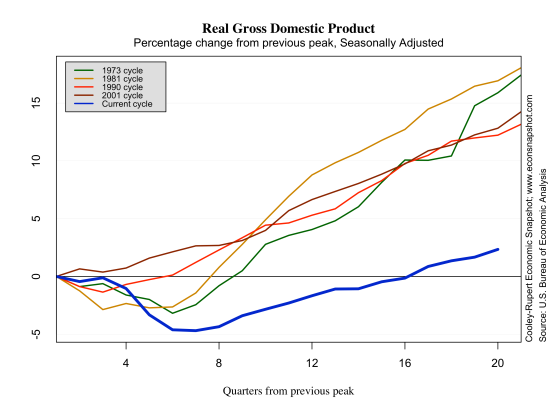

The second estimate of Q3 Real GDP, released today indicates that output grew slightly faster at 2.7% than previously estimated at 2%. On the face of it this seems like good news because it implies a more robust recovery than the earlier estimate. Unfortunately there are reasons to temper that optimism. Much of the increase was due to an upward revision in the Q3 change in inventories which increased from$34 billion to $61 billion. Unfortunately, these inventories could dampen growth in the fourth Quarter as firms work them off. Net Exports were also revised upwards and added significantly to the increase in estimated GDP growth.

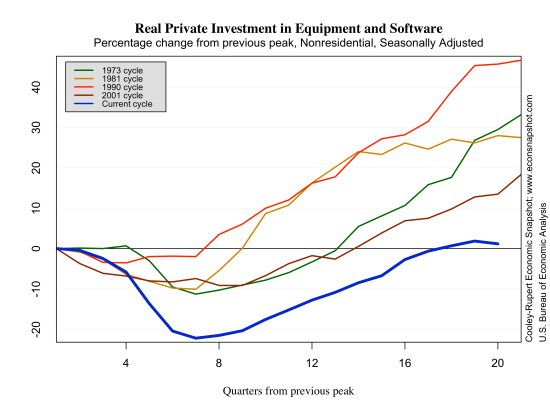

The fundamentals that we look to for evidence of a robust recovery were not encouraging. Real consumption growth was revised downwards from 2% to 1.4% and real private non-residential investment declined 2.2% in the third quarter in contrast to the 3.6% increase in the second. There has been a lot of concern about the drop off in capital spending and many observers attribute it uncertainty about Europe and fiscal policy. Whatever the reason, the consequences for future output growth cause for concern.

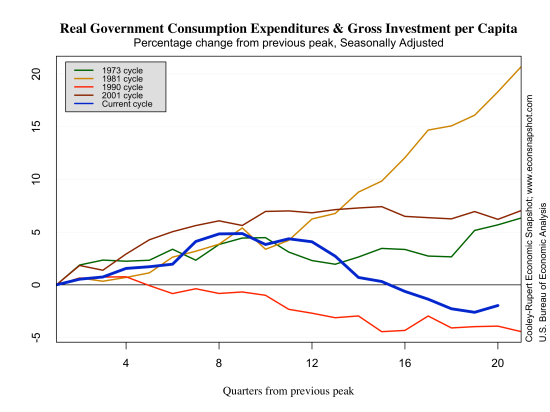

In a departure from our usual format we present many of the series in both per-capita terms and levels in the following graphs.

The Federal Reserve’s release on industrial production shows that manufacturing and utilities output has been declining for the last four months, a possible consequence of the uncertainty surrounding the fiscal cliff and the European economic outlook. The industrial sector is a large component of movements in real GDP over the business cycle and has never fully recovered from its recession trough. Further, the diffusion index below shows that the declines in production are coming across industries. The index measures the percentage of industries that increased production over the last three months plus one-half of the industries in which production remained constant. The index has now dropped back below its peak level of 51.9%.