We are pleased to announce that we have finished updating the U.S. Snapshot. It should now give us the same flexibility in our data presentation as in our partner page: the European Snapshot. We also hope to bring you more regional and state-level analysis in our future posts.

Author: Peter Rupert

In Like a Lion…

By Thomas Cooley and Peter Rupert

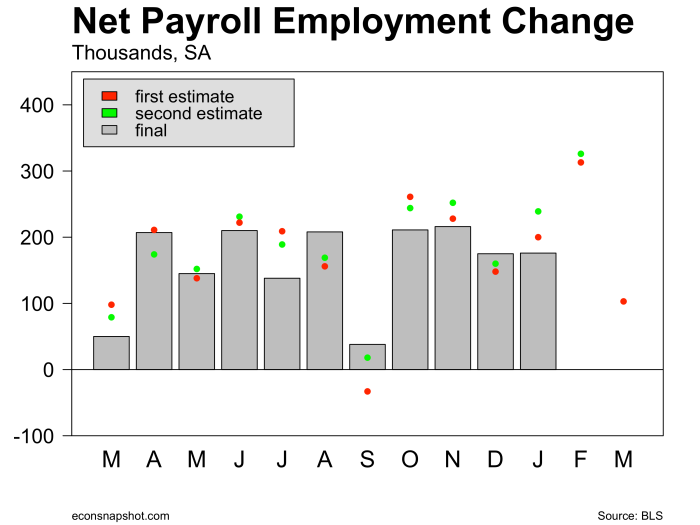

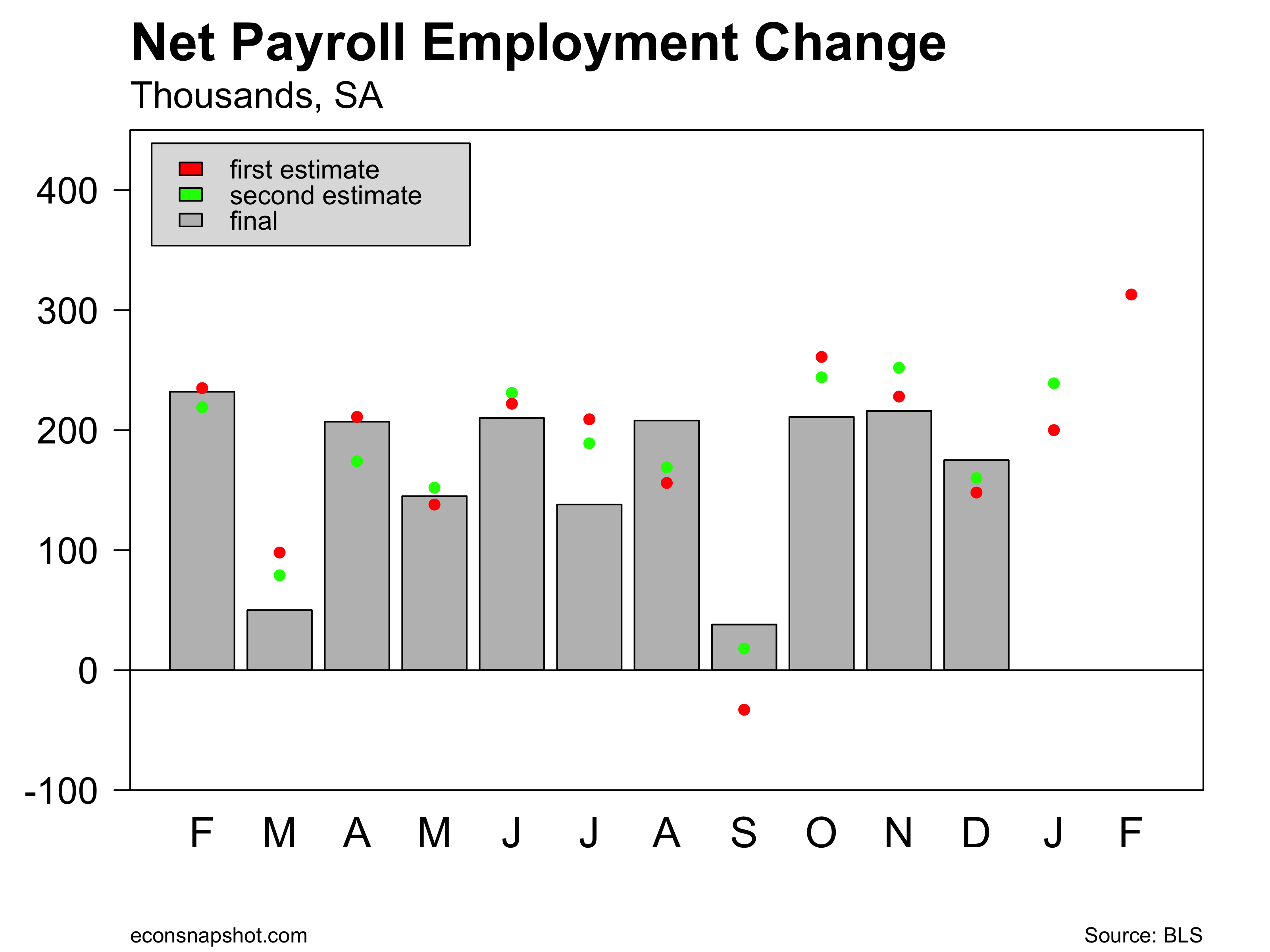

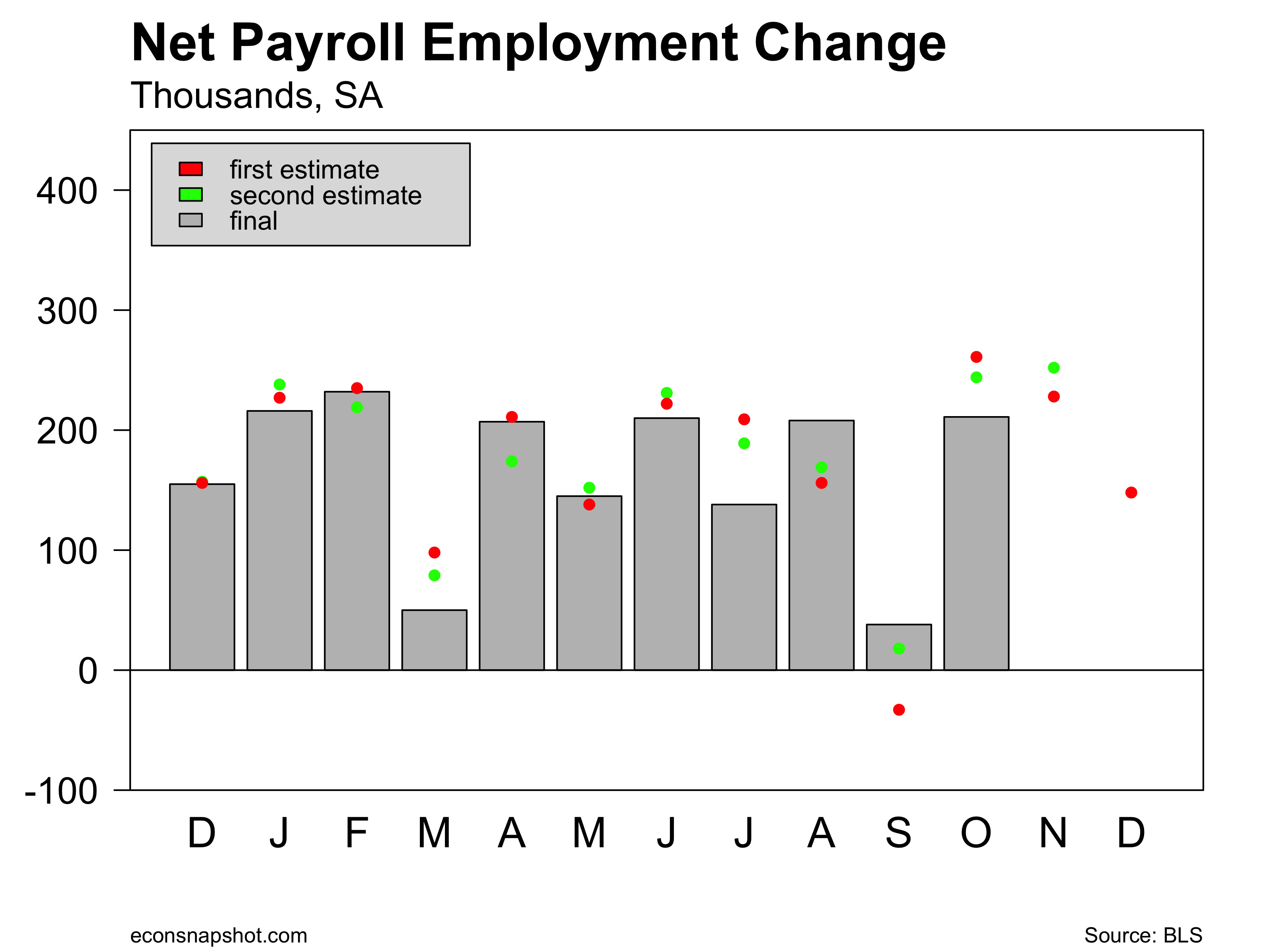

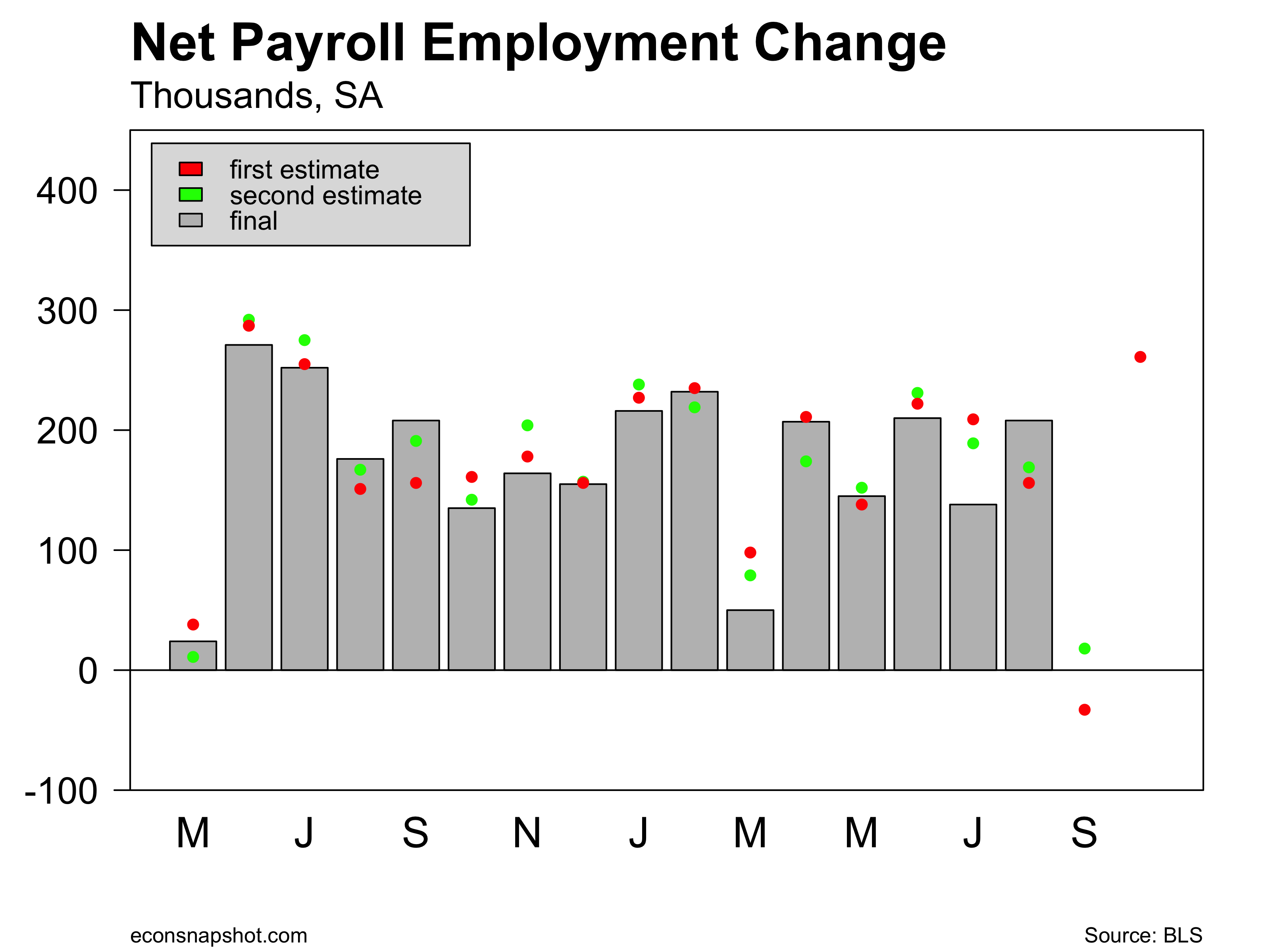

The BLS announced that nonfarm payroll employment rose by 103,000 in March and revised February employment up 13,000 to 326,000 and January down 63,000 to 176,000. The 50,000 in downward revisions and the weak 103,000 March number paints a fairly different picture of the labor market…one not quite as strong as it was just yesterday.

The sharp drop off may well have been weather related as the construction sector lost some 15,000 jobs in March.

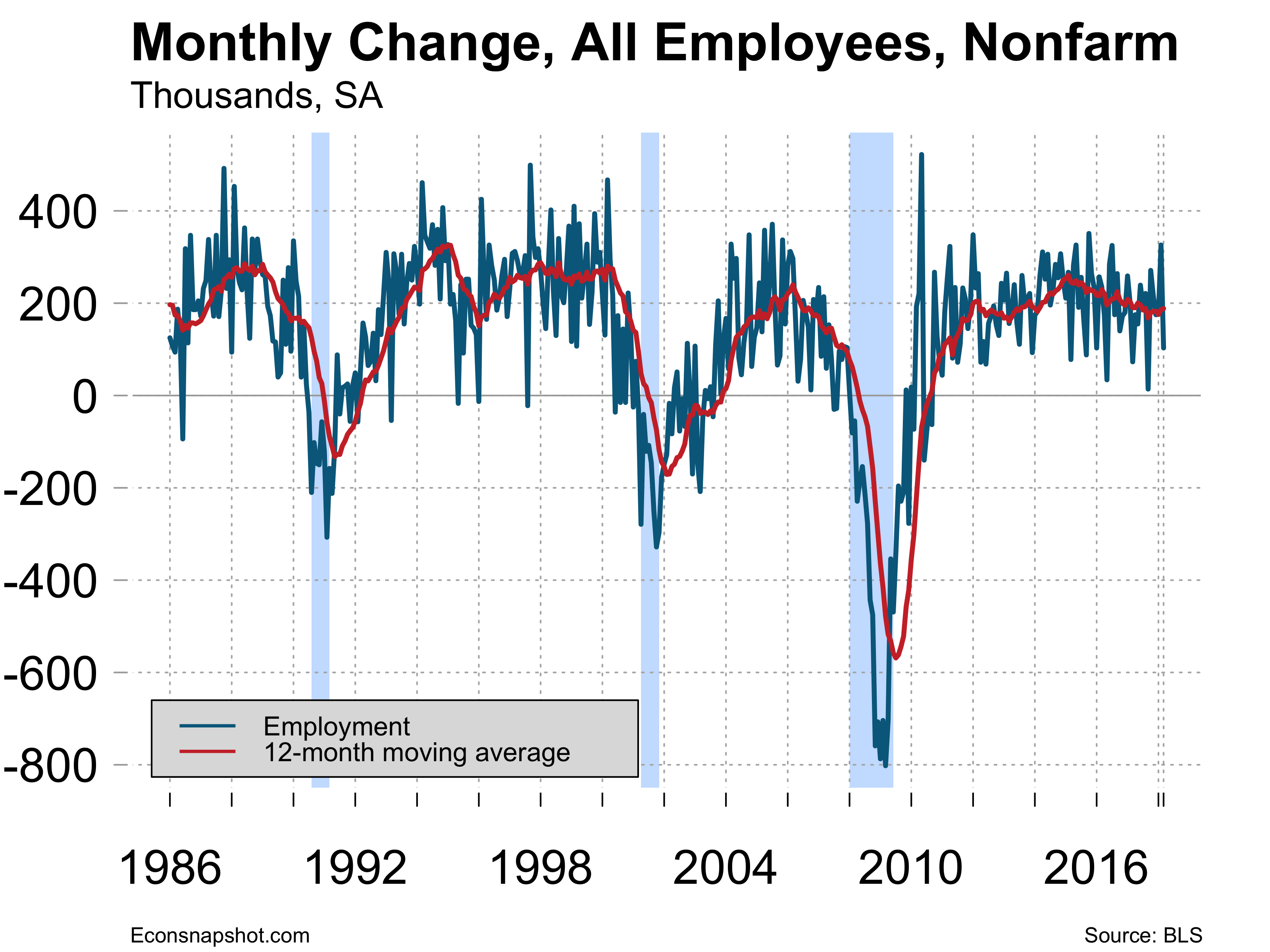

Looking at the data over a longer period of time with a 12 month moving average suggests that employment growth has been slowing for some time. But this is the ninth year of an expansion and the fact that the economy is continuing to add jobs at a good pace is encouraging, the March hiccup notwithstanding.

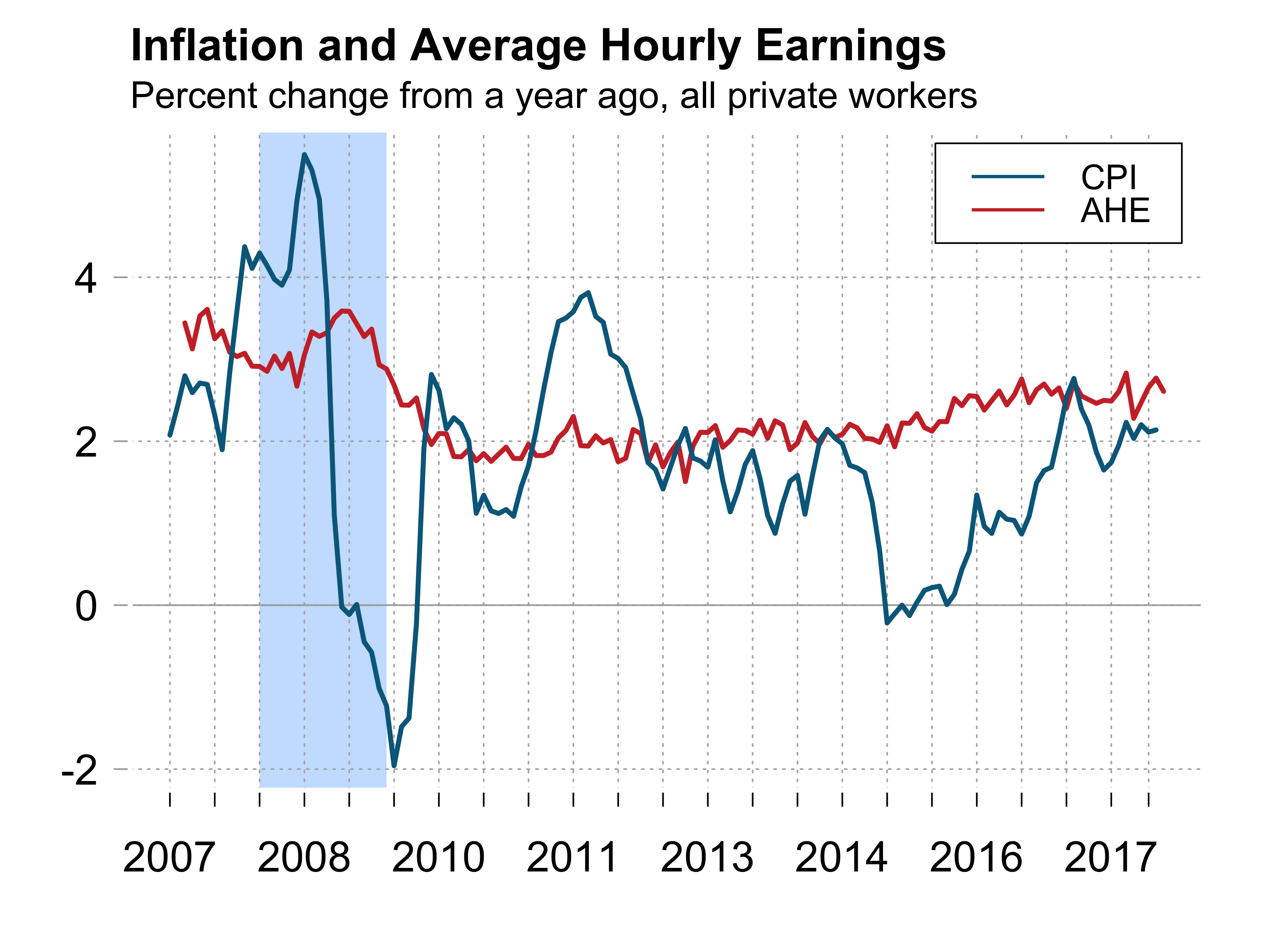

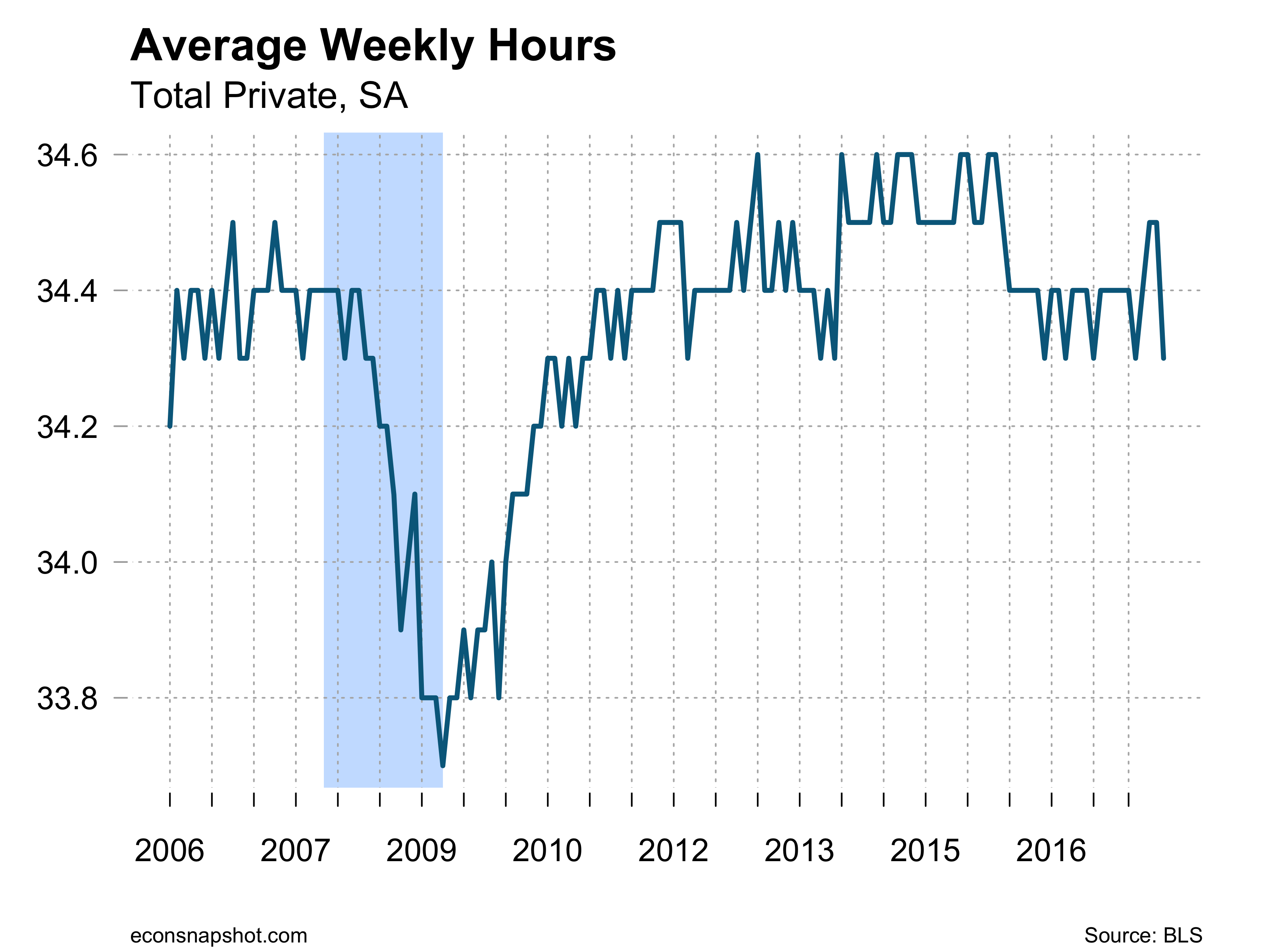

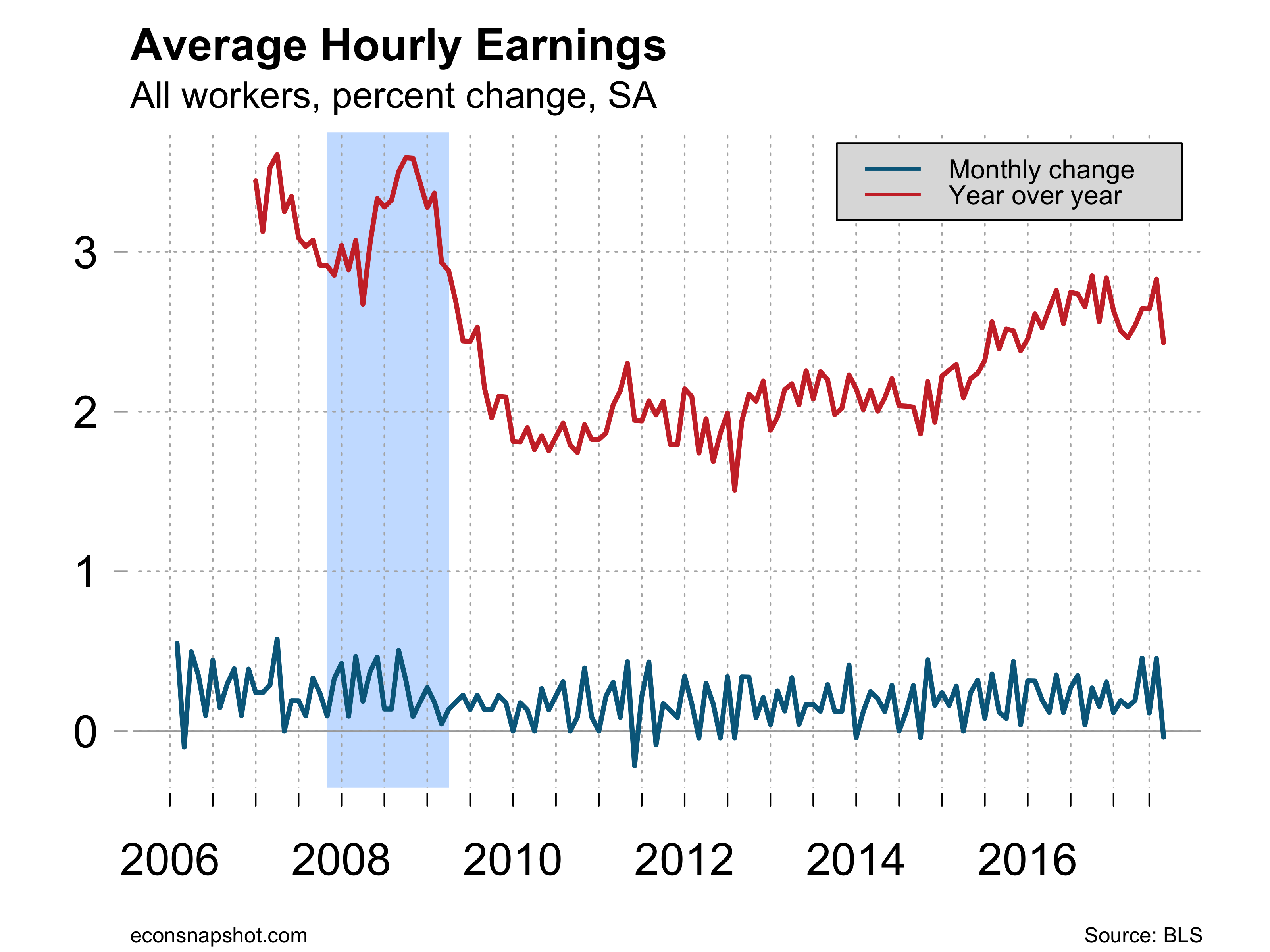

Average hourly earnings increased 8 cents and is up 2.7% since last year and with low inflation has lead to real wage gains. Average weekly hours remained at 34.5.

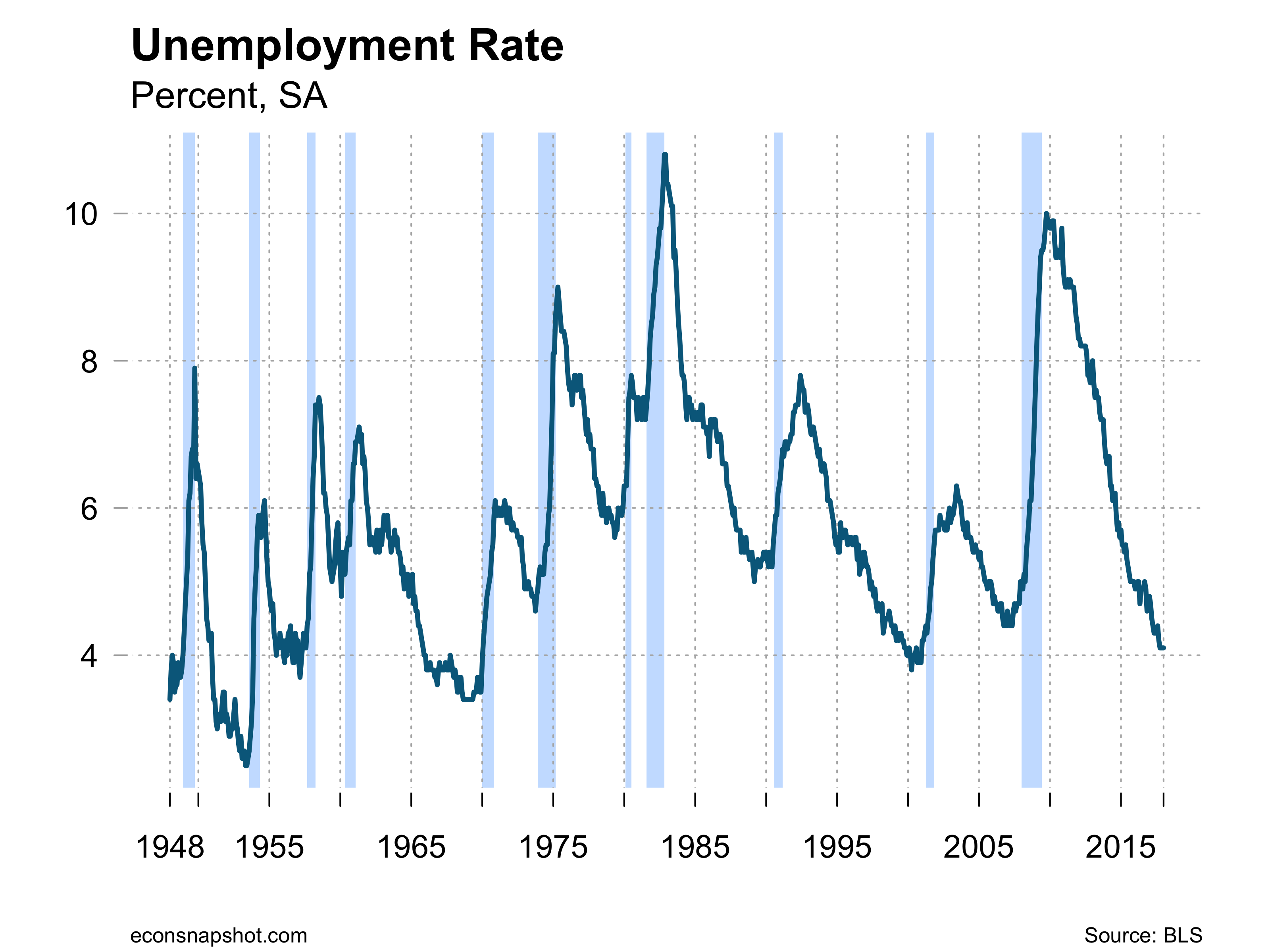

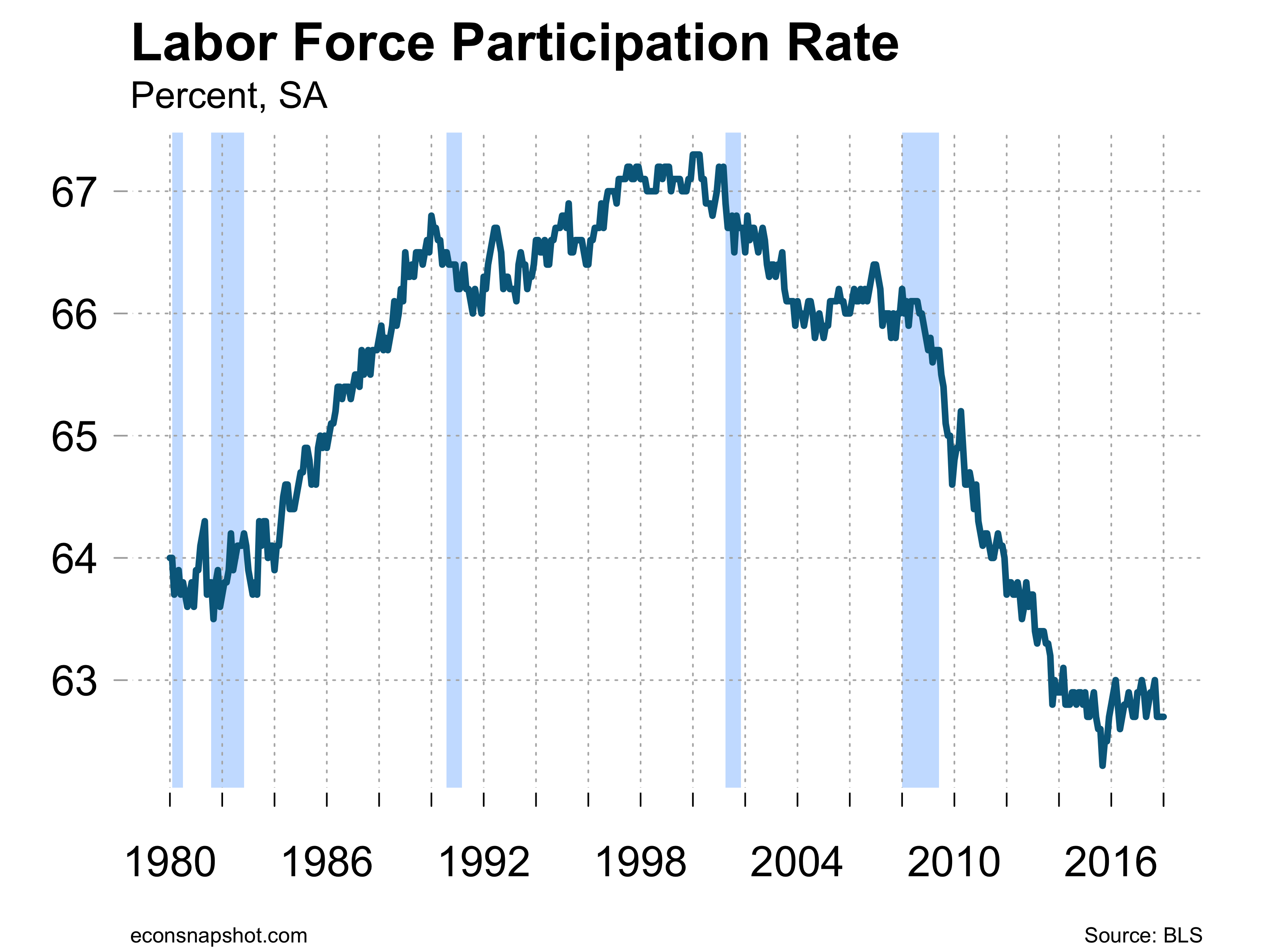

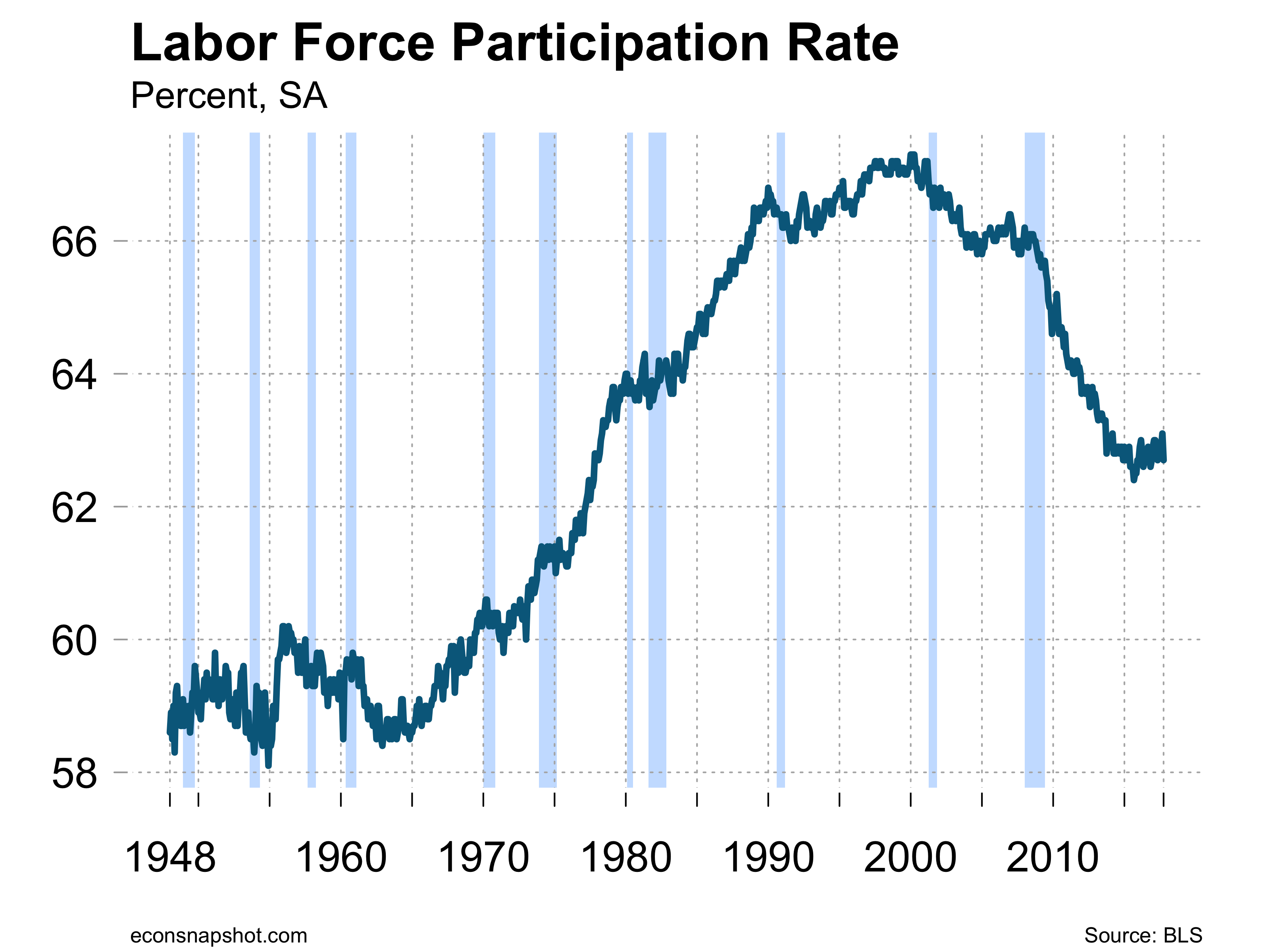

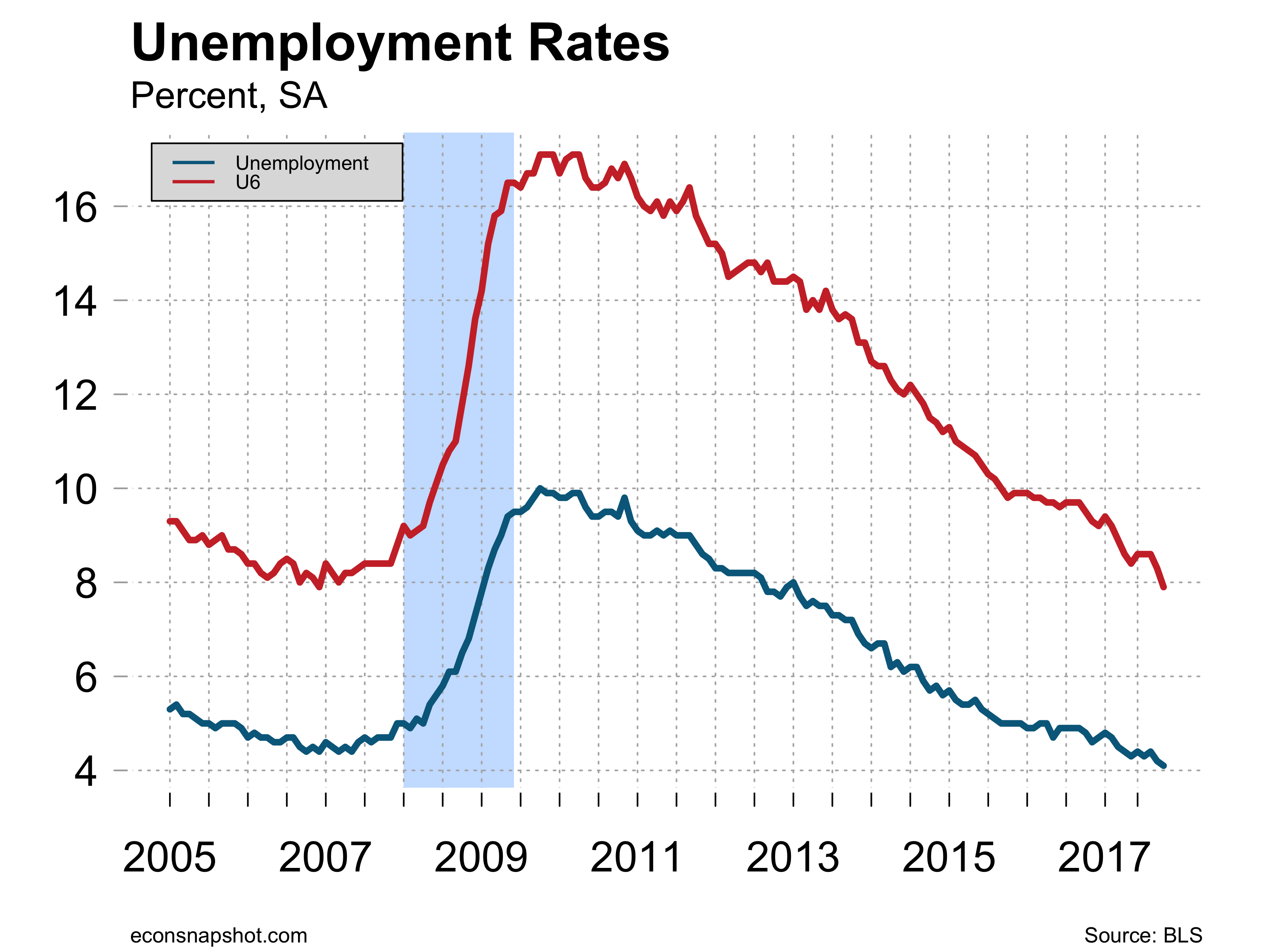

The household survey reveals a decline of 158,000 in the labor force with the participation rate falling from 63.0 to 62.9. The unemployment rate fell slightly from 4.14% to 4.07%.

Upgrading our Blog!

We are pleased to announce that we will be upgrading our blog this weekend in order to give greater flexibility in our data presentation.

After this change, you will still be able to find us at econsnapshot.com.

Subscriptions should remain intact, though to err on the side of caution, we suggest that our loyal readers check back with us on Monday and re-subscribe after the change takes place. We thank you for your readership and we look forward to continuing to bring you the current Economic Snapshot!

February Employment Tops All Estimates

By Thomas Cooley and Peter Rupert

The February payroll employment numbers crushed all preliminary forecasts (in the 200k ballpark) by increasing 313,000. In addition, January employment was revised up 39,000 from the first estimate and December revised up 15,000 from the second estimate. The increase in private payrolls was 287,000 with government employment rising 26,000. Employment in the goods sector increased 100,000. The only significant decline came in the service producing information sector, declining 12,000 and has seen three consecutive months of declining employment.

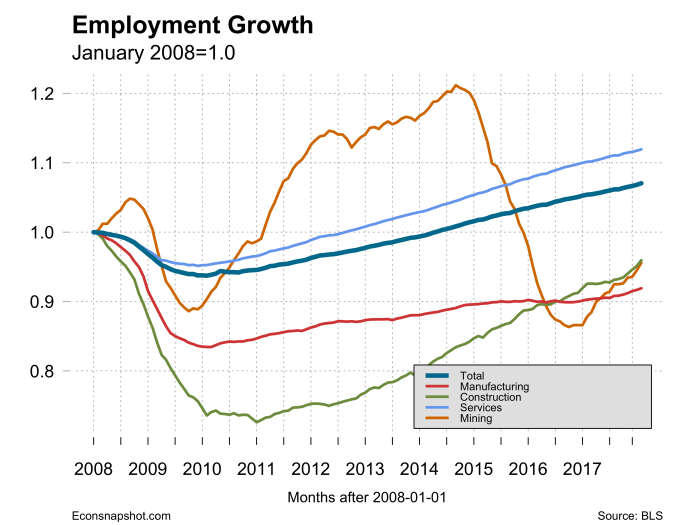

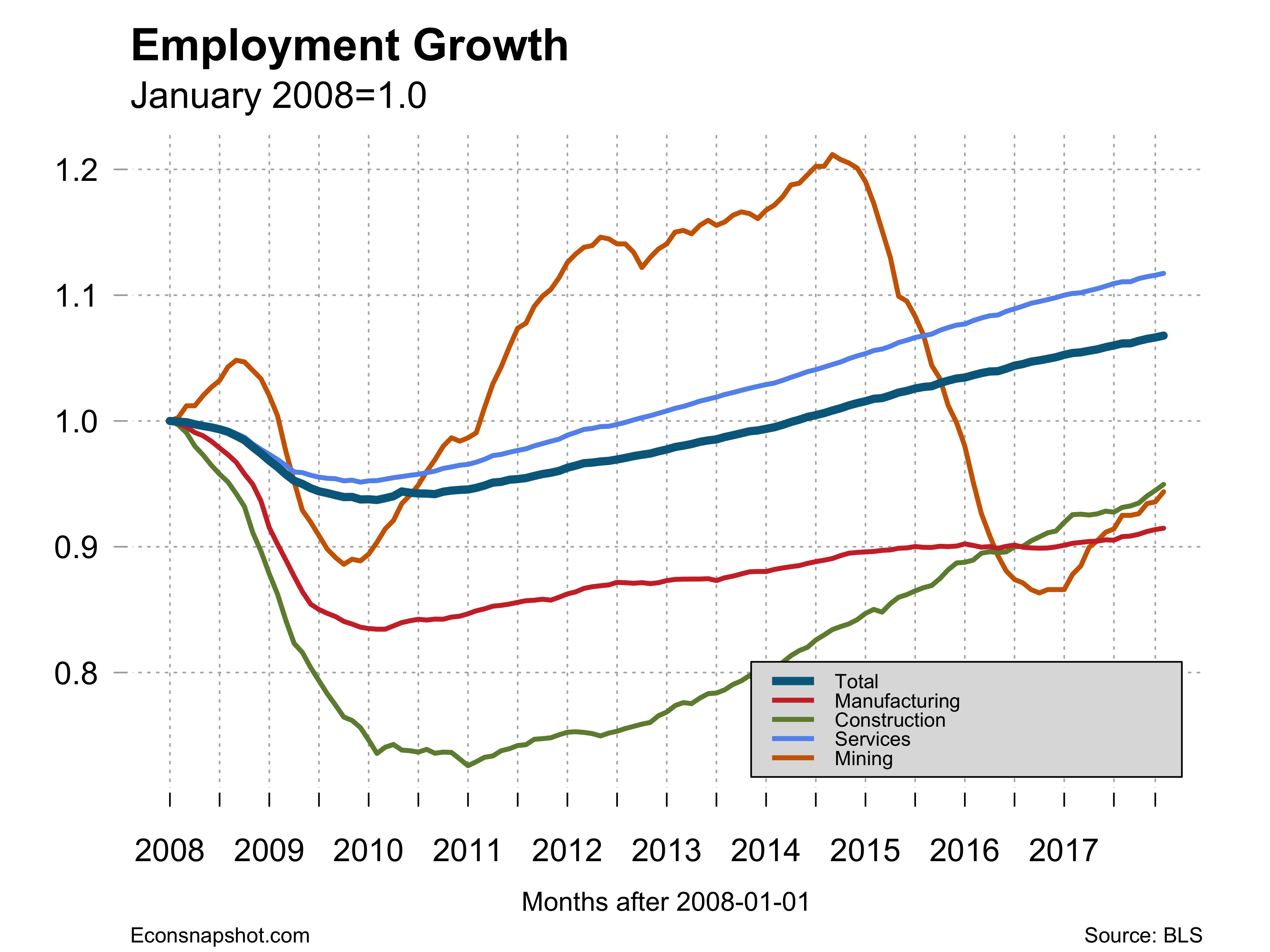

As in the past most of the employment growth was in the service sector continuing a shift in the structure of the economy that has been on-going for many years. Manufacturing remains relatively flat, well below levels of a decade ago. The more volatile mining and construction sector both improved.

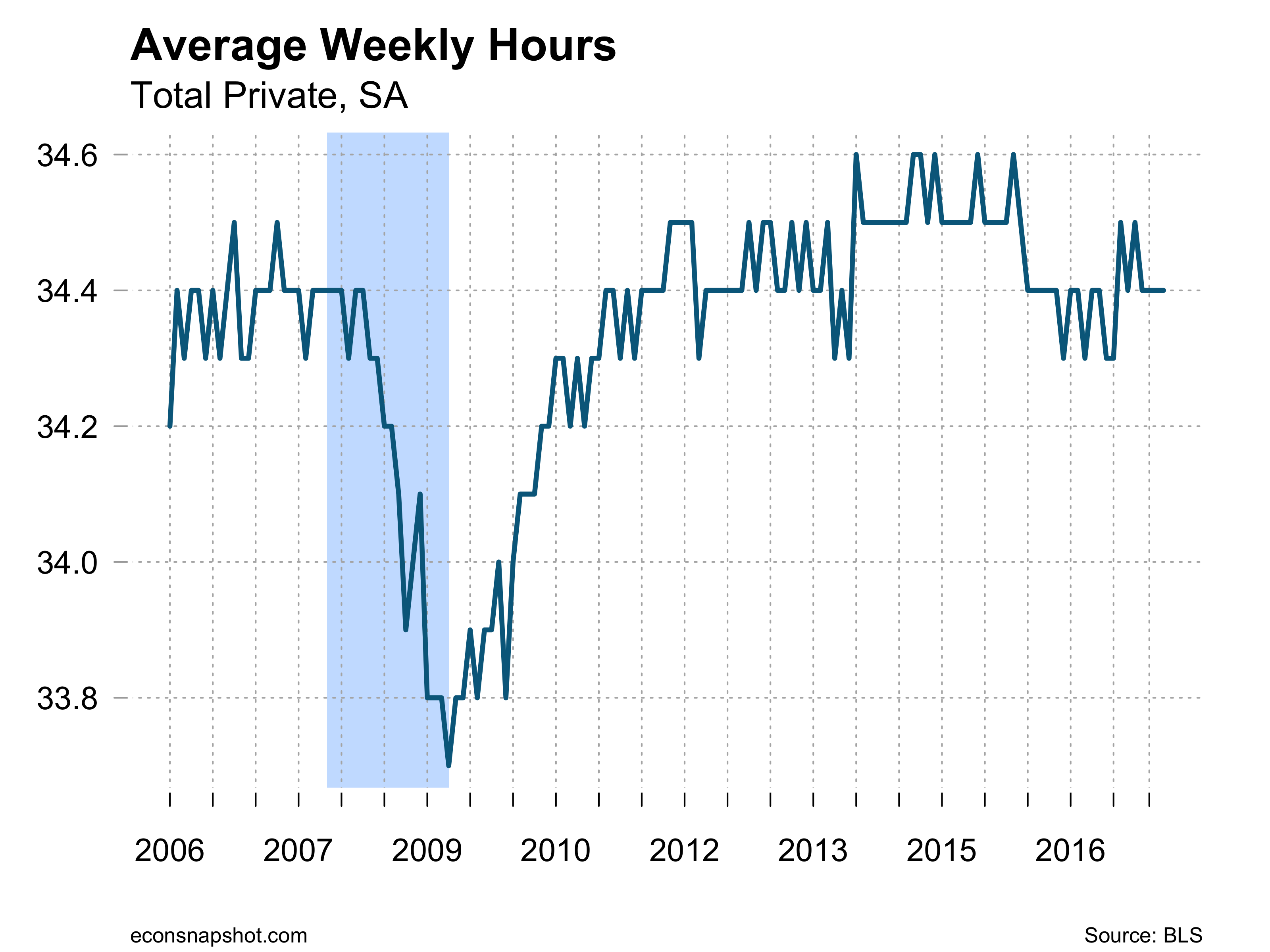

Average weekly hours ticked up from 34.4. to 34.5 and average hourly earnings barely changed, rising from $26.71 to $26.75. The increase in average hours implies that workers paychecks increased in the quarter. Average hourly earnings are up 2.6% year over year and the CPI up 2.1% from a year ago (January to January in the case of the CPI).

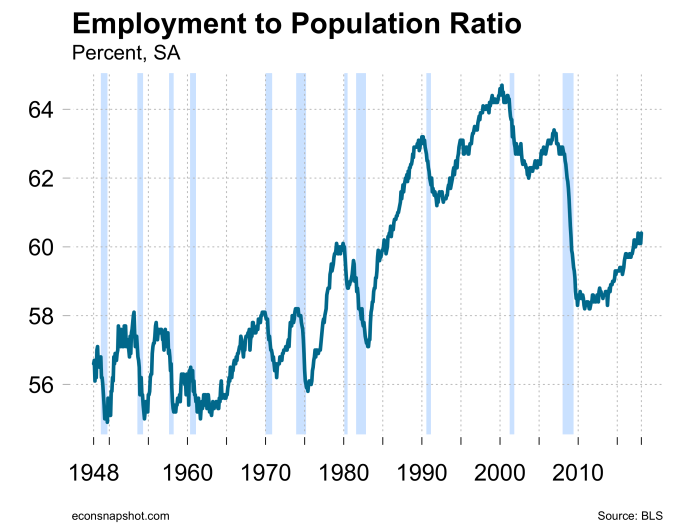

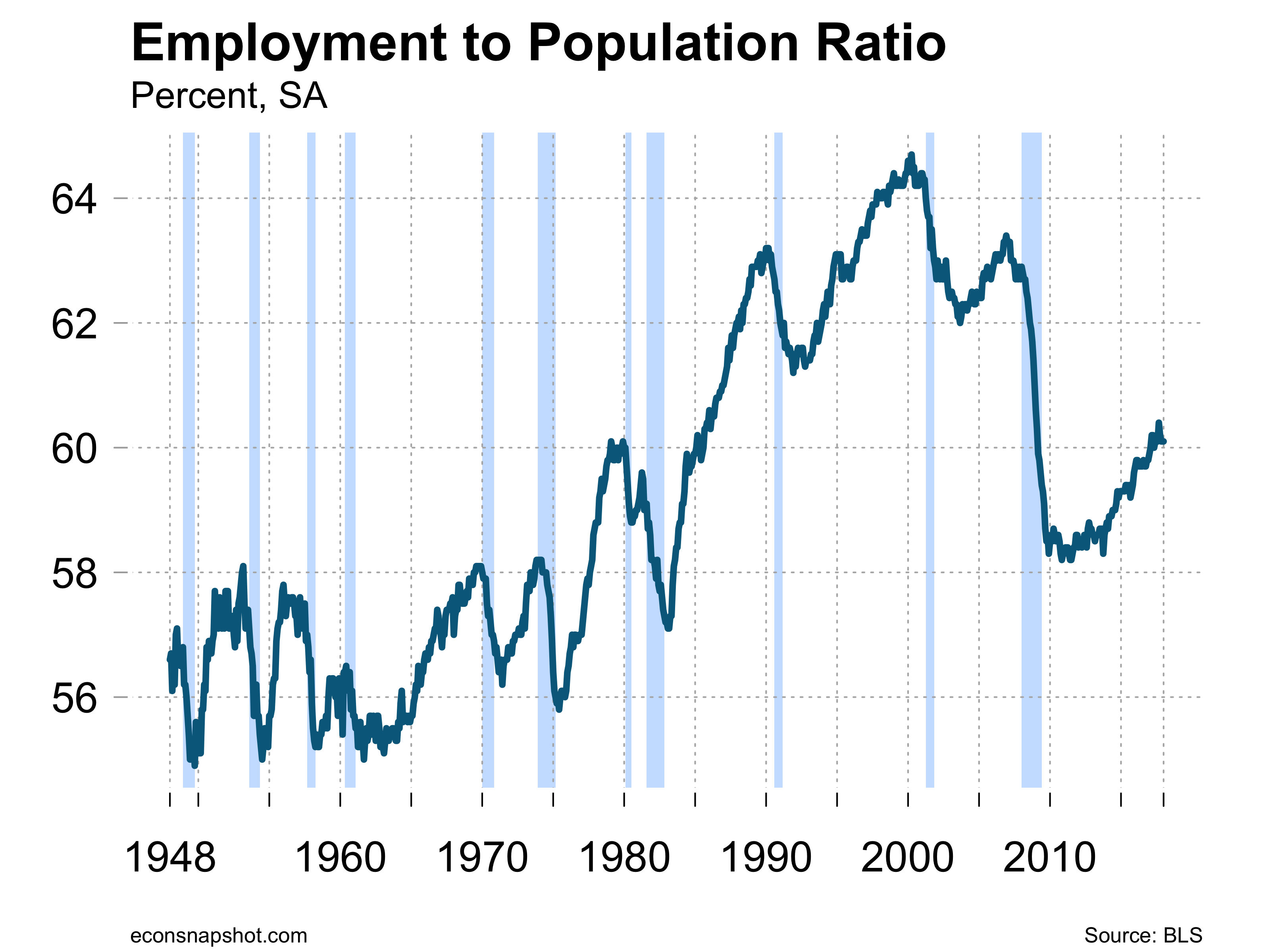

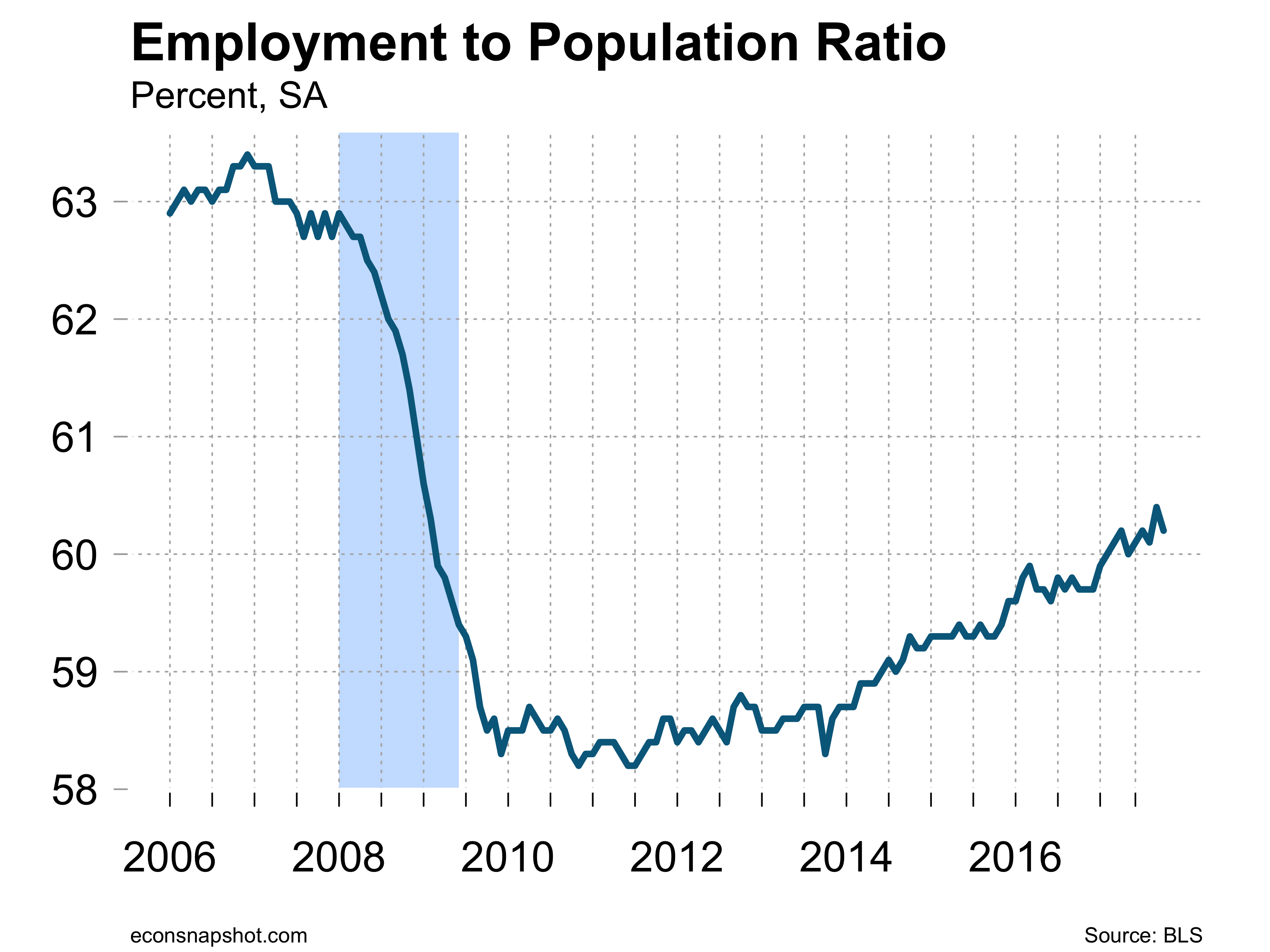

The household survey release reveals a 806,000 increase in the labor force, 785,000 of that from employment and 22,000 more unemployed, leading to almost no change in the 4.1% unemployment rate. Those not in the labor force declined by 653,000. The employment population ratio increased to 60.4%, moving up from historic lows.

The strong job growth most likely reflects business optimism because of the tax cuts and regulation role backs. In additional, we have entered a period in which most of the worlds developed economies are growing in sync. The new Fed Chairman Jerome Powell has signaled the he is open to increasing interest rates several time this year. The very strong labor market gives him cover for that view but the modest rise in hourly earnings is a factor that will have to be considered as well.

Labor market strength continues in January

By Thomas Cooley and Peter Rupert

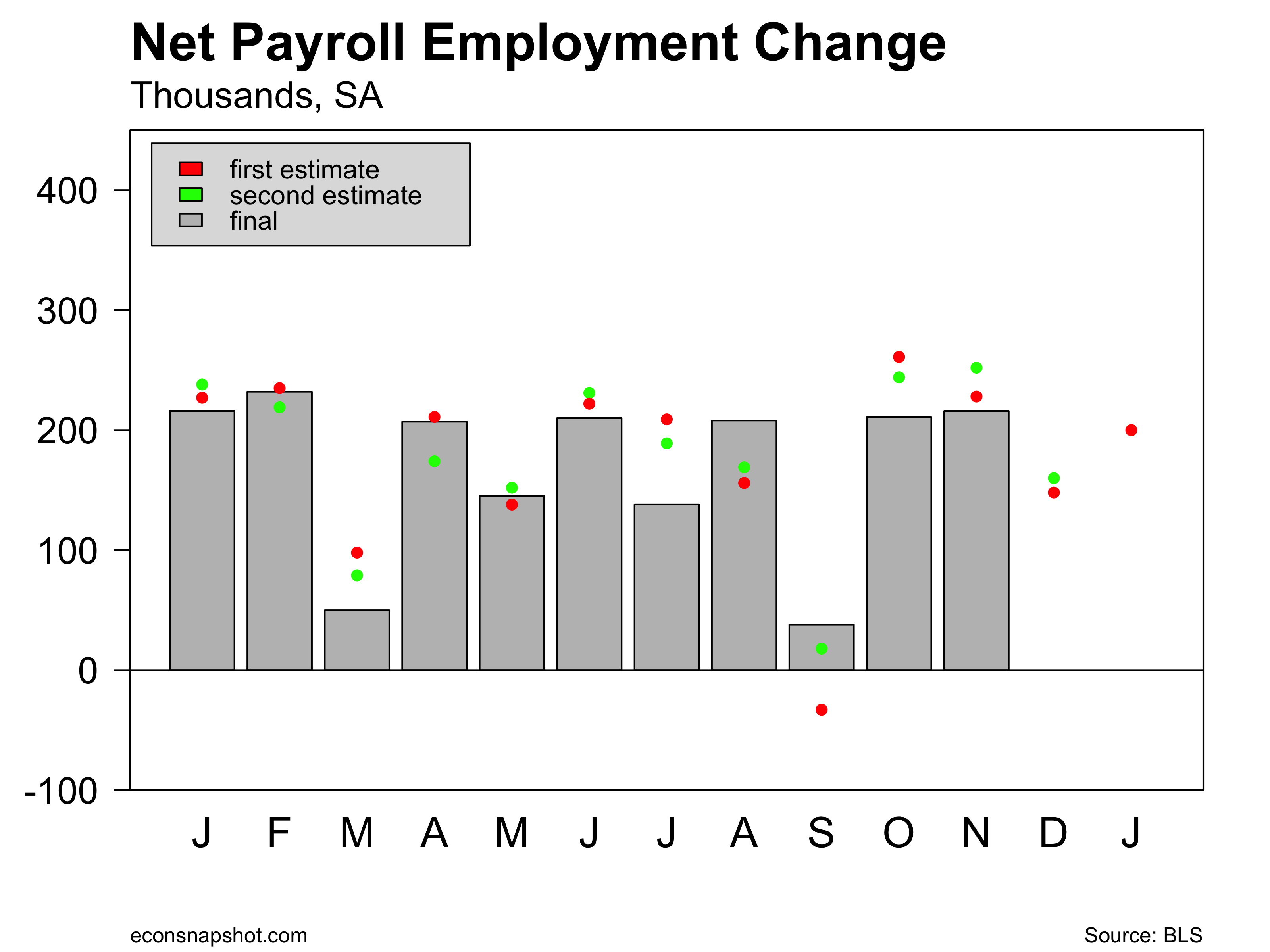

The labor market added 200,000 jobs in January as reported by the BLS. Over the month revisions showed an upward revision in December of 12,000 (148,000 to 160,000) and lower for November (252,000 to 216,000). The private sector added 196,000. The gains were widespread, with only small declines in a few sectors: Nondurable goods down 3,000 and Information jobs in the services sector were down 6,000.

The strongest employment growth was in the service sector but there were also gains in construction and in the volatile mining sector driven by higher oil prices.

Although average hourly earnings rose from $26.65 to $26.74, average weekly pay fell from $919.43 to $917.18 due to weekly hours falling from 34.5 to 34.3. The work week may have contracted because of weather in January so it remains to be seen if there is increasing wage pressure in the labor market.

The household survey showed little changes, if any, in most of the categories. The unemployment rate nudged up from 4.09% to 4.15%. The employment to population ratio held at 60.1% and the labor force participation rate remained at 62.7%. Both of these have been stable for the past several months.

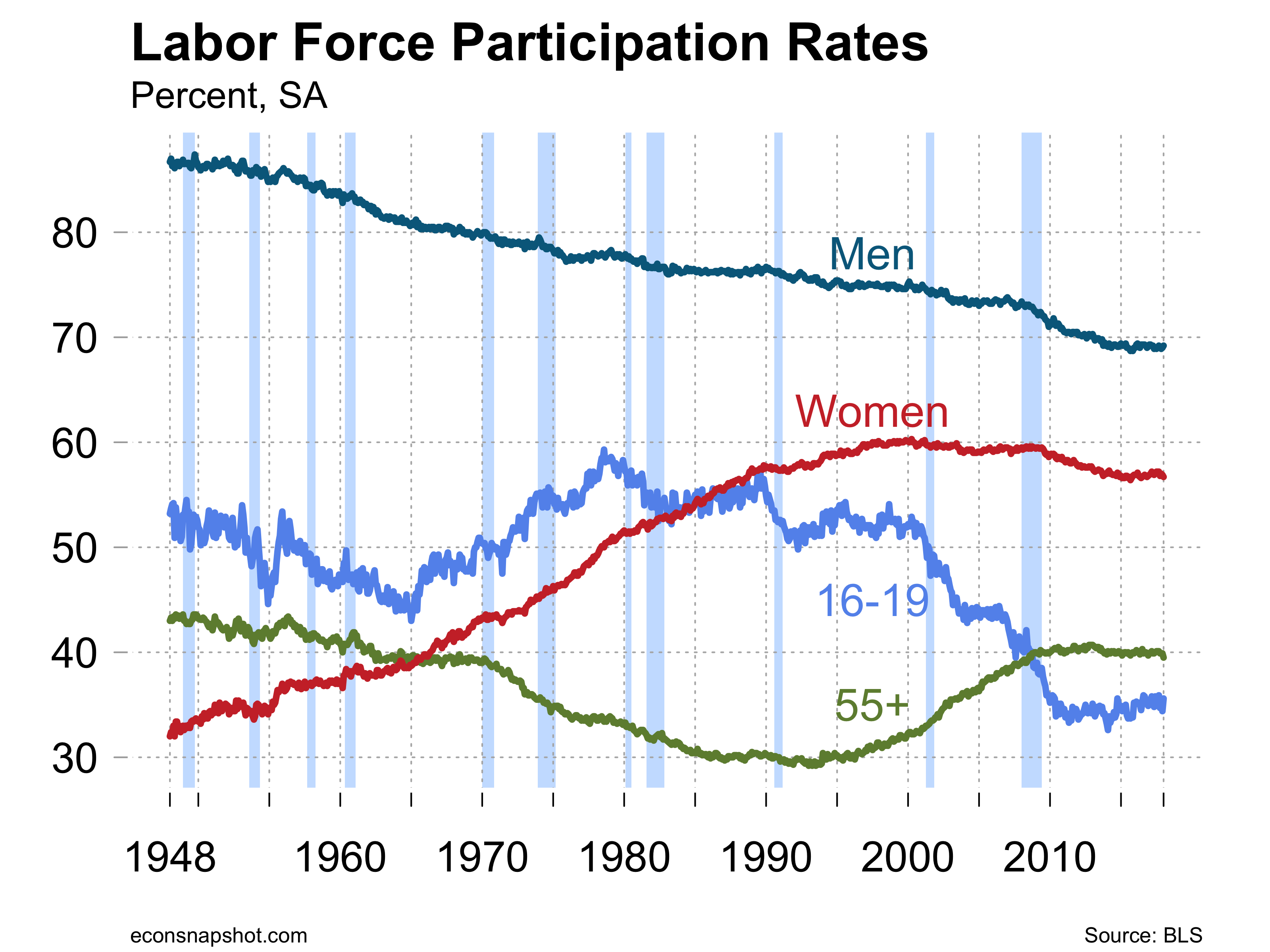

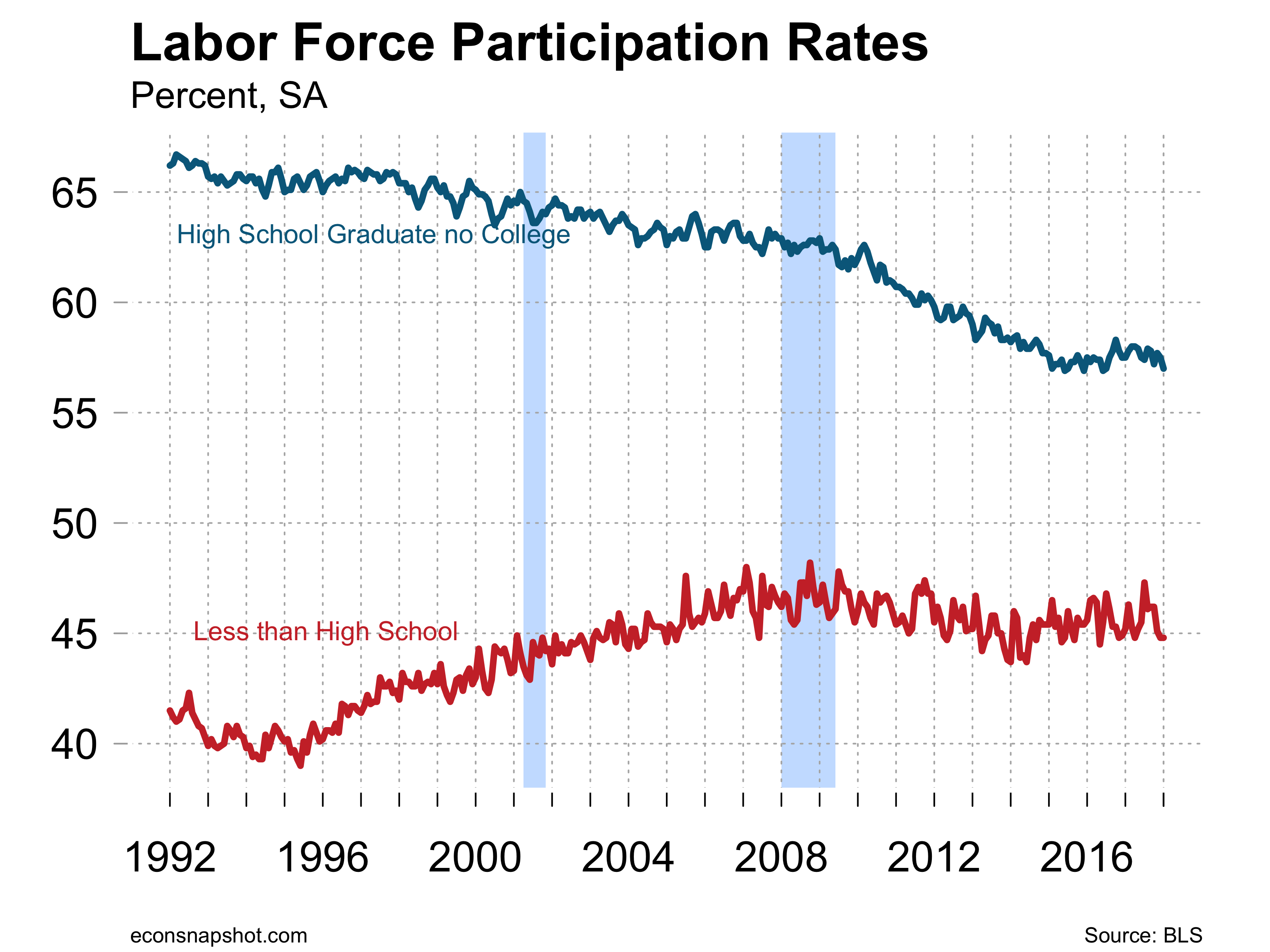

Looking more closely at the labor force participation rate reveals some interesting trends for various groups. While the LFP rate for women had been climbing over time, it peaked in the early 2,000’s and has been declining since, although it has remained stable over the past couple of years. The long decline in male LFP has also slowed of late and is hovering around 69%. The only real increases over the past decade or so was in those 55 years and older. The decline of teens from 50% to about 35% is one of the more remarkable changes. Another large decline is seen for those with only a high school degree. Their labor force participation rate has fallen from about 65% to 57% over the past two decades. However, the LFP rate of those with less than a high school degree has remained roughly constant over the past couple of decades.

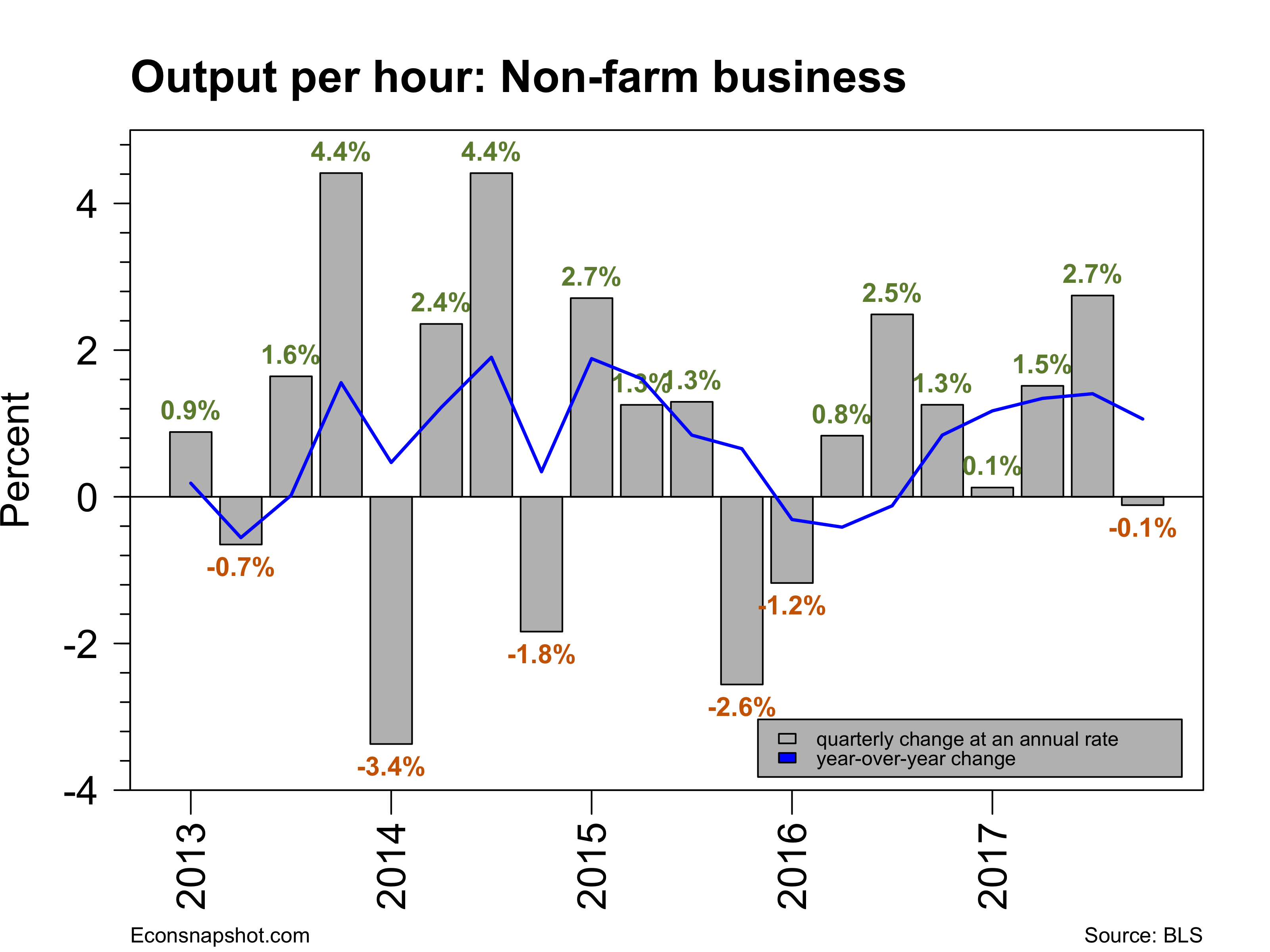

The BLS released productivity numbers for January on February 1. Output per hour in the nonfarm business sector fell by 0.1% with output rising by 3.2% and hours rising 3.3%. This is one facto keeping wage growth low.

End of the year continues strong

By Thomas Cooley and Peter Rupert

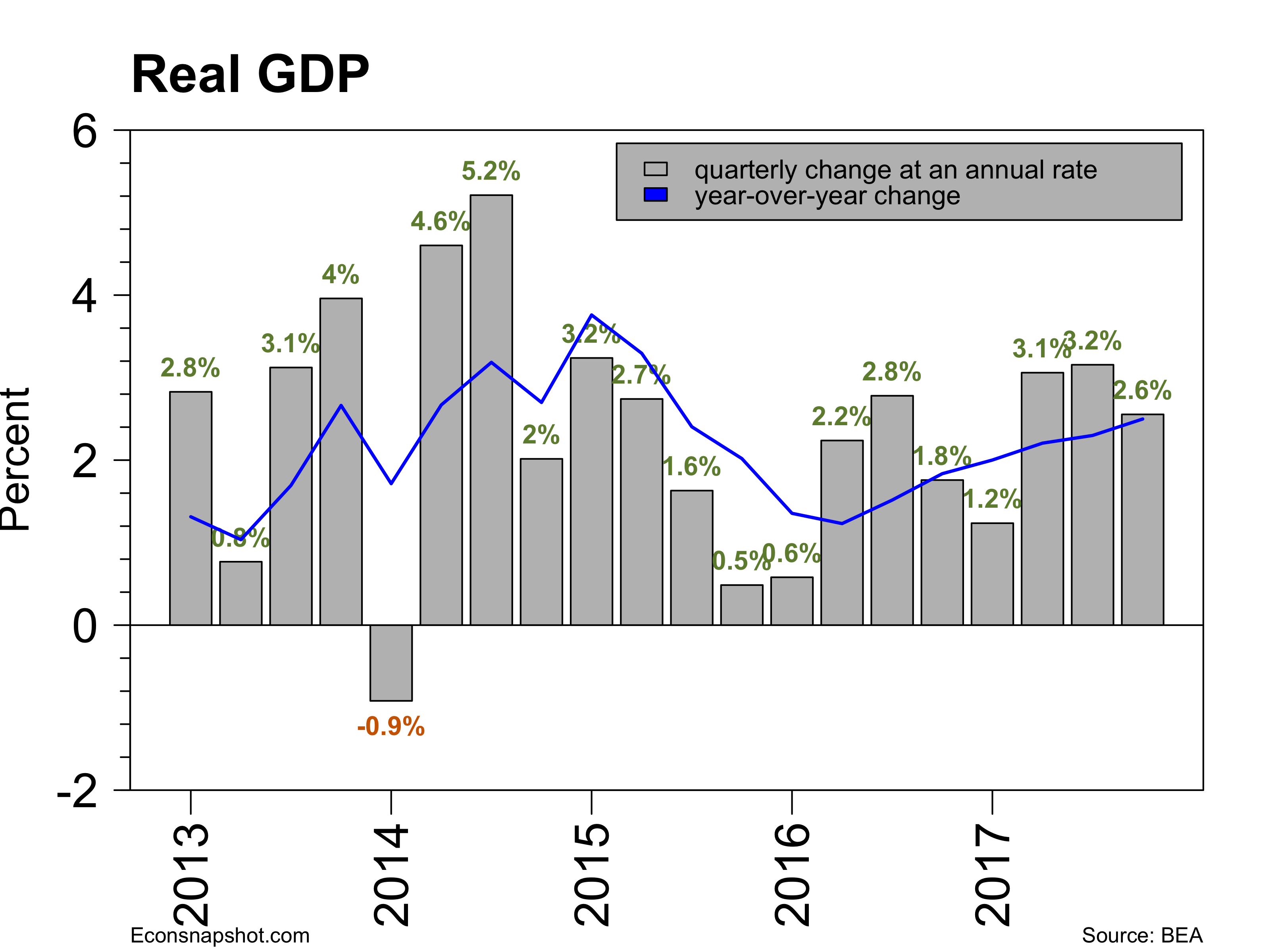

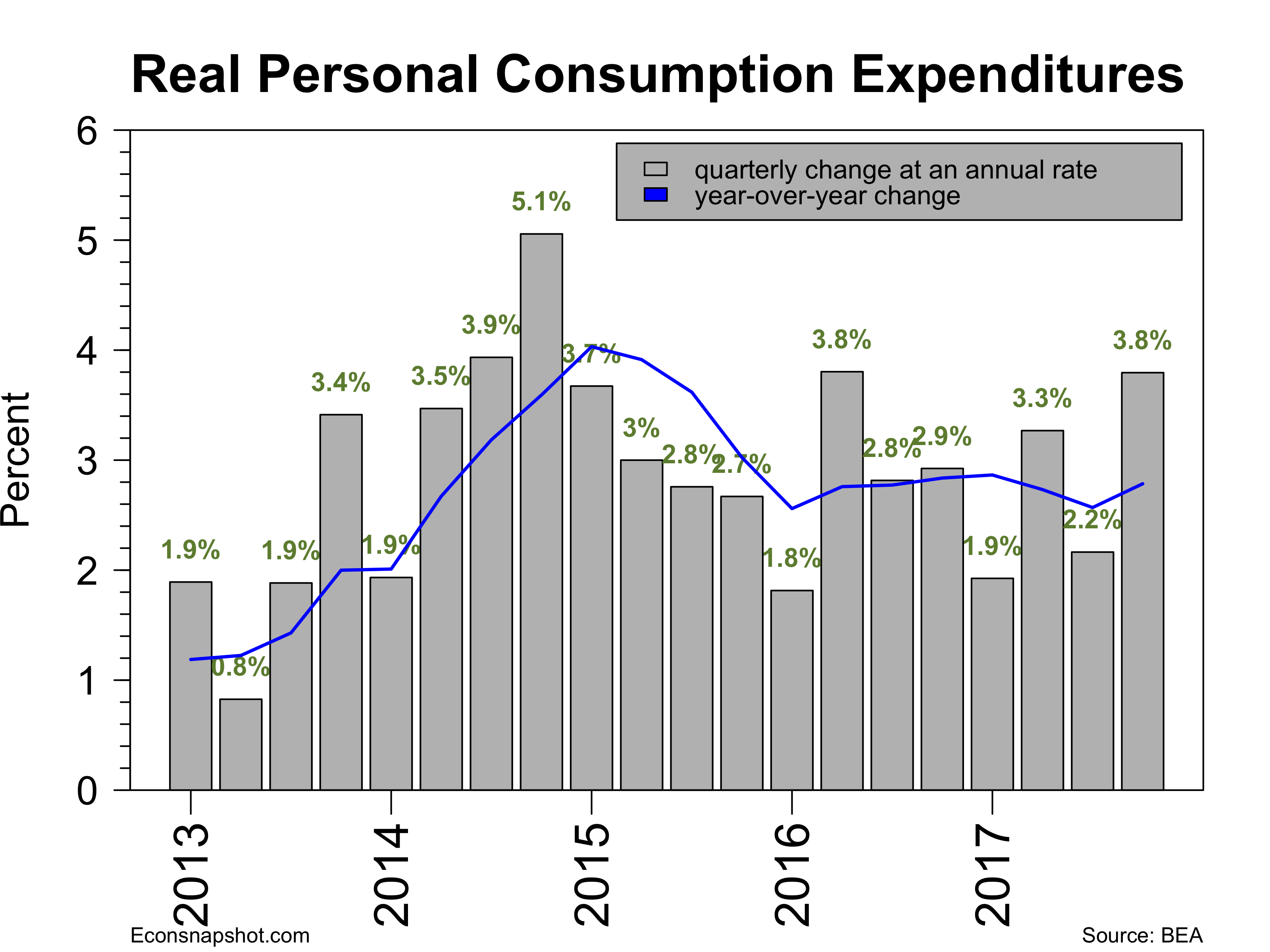

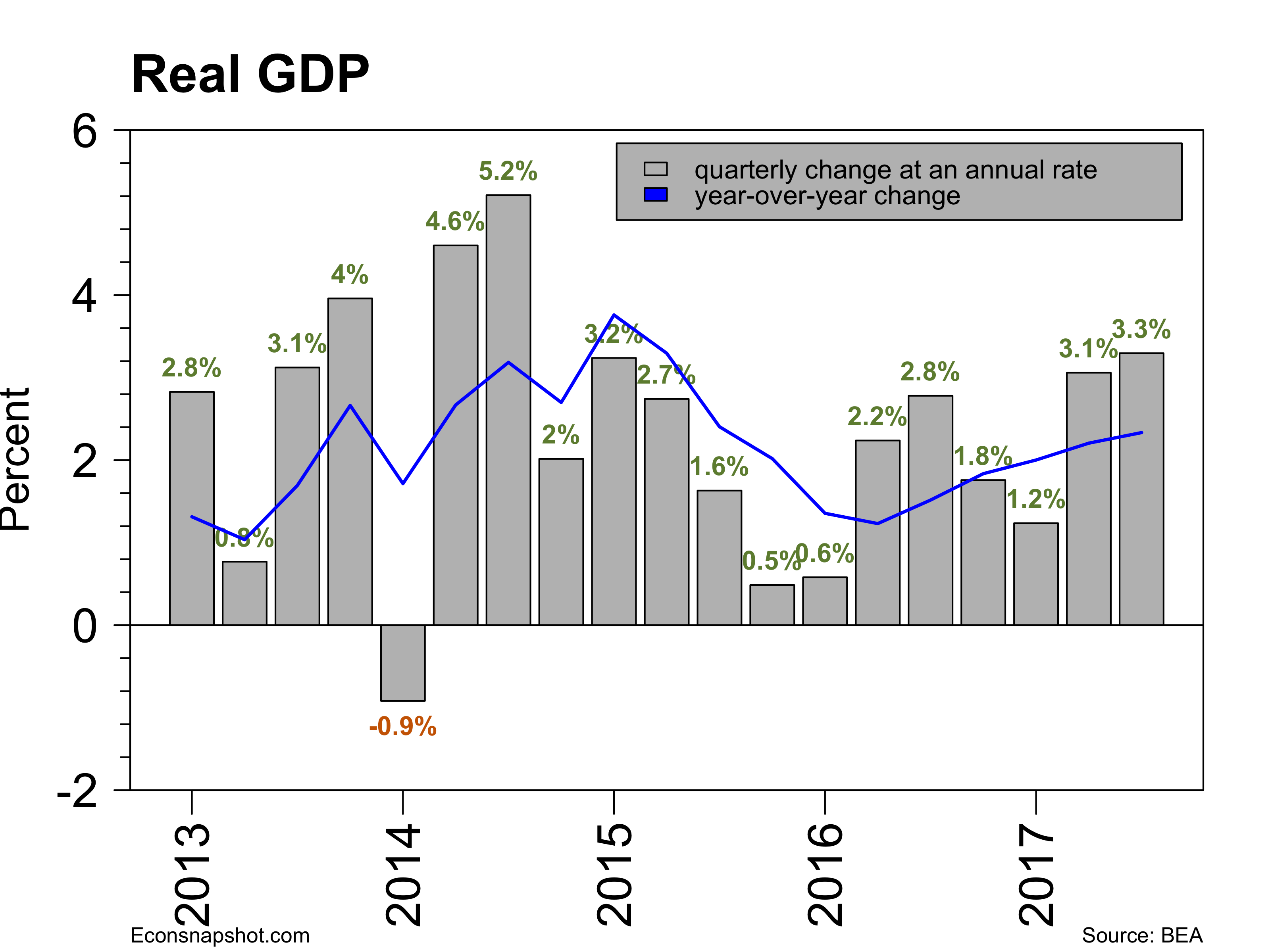

Fourth quarter real GDP increased 2.6% according to the advance estimate from the Bureau of Economic Analysis and 2017 finished up 2.3% overall. Personal consumption expenditures was the leading contributor, rising 3.8%, with durable goods purchases up 14.2%. Investment also came in strong, rising 3.6%, with residential fixed investment increasing 11.6% and non-residential equipment up 11.4% after being in negative territory for the past two quarters. On the negative side, inventories declined $29.3 billion and imports increased 13.9%, the latter being a subtraction in the GDP accounts.

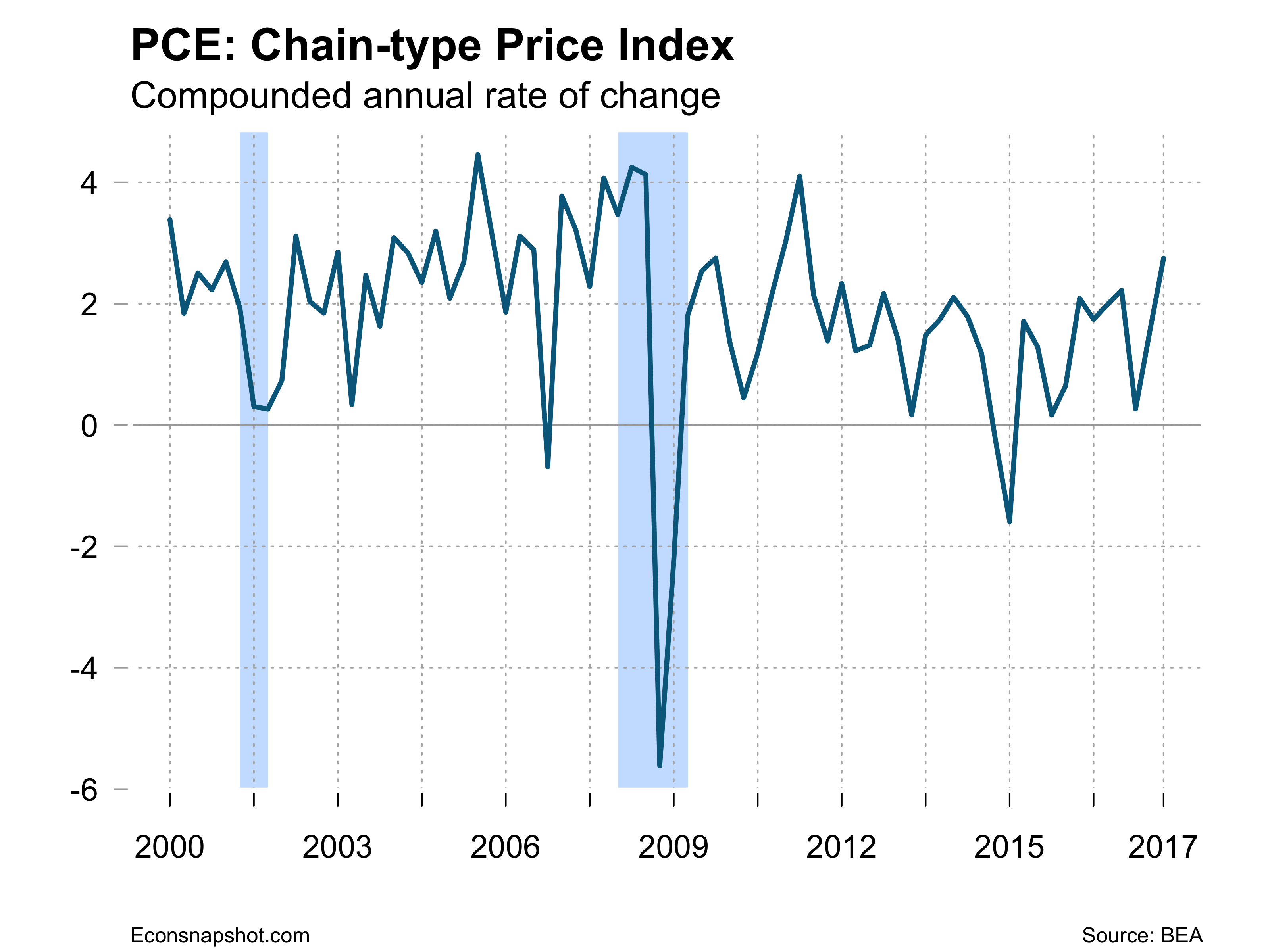

The PCE chained price index increased 2.8%, the largest increase since 2011. It may signal an increase in pricing power in the economy. If so, it will give the Fed further justification for the ongoing increase in interest rates.

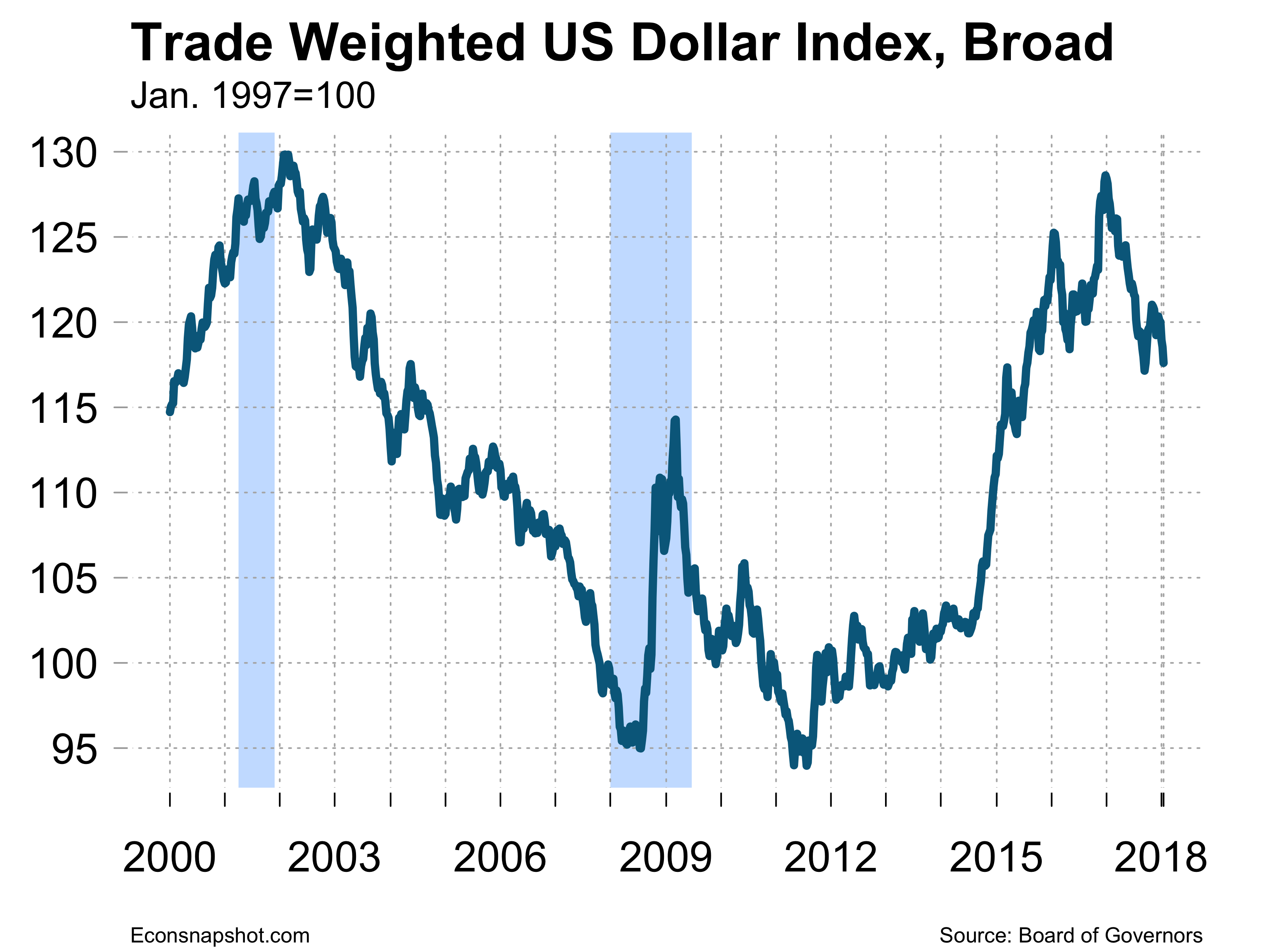

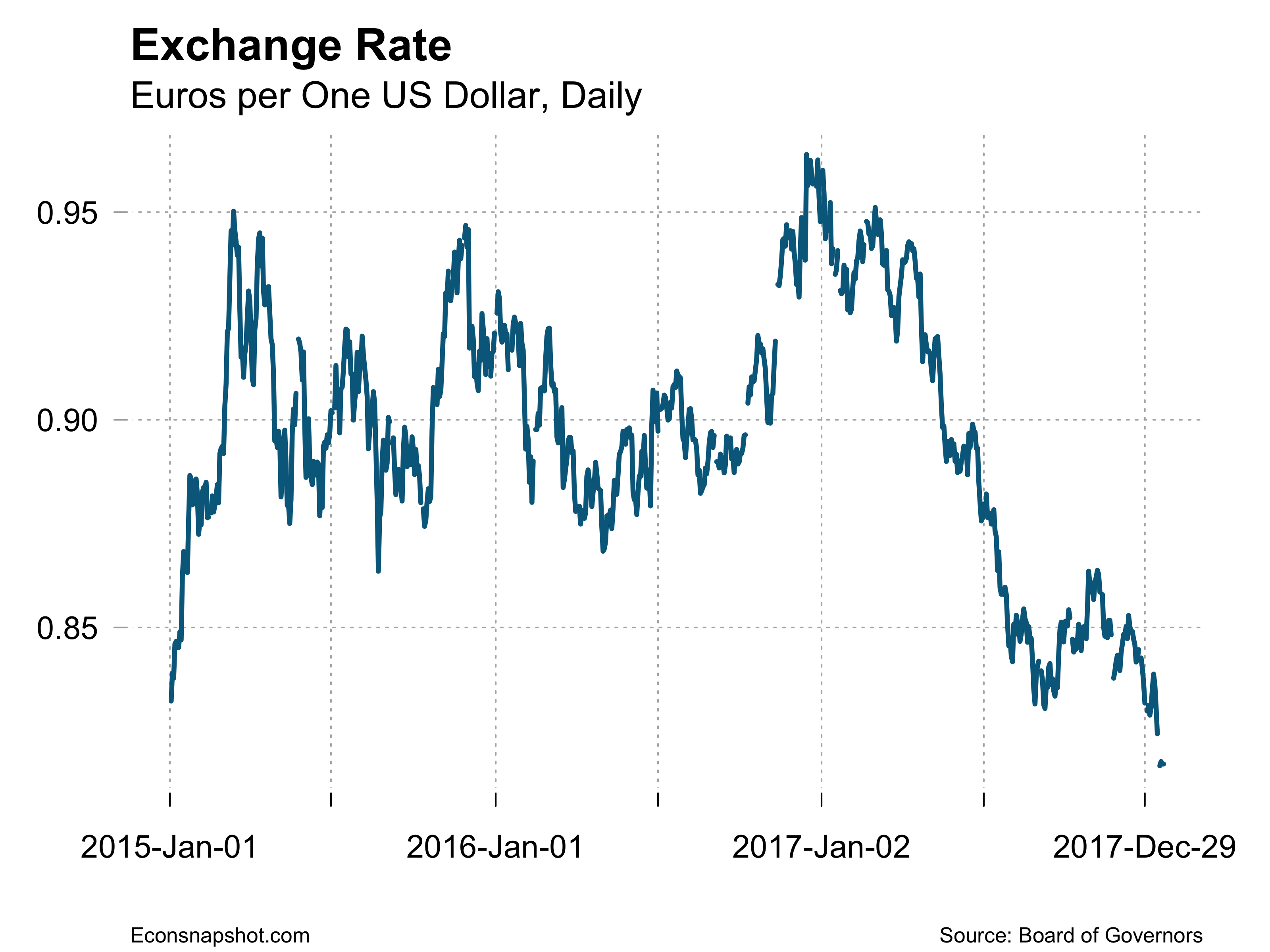

The dollar has been sliding and has recently been the talk of Treasury Secretary Mnuchin and President Trump from Davos. The Davos bump pushed the dollar to some of the lowest levels it has seen against the Euro.

The steady growth in the overall economy keeps the Fed in ready mode, although today’s strong, but not spectacular numbers, likely means no move at the upcoming meeting.

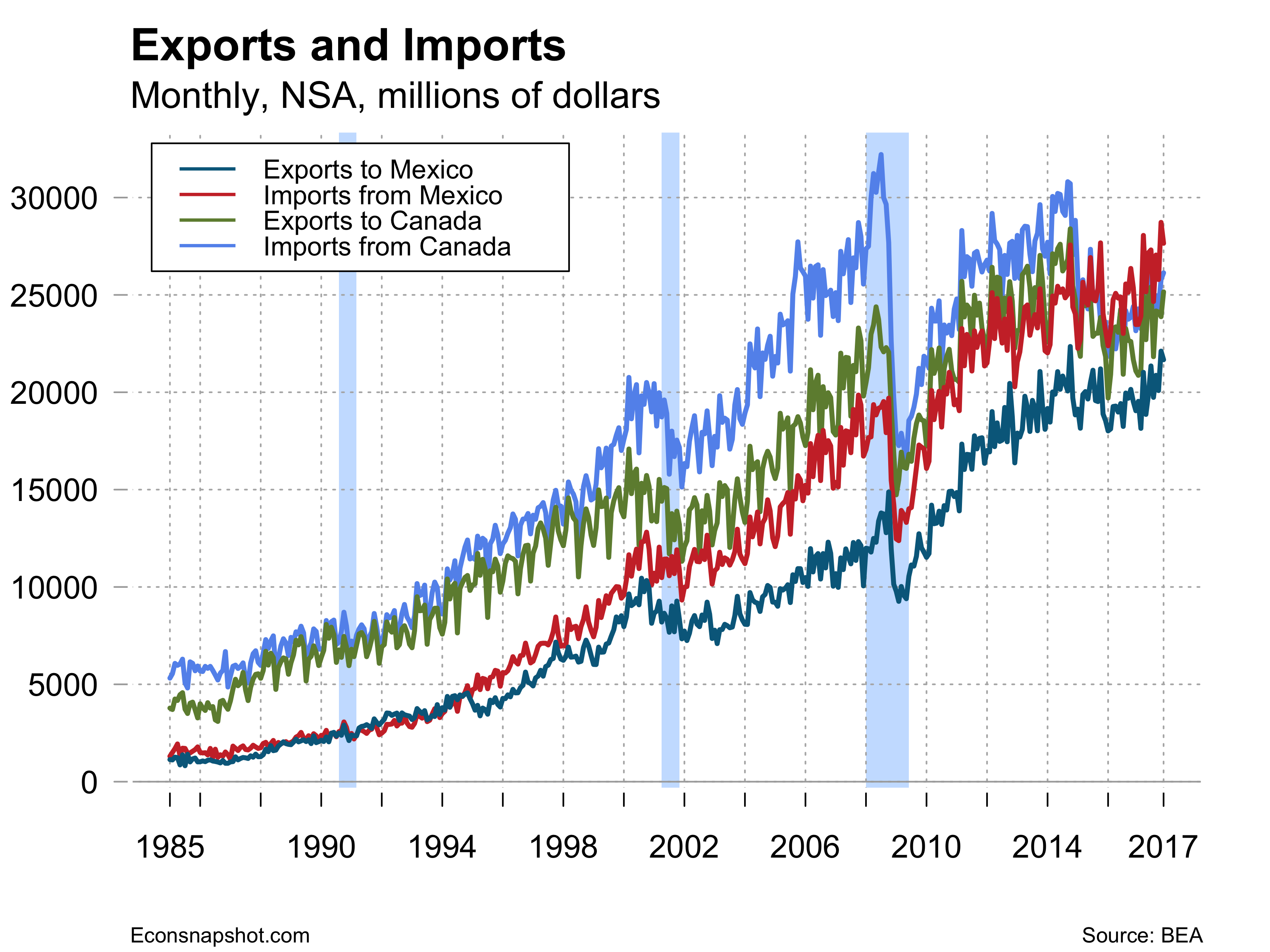

The U.S. is engaged in the sixth round of a scheduled seven rounds of negotiation of the NAFTA Treaty. The U.S. is pressing for changes that would benefit U.S. manufacturing and transportation. The Countries seem far apart on the issues. The chart below makes it clear that the NAFTA has had a tremendous effect on trade between the three countries. Eliminating NAFTA would have severe consequences for all of the economies involved.

The December Employment Numbers Look Softer

By Thomas Cooley and Peter Rupert

The BLS announced that December employment rose by 148,000. The gains were broad-based, the only declines were found in retail trade, -20.3, and utilities, -0.9. This is well off the trend rate of job growth of the last few months. It is also significantly softer than the ADP estimate based on payroll data of 250,000 new private sector jobs. But employment growth has been volatile month-to-month and this softening is not statistically meaningful. The unemployment rate remained steady at 4.1% and other features of the labor market remained much the same.

Average hours of work remained at 34.5 and average hourly earnings ticked up 9 cents to $26.63.

Average hourly earnings increase was 0.3% which signals some upward pressure on wages but nothing like a the break through increases that observers have been looking for as evidence of a tight market.

The household survey shows that labor force participation and the employment population ratio remain largely unchanged at historically low levels. This represents a degree of slack in the labor market and it isn’t changing.

Weather and recurrent natural disasters have had a fairly steady damping effect on the aggregate labor market over the past 12 months. Observers report emerging signs of tightness and rising wages in some regional markets that have not been so affected. We should expect to see some significant strengthening of labor markets over the next 12 months that have nothing to do with changes to the tax law. If that also turns out to have an impact on employment then we should begin to see that show up in wage growth and labor force participation.

November Employment Remains Strong

By Thomas Cooley and Peter Rupert

Payroll employment rose 228,000 for November as reported by the BLS, with the private sector gaining 221,000. The increases were widespread, with only Utilities down slightly and Information employment down 4,000. The Goods producing sector was up 62,000: Mining and Logging 7,000, Construction 24,000 and Manufacturing 31,000. Government employment was up 7,000 after declining for the past few months. Revisions nearly offset, with September up 20,000 and October down 17,000.

Average weekly hours rose to 34.5 and average hourly earnings up from $26.50 to $26.55.

From the household data there is little to report. basically no change in the unemployment rate, from 4.06 % to 4.12%, or the participation rate. However, long term unemployment remains remarkably elevated.

The overall strength of the labor market and the previous GDP report make a December rate hike pretty much a done deal.

Third Quarter GDP Gets a Boost

By Thomas Cooley and Peter Rupert

The BEA announced a small upward revision to Q3 GDP, from 3.0% in the preliminary estimate to 3.3% in the second estimate. Year-over-year growth continues its upward trajectory. Consumption growth was revised down slightly to 2.3%.

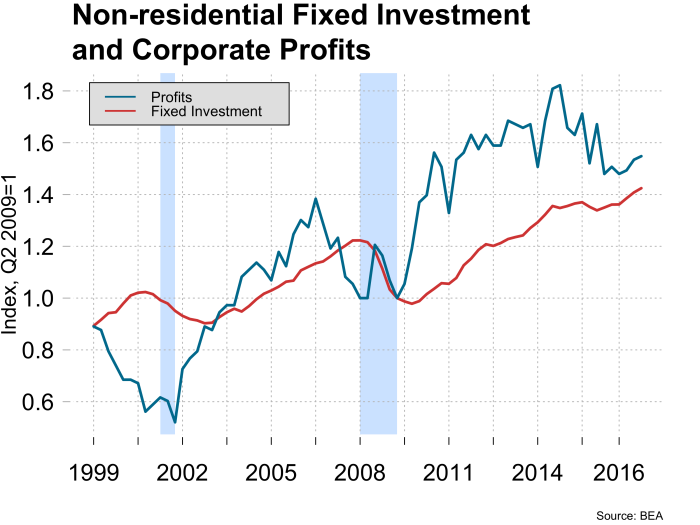

The upward revision to fixed investment was large, increasing almost a full percentage point, from 1.5% to 2.4%. The big gainers in the investment sector were equipment, from 8.6% to 10.4%, and intellectual property, from 4.3% to 5.8%. Non-residential structures were bumped down, from -5.2% to -6.8%. Residential investment, however, was revised up, from -6.0% to -5.1%, respectively.

Corporate profits increased 4.3% from Q2 to Q3 and are up 5.4% compared to Q3 2016.

This revision does little to change the overall outlook of the US economy…meaning that the Fed is likely still on for a December rate hike.

October Employment

By Thomas Cooley and Peter Rupert

The BLS announced an increase in payroll employment of 261,000 in October and revised September’s preliminary estimate of a decline of -33,000 to an increase of 18,000 and August revised up by 39,000. The increase was widespread across goods producing (33,000), service producing (219,000) and government (9,000).

Average hours remained at 34.4 and average hourly earnings were essentially flat. The labor market continues to plod along, not seeing particular strength or weakness.

The household survey revealed a sharp decline in the labor force, -765,000, and a decline in the number unemployed, -281,000, that lead to a decline in the unemployment rate from 4.220% to 4.065%. Employment declined, -484,000, as did the participation rate from 63.1 to 62.7. The employment to population ratio from 60.4 to 60.2. So while the establishment data looked strong, the household survey had little going for it except the drop in the unemployment rate.

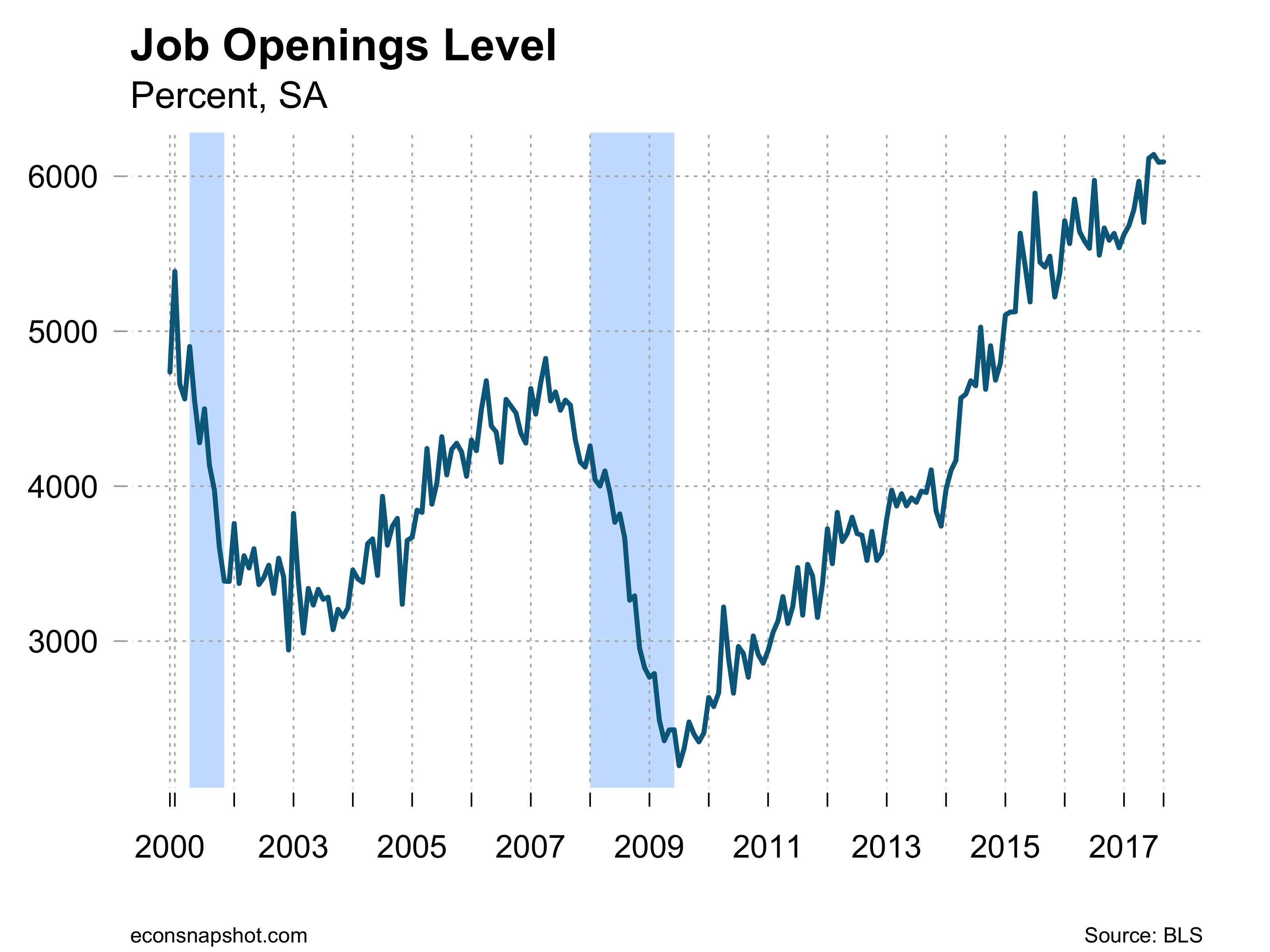

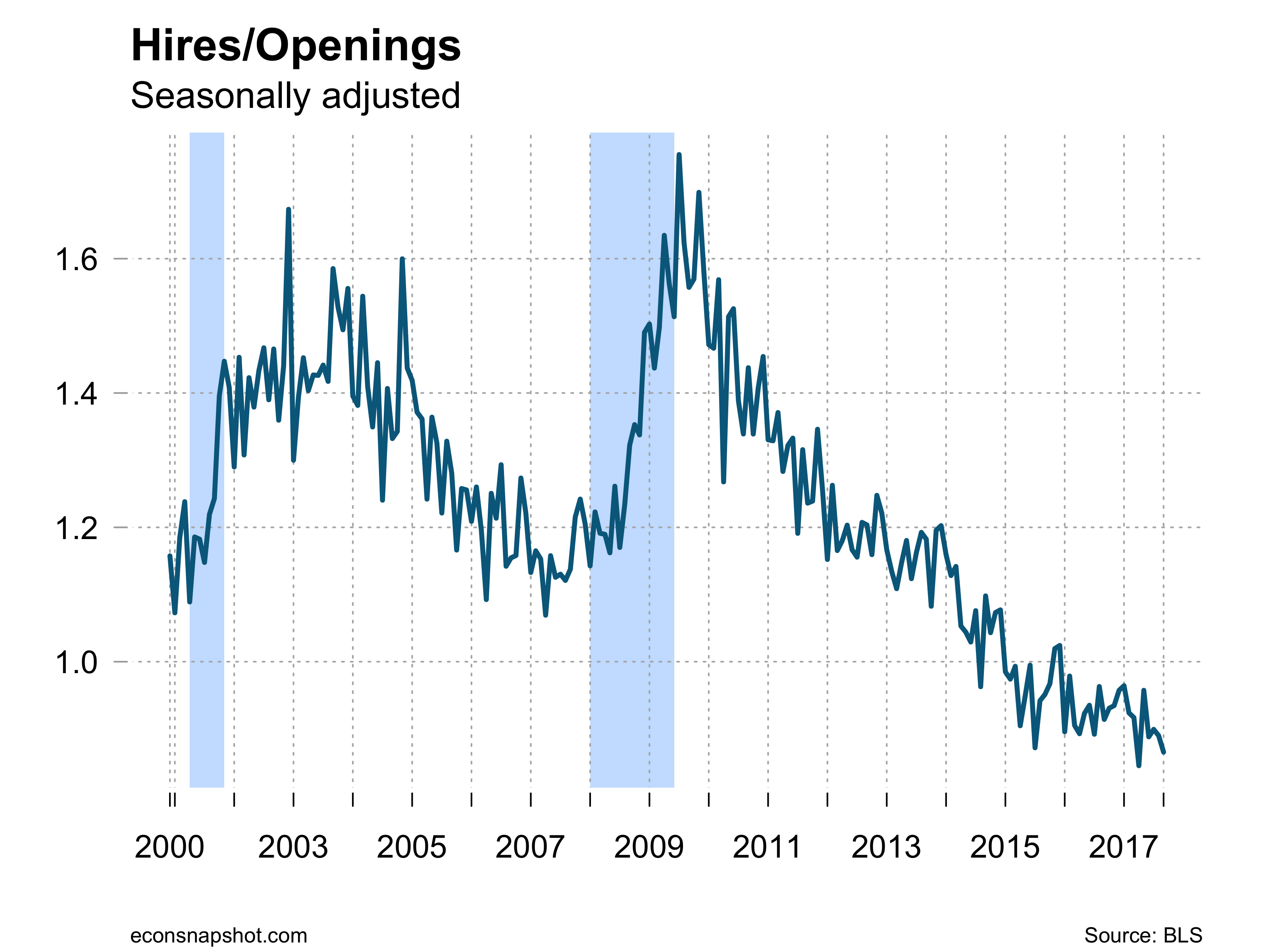

Job openings from JOLTS reveals the number of openings remaining at or near the highest level ever. However, the number of hires per opening has fallen since the end of the Great Recession to its lowest number.

Although natural disasters have somewhat muddied the waters, there is little in this report that would change the likelihood of a December federal funds increase.