By Tom Cooley and Peter Rupert

The employment report released today by the BLS was in line with expectations and so no surprises anywhere to speak of.

Establishment Survey

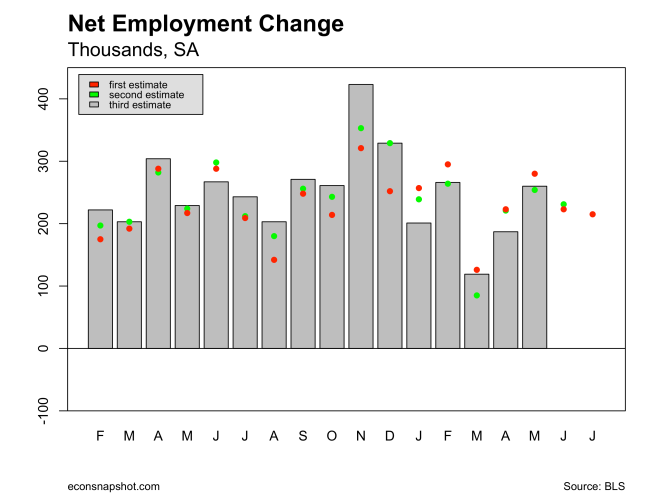

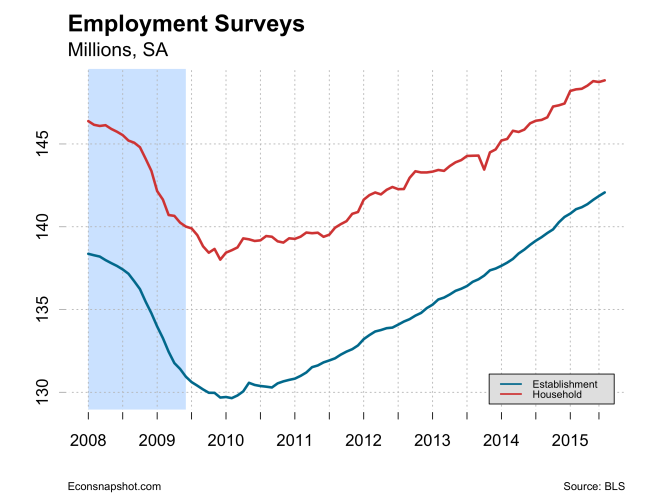

The establishment survey reveals total nonfarm payroll employment increased by 215,000 in July; both May (+6k) and June (+8k) were revised up slightly from the previous estimate, although the average monthly gain for the previous 12 months is 246k. While employment growth has remained steady, though slightly below its 12 month average, today’s report appears to keep the Fed on track for liftoff…most likely in September.

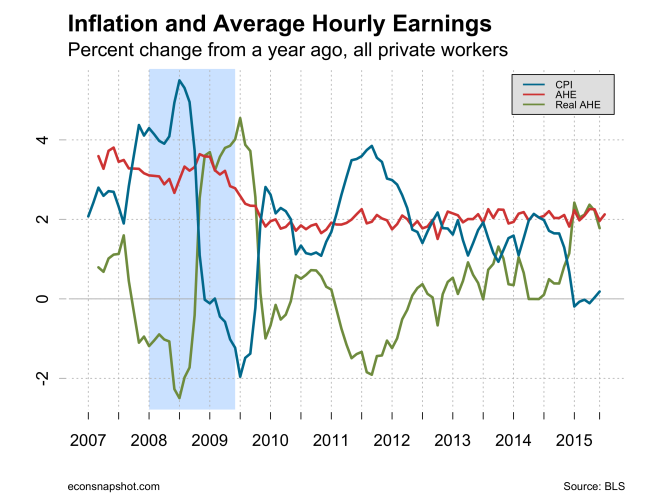

Average weekly hours ticked back up to 34.6 after four straight months at 34.5. Average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.99, up 2% over the past 12 months.

Household Survey

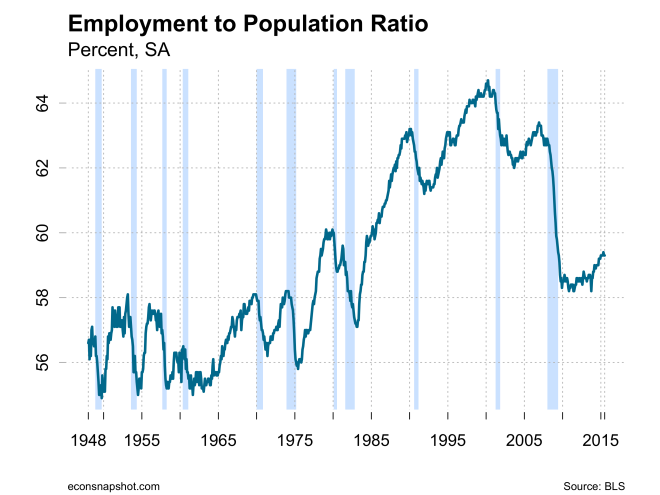

The household survey conveys a slightly weaker picture of the labor market. Household employment grew only 101k. Moreover, the increase over the past five or six months has been much lower than that for the establishment survey. The unemployment rate was virtually unchanged as was the employment to population ratio and the labor force participation rate.

The Fed

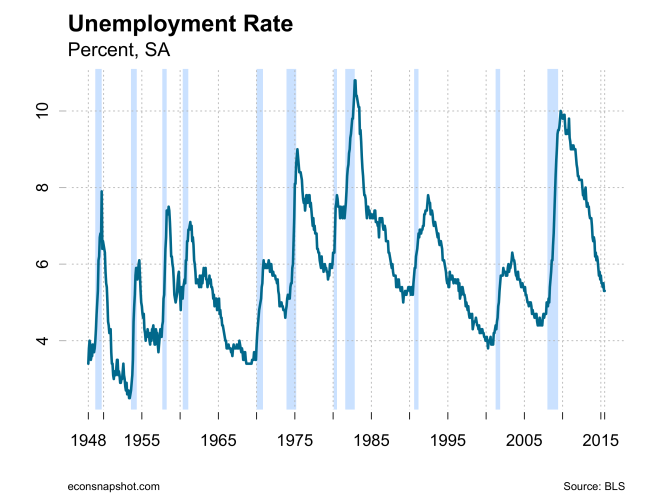

Overall, then, it appears that given the steady performance of the labor market and the commentary from various Fed folks: Atlanta Fed President Lockhart, “It will take a significant deterioration in the economic picture for me to be disinclined to move ahead.” And St. Louis Fed President Bullard, “We are in good shape,” to raise rates in September, leads one to believe a rate hike is quite likely. But here is where one should give pause.

What is the rush to start “liftoff” when there is so little evidence of inflation? One argument might be that keeping interest rates so low creates distortions, but those distortions have been in place now for several years and might be described as the new normal. The Fed of yore would have waited to see some signs of inflation. While many have latched on to the Summers’ quote about not raising rates until you see the whites of its eyes, it is not a new concept nor a new phrase. Alan Blinder said this in a Minneapolis Fed meeting back in 1995. His point then was that it takes time for monetary policy to work,( long and variable lags):

So what is a poor central banker to do? When you look at this set of difficulties—forecasts are not very good, theories and statistical evidence are much in dispute—it is tempting to say: Why don’t we just wait and see what happens? If inflation starts rising, hit the economy with higher interest rates. If unemployment starts rising, do the reverse. I call this the Bunker Hill strategy: Wait until you see the whites of their eyes and then fire. Why don’t we do that?

The answer is very simple: The Bunker Hill strategy will fail. It is sure to lead you into error because by the time you see the whites of their eyes, they’ve already shot you right through the heart.

Is this why the Fed today believes it should raise rates? If not, what is/are the reasons? The labor market has been steadily improving, but certainly has not been on fire. There are no signs of inflation anywhere, not current or expected. Wages have been fairly stagnant. Forward guidance and the Fed’s “threshold” unemployment number, 6.5%, have come and gone. The only explanation seems to be that there is a desire to return to normal monetary policy making and rates have to go up at some point.