Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the new employment numbers released today by the Bureau of Labor Statistics. The complete Snapshot based on the latest revisions to fourth quarter GDP from the Bureau of Economic Analysis can be found in our previous post.

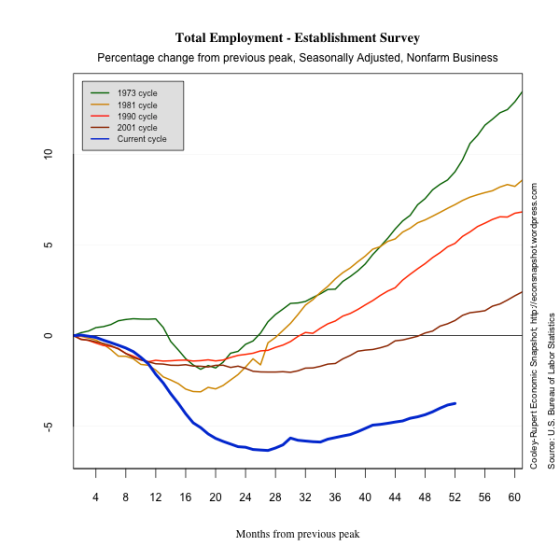

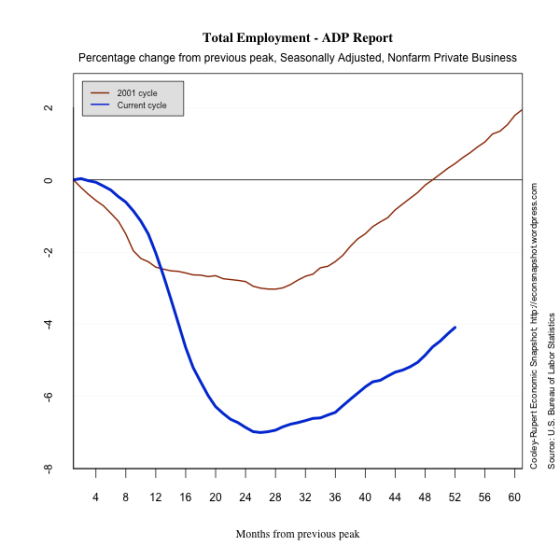

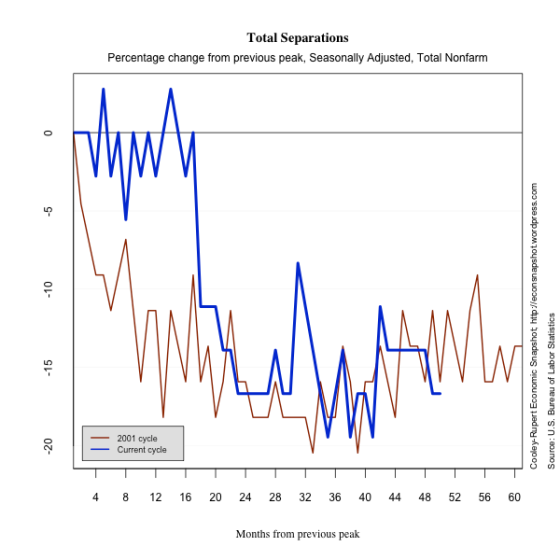

As in all of our snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

You can also find the most recent version of the entire snapshot in pdf form here. As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data.

The Labor Market

The latest Employment Situation report from the Bureau of Labor Statistics shows non-farm payroll employment rose by a disappointing 120,000 jobs in March. Prior payrolls were revised down for January (-9,000) and up for February (+13,000). Many economists had expected the labor market to add about 210,000 jobs, having witnessed three consecutive months of 200,000+ increases, averaging 246,000 per month. The total number of unemployed persons remained essentially constant at 12.7 million and the unemployment rate ticked down slightly to 8.2%. The labor force participation rate ticked down to 63.8%, as did the employment to population ratio, falling to 58.5% from 58.6% in February. For comparison, as we did last month, we plot employment as reported by ADP, an association of payroll processors. Many observers view this as a useful early indicator of the BLS numbers.

The number of long term unemployed fell by 118,000, but, as reported in an earlier post, are roughly 40% of the total unemployed. The numbers of people who are involuntarily underemployed, marginally attached to the labor force and the number of people who classify as discouraged workers also fell slightly. While these are all slight improvements, the meager job growth admits only very minor improvements in the health of the labor market.

Employment continued to increase in professional and business services, health care services and leisure and hospitality. Manufacturing jobs also increased. Retail trade employment decreased for the second consecutive month, falling 33,800 in March after declining 28,600 in February.