By Thomas Cooley, Ben Griffy and Peter Rupert

The Bureau of Labor Statistics announced that non-farm payroll employment for July increased 255,000, beating the “expected” job gains of 180,000. In addition, both May and June were revised up, 13,000 and 5,000, respectively. The bulk of the gains came from service sector jobs, up 201,000 with the majority of those in business and professional services.Employment in manufacturing (+9,000) and construction (+14,000) rose while mining continued its decline (-7,000), consistent with continued weakness in the energy sector and oil prices.

The continued strength in the labor market also showed up in an increase in average weekly hours and average hourly earnings. Earnings are now increasing at a rate of over 2.5% year over year.

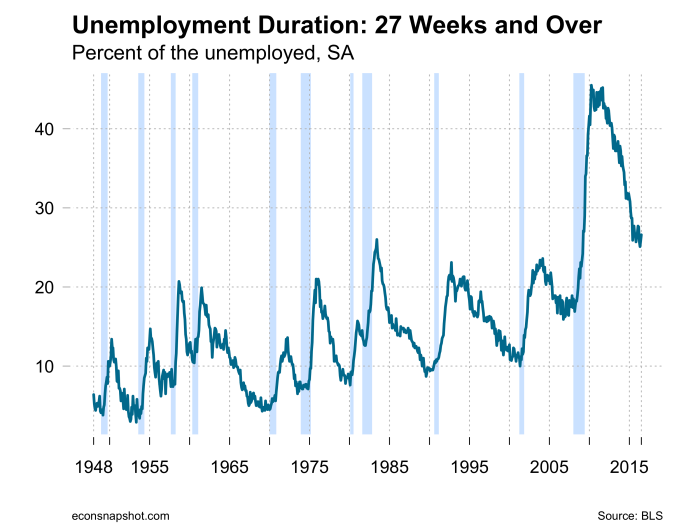

Labor market dynamics from the household survey revealed an encouraging increase in labor force participation and employment and a decline in the number of persons unemployed, resulting in essentially no change in the unemployment rate at 4.89%. This means that fewer people are sitting on the sidelines. While the news is, on the whole, positive, the number of persons unemployed more than 27 weeks increased for the third straight month.

The big puzzle is how to reconcile the continued strength in the labor market with the very weak GDP growth reported last week and how the parse the impact of this on the decision making of the Fed. Most likely the reason for these diverging signals will be become clearer over the next few months. The widespread view is that the continued strength of the labor market makes it likely that there will be a rate increase in 2016, although the weak GDP numbers will keep the market guessing.