By Thomas Cooley and Peter Rupert

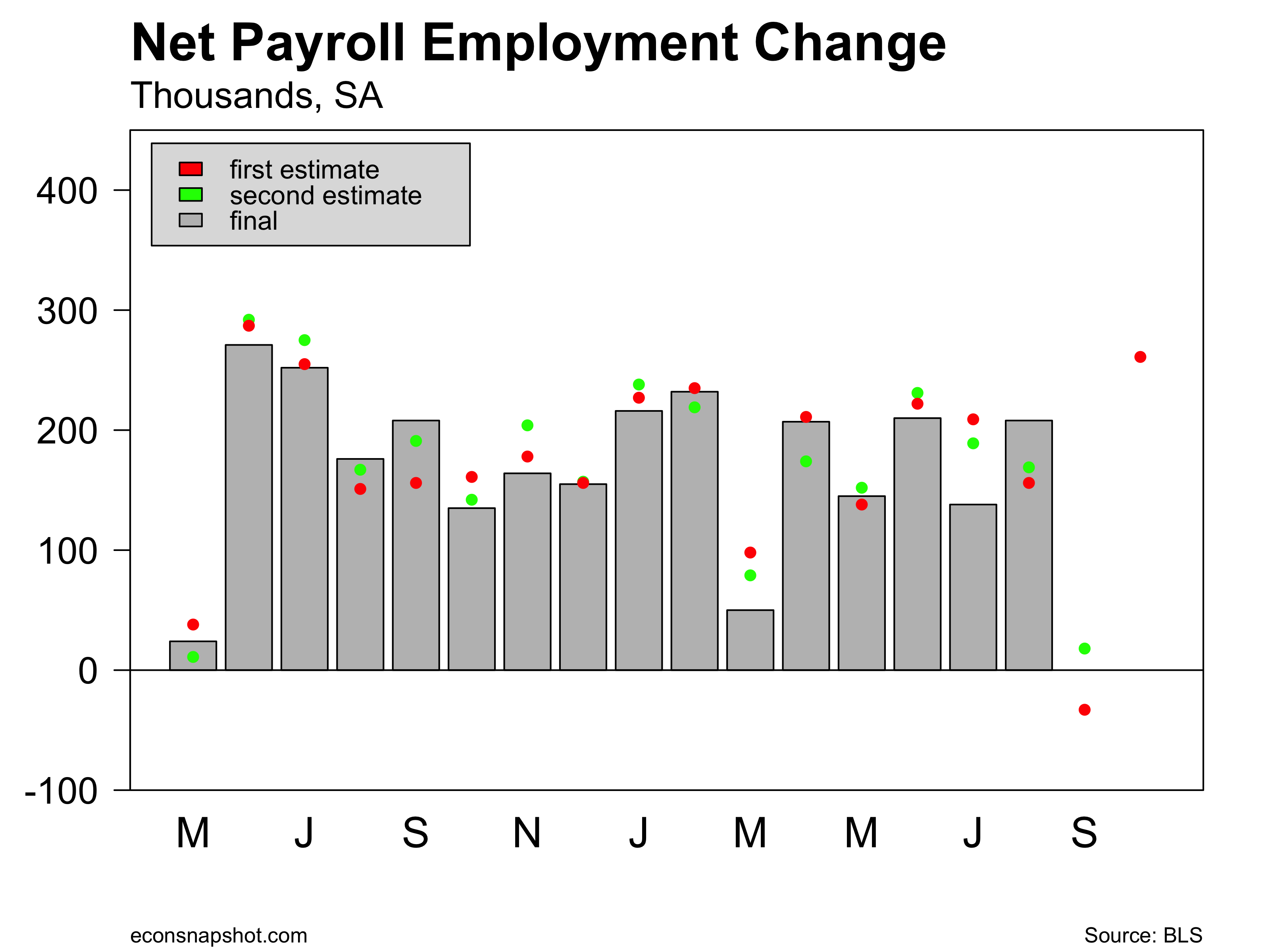

The BLS announced an increase in payroll employment of 261,000 in October and revised September’s preliminary estimate of a decline of -33,000 to an increase of 18,000 and August revised up by 39,000. The increase was widespread across goods producing (33,000), service producing (219,000) and government (9,000).

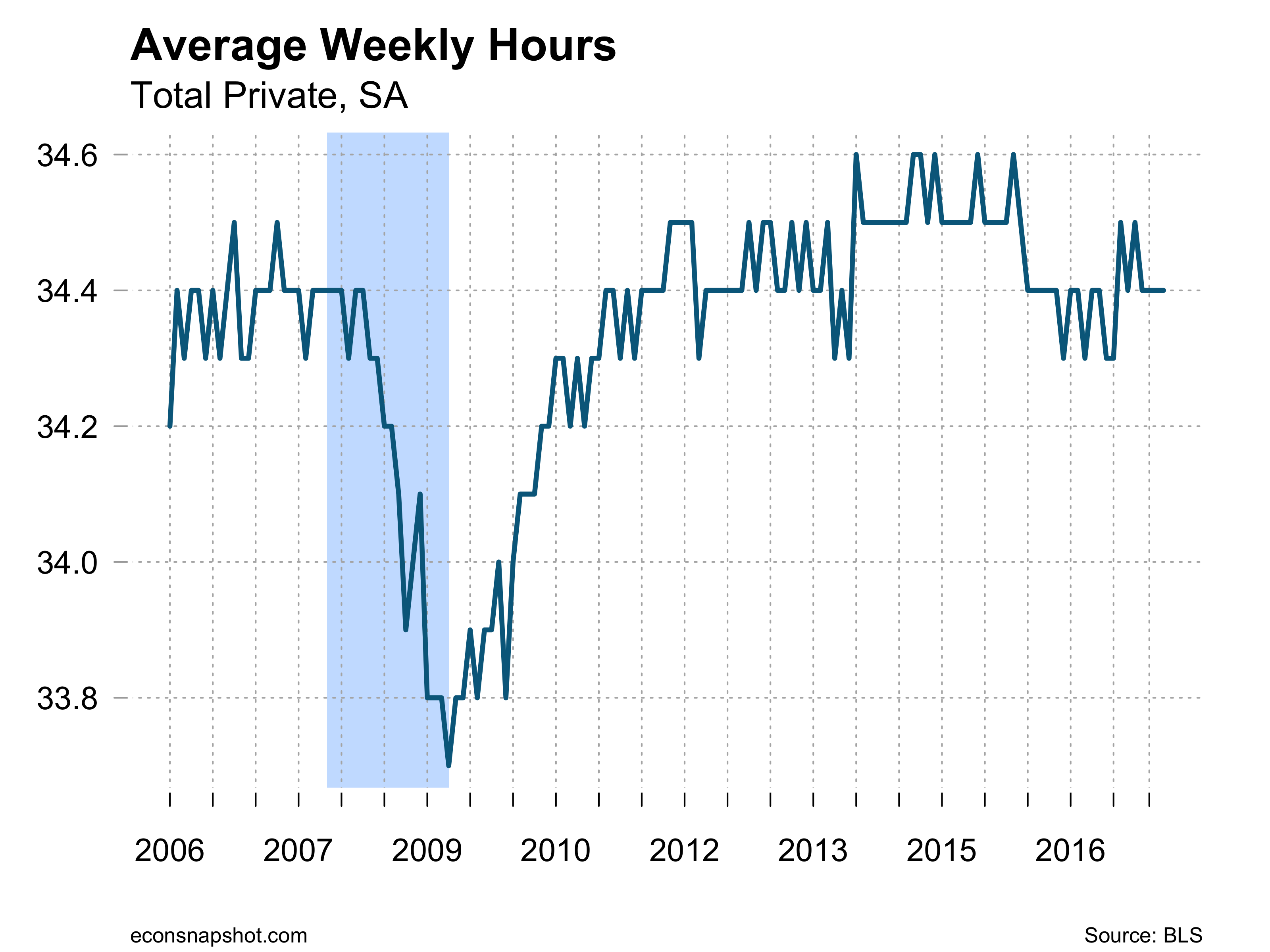

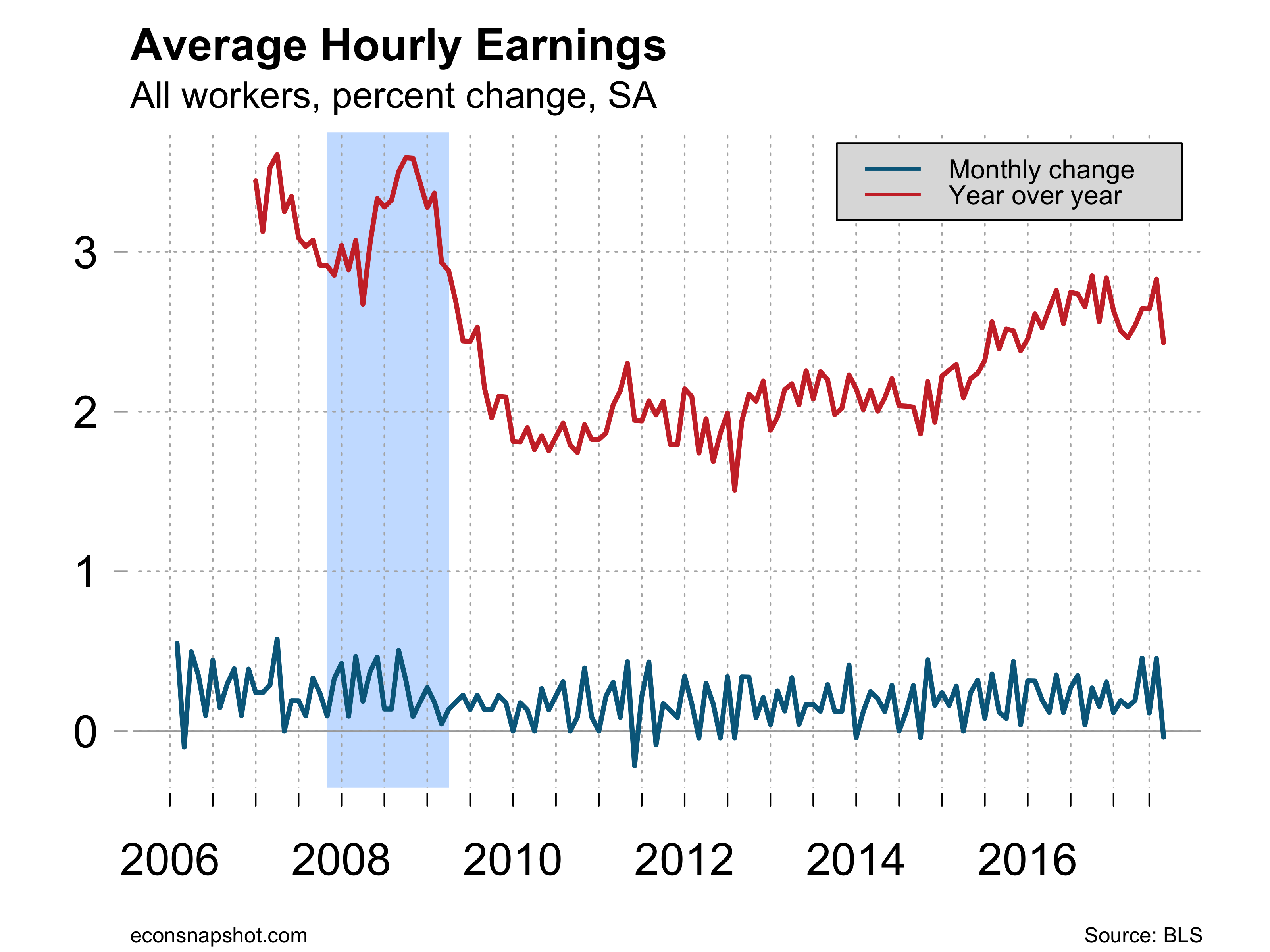

Average hours remained at 34.4 and average hourly earnings were essentially flat. The labor market continues to plod along, not seeing particular strength or weakness.

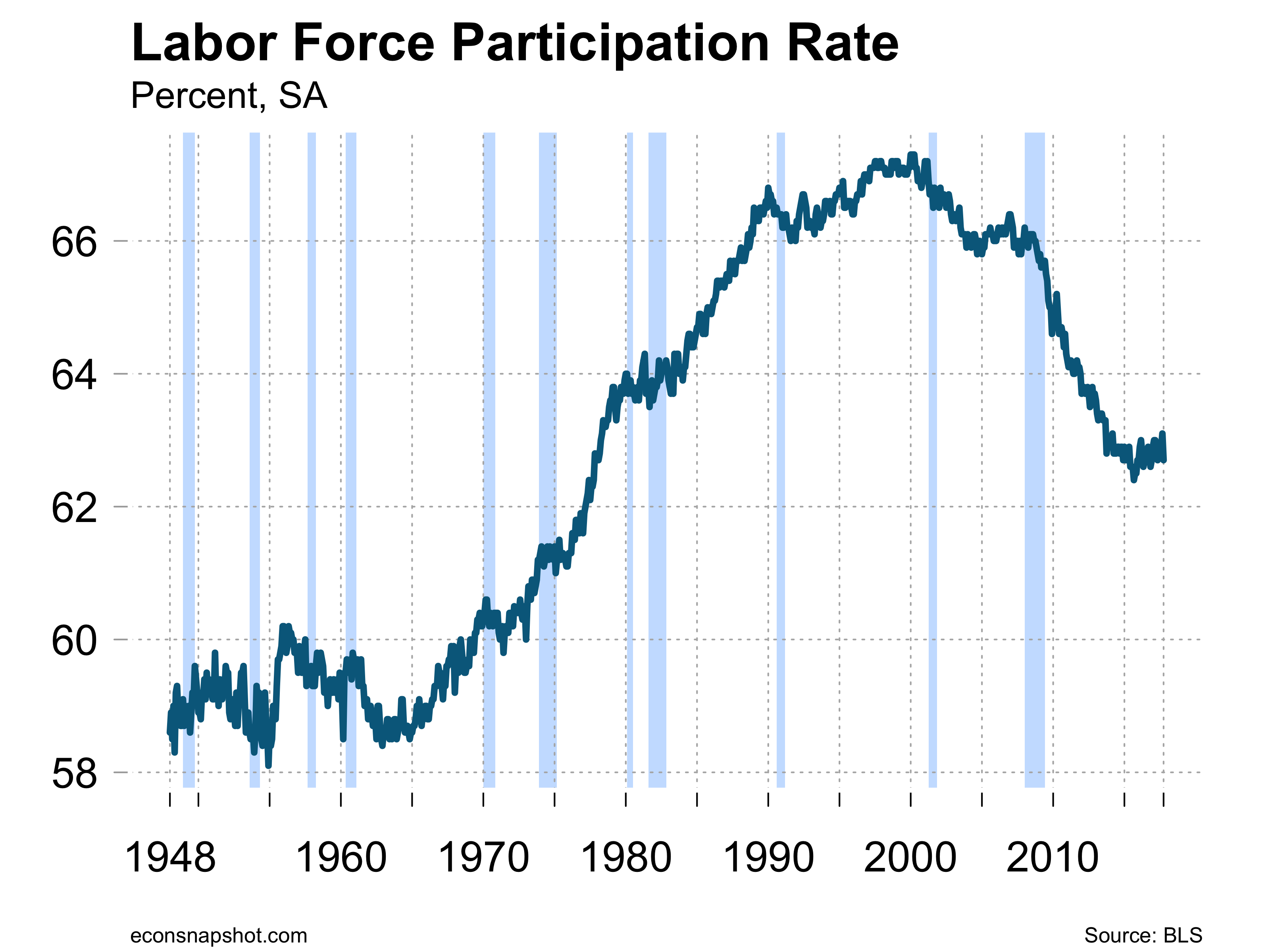

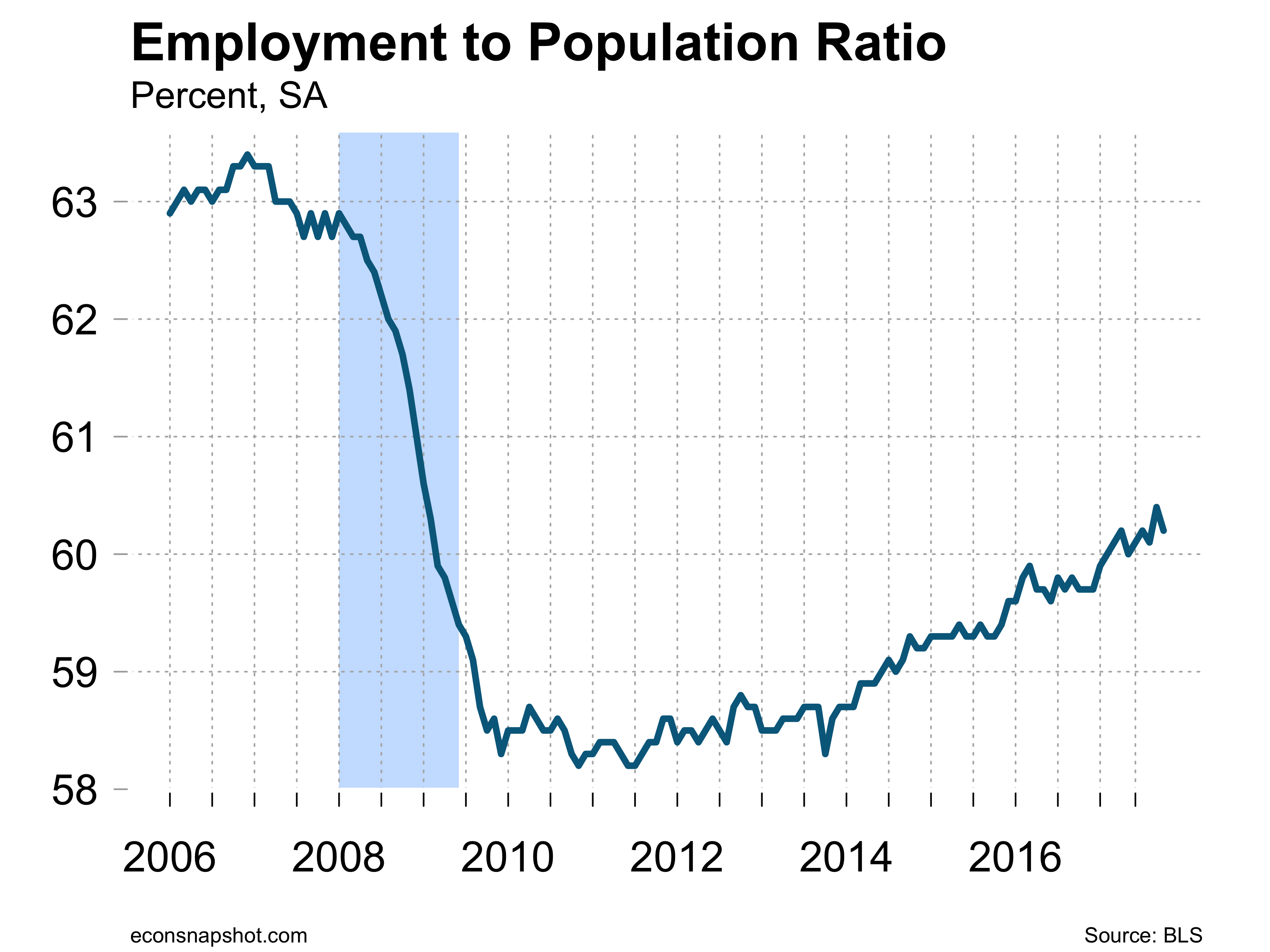

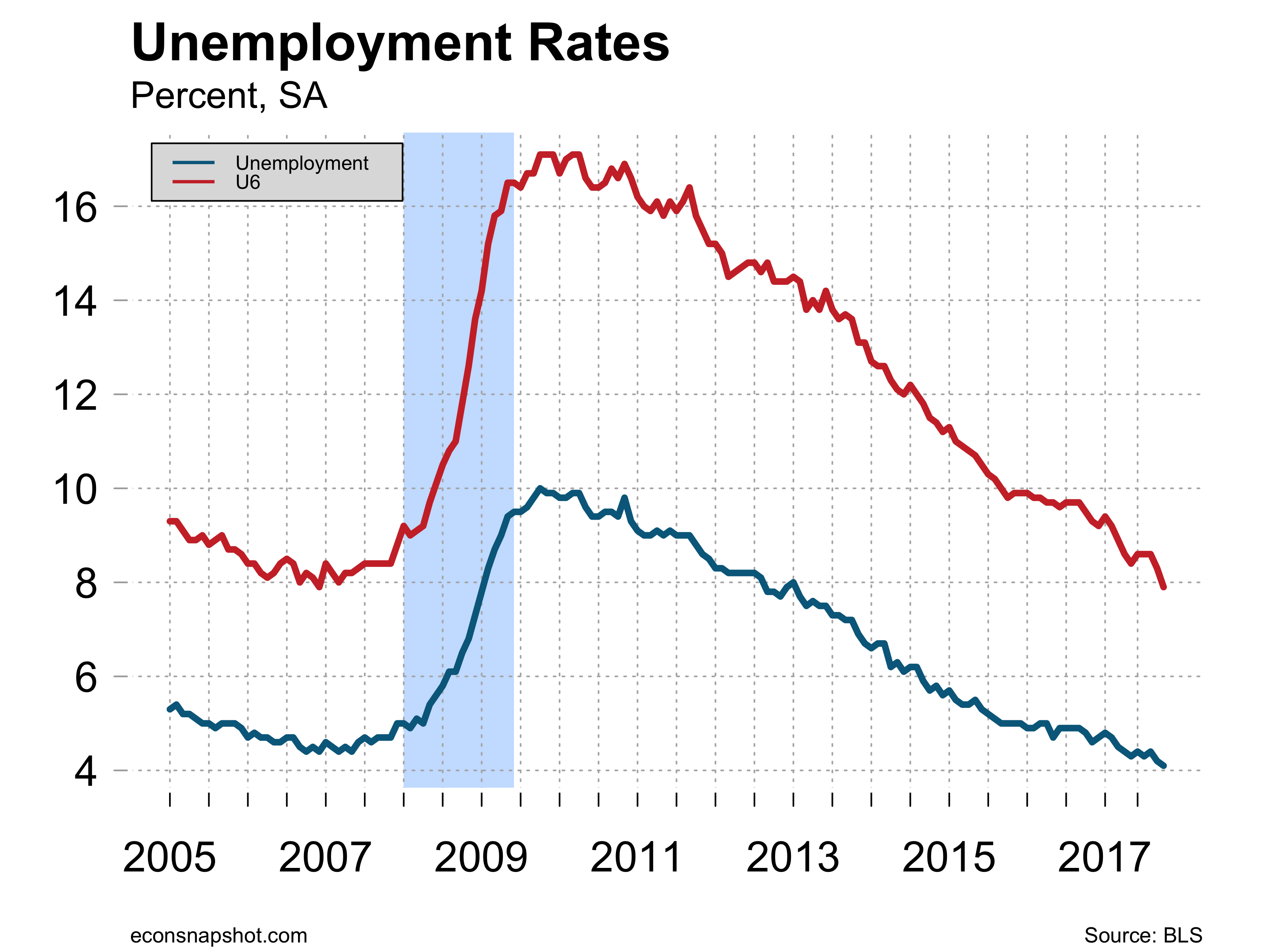

The household survey revealed a sharp decline in the labor force, -765,000, and a decline in the number unemployed, -281,000, that lead to a decline in the unemployment rate from 4.220% to 4.065%. Employment declined, -484,000, as did the participation rate from 63.1 to 62.7. The employment to population ratio from 60.4 to 60.2. So while the establishment data looked strong, the household survey had little going for it except the drop in the unemployment rate.

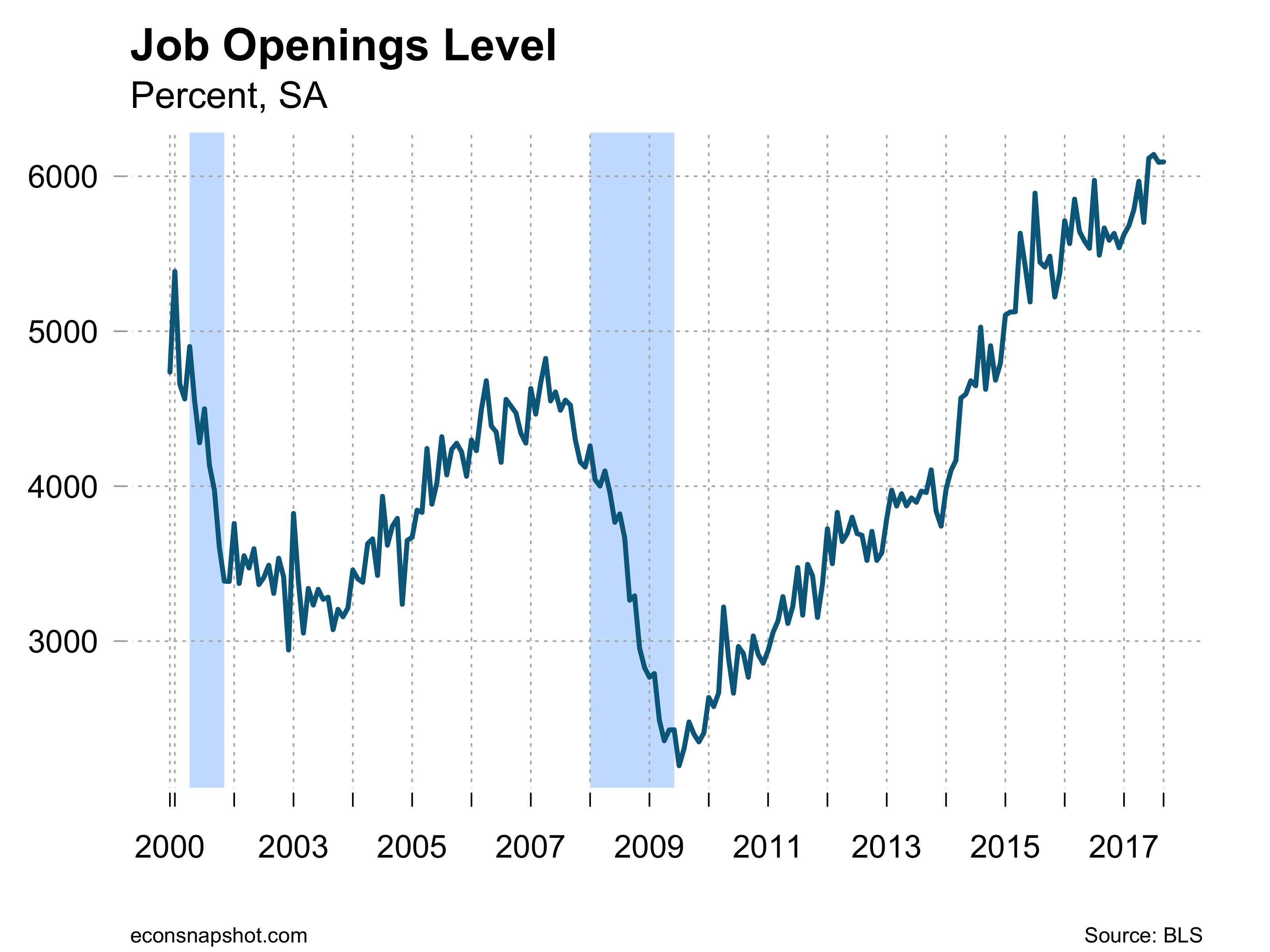

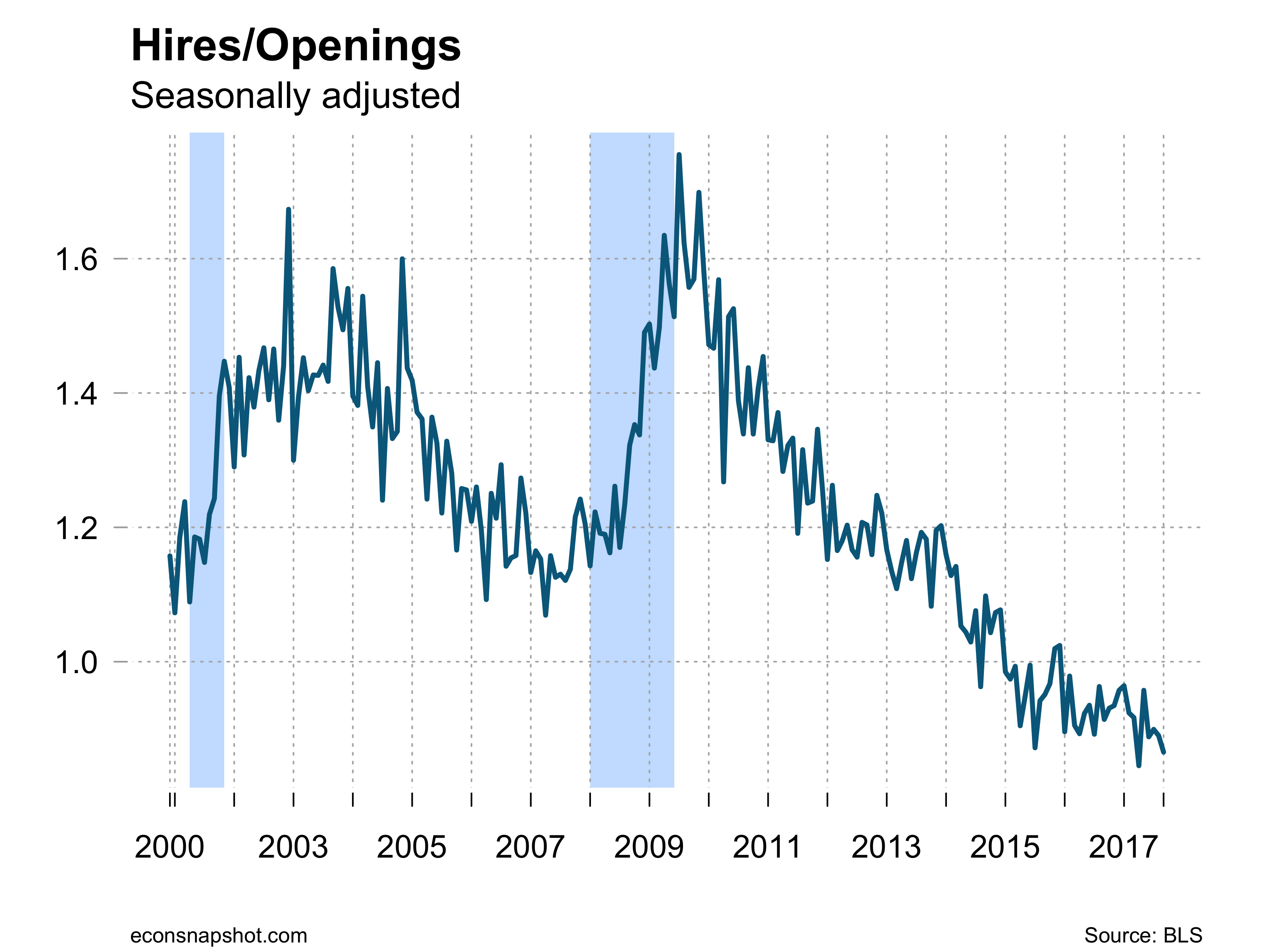

Job openings from JOLTS reveals the number of openings remaining at or near the highest level ever. However, the number of hires per opening has fallen since the end of the Great Recession to its lowest number.

Although natural disasters have somewhat muddied the waters, there is little in this report that would change the likelihood of a December federal funds increase.