We present the data in four sections. The first summarizes the path of Gross Domestic Product and its components. This post primarily updates GDP and its components based on preliminary estimates of third quarter activity from the BEA. We also present the most recent labor market data and the summary of activity in credit markets. The final section summarizes the features of industrial production and inflation.

As always we welcome any suggestions for additional data that you would like to see and suggestions for how to improve the presentation of the data.Welcome to the Cooley-Rupert Economic Snapshot–our view of the current economic environment. Click here to go to the latest snapshot in one pdf document. Or, read on–the labor market section is new since the last post on Sept. 30….

Introduction

This is the latest version of our snapshot of the U.S. Economy based on the preliminary third quarter data on National Income and Product from the Bureau of Economic Analysis and the Federal Reserve. As in previous snapshots we present the data in a way that we find particularly useful for assessing where we are in the business cycle and tracking the U.S. economic recovery. The paths of all the series presented are plotted relative to the their value at the peak of the respective business cycles. We use the business cycle dates identified by the National Bureau of Economic Research.

A More Optimistic View of The Economy

The most recent GDP numbers include the preliminary data on economic activity for the third quarter. They continue to bear witness to the severity of this recession but third quarter growth turns out to have been strong compared to previous quarters. The annual growth rate was 2.5 percent. If sustained this is an encouraging sign of recovery and evidence that we are not slipping into a double-dip recession.

The third quarter growth was due in large part to increased consumption as households cut savings. Private Domestic Investment continued to improve with strong increases in investment in equipment and software. Once again the glaring Albatross is Fixed Private Residential Investment that continues to be completely stagnant, bouncing along at a level that is 40% below the previous peak. To repeat the thought experiment from our previous blog, GDP is roughly $15 trillion and Gross Private Domestic Investment is roughly $1.9 trillion or 12.6% of GDP. Private Residential Fixed Investment is just over $300 billion, more than $300 billion below its business cycle peak and nearly $500 billion from its own peak. Since there is currently no compelling scenario under which residential investment is likely to recover this will continue to drag down the economy for many quarters to come. In no other post 1970 recession did it fall so far and continue to stagnate nearly four years since the recession began. The last time residential investment was this low was in 1996 when GDP was slightly more than half what it is now.

One encouraging sign is that policy makers and pundits have returned their attention to are strategies for directly addressing the problems of the housing sector and the vast number of underwater and non-performing mortgage loans. At the outset of the housing crisis there were many proposed strategies to address these problems. They turned out to be either unworkable solutions, ineptly implemented, or they were ignored. Perhaps this time will be different, but the initial indicators are not encouraging.

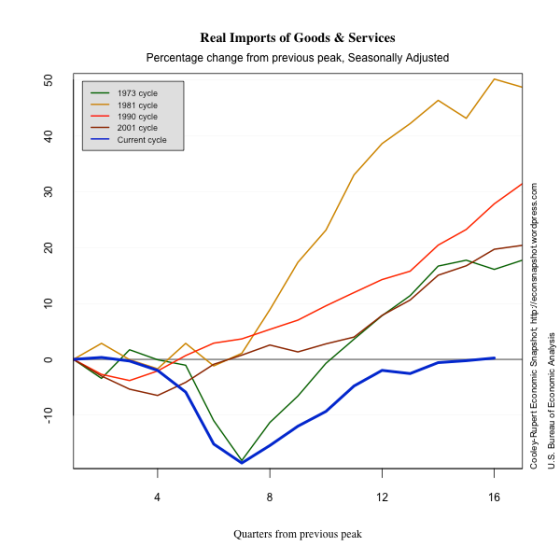

Investment in Equipment and Software continues to improve but it would have to be nearly a third larger to counter the decline in residential investment. Exports are increasing and Imports are evolving in a way that is typical of previous recessions.

The Labor Market – Not Worse, Not Much Better

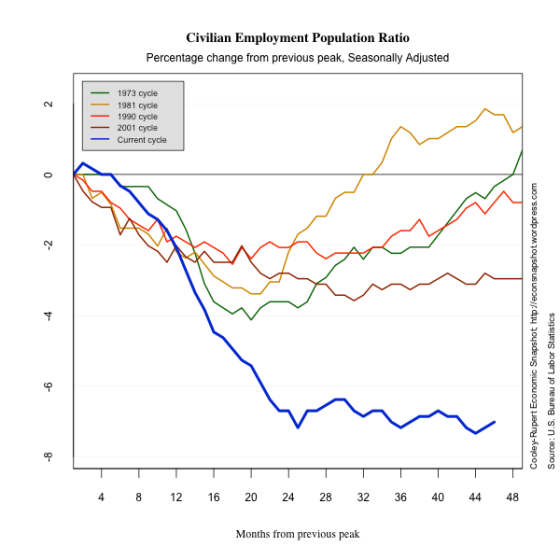

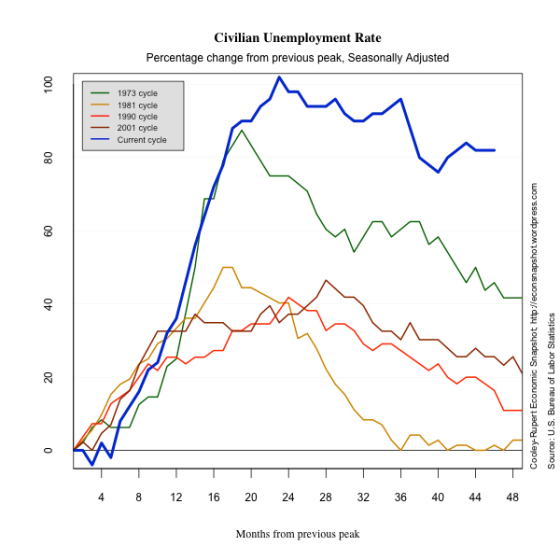

Back in 2001, the labor market was quite unresponsive, leading to the moniker, The Jobless Recovery. Unfortunately, the depth and length of the current experience in the labor market is far worse – what will we call this one?

If one only looked at the labor market it would be hard to conclude that we are experiencing a recovery. Rather, it suggests an economy that is bumping along at the bottom of a business cycle trough. It is, perhaps, the primary testament to the severity and longevity of this recession.

The latest data show a net addition of 103,00 jobs in September. Of these 45,000 represented the return to work of striking telecommunications workers. The unemployment rate held at 9.1\% and there were slight upward revisions to the jobs numbers for July and August. While this is not bad news for the labor market it is not a story of recovery. Rather we seem to remain stuck in the trough of this cycle.

As we noted in a previous post, the dating of business cycles by the NBER is based on a mixture of evidence that often includes reference to the labor market. Indeed, when the NBER dating committee dated the beginning of this past recession, they made it clear that the labor market was a key variable in their decision, as can be seen here. However, when the committee announced the trough there was no mention of the labor market, which has not shown any signs of recovery. Indeed, the paths of the employment/population ratio and the labor force participation rate make the strongest case for concern about a double dip recession.

In this post we take a deeper look at the labor market, including data on Aggregate Hours of work and the duration of unemployment. Aggregate Hours captures changes in both the extensive margin of labor force adjustment (employment), and the intensive margin (hours of work). Many believe this offers a more accurate picture of the economy …and the picture is grim. The data on the duration of unemployment is particularly discouraging.

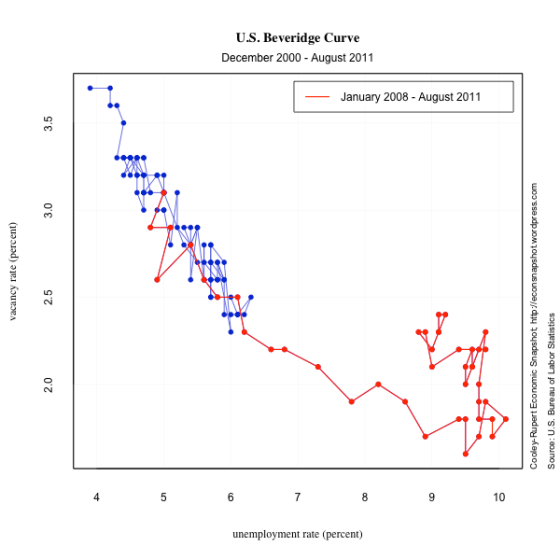

We also include data from JOLTS, the Job Openings and Labor Turnover Survey. These show some more refined features of the labor market and permit comparison to the 2001 business cycle. What stands out in these data is that, while separations look similar to the 2001 cycle, this masks the extraordinarily abrupt increase in layoffs and discharges and the sharp decline in quits.

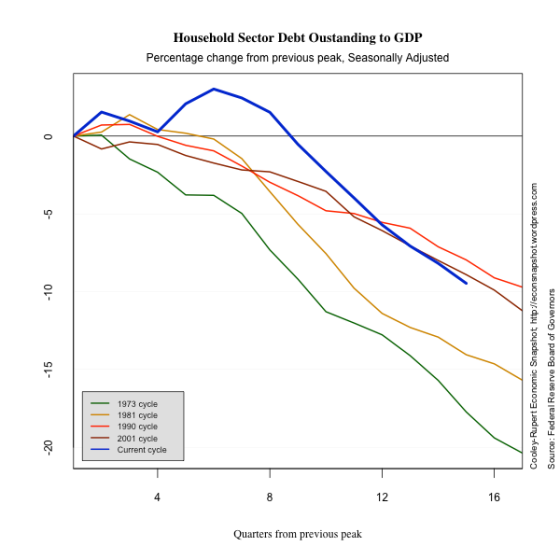

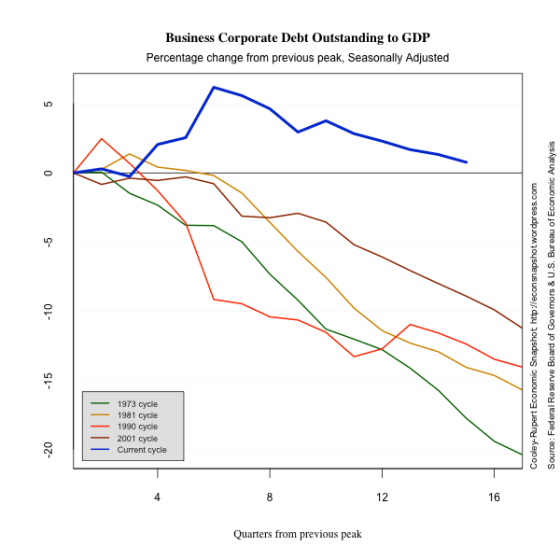

Credit markets continue to show the after-effects of the tremendous increase in leverage the took place prior to the 2007-2009 crisis. Households are continuing to reduce their debt and at an increasing rate. Corporate sector borrowing continues to improve and is following a path that is typical of prior recessions. The big story in credit markets is the dramatic shift of leverage to the public sector. Public sector debt outstanding is reaching levels unprecedented in the post-war economy.

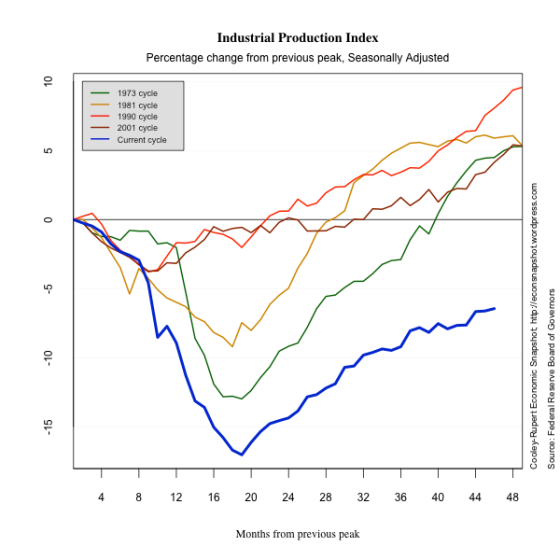

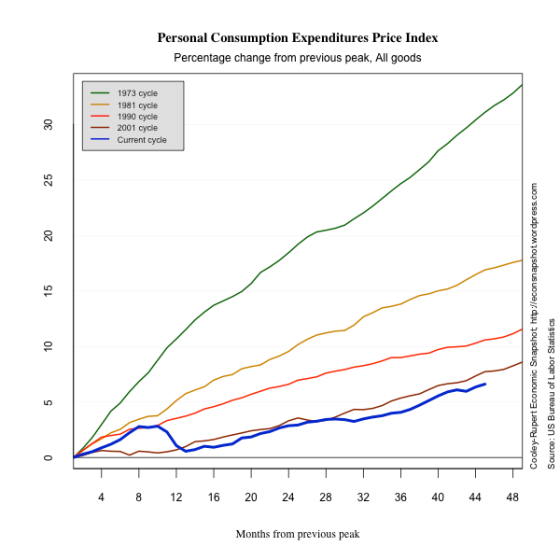

Industrial Production and Inflation

In this section we present some plots of miscellaneous series that reflect other characteristics of this business cycle. The decline in industrial production is dramatic. There is no evidence of inflation or deflation.

Glossary

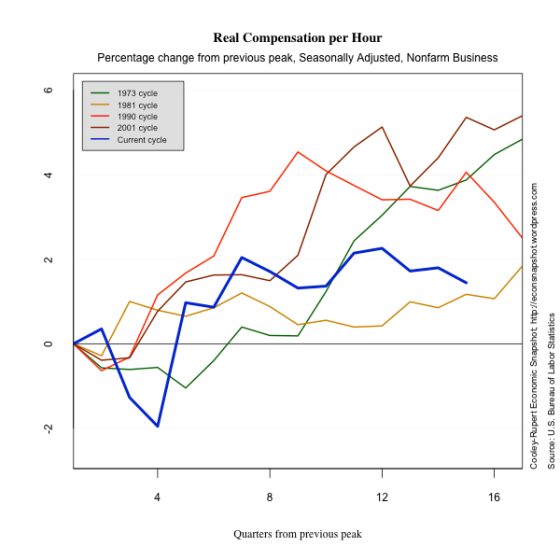

Compensation includes accrued wages and salaries, supplements, employer contributions to employee benefit plans, and taxes.

Consumer Price Index measures the price paid by urban consumers

for a representative basket of goods and services. Prices are collected from 87 urban areas and from approximately 23,000 retail and service establishments.

Debt Outstanding measures the current level debt owed on credit market

instruments. Credit market instruments include open market paper, Treasury securities, agency and GSE-backed securities, municipal securities, corporate and foreign bonds, bank loans, mortgages, and

consumer credit.

Durables are goods that have an average useful life of at least 3

years.

Employment Population Ratio is the ratio of the number of

civilians in the labor force to the total civilian population.

Exports consist of goods and services that are sold or

transferred by U.S. residents to foreign residents.

Goods are tangible commodities that can be stored or inventoried.

Government Consumption Expenditures and Gross Investment measures

current consumption expenditures by the government in order to produce goods and services to the public and investment in structures and equipment and software.

Gross Private Domestic Investment measures additions and

replacements to the stock of private fixed assets without deduction of

depreciation.

Imports consist of goods and services that are sold or

transferred by foreign residents to U.S. residents.

Industrial Production Index measures real output of

manufacturing, mining, and electric and gas utilities industries.

Job Openings or Vacancies are all positions that are open (not

filled) on the last business day of the month.

Labor Force is defined as the number of unemployed persons plus

the number of employed persons.

Labor Force Participation Rate is the ratio of unemployed persons

to the number of persons in the labor force.

Net Worth equals to total assets minus total liabilities. Assets

include owner-occupied real estate, consumer durables, and equipment and software owned by nonprofit organizations.

Nondurables are goods that have an average useful life of less

than 3 years.

Nonresidential Fixed Investment measures investment by businesses

and nonprofit institutions in nonresidential structures and in equipment and software.

Personal Consumption Expenditures measures the value of goods and services purchased by households, nonprofit institutions that primarily serve households, private non-insured welfare funds, and private trust funds.

Residential Fixed Investment measures investment by businesses and households in residential structures and equipment, primarily new construction of single-family and multifamily units.

Services are commodities that cannot be stored or inventoried and

that are usually consumed at the place and time of purchase.

Total Borrowing measures the flow of new credit market liabilities during the period. Credit market liabilities include open market paper, Treasury securities, agency and GSE-backed securities, municipal securities, corporate and foreign bonds, bank loans, mortgages, and

consumer credit.