Welcome to the Cooley-Rupert Economic Snapshot, our view of the current economic environment. This is the latest version of our snapshot of the U.S. Economy based on the preliminary fourth quarter data on National Income and Product from the Bureau of Economic Analysis as well as the January Employment Situation released by the Bureau of Labor Statistics. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. This post primarily updates GDP and its components based on preliminary estimates of fourth quarter activity from the BEA. We also include the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data. Click here to go to the latest snapshot in one pdf document. Or, read on–

How bad is this recession and how should we assess the recovery?

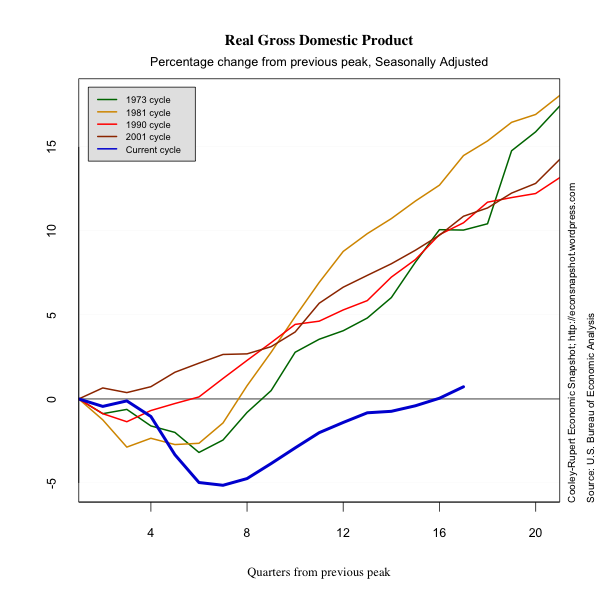

The preliminary estimates of fourth quarter GDP and its components show that the economy picked up a little momentum with GDP increasing at an annual rate of 2.8% compared to the rather anemic 1.8% growth rate in the third quarter. We should caution that preliminary estimates have been revised downward in both of the previous two quarters, so the 2.8 percent figure could be optimistic. The figure below shows that the recovery has now brought GDP above the previous peak.

Several things become apparent when looking at the above picture. First, the length of the downturn of the current cycle was close to what it has been in previous cycles. However the depth was much more severe bringing real GDP more than 5% below its peak level. Second, and more discouraging, the length of the recovery has been much longer and the pace much slower. It has taken 16 quarters for real GDP to reach its previous peak level. In all other post-war cycles, the longest GDP has taken to reach previous peak was 8 quarters during the 1973 cycle. It is obvious why this last episode has been called the “The Great Recession,” but we may want to add to that “The Abysmal Recovery.”

Continue reading “Snapshot – Fourth Quarter GDP Estimates – Growth Improves, Concerns Remain–January Labor Market Update”