Aside from the downturn in hiring activity the labor market picture remained largely unchanged. It is neither robust nor stagnant.

Although the unemployment rate ticked down slightly, from 6.2 to 6.1, the labor force fell by 64k.

Average hours and average hourly earnings were basically flat.

Much of the commentary from the Fed has revolved around the slack labor market and the latest report may affect the stance of monetary policy going forward. For example, from the latest FOMC statement

“If incoming information broadly supports the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee’s decisions about their pace will remain contingent on the Committee’s outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.”

Last week the second estimate for Q2 GDP released by the BEA on August 28 revised up GDP growth from 4.0% to 4.2%. Business fixed investment largely led the way, contributing roughly 1 percentage point to overall growth.

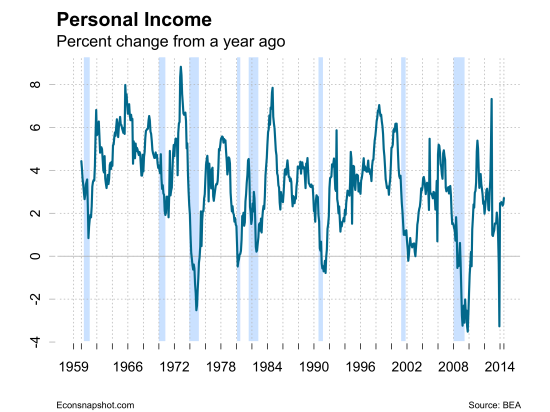

Personal Income was released on August 29. It showed an increase of .2 % in July.

The recovery continues but at a very slow pace compared to past recoveries. We finish again with the bar chart showing the growth rate of GDP during the current recovery compared with the growth rate during past recoveries. The stagnation question is still open.