The last several days have given us a a second estimate of GDP for Q3, new data on personal income, the employment report for November, and new unemployment claims. The overall picture from them is one of a steadily improving economy, although personal income fell slightly, down 0.1%.

GDP Report

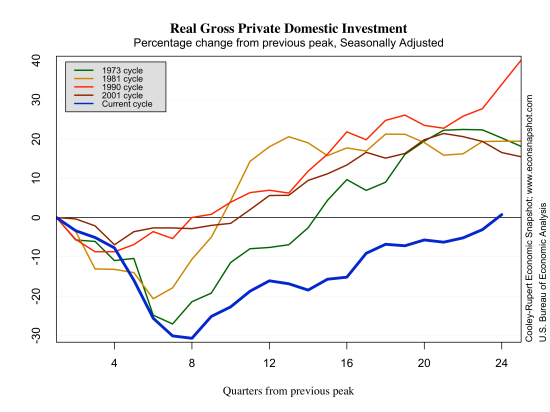

The big news with the release of the second estimate of real GDP for the third quarter from the BEA was the large increase, from 2.8% to 3.6% annualized growth. However, much (most) of this increase came from the big pop in inventory investment–likely meaning it will be unwound over the coming quarters. The implication being that this alone should have little effect on forecasts of real GDP although there is an upside–inventory growth may also reflect positive expectations about future demand. Last year in Q3 inventory investment was also a large contributor (0.6 percentage points) to the overall 2.8% GDP growth. Following that, GDP growth in Q4 of 2012 was only 0.1; moreover there was a very large decline in inventories in Q4 of 2012. Still, even without the current inventory contribution to GDP growth (1.68 p.p.), GDP grew about 1.9%; perhaps not something to write home about, but certainly showing continued solid growth. Real personal consumption expenditures continue to climb steadily and investment has finally reached its level of Q4 2007. Government consumption and gross investment appears to have broken from a three year decline and has held steady for the last couple of quarters, although below the level at the beginning of the recession.

Employment Report

The Employment Situation report from the BLS added more support to the overall picture, that is, one of solid growth. There have been four fairly strong months of employment growth, with nonfarm payroll employment increasing 203,000 for November, 200,000 for October, 175,000 for September, and 238,000 for August. Moreover there are positive signs in the goods sector, with goods employment up 44,000, and over half of that in the manufacturing sector. Unemployment initial claims continue to decline–noting of course the recent effects of the government shutdown. The employment rate declined to 7% putting it in the range that Fed Chairman Bernanke cited earlier in the year as a sign that the labor market was recovering. The positive angle on this estimate is that labor force participation increased as did the employment/population ratio. The increase was not enough to overcome the sharp drop in October.

What next for the Fed?

The recent performance of several sectors in the US leaves a big question mark for the upcoming December meeting of the FOMC. Are these recent positive signs enough to begin to taper? Has forward guidance given us enough guidance to determine the timing? Magnitude? The problem is that there are always some confounding events…Christmas is just around the corner and the Chairman is on his way out. The graceful exit strategy would be to end QE and leave Chairman Yellen with a clean slate of expectations.