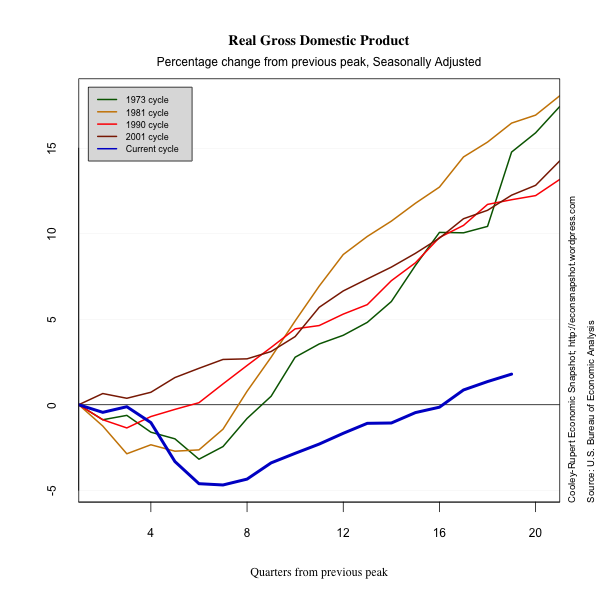

The Second Estimate of Q2 GDP, released on August 29 shows slow, continued growth in many areas, although there isn’t too much to remark on in the current release. The revision for GDP was up, 1.7% from 1.5%. Consumption was revised up the same, from 1.5% to 1.7%, led by an increase in the revision of services, from 1.9% to 2.4%. The graph below plots real GDP comparing this recession and recovery to past ones. A major theme of this blog is that to get an accurate snapshot of where the US economic recovery is, it is necessary to have a benchmark with which to compare. The graphs we present use the comparison of past cycles to guide our understanding of the current economic environment.

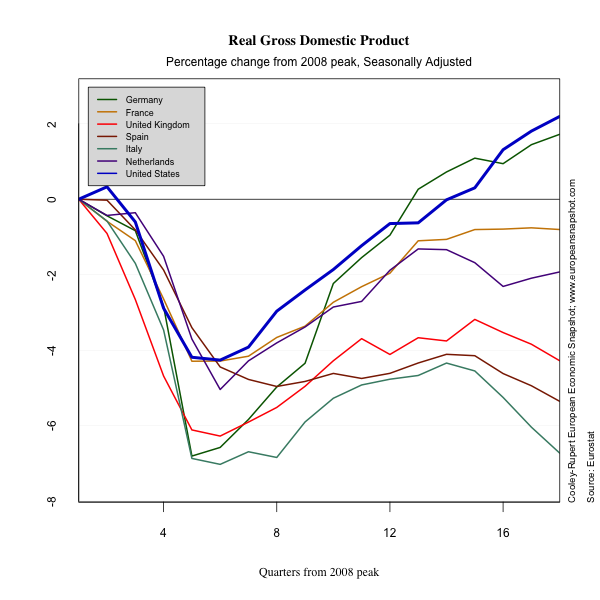

Many have commented on the slow growth coming out of the recession and that commentary is likely using the above comparison. Indeed this last recession and the current recovery stand out compared to any seen since the Great Depression. So, comparing against past recessions and recoveries is one way to put things into perspective. Certainly the crisis that struck the world at the end of 2007 and beginning of 2008 was unprecedented, save for the Great Depression. Not only in causes and scope, but also in its global reach. An interesting comparison might be to look at how several European countries have fared relative to the U.S. Each country felt the crisis in different ways and responded in different ways, leading to different outcomes. The graph below shows the percentage change of real GDP from the peak of the business cycle in Europe (2008 Q1) and the U.S. (2007 Q4).

In this perspective the US hasn’t fared so badly. The depth of the recession in the US was not as bad as that felt in Germany, Italy, or the UK. In terms of recovery, the US is on pace with Germany, around 2 percentage points above peak level. In fact, Germany is the only EU country pictured that has positive output growth, while the rest remain stagnant or are actually falling. The point here is that maybe, just maybe, the U.S. and Germany are doing as well as can be expected given the global environment. And yes, we always want more and we want it faster…but it might not be realistic.

Below we present a snapshot of the current recovery in terms of consumption, investment, government spending, exports and imports.

Continue reading “It’s Slow, but it’s Growth”