By Thomas Cooley, Ben Griffy, and Peter Rupert

Today’s second estimate of real GDP from the Bureau of Economic Analysis shows an increase of 3.2% for Q3. The advance estimate for Q3 had an increase of 2.9%. The final estimate for Q2 was also revised up to 1.4% from 1.1%. The year over year change (blue line) had been trending down for the past 5 quarters or so.

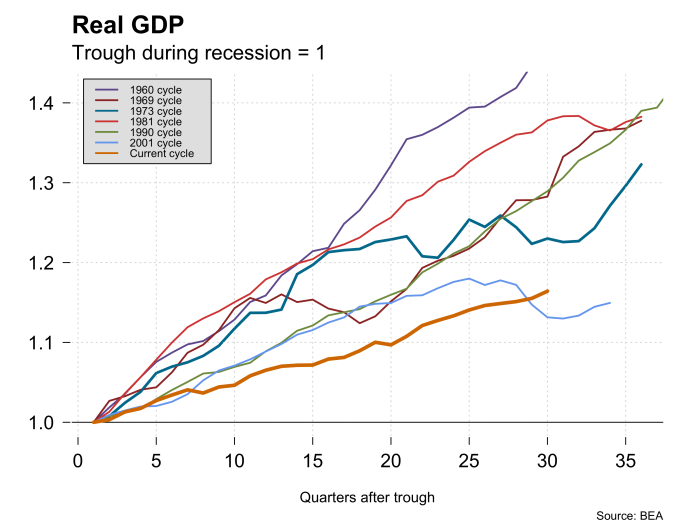

The overall rise in real GDP was led by a 2.8% increase in real personal consumption expenditures (PCE) that contributed 1.9 percentage points to the gain in GDP. Compared to other recoveries this one is now quite mature, yet continues to grow at a steady pace.

There was also a large rise in exports, up 10.1% and imports also increased slightly, up 2.1%. Overall, net exports contributed 0.87 percentage points to GDP growth. Investment, on the other hand, continues to be weak, coming from both nonresidential (up 0.1%) and residential fixed investment (down 4.4%). Spending on equipment has declined 6 out of the last 8 quarters.

This GDP report certainly provides enough support for the FOMC to raise rates during their December 13-14 meeting. Friday’s jobs report is expected to reinforce the view that the economy is on a stable path and that monetary policy can be normalized.