By Thomas Cooley and Peter Rupert

The BLS announced nonfarm payroll employment increased by 2,509,000 in May. We won’t even mention what the expectations were heading into this report since no one really foresaw a rebound this quickly. The increase was the largest one-month increase in the history of the series after the largest one-month decline. The graphs below are, admittedly, quite bizarre. Most likely there are measurement issues and issues with seasonality. However, there can be no doubt that what we are observing today is far beyond the scope of anything we have seen in economic data…ever!

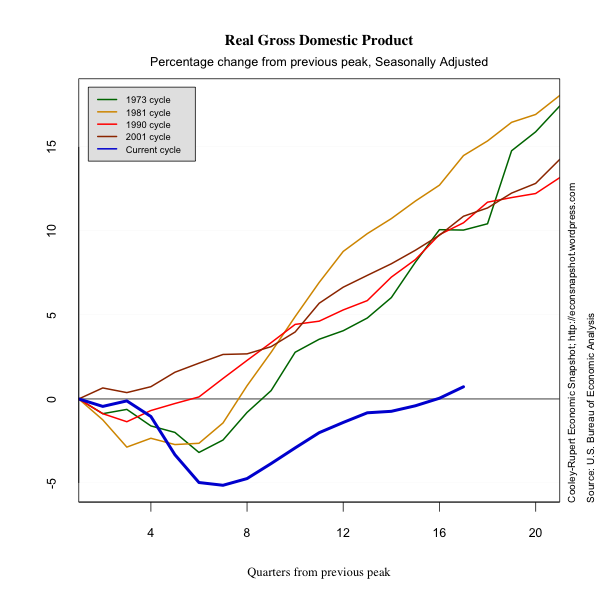

It isn’t time yet to declare a “V” shaped recovery, of course, but it is encouraging that the economy shows signs of adaptability as we begin to return to normal activity. It is still the case that most economists forecast that roughly 40% of jobs that were shut down will not come back.

Many of the jobs that were lost in April were ready to return once the government removed the restrictions. For example, service producing jobs increased 2,245,000 with leisure and hospitality rising 1,239,000. A friend of ours termed this a “synthetic” recession due to the fact that our economy did not put us in this mess…it was mandated by government in the interest of public health.

The rebound in employment was pretty broad based – jobs increased in most sectors.

Some of the increase in employment was the result of labor reallocation. Surveys indicate that for every 10 jobs destroyed since the onset of the pandemic, 3 new jobs were created. Retail jobs lost at Macy’s become new jobs at Walmart and Amazon. Reallocation is normal in recessions but we need way more than a three to one replacement rate to think about this as a recovery.

Average weekly hours soared from 34.2 to 34.7. With the return of many service sector workers, average hourly earnings fell from $30.04 to $29.75 due to the fact that these workers tend to be lower on the pay scale.

The household survey showed an increase in employment of 3,839,000 and an increase in the labor force of 1,746,000. The number of unemployed persons fell 2,093,000 leading to a decrease in the unemployment rate to 13.26 from 14.75.

Yesterday, initial claims showed lower, but still elevated, claims. It is useful to note that the actual number of claims are given by the not seasonally adjusted data, ICNSA, in the chart below. Given the clamp down in the labor market, many of the seasonally adjusted series will be somewhat misleading since the “seasonal” component is likely not useful in this current context. Nonetheless, both series show the same patterns.

The flow from employed to unemployed in April was staggering and the turnaround was also staggering. The not seasonally adjusted data is shown given the affects of seasonal adjustment on the current data.

Labor market “churn” is a distinguishing feature of the U.S. economy and the recent data bear this out. The surprising speed of this reallocation should not lull us into thinking that the economy will snap right back however. The retail sector was already on life support as were parts of leisure and hospitality. The pandemic is simply pushing them along faster. It also reveals weaknesses in other sectors like commercial real estate and higher education. As people discover new ways to organize work and learning the old business models are likely to be replaced.

These parts of labor force reallocation are going to take a long time to be realized and this suggests that recovery may seem swift initially but will have a very long tail.