by Zach Bethune, Thomas Cooley and Peter Rupert

Final Revision to Q1 GDP: UGH!

Yesterday the BEA announced another large downward revision to first quarter GDP growth from -1.0% to -2.9%. The final estimate was primarily attributed to downward revisions in consumption (3.1% to 1.0%) and exports (-6.0% to -8.9%). In addition, there was a major hit to the late-2013 inventory overbuild and construction.

All of this, obviously, leaves the FOMC and the administration in a tough position. While many analysts recount weather-related setbacks and changes in depreciation allowances (such as I.R.C. 179), there is certainly real concern that the weakness is, well, weakness. Before the downward revisions, the weak Q1 GDP figures were already on the Fed’s mind. From Janet Yellen’s congressional testimony on May 8 (emphasis added):

“Although real GDP growth is currently estimated to have paused in the first quarter of this year, I see that pause as mostly reflecting transitory factors, including the effects of the unusually cold and snowy winter weather. With the harsh winter behind us, many recent indicators suggest that a rebound in spending and production is already under way, putting the overall economy on track for solid growth in the current quarter. One cautionary note, though, is that readings on housing activity–a sector that has been recovering since 2011–have remained disappointing so far this year and will bear watching.”

Real private domestic investment, after having just reached its levels from December, 2007, has been stagnant of late. Both nonresidential and residential investment are culprits, though both had upward revisions from -1.6% to -1.2% and -5.0% to -4.2%. The numbers are nothing to cheer over, but there is also nothing in today’s report should change the Fed’s reading on the housing market from May.

More recently from Janet Yellen’s June 18th press conference (again emphasis added):

Although real GDP declined in the first quarter, this decline appears to have resulted mainly from transitory factors. Private domestic final demand—that is, spending by domestic households and businesses—continued to expand in the first quarter, and the limited set of indicators of spending and production in the second quarter have picked up. The Committee thus believes that economic activity is rebounding in the current quarter and will continue to expand at a moderate pace thereafter.

With yesterday’s large downward revisions to consumption, private domestic final demand is now estimated to have fallen in the first quarter, though more recent data are still in line with higher spending in the second quarter.

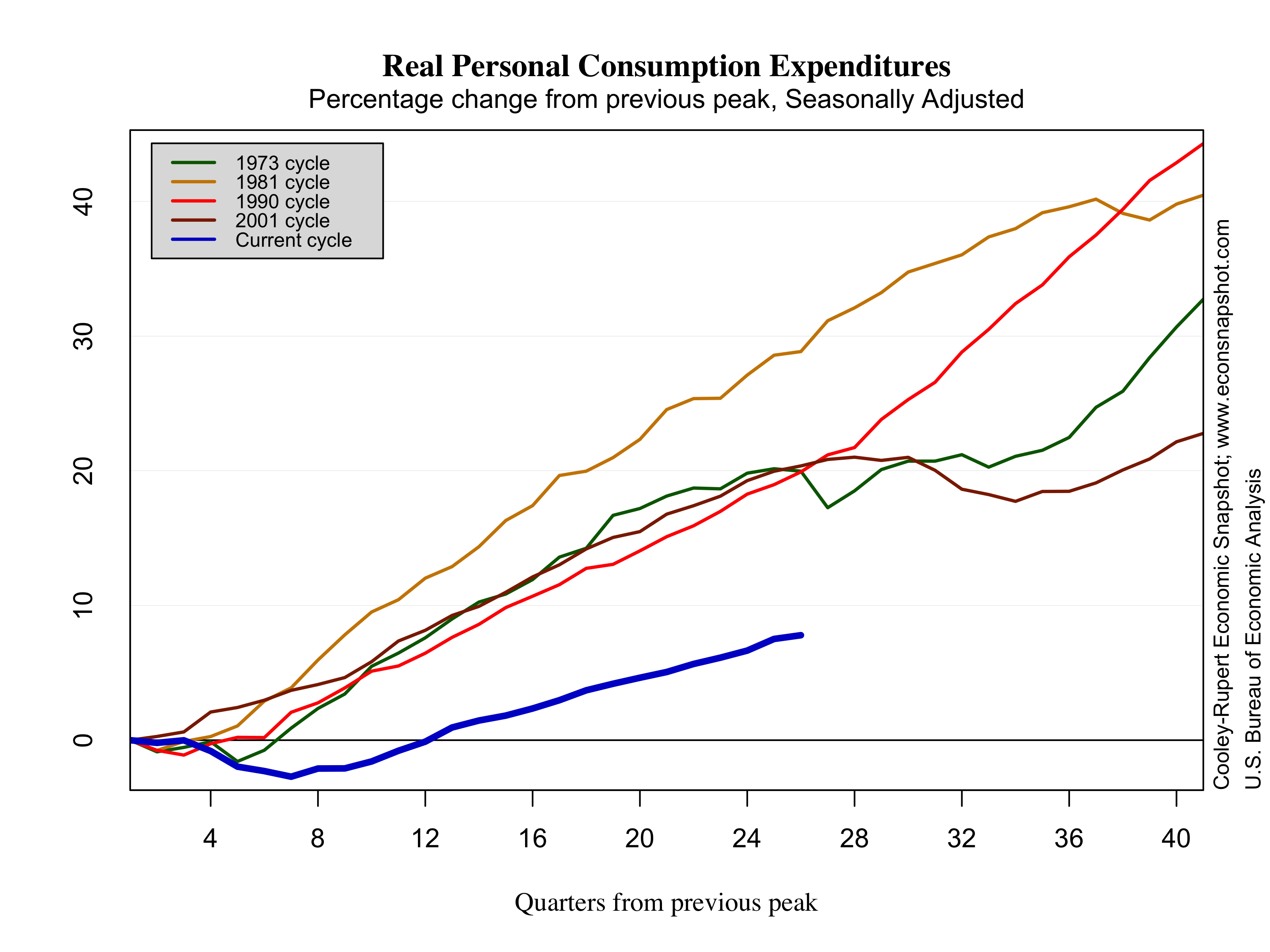

It’s not at all clear how much the revision will alter the Fed’s economic outlook or their stance on policy accommodation. The focus is still largely on improvements in the labor market, but a -2.9% Q1 growth rate is far from the FOMC’s latest central tendency projections for 2014 of 2.1%-2.3% growth. So what exactly does the growth rate of real GDP have to average over the next three quarters to be in line with the FOMC’s projection? The answer is 3.77-4.03%. While those rates are not impossible, it remains highly unlikely given the average growth during the recovery, as the figure below makes apparent.